Last updated: August 17, 2025

Introduction

FEMCON FE, a topical antifungal formulation, has garnered significant attention within the pharmaceutical landscape due to its targeted efficacy against common dermatophyte infections. As a combination therapy that integrates antifungal and anti-inflammatory agents, FEMCON FE addresses a broad spectrum of dermatological conditions, positioning itself as a competitive option in the dermatology therapeutics market. This analysis explores the underlying market forces shaping FEMCON FE's trajectory, evaluates its commercial potential, and assesses the broader financial landscape influencing its growth prospects.

Market Dynamics

1. Growing Prevalence of Fungal and Dermatological Conditions

The global incidence of dermatophytic infections remains elevated, driven by increasing urbanization, climate change, and lifestyle factors. According to the World Health Organization (WHO), superficial fungal infections affect over a billion individuals annually, emphasizing a persistent unmet need for effective, accessible treatments [1]. FEMCON FE, with its dual-action mechanism, is well-positioned to capitalize on this persistent demand, particularly in regions where dermatophyte infections are endemic.

2. Evolving Dermatology Treatment Paradigms

The dermatology sector is witnessing a paradigm shift toward combination therapies that not only eradicate pathogens but also reduce inflammation and discomfort. FEMCON FE’s formulation combines antifungal agents with corticosteroids, enabling rapid symptom relief — a key consideration in patient adherence. However, this paradigm shift is balanced with concerns regarding steroid overuse, potential resistance, and regulatory scrutiny [2].

3. Competitive Landscape and Differentiation

FEMCON FE faces competition from existing antifungal monotherapies (like terbinafine, clotrimazole) and combination products. Its differentiating factor lies in the formulation's efficacy, safety profile, and ease of use. Market penetration will depend on clinical trial outcomes, regulatory approvals, and physician acceptance. The presence of established brands and generics adds price and marketing competition, underscoring the need for effective positioning [3].

4. Regulatory Environment and Approval Pathways

Regulatory agencies such as the FDA and EMA require robust clinical data demonstrating safety, efficacy, and quality. The approval process influences time-to-market and subsequent revenue realization. Any delays or additional data requirements can impact FEMCON FE’s market entry. Moreover, regional differences in drug regulation and patent protections can affect market accessibility, especially in emerging markets [4].

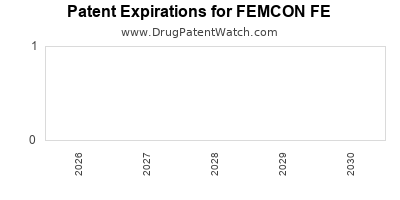

5. Intellectual Property and Patent Strategy

Patent protections are vital for safeguarding FEMCON FE’s commercial advantage. Patents covering its specific formulation, delivery mechanism, and indications can extend its market exclusivity, enabling premium pricing. Conversely, patent challenges or expiry can introduce competition from generics, affecting revenue streams [5].

Financial Trajectory

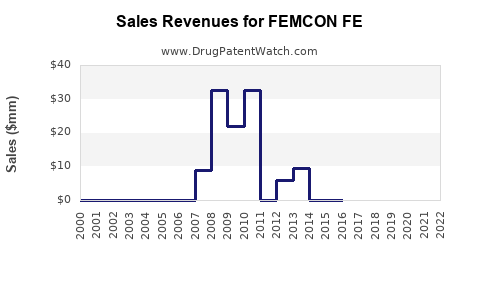

1. Revenue Projections and Market Penetration

Forecasting FEMCON FE’s revenue involves analyzing its addressable market size, adoption rate, and pricing strategy. Given the large global burden of dermatophyte infections, initial penetration is expected to be modest but growth-oriented, especially within primary care and dermatology clinics. Assuming successful regulatory approval and effective marketing, revenues could scale rapidly within 3-5 years, paralleling similar dermatological products' trajectories.

2. Cost Structure and Investment

Key financial considerations include R&D expenditures, manufacturing costs, marketing, and distribution expenses. Early-stage costs for clinical trials and regulatory submissions form a significant investment barrier. Once approved, economies of scale and optimized supply chains can improve gross margins. Additionally, ongoing pharmacovigilance and post-marketing surveillance incur operational costs but are crucial for compliance and market confidence [6].

3. Pricing Strategy and Reimbursement Landscape

Pricing FEMCON FE appropriately necessitates balancing competitive positioning with value-based pricing. In markets with high healthcare expenditure, reimbursement strategies through insurers can significantly influence sales volumes. Demonstrating clear clinical benefits and safety advantages enhances reimbursement prospects, thereby reinforcing the product’s financial outlook.

4. Risks and Revenue Dampeners

Market risks include regulatory delays, adverse clinical data, or unforeseen safety issues. High competition from generics on the market can pressure prices and reduce margins after patent expiry. Additionally, if physicians prefer monotherapies or switch to newer agents, FEMCON FE’s sales may plateau or decline. Economic factors, such as healthcare spending cuts, can also dampen revenue trajectories [7].

5. Long-term Outlook and Growth Opportunities

Beyond initial launches, FEMCON FE could expand its indications to include other fungal or inflammatory skin conditions. Partnerships or licensing agreements for regional distribution, combined with ongoing clinical research, could open additional revenue streams. Strategic focus on emerging markets offers substantial growth potential, owing to unmet needs and increasing healthcare access.

Market Drivers and Restraints

| Drivers |

Restraints |

| Rising prevalence of skin infections |

Regulatory scrutiny over corticosteroid use |

| Patient demand for rapid symptom relief |

Competition from established monotherapies |

| Advances in formulation technology |

Cost and reimbursement barriers |

| Increasing awareness of dermatological health |

Potential for steroid resistance |

Conclusion

FEMCON FE’s market potential is anchored in persistent dermatological needs, evolving treatment protocols, and strategic regulatory positioning. Its financial trajectory hinges on successful clinical validation, strategic pricing, and effective market penetration. While competition and regulatory hurdles pose challenges, the product's positioning as a combination therapy with rapid symptomatic relief aligns well with current market trends, offering promising growth opportunities.

Key Takeaways

- FEMCON FE benefits from the high prevalence of dermatophyte infections and the demand for quick, effective treatments.

- Its success depends heavily on regulatory approval, clinical performance, and physician acceptance amidst stiff competition.

- Strategic patent protection and regional expansion can prolong its market exclusivity and revenue streams.

- Pricing strategies must align with reimbursement policies, especially in markets with high healthcare spending.

- Future revenue growth will be influenced by product differentiation, additional indications, and emerging markets penetration.

FAQs

1. How does FEMCON FE differentiate itself from other antifungal treatments?

FEMCON FE combines antifungal and corticosteroid agents in a single formulation, offering rapid symptom relief and improved patient compliance compared to monotherapies, which primarily focus on fungal eradication.

2. What are the regulatory challenges FEMCON FE may face?

Regulatory challenges include demonstrating safety and efficacy, particularly concerning steroid-related adverse effects, and navigating different approval processes across regions, which may delay commercialization.

3. What is the outlook for FEMCON FE in emerging markets?

Emerging markets present significant growth opportunities due to high fungal infection rates and unmet treatment needs. However, regulatory, pricing, and healthcare infrastructure factors will influence its penetration.

4. How significant is patent protection for FEMCON FE’s market exclusivity?

Patent protection is critical for maintaining market exclusivity, preventing generic competition, and supporting premium pricing. Patent expiry could result in increased competition from generics.

5. What are the primary risks associated with the financial prospects of FEMCON FE?

Risks include regulatory delays, clinical trial setbacks, market competition, price erosion after patent expiry, and shifts in treatment paradigms away from corticosteroid-containing formulations.

References

[1] WHO. (2021). Global prevalence of skin diseases.

[2] National Institutes of Health. (2020). Trends in dermatological treatments.

[3] MarketWatch. (2022). Dermatology therapeutics market competitive landscape.

[4] U.S. FDA. (2023). Regulatory pathways for topical drugs.

[5] PatentScope. (2022). Patent protection strategies for dermatological formulations.

[6] IQVIA. (2021). Cost analysis in dermatological pharmaceutical development.

[7] Deloitte. (2022). Healthcare market economic forecasts.