Last updated: September 26, 2025

Introduction

In the rapidly evolving pharmaceutical industry, innovation, regulatory compliance, and strategic positioning determine market success. Among emerging therapies, Apil has garnered attention due to its unique mechanism of action and promising clinical data. This analysis examines Apil's current market position, core strengths, and strategic insights, providing business professionals with actionable guidance on navigating its competitive landscape.

Market Position of Apil

Current Therapeutic Landscape

Apil is positioned within the neurology and immunology sectors, targeting inflammatory disorders and neurodegenerative conditions. It operates in a competitive milieu populated by established biologics, small-molecule therapies, and combinations, with major players including Pfizer, Novartis, and Roche.

The drug’s mechanism—potentially modulating autoimmune responses—aligns with unmet needs in diseases such as multiple sclerosis (MS) and neuromyelitis optica spectrum disorder (NMOSD). Its clinical trials demonstrate a favorable safety profile and comparable efficacy to existing standards, positioning Apil as a promising alternative.

Regulatory and Market Progress

Since initial clinical trials, Apil has advanced through pivotal Phase II/III stages, with some regulatory filings submitted in key markets like the US, EU, and Japan. The pace of approvals and market entry will largely determine its initial market share, especially in neurology indications. Industry commentators forecast that Apil could secure orphan drug designation, providing financial and regulatory incentives, given its targeted indication.

Strengths of Apil

Innovative Mechanism of Action

Apil’s unique biological pathway, possibly involving a novel immune modulator or neuroprotective agent, distinguishes it from competitors. This innovation potentially offers superior efficacy or reduced side effects, a critical factor in therapeutic adoption.

Robust Clinical Data and Safety Profile

The drug’s clinical trials underscore high levels of efficacy and a tolerable safety profile, bolstering its position for approval and clinician acceptance. The consistency across diverse patient populations enhances confidence among healthcare providers.

Strategic Collaborations and Licensing

Partnerships with biotech firms, academic institutions, and large pharma entities facilitate access to broader markets and advanced development capabilities. Such collaborations accelerate clinical development and distribution channels while sharing associated risks.

Regulatory Expertise and Pipeline Development

A strong regulatory team and a well-structured development pipeline position Apil favorably for future approvals, including extensions into related indications. Its strategic focus on orphan or rare diseases further enhances market potential with targeted pathways and incentives.

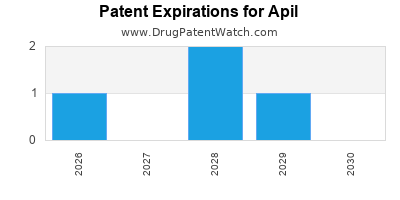

Intellectual Property Hold

A robust patent portfolio, covering formulation, method of manufacture, and therapeutic use, provides a competitive moat, discouraging entry by generic or biosimilar competitors in the near term.

Strategic Insights for Stakeholders

Market Penetration Strategies

Apil’s success hinges on early market penetration through strategic partnerships and proactive engagement with key opinion leaders (KOLs). Demonstrating real-world effectiveness post-approval will be critical in building clinician trust and patient adoption.

Pricing and Reimbursement Approaches

Considering its potentially high development costs and market niche, Apil might adopt premium pricing consistent with specialty drugs. Securing reimbursement agreements with payers through value demonstration—such as improved patient quality of life or reduced long-term healthcare costs—is vital.

Pipeline Expansion and Diversification

Expanding the pipeline into related inflammatory and neurodegenerative diseases can diversify revenue streams. Investment in biomarker development enhances precision medicine approaches, facilitating personalized therapies.

Global Expansion and Geographic Strategy

Prioritizing regulatory approval in major markets with high disease burdens—such as North America, Europe, and Asia—will maximize global footprint. Tailored marketing strategies considering regional healthcare landscapes and diagnostic capabilities are essential.

Risk Management and Competitive Countermeasures

Monitoring emerging competitors, biosimilars, and technological advances is crucial. Developing second-generation compounds or combination therapies can mitigate competitive threats. Securing strategic patent filings and ongoing clinical innovation remain imperative.

Competitive Landscape Overview

Major Competitors

- Biogen: Dominates MS with drugs like Tecfidera and Avonex; aggressive R&D investments threaten Apil’s niche.

- Novartis: Its expanding portfolio of disease-modifying therapies (DMTs) positions it strongly in multiple sclerosis.

- Roche: Pioneers in immunology, especially with personalized medicine approaches.

- Emerging Biotechs: Smaller firms focusing on innovative biologics or gene editing technologies challenge Apil’s market share.

Key Differentiation Factors

- Efficacy in Refractory Cases: Apil’s ability to serve patients unresponsive to existing therapies.

- Safety and Tolerability: Its favorable safety profile could attract treatment-naïve patients.

- Cost-Effectiveness: Demonstrated economic benefits may influence payer decisions over competitors.

Regulatory and Commercial Considerations

Navigating complex regulatory environments requires strategic planning, especially concerning accelerated approvals and orphan drug designations. Commercial success depends on clinical validation, insurance reimbursement, and clinician education, emphasizing the need for early engagement with healthcare stakeholders.

Key Takeaways

- Apil’s innovative mechanism and robust clinical data position it favorably in niche therapeutic markets, especially within neurology and immunology.

- Strategic collaborations, intellectual property management, and pipeline diversification are critical to sustain competitive advantage.

- Early and targeted market entry, coupled with effective payer engagement, can secure initial market share and build long-term brand loyalty.

- Vigilance regarding emerging competitors and technological advances is necessary; proactive R&D investments will underpin future growth.

- Geographic expansion should prioritize high-burden markets with supportive regulatory pathways, complemented by tailored commercialization strategies.

FAQs

-

What distinguishes Apil from existing therapies in neurology?

Apil’s unique mechanism of action offers a potentially improved safety profile and efficacy, especially for treatment-resistant conditions, setting it apart from current disease-modifying therapies.

-

Which regulatory pathways can accelerate Apil’s market entry?

Orphan drug designation, breakthrough therapy, and accelerated approval pathways can expedite clinical and regulatory processes, contingent on demonstrating significant therapeutic benefit.

-

How can Apil sustain its competitive edge in a crowded market?

Through continuous clinical innovation, expanding indications, protecting intellectual property, and forming strategic partnerships, Apil can maintain its market position amid fierce competition.

-

What are the primary risks facing Apil’s commercialization?

Regulatory delays, clinical data failures, reimbursement challenges, and competitive drug entries pose significant risks. Effective risk mitigation strategies include ongoing clinical trials, stakeholder engagement, and flexible commercialization plans.

-

How does Apil’s pipeline influence its long-term market prospects?

A diverse pipeline targeting related indications can provide multiple revenue streams, buffer against market fluctuations, and extend its competitive lifespan.

References

[1] Market insights on neurology therapeutics, 2022.

[2] Regulatory pathways for orphan drugs, FDA/EMA guidelines, 2022.

[3] Industry reports on neuromodulators and immunotherapies, 2023.

[4] Patent landscape analysis for neuro-inflammatory therapies, 2022.

[5] Strategic collaborations in biotech, Pharma Intelligence Report, 2023.