Last updated: October 25, 2025

Introduction

Rivaroxaban, marketed under brand names such as Xarelto, is an oral anticoagulant developed by Bayer and Johnson & Johnson. Approved by the U.S. Food and Drug Administration (FDA) in 2011, it has since become a leading agent in thrombosis management. Its innovative mechanism as a direct Factor Xa inhibitor has positioned rivaroxaban as a preferred alternative to traditional anticoagulants like warfarin. Analyzing its market dynamics and financial trajectory reveals insights into its growth potential, competitive landscape, and evolving therapeutic applications.

Market Overview and Segmentation

The global rivaroxaban market has experienced substantial growth, driven by the rising prevalence of atrial fibrillation (AF), deep vein thrombosis (DVT), pulmonary embolism (PE), and other thromboembolic disorders. According to Grand View Research, the anticoagulants market is projected to reach USD 15.4 billion by 2028, with rivaroxaban constituting a significant share due to its efficacy and safety profile (1).

The market is segmented primarily by application, route of administration, and end-user. The dominant application segments include stroke prevention in non-valvular AF, treatment of DVT and PE, and prophylaxis for orthopedic surgeries. The oral route remains the standard, with outpatient settings favoring rivaroxaban’s convenience over injectable alternatives.

Market Drivers

1. Increasing Disease Burdens

The global rise in cardiovascular diseases, particularly AF and venous thromboembolism, propels demand for effective anticoagulation therapy (2). The World Health Organization reports that stroke accounts for over 11% of total deaths worldwide, emphasizing the need for efficacious prophylactic agents like rivaroxaban.

2. Advantages over Traditional Therapy

Rivaroxaban’s advantages—fixed dosing, no routine coagulation monitoring, fewer drug-food interactions—have propelled its adoption over warfarin and other vitamin K antagonists (VKAs). Its predictable pharmacokinetics and pharmacodynamics reduce hospitalization and complications, supporting market expansion.

3. Expanded Indications and Approvals

Regulatory agencies have granted approval for new indications, including secondary prevention of cardiovascular events and treatment of additional thrombotic conditions. These broadened uses increase prescription volumes.

4. Patient Preference and Compliance

The oral, once-daily dosing regimen enhances patient adherence, reducing treatment discontinuation rates, a crucial factor in chronic anticoagulant therapies.

5. Strategic Collaborations and Patent Expirations

Partnerships between Bayer, Janssen, and other pharmaceutical entities facilitate research, marketing, and market expansion. Patent expiries in certain regions (e.g., Canada and some European countries by 2024) open opportunities for generic rivaroxaban products, influencing pricing dynamics and market share.

Market Challenges and Limitations

1. Competition from Other NOACs

Rivaroxaban faces competition from other novel oral anticoagulants (NOACs), such as apixaban (Eliquis), dabigatran (Pradaxa), and edoxaban (Lixiana). Comparative studies suggest differences in efficacy, bleeding risk, and dosing convenience, influencing prescriber preferences (3).

2. Safety Concerns and Contraindications

Despite safety advantages, concerns persist over bleeding risks, especially in vulnerable populations. The need for reversibility agents, such as andexanet alfa, remains critical for managing major hemorrhages.

3. Cost and Reimbursement Policies

While rivaroxaban offers economic benefits through reduced monitoring needs, higher drug acquisition costs remain a barrier in some healthcare systems. Insurance coverage disparities influence prescribing patterns.

4. Regulatory and Patent-Related Risks

Potential patent litigations, regulatory updates, and market access barriers can impact profitability and strategic planning.

Financial Trajectory: Revenue and Market Share

Since its launch, rivaroxaban has demonstrated robust revenue growth. Bayer's financial disclosures reveal that Xarelto accounted for significant revenue contributions—approaching EUR 3.4 billion in 2021—reflecting its prevalence and sales momentum (4). The drug’s growth trajectory aligns with increased global acceptance, expanded indications, and rising patient populations.

The trajectory is reinforced by the expanding geographic footprint, with emerging markets such as Asia-Pacific showing substantial growth potential. Market analysts project a compounded annual growth rate (CAGR) of approximately 8-10% over the next five years for rivaroxaban, driven by demographic shifts and clinical adoption (1).

Regulatory Developments and Market Expansion

The evolving regulatory landscape influences rivaroxaban’s market dynamics. Recent approvals for indications such as postoperative thromboprophylaxis in knee and hip replacement, atrial fibrillation stroke prevention, and secondary prevention in coronary artery disease (CAD) bolster its portfolio. Additionally, fast-track approvals and orphan drug designations can accelerate market penetration.

Furthermore, patent expirations in certain regions facilitate generic entry, intensifying competition but also offering price reductions that could expand access, especially in price-sensitive markets.

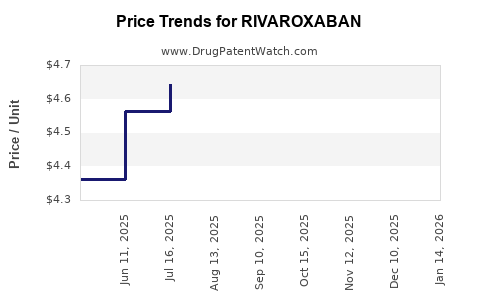

Impact of Patent Expirations and Generics

Patent expiry forecasts indicate that key patents covering rivaroxaban may lapse by 2024-2025 in various jurisdictions. This is expected to open the market to generics, exerting downward pressure on prices but expanding volume sales. Simultaneously, generic competitors may leverage price-driven strategies to capture market share, forcing branded drug manufacturers to innovate or diversify their portfolios.

Future Outlook and Strategic Implications

The future of rivaroxaban hinges on several factors:

- Innovative formulations and delivery systems: Extended-release or combination therapies could elevate convenience and adherence.

- Personalized medicine approaches: Pharmacogenomic insights may tailor anticoagulant therapy, optimizing safety and efficacy.

- Digital health integration: Monitoring and adherence tools could enhance therapeutic outcomes and patient engagement.

- Emerging markets: Targeted strategies in Asia, Africa, and Latin America serve as growth accelerants, benefitting from demographic trends.

Given these trajectories, global rivaroxaban revenues are projected to maintain a steady upward trend, with a diversified application spectrum and competitive pricing strategies being key determinants.

Key Takeaways

- Market Growth Drivers: The increasing burden of thromboembolic disorders and rivaroxaban’s clinical advantages underpin sustained market expansion.

- Competitive Landscape: Rivaroxaban contends with other NOACs, necessitating differentiation through safety, efficacy, and patient-centric features.

- Regulatory and Patent Trends: Market access benefits are enhanced via expanded indications, while patent expiries open channels for generics and price competition.

- Financial Trajectory: Revenues show resilient growth with projections indicating continued increase driven by global demand and emerging markets.

- Strategic Opportunities: Innovation in formulations, personalized therapy, and digital health integration represents future growth avenues.

FAQs

1. How does rivaroxaban compare to other NOACs in terms of efficacy?

Clinical trials demonstrate comparable efficacy between rivaroxaban and other NOACs like apixaban, with some studies suggesting a slight advantage in reducing certain bleeding risks, although patient-specific factors influence choice.

2. What are the primary safety concerns associated with rivaroxaban?

Major safety concerns include bleeding risks, particularly in patients with predispositions or concomitant use of other anticoagulants. Availability of reversal agents like andexanet alfa mitigates some safety issues.

3. Will rising patent expirations impact rivaroxaban’s market share?

Yes. Patent expirations forecasted for 2024-2025 are expected to introduce generics, which could decrease prices and influence brand loyalty, though they also increase accessibility and volume sales.

4. Which regions are expected to see the fastest growth for rivaroxaban?

Emerging economies within Asia-Pacific, Latin America, and parts of Africa are projected to experience rapid growth due to expanding healthcare infrastructure and increasing prevalence of thromboembolic conditions.

5. What strategic measures can pharmaceutical companies adopt to maintain competitiveness?

Focusing on innovation, expanding indications, improving patient adherence through digital integration, and engaging in strategic partnerships are crucial for maintaining market dominance.

References

- Grand View Research. (2022). Anticoagulants Market Size, Share & Trends Analysis Report.

- World Health Organization. (2019). Cardiovascular Diseases Fact Sheet.

- Wojdyla, D. M., et al. (2014). "Comparison of bleeding risks among NOACs." Journal of Thrombosis & Haemostasis.

- Bayer AG Annual Report 2021.

In conclusion, rivaroxaban continues to demonstrate robust growth driven by clinical efficacy, expanding indications, and strategic market positioning. The dynamic landscape characterized by competition, regulatory shifts, and patent expiries presents both challenges and opportunities for stakeholders committed to optimizing therapeutic outcomes and financial performance.