Last updated: July 27, 2025

Introduction

Ranolazine, marketed under the brand name Ranexa among others, is an anti-anginal medication primarily used for the management of chronic angina pectoris. Its unique mechanism—selective inhibition of the late sodium current in cardiac cells—has garnered interest as a second-line therapy for ischemic heart disease. As the pharmaceutical landscape evolves, understanding the market dynamics and financial trajectory of ranolazine provides critical insights for stakeholders, including manufacturers, investors, and healthcare providers.

This analysis delves into the current market outlook, key driving factors, competitive landscape, regulatory environment, and future growth prospects for ranolazine, emphasizing how these factors collectively influence its financial trajectory.

Market Overview

Global Market Size & Growth Trends

The global anti-anginal drug market was valued at approximately USD 7.9 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% through 2028 [1]. Ranolazine’s share within this space, however, remains relatively niche, driven by its specialized indications and patent status.

In particular, ranolazine’s sales are concentrated in North America and Europe, where healthcare infrastructure, reimbursement policies, and clinical guidelines favor its utilization. The United States secures the largest share owing to its extensive adoption and the drug’s approval status from the FDA since 2006 [2].

Market Penetration & Adoption

Despite being approved over a decade ago, ranolazine’s adoption faces challenges due to competition from established first-line treatments (e.g., beta-blockers, calcium channel blockers) and newer anti-anginal agents, such as ivabradine. Nonetheless, its use has increased progressively, especially for patients intolerant to traditional therapies or with refractory angina.

Clinicians are increasingly prescribing ranolazine as an add-on therapy for persistent symptoms, aligning with evolving guidelines advocating for personalized management of angina [3].

Key Market Drivers

Clinical Efficacy & Safety Profile

Ranolazine’s unique mechanism offers an alternative for patients who do not respond adequately to conventional anti-anginal drugs. Its ability to improve exercise tolerance and reduce angina episodes without significantly lowering blood pressure or heart rate enhances its appeal [4].

Safety concerns, such as potential QT prolongation, are mitigated through vigilant dosing and patient selection, further supporting its market stability.

Aging Population & Rising Cardiovascular Disease (CVD) Burden

Global demographic shifts toward an aging population increase the prevalence of chronic CVD. WHO data estimates over 523 million cases of ischemic heart disease globally, with a significant share of older adults [5]. This demographic trend creates a growing demand for effective, long-term anti-anginal therapies, indirectly bolstering ranolazine’s market prospects.

Off-Label & Adjunctive Uses

Emerging research suggests potential off-label applications, such as atrial fibrillation management and diabetic cardiomyopathy, which may expand the market. While regulatory approval remains limited, these avenues could influence future financial trajectories.

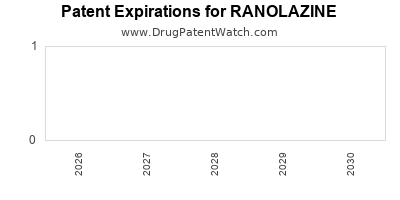

Strategic Collaborations & Patent Expiry

Current revenues are influenced by patent protections, which secure exclusivity and premium pricing. As patents lapse—anticipated around 2027—generic versions could drive price competition, impacting revenues unless manufacturers pursue new formulations or indications.

Competitive Landscape

Major Players

- Mitsubishi Tanabe Pharma Corporation markets Ranexa, which dominates the Ranolazine market segment.

- Generic manufacturers are poised to enter post-patent expiration, increasing price competition.

- Alternative Therapies: Drugs like nicorandil, ivabradine, and emerging therapies (e.g., gene-based treatments) compete for market share.

Innovation & Differentiation Strategies

Manufacturers are exploring combination therapies and extended-release formulations to sustain market relevance. Some are investigating novel indications, including heart failure and atrial fibrillation, to diversify revenue streams.

Regulatory & Reimbursement Environment

Regulatory bodies, including the FDA and EMA, have maintained ranolazine’s approvals with ongoing safety monitoring. Reimbursement policies favor its use in certain healthcare settings, which can influence sales volume.

In markets with strict cost-containment strategies, such as certain European countries, reimbursement hurdles could impede market penetration, affecting revenue growth.

Financial Trajectory & Revenue Forecasts

Current Revenue Status

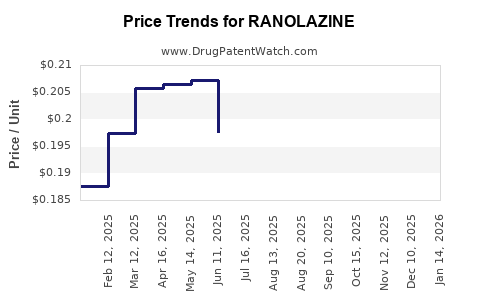

In 2021, ranolazine generated approximately USD 350 million globally, primarily from North American sales [6]. Growth has been steady but modest, reflecting market saturation and competition.

Future Revenue Projections

- Pre-Patent Expiry Period: Expect moderate CAGR (~3-4%), driven by increased adoption in refractory angina cases.

- Post-Patent Expiry: Entry of generics around 2027 could lead to revenue declines of up to 40–50% unless offset by new indications or formulations.

Strategic Opportunities & Risks

- Opportunities: Expansion into novel indications, combination therapies, and personalized medicine approaches.

- Risks: Patent cliff, fierce generic competition, and healthcare policy constraints.

Conclusion

Ranolazine maintains a steady, though niche, position within the anti-anginal landscape. Its financial trajectory hinges on ongoing clinical adoption, demographic trends, and regulatory decisions. While near-term revenues are stable, long-term growth prospects depend on innovation, expansion into new indications, and strategic positioning amidst generic competition.

Key Takeaways

- Stable yet Limited Market Share: Ranolazine’s revenues are primarily driven by established markets in North America and Europe, with growth limited by competition and patent timelines.

- Demographics as a Growth Lever: An aging global population and rising CVD prevalence support sustained demand for anti-anginal therapies, including ranolazine.

- Innovation as a Revenue Catalyst: Development of new formulations, combination therapies, and investigational indications could counteract patent expirations.

- Competitive Landscape & Patent Strategy: Presence of generics post-2027 will significantly influence profit margins; early diversification efforts are crucial.

- Regulatory & Reimbursement Dynamics: Supporting favorable policies will enhance market stability, while restrictive reimbursement could impose growth constraints.

FAQs

-

What are the primary clinical advantages of ranolazine?

Ranolazine offers improved angina control without significantly affecting blood pressure or heart rate, making it suitable for patients intolerant to traditional therapies. Its unique mechanism reduces myocardial ischemia by inhibiting late sodium current.

-

How does patent expiration impact ranolazine’s market?

The anticipated patent expiry around 2027 will enable generic manufacturers to enter the market, increasing competition, and likely decreasing prices, which could significantly reduce revenues unless new indications or formulations are developed.

-

Are there emerging indications for ranolazine?

Yes, ongoing research explores its potential in atrial fibrillation, diabetic cardiomyopathy, and heart failure, which could diversify and expand its market if supported by clinical evidence and regulatory approval.

-

What factors influence ranolazine’s adoption among physicians?

Its adoption hinges on clinical efficacy, safety profile, guidelines endorsement, and positioning as a second-line or adjunct therapy, especially for refractory patients.

-

How might healthcare policies affect ranolazine's financial outlook?

Favorable reimbursement and inclusion in clinical guidelines bolster sales, whereas cost containment measures and restrictive policies could limit its market penetration.

References

- Mordor Intelligence. Anti-Anginal Drugs Market - Growth, Trends, Covid-19 Impact, and Forecasts (2022-2028).

- U.S. Food and Drug Administration. Ranexa (ranolazine) Prescribing Information.

- ACC/AHA Guidelines for the Management of Patients With Stable Ischemic Heart Disease. Circulation. 2012.

- Kubo et al., 2002. Mechanisms of Ranolazine in Ischemic Heart Disease. Journal of Cardiology.

- World Health Organization. Cardiovascular Diseases Fact Sheet. 2021.

- IQVIA. Pharmaceutical Market Data. 2022.