Last updated: July 28, 2025

Introduction

Moxatag (amoxicillin extended-release) represents a critical asset within the antibiotic market, primarily targeting bacterial infections in pediatric and adult populations. Its strategic positioning hinges on pharmaceutical innovation, competitive landscape, regulatory considerations, and evolving healthcare demands. This analysis evaluates the market dynamics influencing Moxatag’s trajectory and projects its financial outlook amidst evolving industry factors.

Product Profile and Clinical Significance

Moxatag, developed by GlaxoSmithKline (GSK), combines the well-established efficacy of amoxicillin with an extended-release formulation, facilitating once-daily dosing. This enhances patient compliance, a critical factor in infectious disease management. Approved by the FDA for upper respiratory tract infections and sinusitis, it addresses a broad spectrum of bacterial pathogens, bolstering its clinical utility.

The product’s pharmacokinetic profile, showcasing steady serum concentrations, minimizes gastrointestinal side effects linked with traditional amoxicillin formulations. As antibiotic stewardship gains prominence, Moxatag’s convenience could influence prescribing patterns favorably, provided antimicrobial resistance (AMR) concerns are managed effectively.

Market Landscape and Competitive Environment

1. Antibiotic Market Trends

The global antibiotics market, valued at approximately USD 43 billion in 2022, is characterized by moderate growth driven by rising bacterial infection incidences, aging populations, and heightened awareness of antimicrobial resistance [1]. However, the market faces headwinds, including regulatory pressures aimed at curbing overuse and the pandemic-induced focus shift away from infectious disease management.

2. Competitive Positioning

Moxatag's main competitors comprise both immediate-release amoxicillin formulations and other extended-release antibiotics. Notable players include Pfizer’s augmentin and generic formulations. The penetration of generics significantly reduces Moxatag’s pricing premium, affecting its profitability. Still, its once-daily dosing remains a differentiator, enhancing adherence and potentially allowing premium pricing in certain markets.

3. Regulatory and Prescribing Trends

Regulatory agencies emphasize antimicrobial stewardship, introducing stricter prescribing guidelines for antibiotics [2]. While this may constrain overall volume growth, drugs with improved safety profiles and convenience—like Moxatag—may sustain or expand market share if aligned with stewardship goals. Additionally, the drug’s patent expiry status influences future revenue streams; if off-patent, generic competition intensifies.

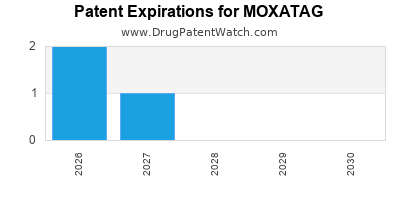

Patent and Regulatory Considerations

GSK’s patent protection for Moxatag, obtained in the early 2000s, has expired in multiple jurisdictions, opening avenues for generic competition. The end of patent exclusivity typically results in significant revenue declines, with market share captured by cheaper generics. However, brand loyalty and clinical advantages could sustain some level of premium pricing in select segments.

Regulatory trends increasingly favor novel formulations that combat AMR by reducing inappropriate antibiotic use. Moxatag’s extended-release formulation aligns with such efforts, potentially facilitating regulatory endorsements that could sustain its market presence.

Pricing and Reimbursement Dynamics

Pricing strategies are pivotal. Extended-release formulations generally command higher prices than immediate-release counterparts. However, payer pressures and cost-containment policies dominate, especially in consolidated healthcare systems. Value-based pricing, emphasizing improved compliance and reduced adverse events, could justify premium pricing.

Reimbursement considerations vary globally. In markets like the U.S., Medicaid and private insurers influence formulary placements, often favoring generics unless clinical differentiation justifies higher prices.

Distribution Channels and Market Penetration

Moxatag's distribution relies on hospital formularies, retail pharmacies, and direct prescriber relationships. Its success depends on physician prescribing preferences and patient acceptance. Adoption hinges on efficacy, safety profiles, and convenience, as well as clinician familiarity with its benefits.

Emerging markets present growth opportunities, albeit with challenges related to regulatory approval and local formulary policies. Strategic partnerships can facilitate market entry and expansion.

Financial Trajectory Projection

1. Revenue Forecasting

Assuming a conservative decline post-patent expiry—estimated at 20-30% annually over the subsequent 3-5 years—revenues from Moxatag are expected to diminish cleanly with intensified generic competition. Prior to patent expiry, peak annual sales likely exceeded USD 200 million, but industry trends suggest a gradual decrease to below USD 50 million within five years.

2. Cost Structure and Margins

Manufacturing costs primarily consist of formulation expenses, quality control, and distribution. Extended-release formulations involve higher production complexity, but economies of scale and process optimization could stabilize margins.

Gross margins are anticipated to decline paralleling revenue attrition. However, brand-resistant positioning and clinical advantages could enable higher pricing strategies in niche segments.

3. Strategic Options

GSK and other stakeholders might consider repositioning Moxatag through line extensions, combination therapies, or new indications to mitigate revenue erosion. Licensing arrangements, co-marketing, or transitioning to biosimilars could also influence financial outcomes.

4. Investment and R&D Considerations

Investments in pipeline antibiotics targeting resistant bacteria could offset declining Moxatag revenue, aligning with global efforts to combat antimicrobial resistance.

Key Market Drivers and Risks

Drivers include:

- Rising bacterial infections among aging populations.

- Demand for convenient, adherence-improving formulations.

- Healthcare initiatives promoting stewardship through effective dosing regimens.

Risks encompass:

- Patent expiration leading to generic competition.

- Regulatory changes prioritizing antimicrobial conservation.

- The global decline in antibiotic prescriptions due to stewardship programs.

- The emergence of resistant strains reducing drug efficacy.

Conclusion

Moxatag's market dynamics are shaped by patent status, competitive pressures, regulatory trends, and clinical advantages. While its innovational formulation offers strategic value, impending patent expiration and market shifts forecast a declining revenue trajectory in the medium term. Opportunities for repositioning and pipeline development could sustain its relevance, particularly if aligned with antimicrobial stewardship objectives.

Key Takeaways

- Moxatag’s extended-release formulation confers competitive advantages in adherence and safety, positioning it favorably in niche segments amidst generic competition.

- Patent expiry significantly alters the revenue landscape, necessitating strategic responses such as line extensions or new indications.

- Global antimicrobial stewardship policies exert downward pressure on antibiotic volumes, impacting future sales projections.

- Pricing strategies that emphasize value attribution—improved compliance and safety—are pivotal in maintaining margins.

- Opportunities exist in emerging markets and for pipeline innovation, but success depends on navigating regulatory hurdles and competitive dynamics.

FAQs

1. How does patent expiry impact Moxatag’s market performance?

Patent expiry allows generic manufacturers to produce lower-cost versions, leading to significant revenue declines for brand-name drugs like Moxatag. Maintaining market share depends on clinical differentiation, brand loyalty, and pricing strategies.

2. What are the primary competitors to Moxatag in the extended-release antibiotic segment?

Direct competition includes other extended-release amoxicillin formulations and combination antibiotics, notably Pfizer’s augmentin. Generic immediate-release amoxicillin formulations also compete on price.

3. How do antimicrobial stewardship programs influence Moxatag’s future sales?

Stewardship campaigns aim to reduce unnecessary antibiotic prescriptions, potentially limiting Moxatag’s volume. However, formulations that improve adherence without promoting overuse can aid compliance, positively influencing targeted prescribing.

4. Are there pipeline opportunities to extend Moxatag’s lifecycle?

Yes. Line extensions, such as new dosing formulations or combination therapies, could provide renewed revenue streams. Additionally, developing indications for resistant infections might enhance value.

5. What strategies can GSK employ to maximize Moxatag’s value amid declining sales?

Strategies include repositioning the drug through targeted marketing, engaging in licensing or partnership deals, enhancing formulation benefits, and integrating into stewardship programs to emphasize appropriate use.

References

[1] MarketsandMarkets. "Antibiotics Market," 2022.

[2] U.S. Food and Drug Administration. "Antimicrobial Stewardship Programs."