Last updated: July 27, 2025

Introduction

Zidovudine (AZT, azidothymidine) remains a landmark antiretroviral medication, primarily used in the management of HIV/AIDS. Since its synthesis in the mid-1980s, zidovudine marked the first FDA-approved drug targeting HIV, radically transforming the trajectory of HIV/AIDS treatment. This analysis examines zidovudine’s evolving market dynamics, competitive landscape, pricing strategies, regulatory influences, and future financial outlooks within the context of changing therapeutic paradigms.

Historical Context and Market Evolution

Initial Introduction and Market Penetration

Approved by the U.S. Food and Drug Administration (FDA) in 1987, zidovudine was hailed as a breakthrough, becoming a cornerstone in HIV therapy. Its initial market was driven by the urgent demand for effective antiretroviral agents amidst a burgeoning global HIV/AIDS crisis. The drug's relatively high manufacturing costs, coupled with limited competition, positioned it as a lucrative product for manufacturers like Burroughs Wellcome (later acquired by GlaxoSmithKline).

Regulatory Milestones and Patent Lifecycle

Zidovudine’s patent protection spanned from the late 1980s through the early 2000s, with patent expiry occurring around the early 2000s in multiple markets. The expiration precipitated significant market erosion due to generic entry, challenging the profitability of the drug. Regulatory pathways, including the introduction of new formulations—such as fixed-dose combinations—have extended its clinical relevance and market longevity.

Market Dynamics Influencing Zidovudine

Competitive Landscape

The advent of newer antiretrovirals—integrase inhibitors, boosted protease inhibitors, and non-nucleoside reverse transcriptase inhibitors—has gradually shifted the market away from zidovudine. While zidovudine remains included in combination regimens, standalone use has declined. Generic zidovudine now captures a substantial share in emerging markets, intensifying price competition.

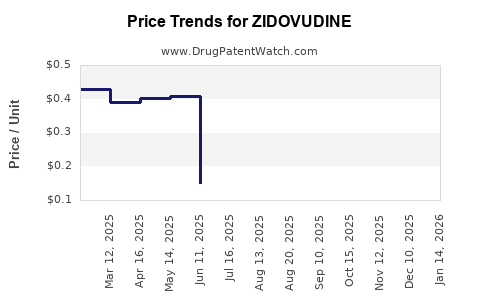

Pricing and Reimbursement Trends

Post-patent expiration, generic zidovudine’s prices have plummeted, especially in low- and middle-income countries (LMICs). According to WHO data, generic formulations are now available at significantly reduced prices, facilitating broader access but diminishing revenue streams for originators. In high-resource settings, zidovudine retains niche applications, often reimbursed under public healthcare programs, but with constrained margins.

Demand Drivers and Regional Variations

Global HIV/AIDS burden directly influences zidovudine demand. As UNAIDS reports, approximately 38 million people globally live with HIV/AIDS[1], with substantial treatment initiatives in Africa, Asia, and Latin America. In regions with limited access to the latest therapies, zidovudine remains a mainstay. Conversely, high-income nations favor integrase inhibitors and combination therapies, marginalizing zidovudine’s role.

Patent and Regulatory Policies

Patent litigation and compulsory licensing in LMICs foster generic proliferation, impacting revenue streams for patent holders. International agreements, such as the TRIPS flexibilities, have enabled wider access but at the expense of market exclusivity[2].

Financial Trajectory and Future Outlook

Current Revenue Streams

In recent years, global sales of zidovudine have plateaued or declined, with some estimates indicating sales figures in the low hundreds of millions USD annually, primarily driven by generic sales in LMICs[3]. Major pharmaceutical companies have transitioned focus toward novel antiretrovirals, reducing investment in zidovudine.

Market Expansion Opportunities

Despite declining profitability in developed economies, significant opportunities remain in LMICs. The World Health Organization (WHO) recommends zidovudine as part of first-line ART in resource-limited settings, supported by Gavi and UNAIDS programs which facilitate procurement and distribution at low costs[4]. These initiatives sustain demand and provide stable revenue streams with minimal R&D investments.

Challenges Impacting Financial Outlook

- Generic Competition: Price erosion accelerates profit attrition.

- Therapeutic Shift: Preference for integrase inhibitor-based regimens narrows zidovudine’s clinical role.

- Regulatory Hurdles: Variations in approval and licensing influence market access.

- Pricing Pressures: Global push for cost reduction constrains margins.

Future Market Strategies

Pharmaceutical companies are exploring reformulations—such as fixed-dose combination pills incorporating zidovudine—aimed at improving adherence and clinical outcomes. Moreover, research into long-acting formulations or new delivery methods could unlock niche markets. However, the primary revenue driver is expected to remain in affordable generics for LMICs, with high-income markets diminishing in relevance.

Strategic Implications for Stakeholders

- Manufacturers: Prioritize production efficiency and strategic licensing to maximize profitability in emerging markets.

- Investors: Focus on LMIC-focused portfolios and emerging indications, rather than high-income country markets.

- Policymakers: Balance affordable access with incentives for innovation, considering the essential role of zidovudine in global HIV/AIDS programs.

Key Takeaways

- Zidovudine pioneered HIV treatment but faces declining revenues due to patent expiration, generic competition, and evolving clinical guidelines favoring newer drugs.

- Its ongoing market presence predominantly hinges on inclusion in essential medicines lists and procurement programs targeting LMICs.

- Strategic focus should shift to optimizing supply chain efficiencies, exploring novel formulations, and aligning with global health initiatives.

- Continued investment in combination therapies and potential long-acting formulations could sustain niche markets, but overall financial focus is waning.

- The long-term financial viability of zidovudine hinges on global HIV/AIDS management strategies and equitable access initiatives.

FAQs

1. Why did zidovudine initially become the standard treatment for HIV/AIDS?

Zidovudine was the first FDA-approved antiretroviral agent targeting HIV, offering a significant step forward in disease management and demonstrating viral suppression, which established its role as a cornerstone therapy upon approval in 1987.

2. How has patent expiration affected zidovudine’s market?

Patent expirations led to the proliferation of generic versions, significantly reducing prices and market revenue in many regions, especially LMICs, while diminishing profitability for originators in high-income markets.

3. In which regions does zidovudine still hold a significant market?

Zidovudine remains vital in resource-limited settings supported by global health initiatives, where affordability dictates continued use, despite the availability of newer therapies elsewhere.

4. What are the future opportunities for zidovudine?

Potential exists in the development of fixed-dose combinations, long-acting formulations, or niche indications. Nonetheless, its role will likely continue to diminish in favor of newer, more tolerable, and effective drugs.

5. How do global health policies influence zidovudine’s market trajectory?

WHO guidelines and procurement programs substantially influence demand in LMICs, ensuring a steady, if declining, market despite reduced interest from private sector players in high-income markets.

References

[1] UNAIDS. Global HIV & AIDS statistics — 2022 fact sheet.

[2] World Trade Organization. Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

[3] IMS Health, Global HIV Drugs Market Data, 2022.

[4] WHO. Consolidated guidelines on HIV prevention, testing, treatment, service delivery and monitoring — 2021.