complera Drug Patent Profile

✉ Email this page to a colleague

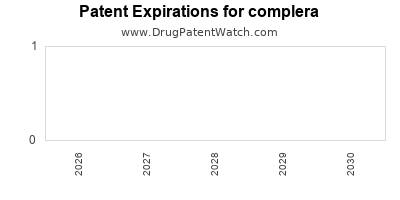

Which patents cover Complera, and when can generic versions of Complera launch?

Complera is a drug marketed by Gilead Sciences Inc and is included in one NDA. There are three patents protecting this drug and one Paragraph IV challenge.

This drug has two hundred and seventy-three patent family members in fifty-two countries.

The generic ingredient in COMPLERA is emtricitabine; rilpivirine hydrochloride; tenofovir disoproxil fumarate. There are eighteen drug master file entries for this compound. Two suppliers are listed for this compound. Additional details are available on the emtricitabine; rilpivirine hydrochloride; tenofovir disoproxil fumarate profile page.

DrugPatentWatch® Generic Entry Outlook for Complera

Complera was eligible for patent challenges on May 20, 2015.

There have been fifteen patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for complera?

- What are the global sales for complera?

- What is Average Wholesale Price for complera?

Summary for complera

| International Patents: | 273 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 2 |

| Clinical Trials: | 6 |

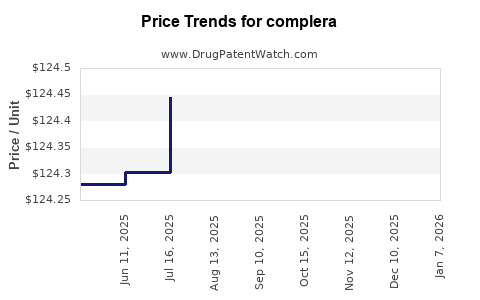

| Drug Prices: | Drug price information for complera |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for complera |

| What excipients (inactive ingredients) are in complera? | complera excipients list |

| DailyMed Link: | complera at DailyMed |

Recent Clinical Trials for complera

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| CIHR Canadian HIV Trials Network | Phase 3 |

| Ottawa Hospital Research Institute | Phase 3 |

| Gilead Sciences | Phase 3 |

Pharmacology for complera

Paragraph IV (Patent) Challenges for COMPLERA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| COMPLERA | Tablets | emtricitabine; rilpivirine hydrochloride; tenofovir disoproxil fumarate | 200 mg/25 mg/ 300 mg | 202123 | 1 | 2015-05-20 |

US Patents and Regulatory Information for complera

complera is protected by three US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gilead Sciences Inc | COMPLERA | emtricitabine; rilpivirine hydrochloride; tenofovir disoproxil fumarate | TABLET;ORAL | 202123-001 | Aug 10, 2011 | AB | RX | Yes | Yes | 8,841,310 | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| Gilead Sciences Inc | COMPLERA | emtricitabine; rilpivirine hydrochloride; tenofovir disoproxil fumarate | TABLET;ORAL | 202123-001 | Aug 10, 2011 | AB | RX | Yes | Yes | 7,125,879 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | |

| Gilead Sciences Inc | COMPLERA | emtricitabine; rilpivirine hydrochloride; tenofovir disoproxil fumarate | TABLET;ORAL | 202123-001 | Aug 10, 2011 | AB | RX | Yes | Yes | 10,857,102 | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for complera

International Patents for complera

When does loss-of-exclusivity occur for complera?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

African Regional IP Organization (ARIPO)

Patent: 16

Estimated Expiration: ⤷ Get Started Free

Argentina

Patent: 4500

Estimated Expiration: ⤷ Get Started Free

Patent: 3409

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 11329642

Estimated Expiration: ⤷ Get Started Free

Patent: 16208417

Estimated Expiration: ⤷ Get Started Free

Patent: 18202635

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2013012245

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 18097

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 13001402

Estimated Expiration: ⤷ Get Started Free

China

Patent: 3491948

Estimated Expiration: ⤷ Get Started Free

Patent: 6511357

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 61300

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 130293

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0140946

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 16115

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 40362

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 13012700

Estimated Expiration: ⤷ Get Started Free

Patent: 19078196

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 5852

Estimated Expiration: ⤷ Get Started Free

Patent: 1390651

Estimated Expiration: ⤷ Get Started Free

Patent: 1691695

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 40362

Estimated Expiration: ⤷ Get Started Free

Patent: 26466

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 90064

Estimated Expiration: ⤷ Get Started Free

Patent: 06592

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6300

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 38851

Estimated Expiration: ⤷ Get Started Free

Patent: 14500261

Estimated Expiration: ⤷ Get Started Free

Patent: 15131853

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 5604

Patent: THERAPEUTIC COMPOSITIONS COMPRISING RILPIVIRINE HCL AND TENOFOVIR DISOPROXIL FUMARATE

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 7512

Estimated Expiration: ⤷ Get Started Free

Patent: 13005669

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 980

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 735

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 0729

Patent: Therapeutic compositions comprising rilpivirine hcl and tenofovir disoproxil fumarate

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 140163

Patent: COMPOSICIONES TERAPEUTICAS QUE COMPRENDEN RILPIVIRINA HCL Y TENOFOVIR DISOPROXIL FUMARATO

Estimated Expiration: ⤷ Get Started Free

Patent: 170521

Patent: COMBINACION FARMACEUTICA QUE COMPRENDE RILPIVIRINA HCL, TENOFOVIR DISOPROXIL FUMARATO Y EMTRICITABINA

Estimated Expiration: ⤷ Get Started Free

Patent: 211657

Patent: COMPOSICIONES TERAPEUTICAS QUE COMPRENDEN RILPIVIRINA HCL Y TENOFOVIR DISOPROXIL FUMARATO

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 013501002

Patent: THERAPEUTIC COMPOSITIONS COMPRISING RILPIVIRINE HCL AND TENOFOVIR DISOPROXIL FUMARATE

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 40362

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 40362

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 01400150

Patent: Composizioni terapeutiche comprendenti rilpivirinacloridrato e tenofovir disoproxil fumarato

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 691

Patent: TERAPEUTSKE KOMPOZICIJE KOJE SADRŽE RILPIVIRIN HCL I TENOVOFIR DIZOPROKSIL FUMARAT (THERAPEUTIC COMPOSITIONS COMPRISING RILPIVIRIN HCL AND TENOVOFIR DISOPROXIL FUMARATE)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 0333

Patent: THERAPEUTIC COMPOSITIONS COMPRISING RILPIVIRINE HCL AND TENOFOVIR DISOPROXIL FUMARATE

Estimated Expiration: ⤷ Get Started Free

Patent: 201509521W

Patent: THERAPEUTIC COMPOSITIONS COMPRISING RILPIVIRINE HCL AND TENOFOVIR DISOPROXIL FUMARATE

Estimated Expiration: ⤷ Get Started Free

Patent: 201912527X

Patent: THERAPEUTIC COMPOSITIONS COMPRISING RILPIVIRINE HCL AND TENOFOVIR DISOPROXIL FUMARATE

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 40362

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1304481

Patent: THERAPEUTIC COMPOSITIONS COMPRISING RILPIVIRINE HCL AND TENOFOVIR DISOPROXIL FUMARATE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1923103

Estimated Expiration: ⤷ Get Started Free

Patent: 140037799

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 24408

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 56840

Estimated Expiration: ⤷ Get Started Free

Patent: 1238612

Patent: Therapeutic compositions

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 4075

Patent: БАГАТОШАРОВА ТАБЛЕТКА, ЩО МІСТИТЬ РИЛПІВІРИН HCl, ЕМТРИЦИТАБІН І ТЕНОФОВІРУ ДИЗОПРОКСИЛФУМАРАТ

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering complera around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Slovenia | 1243593 | ⤷ Get Started Free | |

| Denmark | 0984013 | ⤷ Get Started Free | |

| Australia | 8077398 | ⤷ Get Started Free | |

| China | 1920050 | ⤷ Get Started Free | |

| Austria | 517891 | ⤷ Get Started Free | |

| Croatia | P20140379 | PRIPRAVCI I METODE ZA KOMBINIRANU ANTIVIRUSNU TERAPIJU (COMPOSITIONS AND METHODS FOR COMBINATION ANTIVIRAL THERAPY) | ⤷ Get Started Free |

| Portugal | 1278735 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for complera

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 3808743 | PA2022515,C3808743 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: RILPIVIRINO ARBA FARMACINIU POZIURIU PRIIMTINOS PRIDETINES RILPIVIRINO DRUSKOS, ISKAITANT RILPIVIRINO HIDROCHLORIDO RUGSTIES DRUSKA, IR EMTRICITABINO DERINYS; REGISTRATION NO/DATE: EU/1/11/737/001-002 20111128 |

| 1663240 | 2015/052 | Ireland | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF RILPIVIRINE OR A PHARMACEUTICALLY ACCEPTABLE SALT OF RILPIVIRINE, INCLUDING THE HYDROCHLORIDE SALT OF RILPIVIRINE, AND EMTRICITABINE; REGISTRATION NO/DATE: EU/1/11/737/001-002 20111128 |

| 1663240 | 132016000129162 | Italy | ⤷ Get Started Free | PRODUCT NAME: ASSOCIAZIONE DI RILPIVIRINA O UNA SUA FORMA TERAPEUTICAMENTE EQUIVALENTE PROTETTA DAL BREVETTO DI BASE, COME UN SALE FARMACEUTICAMENTE ACCETTABILE DI RILPIVIRINA, COMPRESO IL SUO SALE CLORIDRATO, EMTRICITABINA, E TENOFOVIR ALAFENAMIDE O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE, IN PARTICOLARE IL TENOFOVIR ALAFENAMIDE EMIFUMARATO(ODEFSEY); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/16/1112, 20160623 |

| 0915894 | 08C0020 | France | ⤷ Get Started Free | PRODUCT NAME: EFAVIRENZ; EMTRICITABINE; TENOFOVIR DISOPROXIL FUMARATE; REGISTRATION NO/DATE: EU/1/07/430/001 20071213 |

| 1663240 | 2015/053 | Ireland | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF RILPIVIRINE OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF, INCLUDING THE HYDROCHLORIDE SALT, TENOFOVIR, IN PARTICULAR TENOFOVIR DISOPROXIL FUMARATE, AND EMTRICITABINE; REGISTRATION NO/DATE: EU/1/11/737/001-002 20111128 |

| 1632232 | SPC/GB17/007 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF RILPIVIRINE HYDROCHLORIDE AND TENOFOVIR ALAFENAMIDE, OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF, IN PARTICULAR TENOFOVIR ALAFENAMIDE FUMARATE; REGISTERED: UK EU/1/16/1112 (NI) 20160623; UK PLGB 11972/0019 20160623 |

| 1419152 | PA2012009 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: EMTRICITABINUM + RILPIVIRINUM + TENOFOVIRUM DISOPROXILUM; REGISTRATION NO/DATE: EU/1/11/737/001, 2011 11 28 EU/1/11/737/002 20111128 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for COMPLERA ( rilpivirine/emtricitabine/tenofovir)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.