RIVAROXABAN Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Rivaroxaban, and what generic alternatives are available?

Rivaroxaban is a drug marketed by Alkem Labs Ltd, Lupin Ltd, Aiping Pharm Inc, Alembic, Apotex, Ascent Pharms Inc, Aurobindo Pharma Ltd, Biocon Pharma, Breckenridge, Dr Reddys, Invagen Pharms, Macleods Pharms Ltd, MSN, Regcon Holdings, Sciegen Pharms Inc, Sunshine, and Taro. and is included in nineteen NDAs.

The generic ingredient in RIVAROXABAN is rivaroxaban. There are thirty-five drug master file entries for this compound. Nineteen suppliers are listed for this compound. Additional details are available on the rivaroxaban profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Rivaroxaban

A generic version of RIVAROXABAN was approved as rivaroxaban by LUPIN LTD on March 3rd, 2025.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for RIVAROXABAN?

- What are the global sales for RIVAROXABAN?

- What is Average Wholesale Price for RIVAROXABAN?

Summary for RIVAROXABAN

Recent Clinical Trials for RIVAROXABAN

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Melbourne | PHASE4 |

| Emily McDonald | PHASE4 |

| McMaster University | PHASE3 |

Pharmacology for RIVAROXABAN

| Drug Class | Factor Xa Inhibitor |

| Mechanism of Action | Factor Xa Inhibitors |

Medical Subject Heading (MeSH) Categories for RIVAROXABAN

Anatomical Therapeutic Chemical (ATC) Classes for RIVAROXABAN

Paragraph IV (Patent) Challenges for RIVAROXABAN

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| XARELTO | Capsules | rivaroxaban | 10 mg, 15 mg and 20 mg | 022406 | 1 | 2022-06-17 |

| XARELTO | Tablets | rivaroxaban | 2.5 mg | 022406 | 4 | 2018-11-19 |

| XARELTO | Tablets | rivaroxaban | 10 mg, 15 mg, and 20 mg | 022406 | 8 | 2015-07-01 |

US Patents and Regulatory Information for RIVAROXABAN

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Macleods Pharms Ltd | RIVAROXABAN | rivaroxaban | TABLET;ORAL | 213114-002 | May 14, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Dr Reddys | RIVAROXABAN | rivaroxaban | TABLET;ORAL | 208534-004 | May 14, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Regcon Holdings | RIVAROXABAN | rivaroxaban | TABLET;ORAL | 218445-002 | Aug 11, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Taro | RIVAROXABAN | rivaroxaban | TABLET;ORAL | 208557-002 | Oct 7, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for RIVAROXABAN

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Accord Healthcare S.L.U. | Rivaroxaban Accord | rivaroxaban | EMEA/H/C/005279Prevention of venous thromboembolism (VTE) in adult patients undergoing elective hip or knee replacement surgery.Treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE), and prevention of recurrent DVT and PE in adults. (See section 4.4 for haemodynamically unstable PE patients.Treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE), and prevention of recurrent DVT and PE in adults. (See section 4.4 for haemodynamically unstable PE patients).AdultsPrevention of stroke and systemic embolism in adult patients with non valvular atrial fibrillation with one or more risk factors, such as congestive heart failure, hypertension, age ≥ 75 years, diabetes mellitus, prior stroke or transient ischaemic attack.Treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE), and prevention of recurrent DVT and PE in adults. (See section 4.4 for haemodynamically unstable PE patients.)Paediatric populationTreatment of venous thromboembolism (VTE) and prevention of VTE recurrence in children and adolescents aged less than 18 years and weighing from 30 kg to 50 kg after at least 5 days of initial parenteral anticoagulation treatment.Rivaroxaban Accord, co administered with acetylsalicylic acid (ASA) alone or with ASA plus ticlopidine, is indicated for the prevention of atherothrombotic events in adult patients after an acute coronary syndrome (ACS) with elevated cardiac biomarkers (see sections 4.3, 4.4 and 5.1).Rivaroxaban Accord, co administered with acetylsalicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients with coronary artery disease (CAD) or symptomatic peripheral artery disease (PAD) at high risk of ischaemic events.AdultsPrevention of stroke and systemic embolism in adult patients with non-valvular atrial fibrillation with one or more risk factors, such as congestive heart failure, hypertension, age ≥ 75 years, diabetes mellitus, prior stroke or transient ischaemic attack.Treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE), and prevention of recurrent DVT and PE in adults. (See section 4.4 for haemodynamically unstable PE patients.)Paediatric populationTreatment of venous thromboembolism (VTE) and prevention of VTE recurrence in children and adolescents aged less than 18 years and weighing more than 50 kg after at least 5 days of initial parenteral anticoagulation treatment. | Authorised | yes | no | no | 2020-11-16 | |

| Mylan Ireland Limited | Rivaroxaban Viatris (previously Rivaroxaban Mylan) | rivaroxaban | EMEA/H/C/005600Rivaroxaban Mylan co-administered with acetylsalicylic acid (ASA) alone or with ASA plus clopidogrel or ticlopidine, is indicated for the prevention of atherothrombotic events in adult patients after an acute coronary syndrome (ACS) with elevated cardiac biomarkers. Rivaroxaban Mylan co-administered with acetylsalicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients with coronary artery disease (CAD) or symptomatic peripheral artery disease (PAD) at high risk of ischaemic events. ------Prevention of venous thromboembolism (VTE) in adult patients undergoing elective hip or knee replacement surgery. Treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE), and prevention of recurrent DVT and PE in adults.-------Adults Prevention of stroke and systemic embolism in adult patients with non-valvular atrial fibrillation with one or more risk factors, such as congestive heart failure, hypertension, age ≥ 75 years, diabetes mellitus, prior stroke or transient ischaemic attack.Paediatric population Treatment of venous thromboembolism (VTE) and prevention of VTE recurrence in children and adolescents aged less than 18 years and weighing from 30 kg to 50 kg after at least 5 days of initial parenteral anticoagulation treatment.Paediatric population Treatment of venous thromboembolism (VTE) and prevention of VTE recurrence in children and adolescents aged less than 18 years and weighing more than 50 kg after at least 5 days of initial parenteral anticoagulation treatment. | Authorised | yes | no | no | 2021-11-12 | |

| Bayer AG | Xarelto | rivaroxaban | EMEA/H/C/000944Xarelto, co-administered with acetylsalicylic acid (ASA) alone or with ASA plus clopidogrel or ticlopidine, is indicated for the prevention of atherothrombotic events in adult patients after an acute coronary syndrome (ACS) with elevated cardiac biomarkers.Xarelto, co-administered with acetylsalicylic acid (ASA), is indicated for the prevention of atherothrombotic events in adult patients with coronary artery disease (CAD) or symptomatic peripheral artery disease (PAD) at high risk of ischaemic events.Prevention of venous thromboembolism (VTE) in adult patients undergoing elective hip or knee replacement surgery.Treatment of deep vein thrombosis (DVT) and pulmonary embolism (PE), and prevention of recurrent DVT and PE in adults.AdultsPrevention of stroke and systemic embolism in adult patients with non-valvular atrial fibrillation with one or more risk factors, such as congestive heart failure, hypertension, age ≥ 75 years, diabetes mellitus, prior stroke or transient ischaemic attack.Paediatric population Treatment of venous thromboembolism (VTE) and prevention of VTE recurrence in children and adolescents aged less than 18 years and weighing from 30 kg to 50 kg after at least 5 days of initial parenteral anticoagulation treatment.Paediatric population Treatment of venous thromboembolism (VTE) and prevention of VTE recurrence in children and adolescents aged less than 18 years and weighing more than 50 kg after at least 5 days of initial parenteral anticoagulation treatment. | Authorised | no | no | no | 2008-09-30 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

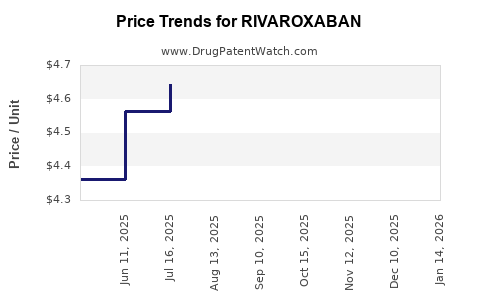

Market Dynamics and Financial Trajectory for Rivaroxaban

More… ↓