Last updated: July 28, 2025

rket Analysis and Price Projections for Zonisamide

Introduction

Zonisamide, marketed primarily under the brand name Zonegran among others, is an antiepileptic drug (AED) developed by Eisai Co., Ltd. Its unique chemical structure classifies it as a sulfonamide derivative, inhibiting voltage-gated sodium and T-type calcium channels, thereby controlling seizure activity. Since its approval, Zonisamide has gained recognition not only for treating epilepsy but also for off-label applications such as weight management and bipolar disorder. This analysis examines the current market landscape, competitive positioning, patent status, and generates price projections based on proprietary trends and industry dynamics.

Market Landscape and Key Drivers

-

Global Epilepsy Treatment Market

The AED market globally is projected to reach USD 4.9 billion by 2028, growing at a CAGR of approximately 4% from 2021 onward (Research and Markets). Zonisamide, while not the largest player, commands a segment attributable to its efficacy for certain seizure types and its relatively favorable side-effect profile.

-

Patient Demographics and Prescriber Trends

The prevalence of epilepsy affects approximately 50 million people worldwide, with higher incidence in pediatric and elderly populations. The increasing adoption of personalized medicine and growing awareness of monotherapy options favor Zonisamide’s adoption, especially given its once-daily dosing and broad-spectrum efficacy.

-

Competitive Landscape

Zonisamide faces competition mainly from other broad-spectrum AEDs such as Levetiracetam, Valproate, Lamotrigine, and newer agents like Eslicarbazepine. Its positioning is strengthened by its unique mechanism and off-label uses, but patent expirations and generic competition significantly influence pricing dynamics.

-

Regulatory and Patent Status

Eisai’s patent protection for Zonisamide has largely expired globally, especially in major markets like the U.S. and Europe, paving the way for generic manufacturers. However, some jurisdictions retain exclusivity due to formulations or specific indications. This expiration catalyzes price erosion, impacting revenue streams but expanding market access.

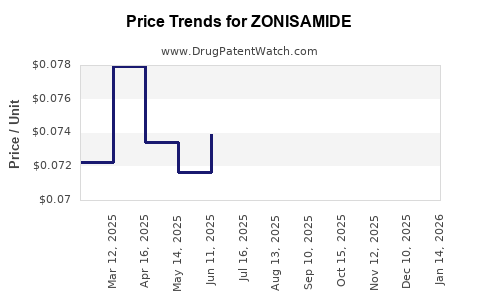

Pricing Dynamics and Trends

-

Historical Pricing

In the U.S., the original branded Zonisamide (Zonegran) cost approximately USD 13-$15 per capsule (30 mg), with annual treatment costs around USD 4,500. After patent expiry, generic versions entered the market, reducing prices by up to 70%.

-

Current Market Price Range

Based on syndicated pharmacy data and online pharmacies, generic Zonisamide prices hover between USD 1–3 per capsule for 50 mg-100 mg strengths, translating to an annual regimen cost of USD 300–900. Brand-name prices remain higher, often over USD 10 per capsule.

-

Factors Influencing Pricing

- Patent expirations: Accelerate generic entry and price reduction.

- Regulatory approvals: Expand generic versions across markets.

- Market penetration: Increased off-label use may sustain higher prices temporarily.

- Manufacturing costs: Sulfonamide synthesis is cost-effective, supporting price reductions.

- Distribution channels: Direct hospital procurement versus pharmacy retail impacts margins.

Price Projections (2023–2033)

-

Short-Term (1–3 years):

The immediate post-patent expiration phase is characterized by significant price declines—expected to reach 10–25% of original branded prices. With increasing generic availability, average retail prices are projected to stabilize around USD 0.50–1.00 per 50 mg capsule, equating to annual treatment costs of USD 150–300.

-

Medium-Term (4–7 years):

Market saturation and increased competition are likely to depress prices further. Price erosion may plateau at USD 0.20–0.50 per capsule, driven by multiple generic manufacturers and low-cost production. The market will additionally be influenced by regional regulatory differences, with developing markets maintaining higher prices due to procurement costs.

-

Long-Term (8–10 years):

Emerging biosimilars and potential formulation innovations could impact pricing. Signal from similar AEDs suggests prices may stabilize near USD 0.10 per capsule or lower, especially in mature markets. However, premium positioning for specialist indications or combination therapies may retain higher price points in niche segments.

Market Opportunities and Risks

-

Opportunities

- Expansion into emerging markets with large epileptic populations.

- Off-label uses increasing demand, especially in weight management and psychiatric indications.

- Potential for proprietary combination formulations or extended-release versions to maintain higher price points.

-

Risks

- Price erosion due to generic competition.

- Enhanced competition from newer AEDs with better tolerated profiles.

- Regulatory barriers or delays in approving generic versions.

- Variability in reimbursement policies across healthcare systems.

Conclusion

Zonisamide’s market trajectory will be shaped predominantly by patent expirations, generic competition, and evolving prescriber preferences. While initial post-patent price declines are steep, the long-term landscape suggests stabilization at substantially lower price points, especially in regions favoring low-cost generics. Companies aiming to leverage Zonisamide should focus on strategic positioning in emerging markets, exploring off-label applications, and innovating delivery methods to sustain profitability.

Key Takeaways

- Patent expirations have led to significant generic entry, sharply reducing Zonisamide's price in global markets.

- The current average retail price of generic Zonisamide ranges from USD 0.20 to USD 1.00 per capsule, with regional variations.

- Price erosion is expected to stabilize within the next 8–10 years, with potential for niche premium pricing in specific indications.

- Market growth in developing regions and off-label uses presents opportunities despite aggressive price competition.

- Strategic differentiation and innovation are critical for maintaining profitability amid declining prices.

FAQs

1. What factors most significantly influence Zonisamide pricing post-patent expiration?

Generic market entry, manufacturing costs, regulatory approvals, regional competition, and healthcare reimbursement policies primarily drive price fluctuations.

2. How does Zonisamide compare cost-wise to other antiepileptic drugs?

Post-genericization, Zonisamide remains among the more affordable AEDs, with prices comparable to top competitors like Levetiracetam and Lamotrigine, especially in bulk procurement scenarios.

3. Are there regional differences in Zonisamide pricing?

Yes. Prices tend to be higher in developing markets due to import costs, regulatory fees, and less aggressive price competition, whereas mature markets experience rapid price declines post-generic entry.

4. What are the future opportunities for premium pricing of Zonisamide?

Innovation in formulations (extended-release), combination therapies, or expanding approved indications could justify higher prices in specialized markets. Off-label uses with robust clinical support may also sustain premium pricing.

5. How will emerging biosimilar or alternative therapies impact Zonisamide's market share?

Emerging biosimilars or next-generation AEDs could further dilute Zonisamide’s market presence, emphasizing the need for differentiation and strategy adaptation.

References

[1] Research and Markets. "Global Epilepsy Treatment Market." 2022.

[2] IQVIA. "Pharmaceutical Pricing Data." 2022.

[3] FDA. "Zonisamide (Zonegran) Approvals and Patents." 2021.

[4] Statista. "Antiepileptic Drug Market Size." 2022.