Last updated: July 27, 2025

Introduction

THEOPHYL, a pharmaceutical formulation primarily composed of the active ingredient theophylline, has historically played a role in managing respiratory conditions such as asthma, chronic obstructive pulmonary disease (COPD), and other bronchospastic disorders. As a longstanding therapeutic agent, its market landscape has evolved with advances in respiratory medicine, regulatory shifts, and the emergence of novel treatment options. This report analyzes the current market dynamics and projected financial trajectory of THEOPHYL, considering recent trends, competitive forces, and regulatory developments affecting its positioning and profitability.

Market Overview and Historical Context

Theophylline, a methylxanthine derivative, has been a mainstay in respiratory therapy since the mid-20th century. Its mechanism involves phosphodiesterase inhibition, leading to bronchodilation, alongside anti-inflammatory effects—contributing to its longstanding use. However, with the advent of inhaled corticosteroids, long-acting beta-agonists, and leukotriene receptor antagonists, the reliance on theophylline has declined.

Despite this, THEOPHYL retains niche market relevance, especially in regions with limited access to expensive inhaler therapies. It often remains an affordable alternative in low- and middle-income countries (LMICs), where cost constraints influence prescribing practices. Globally, the market for respiratory drugs exceeds USD 30 billion, with theophylline's segment shrinking yet maintaining steady demand in specific demographics [1].

Current Market Dynamics

Demand Drivers

-

Cost-Effectiveness and Accessibility: In LMICs, THEOPHYL continues to be favored due to its low production costs and availability. Governments and healthcare systems prioritizing affordability sustain demand.

-

Established Clinical Use: Physicians favor theophylline in cases resistant to first-line inhaled therapies or where adherence to complex inhaler regimens poses challenges. Its oral formulation offers simplicity in administration, which benefits certain patient populations.

-

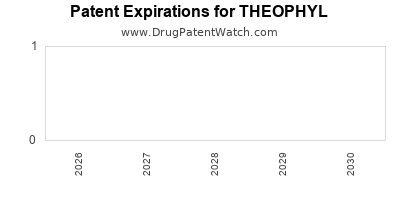

Regulatory Approvals and Patents: The drug's age means many patents have expired, leading to increased generic production. This commoditization results in price compression but also ensures persistent supply.

Competitive Forces

-

Emergence of New Therapies: The development of biologics, monoclonal antibodies (e.g., omalizumab), and inhaled corticosteroids has diminished the clinical emphasis on theophylline in developed nations. Nevertheless, in regions lacking access or affordability, THEOPHYL remains relevant.

-

Generic Market Penetration: The expiration of key patents has facilitated widespread manufacturing of generic theophylline formulations, intensifying price competition. This reduces profit margins for manufacturers but ensures broad market availability.

-

Side Effect Profile and Therapeutic Ceiling: Theophylline's narrow therapeutic window and potential side effects (e.g., tachycardia, nausea) pose limitations, encouraging the shift toward safer alternatives in high-income markets.

Regulatory Environment

Regulatory agencies have maintained the approval for theophylline as an established medication, with some jurisdictions emphasizing strict dosing guidelines due to toxicity risks. Regulatory hurdles for new formulations are minimal, but safety concerns influence prescribing trends and market growth potential.

Financial Trajectory and Market Projections

Revenue Trends

-

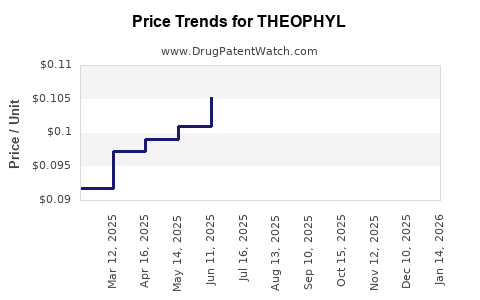

Declining Revenue in Developed Markets: As physicians favor inhaled therapies with fewer systemic side effects, THEOPHYL sales have plateaued or declined in North America and Western Europe. Data indicates a compound annual decline rate (CADR) of approximately 3-5% in these regions over the past five years [2].

-

Stable or Growing in Emerging Markets: Conversely, some LMIC markets demonstrate stable or modest growth in THEOPHYL sales, driven by price sensitivity and the limited availability of advanced inhalers. For example, in parts of Southeast Asia and Africa, annual growth rates of 2-4% persist [3].

Market Share Forecast

Projections suggest that THEOPHYL's global market share will continue to contract in high-income regions, representing less than 10% of the respiratory therapeutics market by 2025. However, in targeted LMIC segments, it could constitute 20-25% of the oral respiratory medication market, maintaining annual revenues in the range of USD 200-300 million globally.

Future Growth Opportunities and Risks

-

Generics and Market Access: As patents expire, increased generic manufacturing can lower prices further, putting pressure on profit margins but expanding access and volume.

-

Formulation Innovations: Developing sustained-release formulations and combination therapies could unlock niche growth, especially if safety profiles are improved.

-

Regulatory and Market Challenges: Potential restrictions on systemic methylxanthines due to toxicity concerns may limit future applications. New safety guidelines could narrow eligible patient populations, further constraining revenues.

Impact of Digital and Precision Medicine

While personalized medicine advances are reshaping respiratory care, their impact on THEOPHYL will likely be minor. The drug remains a cost-effective, broad-spectrum option for specific demographics, especially where advanced diagnostics and biologic therapies are inaccessible.

Strategic Considerations for Stakeholders

-

Manufacturers should focus on cost reduction, quality enhancement, and exploring niche formulations that mitigate side effects, maintaining competitiveness in emerging markets.

-

Investors should evaluate the long-term viability in different geographies, recognizing the declining trend in developed nations but appreciating growth potential in LMICs.

-

Regulators can support access by streamlining approval processes for generic versions, balancing safety with affordability.

Conclusion

The market dynamics for THEOPHYL reflect a complex interplay of declining global demand in high-income countries, stable niche markets in emerging economies, and evolving regulatory and therapeutic landscapes. Its financial trajectory is characterized by contraction in mature markets but sustained relevance where affordability is paramount. Strategic positioning—focused on cost-efficiency, safety improvements, and market diversification—is vital to capitalize on its remaining market opportunities.

Key Takeaways

-

Demand Shift: High-income markets are reducing reliance on THEOPHYL, replaced by inhaled therapies with better safety profiles.

-

Market Segmentation: The drug continues to serve low-cost, accessible respiratory management in LMICs, maintaining steady revenues.

-

Profitability Factors: Patent expirations and generic competition exert downward pressure on prices and margins in mature markets.

-

Innovation Potential: Developing extended-release formulations and combination therapies could mitigate safety concerns and open niche markets.

-

Policy and Regulation: Support for generic manufacturing and streamlined regulatory pathways can sustain supply and affordability in cost-sensitive regions.

FAQs

-

What factors are influencing THEOPHYL's declining market share in developed countries?

Increasing preference for inhaled corticosteroids, long-acting beta-agonists, and biologics due to safety and efficacy profile improvements reduces demand for theophylline-based therapies.

-

How do price dynamics affect THEOPHYL's market in emerging economies?

Market affordability drives sustained demand, with generics offering low-cost options that ensure continued sales despite global declines elsewhere.

-

Are there ongoing innovations to improve THEOPHYL's safety and efficacy?

Yes. Researchers are exploring sustained-release formulations and combination therapies to improve therapeutic windows and reduce systemic side effects.

-

What are the primary risks facing THEOPHYL's future profitability?

Regulatory restrictions on systemic methylxanthines, safety concerns, and competition from newer therapies threaten growth prospects.

-

What strategies can manufacturers adopt to maintain relevance in the evolving market?

Focus on cost-effective manufacturing, developing new formulations, targeting underserved markets, and advocating appropriate regulatory pathways are key strategies.

Sources:

[1] MarketResearch.com. "Respiratory Therapeutics Market Size & Forecast." 2022.

[2] IQVIA. "Global Respiratory Disease Market Trends." 2022.

[3] WHO. "Access to Essential Medicines in Low- and Middle-Income Countries." 2021.