BREO ELLIPTA Drug Patent Profile

✉ Email this page to a colleague

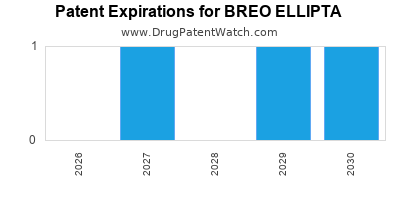

When do Breo Ellipta patents expire, and when can generic versions of Breo Ellipta launch?

Breo Ellipta is a drug marketed by Glaxo Grp Ltd and is included in one NDA. There are five patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and eighty-eight patent family members in thirty-three countries.

The generic ingredient in BREO ELLIPTA is fluticasone furoate; vilanterol trifenatate. There are twenty-nine drug master file entries for this compound. Two suppliers are listed for this compound. Additional details are available on the fluticasone furoate; vilanterol trifenatate profile page.

DrugPatentWatch® Generic Entry Outlook for Breo Ellipta

Breo Ellipta was eligible for patent challenges on May 10, 2017.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be August 26, 2029. This may change due to patent challenges or generic licensing.

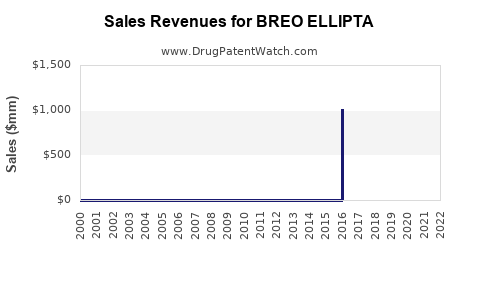

Annual sales in 2022 were $2.0bn, indicating a strong incentive for generic entry (peak sales were $2.8bn in 2021).

There have been six patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for BREO ELLIPTA?

- What are the global sales for BREO ELLIPTA?

- What is Average Wholesale Price for BREO ELLIPTA?

Summary for BREO ELLIPTA

| International Patents: | 188 |

| US Patents: | 5 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 2 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 49 |

| Patent Applications: | 71 |

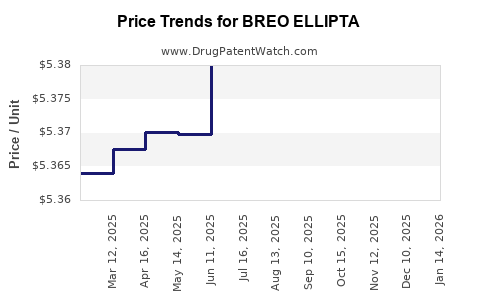

| Drug Prices: | Drug price information for BREO ELLIPTA |

| Drug Sales Revenues: | Drug sales revenues for BREO ELLIPTA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for BREO ELLIPTA |

| What excipients (inactive ingredients) are in BREO ELLIPTA? | BREO ELLIPTA excipients list |

| DailyMed Link: | BREO ELLIPTA at DailyMed |

See drug prices for BREO ELLIPTA

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for BREO ELLIPTA

Generic Entry Date for BREO ELLIPTA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

POWDER;INHALATION |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for BREO ELLIPTA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| GlaxoSmithKline | PHASE4 |

| University of Tennessee Graduate School of Medicine | PHASE4 |

| Theravance Biopharma | PHASE4 |

Pharmacology for BREO ELLIPTA

| Drug Class | Corticosteroid beta2-Adrenergic Agonist |

| Mechanism of Action | Adrenergic beta2-Agonists Corticosteroid Hormone Receptor Agonists |

Paragraph IV (Patent) Challenges for BREO ELLIPTA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| BREO ELLIPTA | Powder for Inhalation | fluticasone furoate; vilanterol trifenatate | 100 mcg/25 mcg | 204275 | 1 | 2025-06-16 |

US Patents and Regulatory Information for BREO ELLIPTA

BREO ELLIPTA is protected by five US patents and three FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of BREO ELLIPTA is ⤷ Get Started Free.

This potential generic entry date is based on patent 11,116,721.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Glaxo Grp Ltd | BREO ELLIPTA | fluticasone furoate; vilanterol trifenatate | POWDER;INHALATION | 204275-003 | May 12, 2023 | RX | Yes | No | 7,439,393*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Glaxo Grp Ltd | BREO ELLIPTA | fluticasone furoate; vilanterol trifenatate | POWDER;INHALATION | 204275-002 | Apr 30, 2015 | RX | Yes | Yes | 8,511,304*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Glaxo Grp Ltd | BREO ELLIPTA | fluticasone furoate; vilanterol trifenatate | POWDER;INHALATION | 204275-003 | May 12, 2023 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for BREO ELLIPTA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Glaxo Grp Ltd | BREO ELLIPTA | fluticasone furoate; vilanterol trifenatate | POWDER;INHALATION | 204275-001 | May 10, 2013 | 7,776,895 | ⤷ Get Started Free |

| Glaxo Grp Ltd | BREO ELLIPTA | fluticasone furoate; vilanterol trifenatate | POWDER;INHALATION | 204275-002 | Apr 30, 2015 | 5,873,360 | ⤷ Get Started Free |

| Glaxo Grp Ltd | BREO ELLIPTA | fluticasone furoate; vilanterol trifenatate | POWDER;INHALATION | 204275-001 | May 10, 2013 | 5,873,360 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for BREO ELLIPTA

When does loss-of-exclusivity occur for BREO ELLIPTA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Croatia

Patent: 0191257

Estimated Expiration: ⤷ Get Started Free

Patent: 0241000

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 21914

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 00950

Estimated Expiration: ⤷ Get Started Free

Patent: 78169

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 00950

Estimated Expiration: ⤷ Get Started Free

Patent: 78169

Estimated Expiration: ⤷ Get Started Free

Patent: 03231

Estimated Expiration: ⤷ Get Started Free

Patent: 78502

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 78169

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 45917

Estimated Expiration: ⤷ Get Started Free

Patent: 67290

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 09985

Estimated Expiration: ⤷ Get Started Free

Patent: 12518663

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 00950

Estimated Expiration: ⤷ Get Started Free

Patent: 78169

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 00950

Estimated Expiration: ⤷ Get Started Free

Patent: 78169

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 00950

Estimated Expiration: ⤷ Get Started Free

Patent: 78169

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 00950

Estimated Expiration: ⤷ Get Started Free

Patent: 78169

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 39352

Estimated Expiration: ⤷ Get Started Free

Patent: 94042

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering BREO ELLIPTA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Australia | 2003250166 | ⤷ Get Started Free | |

| China | 1468252 | 作为抗炎剂的 6α , 9α -二氟 - 1 7α -[ ( 2 -呋喃基羧基 )氧基 ] - 1 1β -羟基 - 1 6α -甲基 - 3 -氧代-雄甾-1,4-二烯-17-硫代羧酸S-氟甲酯 (6.alpha., 9.alpha.-difluoro-17.alpha.-[(2-furanylcarboxyl) oxy]-11.beta.-hydroxy-16.alpha.-methyl-3-oxo-androst-1,4,-diene-17-carbothioic acid s-fluoromethyl ester as an anti-inflammatory agent) | ⤷ Get Started Free |

| Lithuania | 2400950 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for BREO ELLIPTA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1519731 | 13C0067 | France | ⤷ Get Started Free | PRODUCT NAME: AZELASTINE OU SES SELS PHARMACEUTIQUEMENT ACCEPTABLES ET UN ESTER PHARMACEUTIQUEMENT ACCEPTABLE DE FLUTICASONE; NAT. REGISTRATION NO/DATE: NL41755 20130925; FIRST REGISTRATION: SK - 24/0055/13-S 20130215 |

| 1425001 | PA2014019,C1425001 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: VILANTEROLUM; REGISTRATION NO/DATE: EU/1/13/886/001-006 20131113 |

| 1425001 | 174 50004-2014 | Slovakia | ⤷ Get Started Free | PRODUCT NAME: VILANTEROLTRIFENATAT; REGISTRATION NO/DATE: EU/1/13/886/001 - EU/1/13/886/006 20131113 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory of BREO ELLIPTA

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.