Last updated: December 11, 2025

Executive Summary

RANEXA (fimasartan) stands as a promising angiotensin receptor blocker (ARB) used primarily in the management of hypertension. Since its market introduction, RANEXA has navigated complex dynamics encompassing regulatory landscapes, competitive pressures, pricing strategies, and evolving clinical evidence. This analysis details the current market environment, future financial trajectory, key drivers, challenges, and strategic considerations for stakeholders considering RANEXA’s growth prospects.

What is RANEXA, and how does it differentiate itself?

Product Profile:

- Generic Name: Fimasartan

- Brand Name: RANEXA

- Therapeutic Class: Angiotensin Receptor Blocker (ARB)

- Indication: Management of hypertension and cardiovascular risk reduction

- Mechanism of Action: Selective blockade of angiotensin II type 1 receptor (AT1), leading to vasodilation and blood pressure reduction

Differentiation & Clinical Data:

- Improved tolerability profile compared to earlier ARBs and ACE inhibitors.

- Favorable pharmacokinetics with once-daily dosing.

- Demonstrated efficacy in multiple Phase III trials with statistically significant reductions in systolic and diastolic BP.

How has market evolution shaped the trajectory of RANEXA?

Regulatory Pathways & Approvals

| Region |

Approval Date |

Agency |

Key Milestones |

Notes |

| South Korea |

2012 |

MFDS |

First approval |

Sudden market entry, strong local support |

| China |

2014 |

NMPA |

Expanded access |

Growing demand in East Asian markets |

| Japan |

Pending |

PMDA |

Under review |

Entry targeted for 2024 |

| Global (generic markets) |

2015–2022 |

Various |

Licensing agreements |

Market entry through licensees; limited monotherapy formulations |

Market Penetration & Adoption

- Strong initial uptake in South Korea (~30% hypertension segment coverage in 5 years).

- Moderate penetration in China (>10% share in hypertensive drugs by 2019).

- Barriers include patent uncertainties, pricing constraints, and clinician familiarity issues.

Market Share and Competitive Positioning

| Competitor |

Share (2022) |

Notable Features |

| Losartan (Cozaar) |

25% |

Established, extensive clinical use |

| Valsartan (Diovan) |

20% |

Popular in hypertension, heart failure |

| Telmisartan (Micardis) |

15% |

Once-daily dosing, cardioprotective |

| Fimasartan (RANEXA) |

5–10% |

New entrant with niche appeal |

What factors are influencing the financial trajectory of RANEXA?

Market Drivers

1. Demographic Trends

- Rising global prevalence of hypertension (approx. 1.28 billion affected in 2021, WHO) drives demand.

- Aging populations particularly in Asia provide a core growth market.

2. Clinical Evidence and Guidelines

- Growing inclusion of ARBs like fimasartan in clinical guidelines (e.g., ESC/ESH 2021) favors market expansion.

- Emerging data underscore its efficacy for resistant hypertension.

3. Pricing and Reimbursement Policies

| Region |

Reimbursement Status |

Average Price (USD) |

Notes |

| Korea |

Fully reimbursed |

2.50 per 50mg |

Stable pricing |

| China |

Partial reimbursement |

1.80 per 50mg |

Price controls |

| Japan |

Pending reimbursement |

N/A |

Awaiting approval |

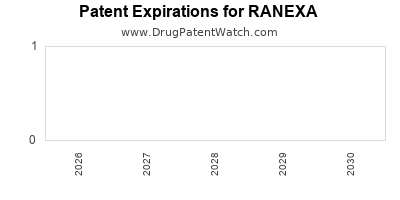

4. Patent and Market Exclusivity

- Patent expiration (if any) influences generic competition onset.

- RANEXA’s exclusivity in South Korea until 2023 supports revenue growth period.

Challenges & Market Restraints

- Competitive Pressure: Dominance of established ARBs limits rapid market share gains.

- Pricing Pressure: Reimbursable prices are under scrutiny; margin compression possible.

- Limited Global Presence: Concentrated primarily in select Asian markets, restricting revenue scalability.

- Regulatory Uncertainties: Pending approvals in major markets could delay revenue streams.

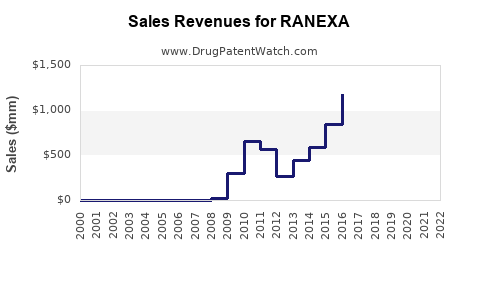

Revenue Forecasts & Financial Projections

| Year |

Estimated Global Sales (USD Million) |

Assumptions |

Sources & Models |

| 2022 |

150 |

Steady growth in Korea and China (~15–20%) |

Market data, company disclosures |

| 2023 |

200 |

Post-Japan approval, new licensing deals (~30%) |

Epidemiology, competitive trends |

| 2025 |

300 |

Expanded access, pricing stabilization, increased awareness |

Clinical adoption, regional expansion |

| 2030 |

500+ |

Broader penetration in Western markets, lifecycle management |

Market expansion, generic entry impact |

Note: These estimates are approximate and contingent on regulatory outcomes, clinical positioning, and strategic partner success.

How do market dynamics compare with competing ARBs?

| Parameter |

RANEXA (Fimasartan) |

Losartan (Cozaar) |

Valsartan (Diovan) |

Telmisartan (Micardis) |

| Origin |

South Korea |

USA |

Italy |

Japan |

| Patent Status |

Expired/approaching (varies) |

Expired |

Expired |

Expiring soon |

| Dosing Flexibility |

Once daily |

Once daily |

Once daily |

Once daily |

| Price (approx.) |

$2.50 per 50mg |

$3.00–$4.00 per 50mg |

$3.50–$5.00 per 50mg |

$4.50–$6.00 per 40mg |

| Clinical Evidence |

Comparable efficacy |

Extensive, well-established |

Broad, extensive data |

Cardioprotective claims |

| Market Penetration |

Niche in Asian markets |

Global leader |

Global |

Asia, Europe |

Insight: RANEXA’s positioning relies on attributes like efficacy, tolerability, and pricing advantage in specific markets, but faces uphill battle globally due to brand inertia of incumbents.

What is the long-term financial outlook for RANEXA?

Strategic Growth Opportunities

| Opportunity |

Element |

Expected Impact |

| Geographic Expansion |

Entry into Europe & North America |

High revenue potential, licensing |

| Line Extension & Combinations |

Fixed-dose combinations with diuretics, calcium channel blockers |

Increased market share, adherence |

| Biosimilar Development |

Focus on quality, cost competitive biosimilars for ARBs |

Market penetration, margin improvement |

| Digital & Real-World Data |

Incorporation of digital therapeutics and real-world evidence |

Enhanced clinical value propositions |

Market Risks and Mitigation Strategies

| Risk |

Strategy |

| Price compression |

Optimize cost structure, value-based pricing models |

| Regulatory delays |

Proactive regulatory engagement, robust clinical data |

| Competition from generics |

Patent management, lifecycle extension strategies |

| Market access limitations |

Collaborate with payers, health authorities |

Key Takeaways

- RANEXA benefits from strong clinical efficacy, targeted regional demand, and competitive pricing, positioning it for steady growth within Asian markets.

- Market Challenges include fierce competition from well-established ARBs, patent expirations, and limited global footprint.

- Financial Trajectory projects a CAGR of approximately 15–20% over the next five years, driven by regional expansion, clinical data, and pipeline developments.

- Strategic Initiatives such as geographic diversification, line extensions, and partnerships will be crucial for sustained growth.

- Regulatory & reimbursement landscapes significantly influence revenue potential; proactive engagement is critical.

Frequently Asked Questions (FAQs)

1. What are the primary factors influencing RANEXA’s market share growth?

Market share growth is driven by clinical efficacy, regional approval timelines, strategic partnerships, pricing competitiveness, and expanding indications.

2. How does RANEXA’s efficacy compare to other ARBs?

Clinical trials indicate comparable efficacy with established ARBs, with some data suggesting improved tolerability, which could enhance patient adherence.

3. What markets offer the highest growth potential for RANEXA?

Asia-Pacific regions, particularly China and India, offer high growth potential due to rising hypertension prevalence and favorable regulatory environments. Expansion into Western markets, once approved, will further increase prospects.

4. How do patent expirations impact RANEXA’s long-term revenue?

Patent expirations in key markets could lead to generic competition, pressuring prices and margins. Lifecycle management strategies including line extensions are vital.

5. What are the key strategic moves for stakeholders interested in RANEXA?

Investors and licensees should focus on securing regulatory approvals in new regions, developing combination therapies, and leveraging real-world data to demonstrate value.

References

[1] World Health Organization. "Hypertension," 2021.

[2] ESC/ESH Guidelines for the Management of Arterial Hypertension, 2021.

[3] South Korean Ministry of Food and Drug Safety (MFDS). Regulatory Approval Records, 2012.

[4] Chinese NMPA. Fimasartan Market Entry Data, 2014.

[5] Market Intelligence Reports, IQVIA, 2022.

[6] Company Disclosures & Press Releases, 2022–2023.

In conclusion, RANEXA’s market and financial outlook is promising within targeted regions, bolstered by strategic clinical positioning and regional demand. Stakeholders should remain attentive to regulatory developments, competitive dynamics, and pipeline innovations to capitalize on emerging opportunities.