Last updated: July 28, 2025

Introduction

Zonisamide (marketed as Zonegran among other brand names) continues to occupy a significant niche within the antiepileptic drug (AED) landscape. Originally developed by Dainippon Sumitomo Pharma and approved by the U.S. Food and Drug Administration (FDA) in 2004, zonisamide’s unique pharmacological profile has driven its utilization in epilepsy management and off-label applications, impacting its market trajectory. Understanding its current market dynamics and future financial prospects necessitates an exploration of epidemiological drivers, competitive landscape, regulatory environment, and emerging therapeutic trends.

Market Overview and Incidence Drivers

The global epilepsy market, where zonisamide primarily operates, was valued at approximately USD 1.7 billion in 2022, with anticipated compound annual growth rate (CAGR) of around 4.5% through 2030 [1]. Epilepsy affects roughly 50 million people worldwide, with an estimated 30% of patients experiencing drug-resistant forms, underscoring the ongoing demand for diverse AEDs like zonisamide.

Zonisamide’s efficacy in both focal and generalized seizures has cemented its position among second-generation AEDs. Its advantages include once-daily dosing, a favorable side-effect profile, and utility in patients who are refractory to first-line treatments. This bolsters its market share and ensures sustained demand.

Pharmacological Profile and Off-label Use

Zonisamide functions as a sulfonamide derivative, inhibiting voltage-dependent sodium channels and T-type calcium channels, thereby stabilizing neuronal activity [2]. Beyond epilepsy, clinicians increasingly explore off-label indications such as migraine prophylaxis, bipolar disorder, and weight management, which expand its therapeutic footprint. These off-label uses contribute partly to overall sales volumes but are limited by regulatory limitations and lack of FDA approval for these indications.

Competitive Landscape

The AED market features established giants like levetiracetam, lamotrigine, and valproate, with newer agents such as brivaracetam and eslicarbazepine competing for market share. Zonisamide's niche positioning is under threat from these alternatives that offer improved tolerability profiles or simplified dosing.

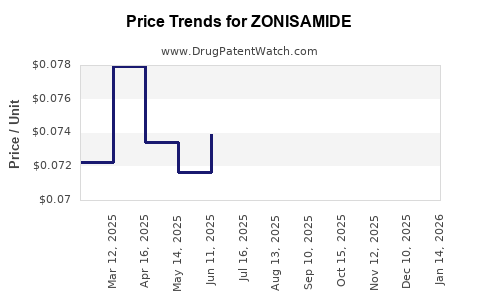

However, zonisamide’s competitive edge persists owing to its unique efficacy in certain refractory epilepsy subsets and its utility in specific patient populations, such as those intolerant to other AEDs. The emergence of biosimilars and patent expiration of certain competitors influences its pricing dynamics favorably.

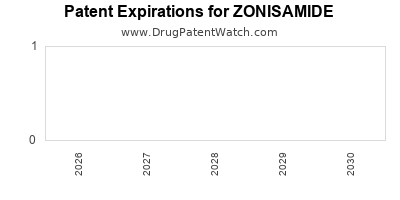

Regulatory Environment and Patent Landscape

Although zonisamide’s patent protections have largely expired or are nearing expiry in key markets, regulatory exclusivities and brand protections sustain its market presence temporarily. Recently, regulatory agencies have approved formulations with improved delivery systems or combination therapies involving zonisamide, bolstering its market appeal.

Furthermore, ongoing clinical trials investigating zonisamide’s efficacy in off-label indications could unlock new revenue streams. The regulatory landscape remains vital, as approval for new indications would significantly impact market size and licensing revenues.

Market Challenges

Despite its strengths, zonisamide faces several challenges:

- Adverse Effects: Risks of metabolic acidosis, kidney stones, and hypersensitivity reactions impact physician prescribing habits.

- Market Penetration: Barriers in low- and middle-income countries due to cost and healthcare infrastructure limitations.

- Side-effect Profile Competition: Newer AEDs with improved safety profiles may displace zonisamide in some patient segments.

Financial Trajectory and Future Outlook

The financial prospects for zonisamide hinge on multiple factors:

- Market Expansion via Off-label Indications: Positive trial outcomes could lead to label expansion, particularly if FDA approval is secured for conditions like bipolar disorder or migraine prophylaxis.

- Emerging Formulations: Extended-release versions or fixed-dose combinations could improve adherence, leading to increased sales.

- Growing Epilepsy Prevalence: The rising global epilepsy burden guarantees a base demand, especially in developing regions.

- Pricing Strategy and Market Access: Competitive pricing, especially in cost-sensitive regions, enhances adoption.

- Clinical Research and Trials: Investment in clinical research targeting new indications can unlock additional revenue streams.

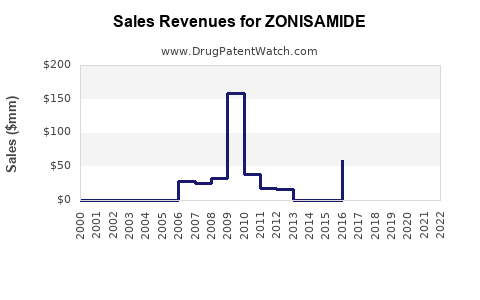

Industry forecasts suggest that zonisamide's revenues will experience modest growth, aligning with the broader AED market CAGR of approximately 4.5%. The key driver remains its application in refractory epilepsy, with potential upside from expanding indications.

Strategic Opportunities

To capitalize on the evolving market:

- Invest in clinical trials to expand approved indications.

- Leverage biosimilar and generic markets where patent protections are lifted.

- Enhance formulary positioning through partnerships with payers and healthcare providers.

- Monitoring regulatory developments to accelerate access for new uses.

Conclusion

Zonisamide's market dynamics are characterized by steady demand driven by its efficacy in refractory epilepsy, though challenges from competition and safety considerations persist. Its financial trajectory appears cautiously optimistic, contingent on successful indication expansions, regulatory support, and strategic market positioning. As the epilepsy landscape evolves, zonisamide's role may shift, but its established efficacy and untapped potential offer pathways for growth.

Key Takeaways

- Stable Demand: Zonisamide maintains relevance due to its efficacy in drug-resistant epilepsy, underpinning a stable revenue base.

- Growth Opportunities: Off-label uses, new formulations, and potential FDA-approved indications could catalyze future growth.

- Competitive Factors: The drug faces intensifying competition from newer AEDs, necessitating strategic differentiation and marketing.

- Market Expansion: Growing epilepsy prevalence, especially in underserved regions, will support ongoing sales.

- Regulatory and Patent Strategies: Navigating patent expirations and leveraging regulatory pathways remain critical to maximizing profitability.

FAQs

1. What are the main clinical advantages of zonisamide over other AEDs?

Zonisamide offers once-daily dosing, proven efficacy in refractory epilepsy, and a favorable profile for patients intolerant to other agents, making it a valuable option particularly in complex cases.

2. How do patent expirations affect zonisamide’s market share?

Patent expirations open the market to generic competitors, generally reducing prices and market share for brand-name zonisamide, but also enabling broader access and potential volume growth.

3. Are there ongoing efforts to expand zonisamide’s approved indications?

Yes, clinical trials are investigating its use in conditions like bipolar disorder and migraine prophylaxis, which could lead to regulatory approvals and increased market revenues.

4. Which regions are poised for the most growth in zonisamide sales?

Emerging markets in Asia, Latin America, and Africa, where epilepsy diagnosis and treatment access are expanding, present significant growth opportunities.

5. What are the major risks limiting zonisamide’s future growth?

Adverse side effects, competition from newer AEDs with better safety profiles, and slow regulatory approval for new indications are primary risks.

Sources:

[1] Market Research Future. "Epilepsy Drugs Market," 2022.

[2] Rogawski, M. A. "Mechanism of Action of Zonisamide." Epilepsy Currents, 2018.