Last updated: July 27, 2025

Introduction

Zidovudine (AZT), also known as azidothymidine, is a nucleoside reverse transcriptase inhibitor (NRTI) primarily used in the management of Human Immunodeficiency Virus (HIV) infection. Since its debut in the late 1980s, AZT remains a cornerstone in antiretroviral therapy (ART), especially in combination regimens. Understanding the current market landscape and deciphering future price trajectories are essential for stakeholders—including pharmaceutical companies, healthcare providers, and investors—aiming to optimize strategies amid evolving treatment landscapes and patent dynamics.

Market Overview

Global Market Size and Growth Dynamics

The global HIV/AIDS therapeutics market, estimated at USD 24.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of approximately 4.8% through 2030 [1]. AZT, as one of the earliest antiretrovirals, retains significant demand, particularly in low- and middle-income countries (LMICs). The market segmentation reveals that:

-

Developed Countries: Primarily utilize fixed-dose combination therapies with AZT as a component. Price sensitivity is lower due to government or insurance coverage.

-

Emerging Markets: Rely heavily on generic formulations of AZT due to affordability, making them the dominant market segment. These regions account for over 70% of global HIV treatment users[2].

Patent and Regulatory Landscape

Initially patented in the 1980s by GlaxoSmithKline (GSK), AZT's patent expiry occurred in the early 2000s in many jurisdictions, facilitating a surge in generic manufacturing. Consequently, pricing in LMICs plummeted, fueling MDR (mass drug distribution) programs globally. However, patent protections persist in certain markets for specific formulations or combination drugs, influencing regional price disparities.

Competitive Environment

The market is heavily commoditized, with several generic manufacturers armed with WHO prequalification and approvals from stringent regulatory authorities (SRAs). Key players include Teva, Mylan, Cipla, and Biocon. Additionally, newer antiretrovirals with improved safety profiles and efficacy are gradually replacing AZT in high-income country regimens, impacting market share.

Pricing Trends and Determinants

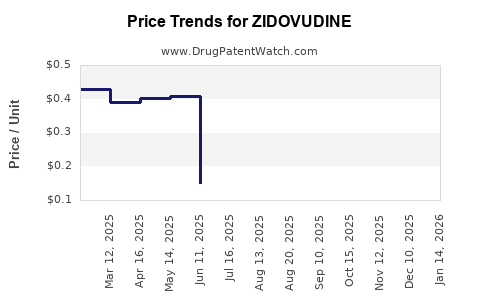

Historical Pricing Dynamics

-

In High-Income Countries: Originally priced at approximately USD 1,000 per month per patient in the 1990s, AZT prices declined sharply over subsequent decades due to generic competition, with current prices dropping below USD 50 per month per patient in the U.S. and Europe [3].

-

In LMICs: Prices as low as USD 0.10–0.50 per dose (per tablet) are prevalent, often underpinned by bulk procurement mechanisms like the Global Fund and PEPFAR.

Factors Influencing Price Trends

-

Patent Status: Expiry of patents leads to significant price erosion and increased competition.

-

Regulatory Developments: Generic approvals and WHO prequalification accelerate price reductions and market penetration.

-

Manufacturing Costs: Advances in manufacturing technologies have decreased costs, enabling further price sustainability, especially in generic segments.

-

Government Policies and International Aid: Subsidies, subsidies, and procurement contracts significantly influence the pricing landscape, predominantly in LMICs.

-

Market Demand: Persistent crucial role in first-line therapies sustains baseline demand, despite the advent of newer drugs.

Future Price Projections

Drivers of Price Stabilization and Decline

-

Patent Expiration and Generic Competition: Most major markets have seen AZT’s patent lapse, with prices in these regions likely to remain stable or decline marginally due to market saturation.

-

Introduction of Fixed-Dose Combinations (FDCs): FDCs integrating AZT with other antiretrovirals are expected to continue driving down per-component costs, improving adherence and reducing overall treatment prices.

-

Regulatory and Procurement Policies: Governments and organizations are increasingly favoring procurement of low-cost generics, keeping unit prices pressured downward.

-

Market Shifts Toward Newer Agents: While AZT remains relevant in resource-limited settings, the introduction of integrase inhibitors and other novel agents in high-income countries may marginalize AZT, impacting pricing and demand.

Projected Price Range (2023-2030)

-

High-Income Countries: Price points will likely hover around USD 10–50 per month per patient, mainly for branded or formulated products with established patents or proprietary formulations.

-

LMICs and Low-Income Countries: Expected to remain in the USD 0.10–0.50 per tablet range, with wholesale prices potentially decreasing further as manufacturing efficiencies improve and donor programs secure bulk purchasing agreements.

Market Opportunities and Challenges

Opportunities

-

Generic Expansion: Expanding manufacturing capacity in LMICs can sustain low prices and increase access.

-

Combination Therapies: Developing affordable FDCs with AZT can stabilize market revenues and improve adherence.

-

Strategic Alliances: Collaborations with NGOs and global health agencies can facilitate wider distribution and standardization.

Challenges

-

Market Decline in Developed Countries: As AZT's role diminishes in high-income nations, revenues are expected to plateau or decline.

-

Regulatory Barriers: Patent disputes or regulatory hurdles in certain jurisdictions could impact pricing and availability.

-

Emerging Resistance: Increasing resistance patterns may necessitate modifications in treatment protocols, affecting demand for AZT.

Regulatory and Policy Considerations

Stakeholders should monitor regional patent statuses and upcoming patent expirations to adapt market strategies. Engagement with global health organizations will be crucial to capitalize on low-cost procurement opportunities. The ongoing focus on universal health coverage (UHC) emphasizes access to affordable HIV treatment, bolstering demand in LMICs.

Conclusion

The market for zidovudine is characterized by a matured landscape with declining prices driven by patent expiries, generic manufacturing, and global health initiatives. While demand persists predominantly in resource-limited settings, the commercial importance of AZT in developed markets diminishes gradually. Price projections suggest stability or slight reductions in LMICs, with prices in high-income countries remaining relatively stable due to established supply chains. Stakeholders should focus on leveraging emerging opportunities in combination therapies and access programs while actively managing challenges posed by evolving treatment paradigms.

Key Takeaways

-

Market maturity with declining prices driven by patent expiries and generic competition, especially in LMICs.

-

Price stability in high-income countries due to existing procurement contracts and regulatory frameworks.

-

Growing emphasis on fixed-dose combinations integrating AZT with newer agents to maintain relevance and affordability.

-

Future market growth primarily centered in low-resource settings, bolstered by international aid and procurement programs.

-

Strategic focus on expanding access, optimizing manufacturing, and aligning with global health policies will be critical to capitalize on remaining market opportunities.

FAQs

1. How has patent expiration affected zidovudine's pricing?

Patent expiry in many jurisdictions has led to the proliferation of generic manufacturers, drastically reducing AZT prices—particularly in LMICs—making it more accessible but decreasing profit margins for innovators.

2. What is the outlook for AZT in high-income countries?

In high-income markets, AZT’s role has diminished, with newer agents replacing it in most treatment regimens, leading to stabilized or declining prices and usage.

3. Are there recent innovations involving AZT?

While direct innovations are limited, AZT remains a component in fixed-dose combinations and long-acting formulations, aiming to improve adherence and treatment efficacy.

4. What are the primary barriers to AZT market expansion?

Key barriers include resistance to older drugs, regulatory hurdles, and the preference for newer agents with better safety profiles, especially in developed countries.

5. How do global health initiatives impact AZT pricing?

Organizations like WHO, Global Fund, and PEPFAR facilitate bulk purchasing and subsidization, maintaining low prices and improving access in targeted regions.

References

[1] Market Research Future, "Global HIV Therapeutics Market Size & Growth Analysis," 2022.

[2] World Health Organization, "HIV/AIDS Treatment Market Analysis," 2021.

[3] IMS Health, "Antiretroviral Pricing Trends," 2020.