TICAGRELOR Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Ticagrelor, and what generic alternatives are available?

Ticagrelor is a drug marketed by Alembic, Alkem Labs Ltd, Amneal, Apotex, Changzhou Pharm, Dr Reddys, Hisun Pharm Hangzhou, Invagen Pharms, Macleods Pharms Ltd, MSN, Mylan, Prinston Inc, Sciegen Pharms Inc, Sunshine, Taro, and Watson Labs Inc. and is included in seventeen NDAs.

The generic ingredient in TICAGRELOR is ticagrelor. There are twenty-one drug master file entries for this compound. Twenty-four suppliers are listed for this compound. Additional details are available on the ticagrelor profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Ticagrelor

A generic version of TICAGRELOR was approved as ticagrelor by WATSON LABS INC on September 4th, 2018.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TICAGRELOR?

- What are the global sales for TICAGRELOR?

- What is Average Wholesale Price for TICAGRELOR?

Summary for TICAGRELOR

Recent Clinical Trials for TICAGRELOR

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Montreal Heart Institute | PHASE3 |

| Ministry of Science and Higher Education, Poland | PHASE4 |

| Collegium Medicum w Bydgoszczy | PHASE4 |

Pharmacology for TICAGRELOR

| Drug Class | P2Y12 Platelet Inhibitor |

| Mechanism of Action | Cytochrome P450 3A4 Inhibitors P-Glycoprotein Inhibitors P2Y12 Receptor Antagonists |

| Physiological Effect | Decreased Platelet Aggregation |

Anatomical Therapeutic Chemical (ATC) Classes for TICAGRELOR

Paragraph IV (Patent) Challenges for TICAGRELOR

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| BRILINTA | Tablets | ticagrelor | 60 mg | 022433 | 3 | 2015-09-30 |

| BRILINTA | Tablets | ticagrelor | 90 mg | 022433 | 16 | 2015-07-20 |

US Patents and Regulatory Information for TICAGRELOR

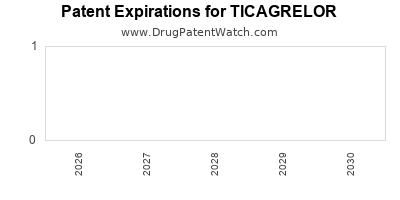

TICAGRELOR is protected by zero US patents and one FDA Regulatory Exclusivity.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Taro | TICAGRELOR | ticagrelor | TABLET;ORAL | 211498-002 | Oct 28, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Watson Labs Inc | TICAGRELOR | ticagrelor | TABLET;ORAL | 208390-001 | Sep 4, 2018 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Alembic | TICAGRELOR | ticagrelor | TABLET;ORAL | 208576-002 | Oct 28, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Msn | TICAGRELOR | ticagrelor | TABLET;ORAL | 208596-002 | Oct 28, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Sciegen Pharms Inc | TICAGRELOR | ticagrelor | TABLET;ORAL | 218962-002 | Oct 28, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for TICAGRELOR

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AstraZeneca AB | Brilique | ticagrelor | EMEA/H/C/001241Brilique, co administered with acetylsalicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients withacute coronary syndromes (ACS) ora history of myocardial infarction (MI) and a high risk of developing an atherothrombotic eventBrilique, co-administered with acetyl salicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients with a history of myocardial infarction (MI occurred at least one year ago) and a high risk of developing an atherothrombotic event. | Authorised | no | no | no | 2010-12-03 | |

| AstraZeneca AB | Possia | ticagrelor | EMEA/H/C/002303Possia, co-administered with acetylsalicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients with acute coronary syndromes (unstable angina, non-ST-elevation myocardial infarction [NSTEMI] or ST-elevation myocardial infarction [STEMI]); including patients managed medically, and those who are managed with percutaneous coronary intervention (PCI) or coronary artery by-pass grafting (CABG). | Withdrawn | no | no | no | 2010-12-03 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

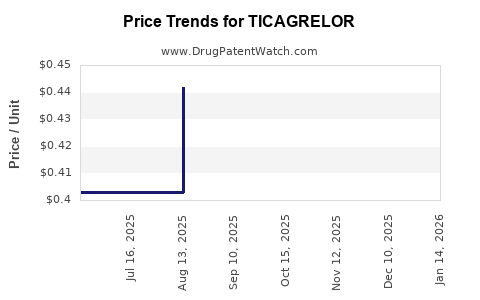

Market Dynamics and Financial Trajectory for Ticagrelor

More… ↓