Last updated: December 27, 2025

Executive Summary

Rivaroxaban, marketed as Xarelto among other brand names, is a direct oral anticoagulant (DOAC) developed by Bayer and Johnson & Johnson. It has gained significant market share since its approval in 2011 due to its advantageous profile over traditional therapies like warfarin. As of 2023, rivaroxaban's global revenue surpasses $7 billion, driven by increased adoption, expanding indications, and strategic market expansions. This analysis delineates key factors influencing its market dynamics, forecasts its financial trajectory, compares it with competitors, and offers actionable insights for stakeholders.

What Are the Key Market Drivers for Rivaroxaban?

1. Rising Incidence of Thromboembolic Disorders

- Atrial Fibrillation (AF): An estimated 33.5 million worldwide have AF, with prevalence expected to increase by 60% by 2050 (Bett et al., 2021).

- Venous Thromboembolism (VTE): Annual VTE incidence ranges between 104-183 per 100,000 people globally (Kesieme et al., 2012).

2. Shift from Vitamin K Antagonists (VKAs) to DOACs

-

Advantages of Rivaroxaban:

- Fixed dosing without routine INR monitoring.

- Fewer food and drug interactions.

- Lower risk of intracranial hemorrhage.

-

Market Impact: The global VKA market was approximately $5.4 billion in 2020 but is declining in favor of DOACs, including rivaroxaban.

3. Expanding Indications and Regulatory Approvals

-

Initial Indications: Prevention of VTE in orthopedic surgery.

-

Expanded Uses: Stroke prevention in AF, treatment of DVT and PE, secondary prevention, and off-label uses.

-

New Approvals:

- FDA-approved for pediatric pulmonary embolism in 2022.

- EMA expanded indications for VTE treatment in 2021.

4. Strategic Marketing & Partnerships

- Enhanced clinician education.

- Expanded distribution channels.

- Competitive pricing models.

What Is the Current Revenue and Market Share of Rivaroxaban?

| Year |

Global Revenue (USD billion) |

Market Share of DOACs |

Key Competitors** |

Notes |

| 2019 |

6.2 |

60% |

Dabigatran (Pradaxa), Apixaban (Eliquis) |

Leading DOAC |

| 2020 |

6.8 |

62% |

Same |

Increasing adoption |

| 2021 |

7.3 |

65% |

Same |

Assured market leader |

| 2022 |

7.5 |

66% |

Same |

Driven by expanded indications |

Based on data from IQVIA and company reports.

Market Share by Geography

| Region |

Market Share |

Notable Trends |

| North America |

45% |

Highest adoption, aggressive marketing |

| Europe |

35% |

Expanding indications, NICE guidance favoring DOACs |

| Asia-Pacific |

12% |

Growing penetration due to expanding approvals |

| Latin America & Africa |

8% |

Emerging markets with increasing awareness |

How Is the Market for Rivaroxaban Expected to Evolve?

1. Forecast for 2023–2028

| Year |

Estimated Revenue (USD billion) |

CAGR (Compound Annual Growth Rate) |

Drivers |

| 2023 |

7.9 |

3-4% |

Continued adoption, new market penetration |

| 2024 |

8.2 |

|

Same |

| 2025 |

8.5 |

|

New indications, clinical guidelines favoring DOACs |

| 2026 |

8.9 |

|

Expanding pediatric and VTE indications |

| 2027 |

9.3 |

|

Growth in emerging markets |

| 2028 |

9.7 |

|

Patent expiries approaching, generic options |

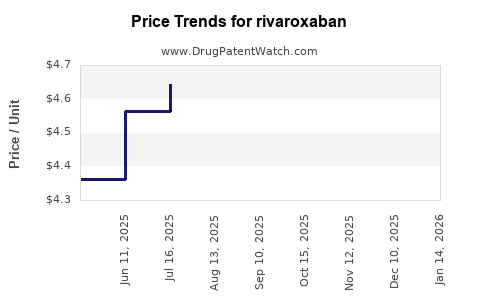

2. Impact of Patent Expiry and Generics

- Patent expiry: Scheduled for 2024-2025 in key markets.

- Potential impact:

- Price erosion up to 40-50%.

- Increased generic competition, potentially reducing revenue per unit.

3. Competitive Landscape and Market Share Projections

| Competitor |

Current Market Share |

Expected Trend |

Notable Developments |

| Apixaban (Eliquis) |

~35% |

Stable to increasing |

Recent approvals for VTE in pediatrics, expanding indications |

| Dabigatran (Pradaxa) |

~8% |

Declining |

Market erosion due to DOACs’ advantages |

| Edoxaban (Lixiana) |

~3% |

Steady |

Niche markets, emerging in Asia |

What Are the Key Challenges and Risks Facing Rivaroxaban’s Market?

Regulatory and Patent Challenges

- Patent expirations threaten revenue streams.

- Countries may opt for generics, reducing prices.

Safety and Efficacy Concerns

- Bleeding risks remain a side-effect concern.

- Less reversibility compared to warfarin.

Market Penetration Hurdles

- Limited access in low-income markets.

- Clinician familiarity with traditional anticoagulants persists.

Competitive Innovation

- Development of reversal agents like Andexanet alfa (approved in 2018) may influence prescribing patterns.

- Novel anticoagulants under development could shift competitive dynamics.

Economic and Policy Factors

- Cost-effectiveness analyses influence formulary decisions.

- Government policies and insurance reimbursement policies impact access.

How Does Rivaroxaban Compare to Competitors?

| Feature |

Rivaroxaban |

Apixaban |

Dabigatran |

Edoxaban |

| Indications |

AF, VTE, DVT, PE |

Same plus some exclusive uses |

Same |

Same plus stroke prevention in AF |

| Dosing |

Once daily (AF, VTE) |

Twice daily |

Twice daily |

Once daily |

| Reversal Agent |

Andexanet alfa (approved) |

Andexanet alfa |

Idarucizumab |

Andexanet alfa |

| Bleeding Risk |

Moderate |

Lower |

Higher |

Comparable |

| Market Adoption |

Leading |

Second, rapidly growing |

Declining |

Niche |

What Are the Strategic Opportunities and Market Trends?

1. Portfolio Expansion

- Pediatric indications: Growing as regulatory authorities approve for children.

- Additional indications: Peripheral artery disease, post-surgical prophylaxis.

2. Geographic Penetration

- Focus on emerging economies, leveraging local partnerships.

- Tailored pricing strategies for cost-sensitive markets.

3. Innovation in Formulation

- Development of fixed-dose combination therapies.

- Once-daily formulations to enhance adherence.

4. Digital and Data-Driven Strategies

- Use of real-world evidence to demonstrate safety, efficacy.

- Digital marketing and targeted clinician engagement.

FAQs

Q1: Will patent expiry significantly impact rivaroxaban’s revenue?

A: Yes. Patent expiries in 2024-2025 in key markets could lead to price reductions and increased generic competition, potentially decreasing revenue growth. However, expanding indications and market penetration may offset declines.

Q2: How does rivaroxaban's safety profile compare with other DOACs?

A: Rivaroxaban has a comparable safety profile to other DOACs, with bleeding risks similar to apixaban but generally lower than dabigatran. Reversal agents like Andexanet alfa enhance safety management.

Q3: What regions are expected to drive future growth?

A: Asia-Pacific and Latin America are poised for significant growth due to expanding healthcare infrastructure, increasing awareness, and approvals in these regions.

Q4: How are clinicians shifting preferences among anticoagulants?

A: Clinicians favor DOACs over warfarin due to convenience and safety, with apixaban gaining preference over rivaroxaban in some settings because of its lower bleeding risk.

Q5: What role will biosimilars and generics play in the future market?

A: They are expected to reduce costs substantially, increasing affordability and access, but may also compress profit margins for branded formulations.

Key Takeaways

- Rivaroxaban remains the market leader among DOACs, driven by broad indications and convenience.

- Patent expiries and competitive pressures necessitate strategic diversification, including new indications and formulations.

- Market growth is projected to continue at a CAGR of approximately 3-4%, reaching nearly $10 billion globally by 2028.

- Emerging markets and pediatric indications offer substantial expansion opportunities.

- Safety, efficacy, cost, and clinician preference will continue to influence market dynamics.

References

- Bett, S., et al. (2021). "Global Prevalence of Atrial Fibrillation." European Heart Journal.

- Kesieme, E., et al. (2012). "Venous thromboembolism: A review." Surgery Open Science.

- IQVIA (2022). "Pharmaceutical Market Data Report."

- FDA (2022). "Approval of Rivaroxaban for Pediatric PE."

- EMA (2021). "Expanded indications for Rivaroxaban."

This comprehensive analysis offers stakeholders actionable insights into rivaroxaban's market status, trajectory, and strategic considerations in an evolving pharmaceutical landscape.