Last updated: October 15, 2025

Introduction

Pfizer Inc. stands as a cornerstone in the global pharmaceutical industry, recognized for its extensive product portfolio, innovative research capabilities, and strategic market presence. As the landscape evolves amid rising R&D costs, regulatory pressures, and transformative technological advancements, understanding Pfizer’s market position and strategic framework is vital for stakeholders aiming to navigate this competitive environment.

This analysis delivers an in-depth evaluation of Pfizer’s current market standing, core strengths, competitive advantages, and strategic directions. It serves as a critical resource for investors, industry analysts, and strategic planners seeking actionable insights into Pfizer’s operational strategies and future growth potential.

Market Position Overview

Pfizer ranks among the top-tier global pharmaceutical companies, consistently positioning itself within the top five by revenue, driven initially by blockbuster drugs and now increasingly by innovative mRNA and biotech products.

Revenue and Market Share

In recent fiscal years, Pfizer reported revenues exceeding $80 billion, underpinning its robust market influence [[1]]. Its core markets include the United States, Europe, and emerging economies, supported by a broad therapeutic area presence spanning oncology, vaccines, rare diseases, and internal medicine.

The release of the COVID-19 vaccine, Comirnaty (developed in partnership with BioNTech), significantly amplified Pfizer’s market share, generating over $37 billion globally in 2021 [[2]]. This product not only diversified its revenue stream but also cemented its leadership in vaccine innovation.

Therapeutic Focus and Innovation

Pfizer’s strategic emphasis on high-impact therapeutic areas—oncology, immunology, and infectious diseases—aligns with current global health priorities. Its investment in mRNA technology and gene therapies signifies positioning at the forefront of biomedical innovation.

Competitive Environment

Pfizer’s principal competitors include Johnson & Johnson, Merck & Co., Novartis, and AstraZeneca. Market dynamics are now shaped largely by innovation cycles, regulatory approvals, and pandemic-related product launches. The consolidation of competitors through mergers (e.g., Merck’s acquisition of MSD) further intensifies rivalry.

Strengths of Pfizer

1. Robust R&D Capabilities

Pfizer’s annual R&D expenditure, exceeding $10 billion, underpins a pipeline of over 100 projects in clinical development [[3]]. Strategic collaborations with biotech firms and academic institutions augment its innovation capacity, particularly in mRNA and gene editing.

2. Diversified Portfolio and Revenue Streams

Pfizer’s product diversification reduces dependency on a limited set of blockbusters. Its portfolio spans vaccines, rare disease therapies, and established medicines like Lipitor and Viagra, which continue generating revenues even as patent protections expire.

3. Leadership in Vaccination and Pandemic Response

The development of COVID-19 vaccines positioned Pfizer as a leader in pandemic response. Its extensive manufacturing capacity and global distribution network facilitated rapid deployment, enhancing its brand reputation and market influence.

4. Strategic Acquisitions and Collaborations

Pfizer’s acquisitions of entities such as Array BioPharma and areas like infectious disease technologies have expanded its scientific reach. Strategic licensing agreements, notably with BioNTech, reinforce Pfizer’s innovative edge.

5. Global Footprint and Market Penetration

Pfizer maintains a pervasive global presence through manufacturing facilities and sales networks across over 150 countries. Its ability to adapt to regional regulatory environments enhances its market penetration.

Strategic Insights

1. Focus on Innovation-Driven Growth

To sustain competitive advantage, Pfizer prioritizes investment in novel modalities like mRNA, cell therapy, and personalized medicine [[4]]. Its strategic R&D pipeline aims to bring multiple molecules to market annually, leveraging cutting-edge science to address unmet medical needs.

2. Emphasizing Digital Transformation

Pfizer’s integration of digital tools in clinical trials and patient engagement accelerates drug development timelines. Utilization of artificial intelligence and data analytics optimizes R&D efficiency and streamlines regulatory pathways.

3. Expanding Geographic Reach and Market Access

Emerging markets represent a significant growth avenue. Pfizer is intensifying efforts to navigate regional regulatory landscapes and establish partnerships, especially within Asia-Pacific and Latin America, to bolster revenue streams.

4. Leveraging Pandemic Infrastructure

The company aims to capitalize on the infrastructure built during the COVID-19 response to develop and distribute other biologics. This capability positions Pfizer to respond swiftly to future health crises and establish long-term revenue.

5. Sustainability and Stakeholder Engagement

Pfizer’s commitment to sustainability, including access to medicines and environmental stewardship, complements its long-term growth strategy and bolsters stakeholder trust [[5]].

Challenges and Strategic Risks

Despite its strengths, Pfizer faces several challenges:

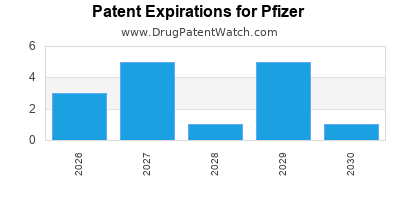

- Patent Cliffs and Generic Competition: The expiration of key patents threatens revenue continuity, compelling Pfizer to innovate and diversify aggressively.

- Regulatory and Pricing Pressures: Government policies aiming to curb drug prices can impact profitability, particularly in developed markets.

- R&D Uncertainties: High failure rates in clinical trials and regulatory hurdles necessitate cautious investment strategies.

- Global Supply Chain Complexities: Manufacturing disruptions, especially for biologics, pose risks to product availability.

Future Outlook

Pfizer’s strategic trajectory emphasizes innovation, digital integration, and geographic diversification. Its ongoing investments in mRNA technology and expansion into personalized medicine are expected to profoundly influence its long-term growth.

The company’s capacity to navigate regulatory complexities, sustain R&D productivity, and maintain a resilient supply chain will be crucial in the evolving global pharma landscape. Partnering initiatives with biotech startups and embracing data-driven drug discovery will further solidify Pfizer’s competitive stance.

Key Takeaways

- Pfizer’s dominant market position is underpinned by its diversified portfolio, extensive R&D capabilities, and strategic pandemic responses.

- Innovation, especially in mRNA and personalized medicine, remains central to Pfizer’s growth strategy.

- The company’s global expansion efforts, particularly in emerging markets, are critical to offset patent expirations.

- Digital transformation initiatives enhance operational efficiency and accelerate drug development timelines.

- Navigating regulatory, pricing, and supply chain challenges will define Pfizer’s ability to sustain long-term competitiveness.

FAQs

1. How has Pfizer’s COVID-19 vaccine impacted its market position?

The COVID-19 vaccine significantly boosted Pfizer’s revenue, brand recognition, and global influence, establishing it as a leader in vaccine innovation and pandemic response.

2. What are Pfizer’s main therapeutic areas of focus?

Pfizer concentrates on oncology, vaccines, rare diseases, cardiology, and immunology, with strategic investments in innovative platforms like mRNA and gene therapies.

3. How does Pfizer plan to offset patent expirations?

Pfizer is advancing its pipeline of novel therapies, expanding into personalized medicine, and pursuing strategic acquisitions and collaborations to diversify and sustain revenue streams.

4. What role does digital technology play in Pfizer’s strategy?

Digital tools improve clinical trial efficiency, enable real-time data analytics, and streamline regulatory processes, underpinning Pfizer’s innovation and operational agility.

5. What are the main risks facing Pfizer in the coming years?

Patent cliffs, regulatory changes, pricing pressures, R&D uncertainties, and supply chain disruptions are prominent risks that Pfizer must address to maintain its market leadership.

References

[1] Pfizer Annual Report 2022.

[2] Pfizer’s COVID-19 Vaccine Revenue Report, 2022.

[3] Pfizer R&D Investment Data, 2022.

[4] Pfizer’s Strategic Focus, Industry Reports, 2022.

[5] Sustainability and Access Initiatives, Pfizer Corporate Website.