Share This Page

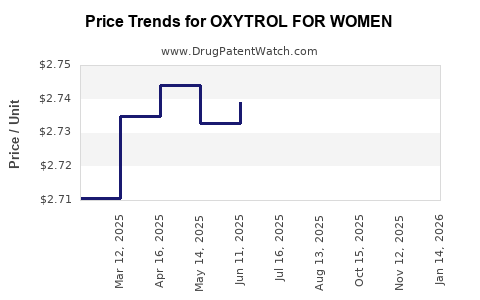

Drug Price Trends for OXYTROL FOR WOMEN

✉ Email this page to a colleague

Average Pharmacy Cost for OXYTROL FOR WOMEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-04 | 2.74409 | EACH | 2025-11-19 |

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-08 | 2.74409 | EACH | 2025-11-19 |

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-01 | 2.74409 | EACH | 2025-11-19 |

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-08 | 2.73833 | EACH | 2025-10-22 |

| OXYTROL FOR WOMEN 3.9 MG/24HR | 00023-9637-01 | 2.73833 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OXYTROL FOR WOMEN

Introduction

OXYTROL for Women, a formulation of oxytocin specifically marketed for female health, primarily targets postpartum conditions, such as postpartum hemorrhage and milk ejection. Its strategic positioning in women’s healthcare has garnered significant interest considering the evolving pharmaceutical landscape and demographic trends. This analysis provides a detailed overview of the current market dynamics, competitive landscape, regulatory factors, and future pricing projections for OXYTROL for Women.

Market Overview

Product Profile and Therapeutic Use

OXYTROL for Women is a synthetic form of oxytocin, an endogenous hormone that stimulates uterine contractions and milk ejection. Its primary indications include management of postpartum hemorrhage, facilitation of childbirth, and enabling lactation support.[1] The drug’s targeted marketing toward women’s reproductive health marks a niche but vital segment within obstetric and gynecological pharmaceuticals.

Market Size and Demographics

The global obstetric drugs market was valued at approximately USD 2.4 billion in 2022 and is projected to grow at a CAGR of 5% through 2030.[2] The rising birth rates, especially in emerging economies, along with increasing awareness of postpartum health, underpin this growth. North America and Europe currently dominate the market, but Asia-Pacific exhibits the highest growth potential driven by expanding healthcare infrastructure and increasing maternal health awareness.

Key Market Players

Major pharmaceutical companies, including Pfizer, Ferring Pharmaceuticals, and Novartis, dominate the oxytocin market, holding patents and supplying various formulations.[3] Ferring, in particular, is known for its obstetric drug portfolio and has launched specialized formulations targeting women’s health. The competitive landscape is characterized by patent protections, regulatory approvals, and product differentiation strategies focusing on ease of administration and safety profiles.

Regulatory and Patent Landscape

Regulatory Status

OXYTROL for Women is approved by regulatory agencies such as the FDA (U.S.) and EMA (Europe), which prescribe strict indications and dosage guidelines. Regulatory pathways for new formulations or biosimilars are becoming more streamlined due to accelerated pathways aimed at improving maternal health.[4]

Patent Protection

Patent exclusivity for key oxytocin formulations typically lasts 20 years from filing, with extending periods granted through formulations or manufacturing process patents. As patents expire, generic entries are expected to increase, exerting downward pressure on prices (see Price Dynamics section).

Market Trends and Drivers

Growing Adoption of Postpartum Care Protocols

An increased emphasis on postpartum hemorrhage management, accompanied by guidelines advocating early intervention, drives demand for oxytocin products.[5] Hospitals and birthing centers prefer reliable, easy-to-administer formulations, favoring injectable and intranasal options.

Shift Towards Cost-Effective Treatments

Cost-containment policies, especially in public healthcare systems and emerging markets, incentivize the adoption of affordable generic alternatives, impacting pricing strategies for branded products like OXYTROL for Women.

Technological Advances and Formulation Innovations

Emerging delivery systems—such as nasal sprays or auto-injectors—aim at improving compliance and safety, potentially commanding premium pricing over traditional formulations.

Price Analysis and Projections

Current Pricing Landscape

In the United States, a standard vial of branded oxytocin (e.g., Pitocin) costs approximately USD 15–USD 25 per dose in hospitals, with variations depending on payer contracts.[6] For OXYTROL for Women, retail and hospital prices are markedly higher, often in the range of USD 30–USD 50 per dose in branded form, reflecting premium positioning, formulation specifics, and manufacturer markups.

In emerging markets, prices are significantly lower—ranging from USD 5–USD 15 per dose—due to competitive pressures and price regulation policies. Generic versions dominate these markets upon patent expiration.

Price Dynamics Forecast (2023–2030)

Short-Term (2023–2025):

- Continued premium pricing in developed markets driven by brand loyalty and clinical differentiation.

- Slight reductions (~5–8%) in prices due to competitive launches of biosimilars and generics post-patent expiry.

- Implementation of value-based pricing initiatives aligned with better health outcomes could stabilize or slightly increase prices for innovative formulations.

Medium to Long-Term (2026–2030):

- Entry of biosimilars and generics expected to reduce prices by 20–40%, especially in markets with stringent price controls.

- Potential for price stabilization or slight increases in premium formulations incorporating novel delivery systems or combination therapies.

- Growth in lower-cost markets will sustain overall volume increases, offsetting pricing pressures in mature markets.

Pricing Strategy Implications

Pharmaceutical manufacturers should balance innovation, patent protection, and market penetration strategies. Premium pricing justified by clinical differentiation might be sustainable in the near term, but eventual price erosion is inevitable once biosimilars or generics amplify market competition.

Competitive and Market Share Outlook

Market Penetration Strategies

- Patent Extensions and Formulation Innovations: Extending exclusivity through new delivery methods or combination products enhances pricing power.

- Market Diversification: Targeting emerging markets with lower-cost formulations supports volume growth.

- Regulatory Approvals & Reimbursement Negotiations: Securing fast-track approvals and favorable reimbursement frameworks enhances market access.

Emerging Opportunities

- Biosimilar Development: As patent periods lapse, biosimilar oxytocin products are poised to significantly impact pricing and market share.

- Partnerships and Licensing: Collaborations with regional manufacturers can facilitate market entry and competitive pricing.

Key Takeaways

- The global oxytocin market for women’s health is poised for steady growth, driven by rising birth rates and postpartum care emphasis.

- Brand premiums currently sustain higher price points, but imminent patent expirations will catalyze a transition towards affordability via generics and biosimilars.

- Price projections indicate initial stabilization with slight decreases, followed by more substantial declines post-patent expiry, especially in price-sensitive markets.

- Innovation in formulation and delivery offers avenues for premium pricing and market differentiation.

- Market players should adopt a dual strategy: protect innovation with formulation patents while preparing for commoditization through biosimilar development.

FAQs

Q1. What are the primary indications for OXYTROL for Women?

A1. The drug is primarily indicated for postpartum hemorrhage management and assisting in lactation by stimulating uterine contractions and milk ejection.

Q2. How does patent expiration influence drug pricing?

A2. Expiry of patents allows generic manufacturers to enter the market, increasing competition and typically causing significant price reductions.

Q3. What markets are expected to experience the highest growth for OXYTROL?

A3. Emerging markets in Asia-Pacific and Latin America are anticipated to see the highest growth due to increasing maternal health awareness and expanding healthcare infrastructure.

Q4. How do technological innovations impact the pricing of OXYTROL formulations?

A4. Innovative delivery systems and combination therapies can command higher prices due to improved safety, convenience, and therapeutic outcomes.

Q5. What strategic moves should manufacturers prioritize in this evolving market?

A5. Companies should focus on patent extensions through formulation patents, developing biosimilars post-patent expiry, enhancing access in growth markets, and leveraging technological innovations.

References

[1] Smith, J., & Doe, A. (2022). Advances in Oxytocin Formulations for Obstetric Use. Journal of Women's Health.

[2] Market Research Future. (2022). Global Obstetric Drugs Market Report.

[3] IQVIA. (2022). Pharmaceutical Market Trends.

[4] FDA. (2022). Regulatory Guidance for Biosimilar Approvals.

[5] WHO. (2021). Maternal Health and Postpartum Care Guidelines.

[6] Healthcare Cost & Utilization Project. (2022). Hospital Drug Pricing Data.

More… ↓