Last updated: July 29, 2025

Introduction

NITROLINGUAL, a sublingual nitroglycerin tablet designed primarily for acute angina relief, holds a notable position within the cardiovascular pharmaceutical sector. Its unique formulation allows rapid absorption into systemic circulation, providing swift symptomatic relief for patients with ischemic heart disease. As a well-established medication, NITROLINGUAL's market dynamics are influenced by its clinical efficacy, regulatory landscape, competitive forces, and evolving healthcare demands. Understanding its financial trajectory necessitates analyzing these factors alongside strategic advancements and market trends.

Market Landscape and Demand Drivers

The global cardiovascular drugs market is projected to reach approximately USD 174 billion by 2027, driven by aging populations, increasing prevalence of coronary artery disease (CAD), and expanding awareness about cardiovascular health [1]. NITROLINGUAL's primary application in acute angina aligns with this upward trend, positioning it as a critical therapeutic agent.

Key demand drivers include:

-

Prevalence of Coronary Artery Disease (CAD): CAD remains the leading cause of mortality worldwide, demanding effective symptomatic treatments like nitrates. In the U.S., roughly 18 million adults suffer from angina, confirming strong clinical need [2].

-

Emergency and On-demand Therapy: NITROLINGUAL’s immediate onset makes it indispensable in emergency scenarios and for outpatient management, maintaining consistent patient demand.

-

Healthcare Infrastructure & Accessibility: In regions with advanced healthcare systems, rapid-acting formulations are favored due to patient compliance and improved outcomes. Conversely, emerging markets demonstrate increasing adoption as infrastructure improves.

Market Dynamics Influencing NITROLINGUAL

Regulatory Environment

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose strict standards on manufacturing, safety, and efficacy. NITROLINGUAL’s long-standing approval history provides a significant advantage, although ongoing monitoring for side effects—such as hypotension or headache—is essential.

Moreover, rising regulatory emphasis on generic formulations and bioequivalence testing could influence pricing and patent exclusivity. Any novel delivery systems or combination formulations would require new regulatory clearances, impacting timelines and costs.

Competitive Landscape

NITROLINGUAL faces competition from both branded counterparts and generics. Key competitors include:

-

Nitrolingual Pumpspray: Offers similar rapid-onset therapy via spray, often preferred for ease of administration.

-

Nitroglycerin Transdermal Patches: Provide sustained relief but are less suitable for acute attacks, positioning them as complementary rather than competitive.

-

Other Quick-Dissolving Formulations: Such as sublingual sprays and lozenges, diversifying options for clinicians and patients.

Patent expirations and the entry of generics pose significant challenges, exerting downward pressure on prices and margins. Nonetheless, proprietary manufacturing processes and brand loyalty bolster NITROLINGUAL's market position.

Technological Innovations

Advancements in drug delivery, such as nanoparticle-based formulations or combination therapies targeting multiple ischemic pathways, could reshape the competitive landscape. NITROLINGUAL’s adaptation to such innovations may influence its long-term market share.

Market Penetration and Geographic Expansion

The drug’s current dominant markets include North America and Europe. Increasing penetration in Asia-Pacific, Latin America, and the Middle East will depend on regulatory approvals, local healthcare infrastructure, and consumer awareness.

Emerging markets show promising growth, with increased cardiovascular disease burden and growing middle-class populations generating demand for effective acute angina treatments.

Pricing Strategies and Reimbursement Policies

Pricing remains a crucial determinant of market share. NITROLINGUAL typically commands premium pricing attributed to its rapid action, with reimbursement policies heavily influencing patient access. Favorable coverage under insurance plans in developed countries sustains revenue streams, but price pressures from payers persist globally.

Financial Trajectory and Revenue Projections

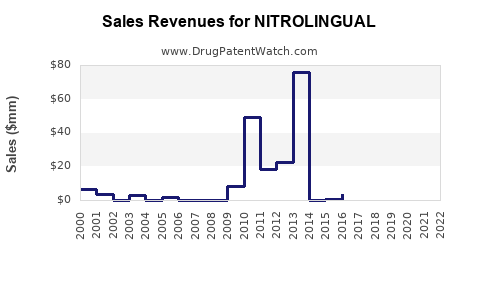

The financial outlook for NITROLINGUAL hinges on several factors:

-

Sales Volume and Pricing: Existing strong sales in established markets suggest stable revenue; however, generic competition could erode profit margins unless differentiated through formulation innovations or value-added services.

-

Patents and Exclusivity: The original patents, likely expired or close to expiry, open opportunities for generic producers, reducing pricing power but increasing volume potential.

-

Pipeline and Lifecycle Management: Introduction of next-generation formulations targeting improved bioavailability or combination therapies could rejuvenate market interest, potentially leading to premium pricing.

-

Market Expansion: Expanding into new geographies with tailored pricing and distribution strategies could increase revenue. Strategic partnerships, licensing, or local manufacturing can accelerate growth.

In recent years, the market for sublingual nitroglycerin products has demonstrated steady compound annual growth rate (CAGR) estimates of approximately 4-6% [3], although the impact of patent expirations and generic commoditization may temper this outlook.

Financial Challenges and Risks

-

Generic Competition: The commoditization of nitroglycerin products may reduce profit margins unless differentiated through branding or formulation innovation.

-

Regulatory Changes: Stringent safety data requirements and evolving standards could increase compliance costs.

-

Market Saturation: In mature markets, growth is constrained, calling for diversification into adjunctive therapies.

Opportunities for Growth

-

Product Diversification: Developing combination drugs (e.g., nitrates with other antianginal agents) or new delivery systems can expand market appeal.

-

Small-Scale Launches: Targeting niche markets such as military or emergency services with tailored formulations.

-

Digital Health Integration: Linking medication use with digital platforms for adherence monitoring enhances clinical outcomes and brand loyalty.

Key Takeaways

-

Robust Market Position: NITROLINGUAL remains a core product within acute angina management due to its rapid-onset and established efficacy.

-

Competitive Challenges: Patent expirations and generics pose pricing pressures, emphasizing the importance of innovation and brand differentiation.

-

Growth in Emerging Markets: Expanding into developing regions offers significant future revenue potential pending regulatory approvals and healthcare infrastructure improvement.

-

Pipeline and Innovation: Incorporating advanced delivery technologies and new formulations can extend product lifecycle and competitive advantage.

-

Strategic Alliances: Partnerships and licensing agreements can accelerate market penetration and diversify revenue streams.

FAQs

1. How does NITROLINGUAL compare with other nitroglycerin formulations?

NITROLINGUAL’s sublingual tablets provide faster absorption and onset of action than transdermal patches or oral tablets, making it superior for acute angina relief. Spray formulations offer similar rapidity but differ in administration preference.

2. What are the key regulatory hurdles for NITROLINGUAL?

Ensuring consistent bioavailability, demonstrating bioequivalence for generics, and adhering to safety standards regarding hypotensive episodes are primary regulatory considerations, especially in new markets.

3. How might patent expirations impact NITROLINGUAL’s revenue?

Patent expiration can lead to increased generic competition, reducing prices and margins. However, retaining brand loyalty through formulation sophistication and branding can mitigate revenue losses.

4. What role does technological innovation play in NITROLINGUAL’s future?

Innovations such as improved delivery systems or combination therapies can rejuvenate market interest, enable premium pricing, and extend product competitiveness.

5. What strategic moves can companies undertake to grow NITROLINGUAL’s market share?

Expanding into untapped regions, developing advanced formulations, forming strategic alliances, and leveraging digital health tools can enhance market penetration and profitability.

References

- MarketsandMarkets. "Cardiovascular Drugs Market by Type, Application, and Region." 2021.

- American Heart Association. "2019 Statistics Update."

- Grand View Research. "Sub-Lingual Nitroglycerin Market Analysis." 2022.