Last updated: December 17, 2025

Executive Summary

AstraZeneca AB stands as a prominent contender in the global pharmaceutical industry, actively vying across multiple therapeutic areas such as oncology, cardiovascular, respiratory, and rare diseases. As of 2023, the company's strategic focus on innovative biologics and precision medicine has solidified its market position. This report critically evaluates AstraZeneca's standing within the competitive landscape, highlighting its market share, core strengths, and strategic initiatives that shape its trajectory. Additionally, we compare its performance against key rivals and outline strategic insights that inform market and investment decisions.

Market Overview and Position

Global Pharmaceutical Market Context

The global pharmaceutical market is expected to reach USD 1.7 trillion in 2023, growing at a compound annual growth rate (CAGR) of approximately 3-6% over the next five years. Key growth drivers include aging populations, increasing prevalence of chronic diseases, and technological advancements in biologics and personalized medicine [1].

AstraZeneca’s Global Footprint

- Revenue (2022): USD 44.5 billion

- Market Share (Pharmaceuticals): Estimated at 2.6% globally [2]

- Top Therapeutic Areas: Oncology (37%), CVRM (cardiovascular, renal, and metabolic diseases—25%), Respiratory (15%) [3]

-

| Geographical Revenue Breakdown (2022): |

Region |

Revenue (USD billion) |

Percentage of Total Revenue |

Key Focus |

| US |

17.4 |

39% |

Oncology, CV |

| Europe |

10.8 |

24% |

Oncology, Respiratory |

| Emerging Markets |

7.2 |

16% |

Respiratory, Oncology |

| Rest of World |

9.1 |

21% |

Varied |

Core Strengths of AstraZeneca

1. Robust Oncology Portfolio

AstraZeneca has transitioned from traditional small-molecule drugs to innovative biologics, with key products including

- Tagrisso (osimertinib): Leading in non-small cell lung cancer (NSCLC)

- Imfinzi (durvalumab): Approved for multiple cancers, including bladder and lung Cancer

- Lynparza (olaparib): A PARP inhibitor with approvals in ovarian and breast cancers

Market Impact: The oncology segment contributed approximately 37% of overall revenue in 2022, with a CAGR of 17% over the past five years, significantly outpacing industry average [4].

2. Strategic R&D Focus on Biologics & Precision Medicine

- R&D expenditure in 2022: USD 6.5 billion, representing 15% of total revenue

- Pipeline of over 90 clinical trials in immuno-oncology, rare diseases, and targeted therapies

- Acquisition of biotech firms in gene therapy (e.g., Viela Bio acquisition, 2021) enhances capabilities [5].

3. Global Market Penetration & Diversification

- Strategic focus on emerging markets such as China, India, and Latin America enables revenue diversification

- Localized collaborations with healthcare providers and government agencies facilitate market entry.

4. Impressive Patent Portfolio & Regulatory Approvals

- Over 20 patents globally granted since 2020 in oncology and biologics

- Approvals from FDA, EMA, and other regulators for multiple high-value products extend exclusivity periods.

Competitive Landscape & Market Position

Major Competitors

| Company |

Key Therapeutic Areas |

Estimated Market Share (2023) |

Notable Products |

Strategies |

| Pfizer |

Oncology, CV, vaccines |

3.2% |

Ibrance, Prevnar, Xeljanz |

Diversification, M&A (e.g., Seagen) |

| Roche |

Oncology, Hematology, Diagnostics |

3.0% |

Herceptin, Rituxan, Acuvue |

Innovation via biologics & diagnostics |

| Novartis |

Oncology, Ophthalmology |

2.9% |

Cosentyx, Gilenya, Zolgensma |

Gene therapy, biotech alliances |

| Merck & Co. (MSD) |

Oncology, Vaccines |

2.1% |

Keytruda, Gardasil |

Immuno-oncology focus |

Note: Figures approximate based on IQVIA data, 2023.

Strengths & Differentiators of AstraZeneca vs. Rivals

| Aspect |

AstraZeneca |

Key Competitors |

| Innovation Focus |

Biologics & targeted therapies |

Broad portfolio, including vaccines and generics |

| R&D Investment |

USD 6.5 billion (2022) |

Varies; Pfizer (~USD 9B), Roche (~USD 10B) |

| Patent Portfolio |

Extensive in oncology biologics |

Strong, but more diversified into diagnostics |

| Market Penetration |

Emerging markets & niche therapies |

Broader global reach, especially in vaccines & primary care |

| Strategic Partnerships |

Collaborations with biotech and academic institutions |

Similar, but AstraZeneca's partnerships focused on oncology & rare diseases |

Strategic Insights & Future Outlook

1. Strengthening Oncology with New Biologicals & Combinations

With a robust pipeline, AstraZeneca aims to expand indications for existing biologics and develop novel combination therapies, especially in lung and breast cancers. Partnering with biotech firms and academic institutions will further accelerate innovation.

2. Expanding in Cell & Gene Therapies

Investment in gene therapies (e.g., CRISPR-based approaches) and cell therapies could open new markets, especially in rare diseases where unmet medical needs are critical.

3. Digital & Data-Driven Clinical Development

Utilizing AI and big data for drug discovery and patient stratification streamlines development timelines and enhances target precision.

4. Navigating Regulatory & Patent Challenges

Proactive engagement with regulators and a robust patent strategy will remain essential, especially in biologics and biosimilars.

5. Market Diversification & Access

Continued focus on emerging markets and partnerships with governments will ensure sustainable growth amid price pressures and patent expiries.

Comparison of Key Financial & Strategic Metrics

| Metric |

AstraZeneca (2022) |

Pfizer |

Roche |

Novartis |

Merck & Co. |

| Revenue (USD billion) |

44.5 |

100.3 |

69.4 |

51.6 |

48.7 |

| R&D expenditure (USD billion) |

6.5 |

9.0 |

10.0 |

9.0 |

3.8 |

| Oncology Revenue Share (%) |

37% |

28% |

29% |

15% |

33% |

| Strategic Focus |

Biologics, Precision |

Vaccines, Biosimilars |

Diagnostics, Biosimilars |

Cell & Gene Therapies |

Immuno-oncology |

Key Challenges & Risks

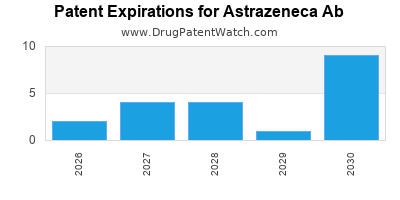

- Patent Expirations: Sunset of patents could erode market share; biosimilar competition is intensifying.

- Pricing Pressures & Regulatory Scrutiny: Governments worldwide seek to control costs; pricing negotiations are rising.

- Pipeline Risks: Clinical trial failures could impact growth potential.

- Global Economic Fluctuations: Currency fluctuations and geopolitical uncertainties may affect revenue streams.

Conclusion & Strategic Recommendations

AstraZeneca’s leadership in oncology biologics and strategic investments in precision medicine position it for sustained growth. Building on current strengths through diversified pipeline development, international expansion, and innovative partnerships will accelerate competitive advantage. Continuous vigilance toward patent management, regulatory shifts, and market disruptions is necessary to maintain its market trajectory.

Key Takeaways

- AstraZeneca commands a significant position in oncology, with fast-growing biologic therapies and strategic R&D investments.

- Its global presence, especially in emerging markets, enhances revenue diversification.

- Competitive edge derives from innovative biologics, digital health integration, and expanding pipeline collaborations.

- Industry rivals are expanding biosimilar and biologic portfolios; AstraZeneca must sustain innovation leadership.

- Long-term growth hinges on navigating patent challenges, regulatory landscapes, and market access initiatives.

FAQs

1. How does AstraZeneca’s R&D focus differentiate it from competitors?

AstraZeneca heavily emphasizes biologics and targeted therapies, with USD 6.5 billion invested in R&D (2022), primarily targeting oncology, rare diseases, and immuno-oncology. This focused innovation approach enables the company to create high-value, first-in-class therapies and expand indications, distinguishing it from rivals with broader portfolios.

2. What are AstraZeneca’s main strategies for market expansion?

The company targets emerging markets through local partnerships, tailored pricing models, and clinical trial collaborations. It also invests in digital health initiatives and builds local manufacturing capacities to enhance feasibility and market penetration.

3. How vulnerable is AstraZeneca to biosimilar competition?

While biologics face biosimilar pressures, AstraZeneca's robust patent portfolio, continuous pipeline innovation, and strategic biologics development help mitigate these risks. However, patent expiries in key products necessitate proactive pipeline replacement strategies.

4. Which therapeutic areas offer the highest growth potential for AstraZeneca?

Oncology, notably lung and breast cancers, remains the highest growth area, supported by biologics like Tagrisso, Imfinzi, and Lynparza. Additionally, rare diseases and gene therapies will offer significant opportunities as evidence and technologies mature.

5. How significant is AstraZeneca’s pipeline in securing future market share?

AstraZeneca’s pipeline comprising over 90 clinical trials and multiple approvals positions it for sustained growth. Early-stage assets in gene therapy and immuno-oncology could redefine market dynamics, reinforcing its competitive position over the next decade.

References

- IQVIA. "Global Pharmaceutical Market Review 2023."

- AstraZeneca Annual Report 2022.

- EvaluatePharma. "Top Therapeutic Areas by Revenue 2022."

- Pfizer Annual Report 2022.

- AstraZeneca Press Release. "Acquisition of Viela Bio," March 2021.