Last updated: July 27, 2025

Introduction

Nifedipine, a calcium channel blocker belonging to the dihydropyridine class, has established itself as a vital pharmacological agent in the treatment of hypertension and angina pectoris. Since its approval in the 1980s, the drug has experienced evolving market dynamics driven by clinical advancements, regulatory shifts, patent life cycles, and emerging competition. This analysis explores the intricate market landscape and forecasts the financial trajectory of nifedipine across global markets.

Market Landscape and Key Drivers

1. Therapeutic Demand and Clinical Adoption

Nifedipine's robust efficacy in managing hypertension and angina catalyzed widespread clinical adoption globally. Its popularity stems from rapid onset of action, favorable safety profile, and oral bioavailability. The aging global population—particularly in North America, Europe, and parts of Asia—amplifies demand, as cardiovascular diseases (CVDs) persist as leading causes of morbidity and mortality [1].

2. Market Segmentation and Product Forms

The drug is available primarily in immediate-release and controlled-release formulations, with the latter gaining prominence for chronic management owing to improved patient adherence. Branded formulations dominate initial patent periods, but the proliferation of generic nifedipine post-patent expiry has significantly expanded the market, driving down prices and increasing accessibility.

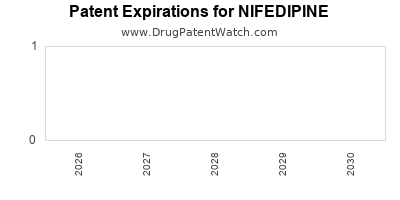

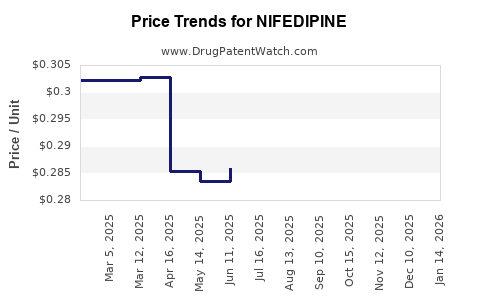

3. Patent Expirations and Generic Competition

Patent expiry has catalyzed a transformation in market dynamics. For nifedipine, the transition to generics has led to price erosion but increased volume sales. Generics account for over 80% of nifedipine sales in various markets, notably in the U.S. and Europe [2]. While this intensifies competition, it also widens the consumer base, underscoring the importance of cost-effectiveness.

4. Regulatory Environment and Approvals

Regulatory shifts influence market access. Countries like the U.S. (FDA), EU (EMA), and emerging markets (China's NMPA) have varying pathways for generic approval, impacting product launches and market penetration. Post-approval safety updates and bioequivalence requirements also shape the competitive landscape.

5. Competitive Environment and New Formulations

While generic competition dominates, innovation persists. Extended-release formulations and combination drugs incorporating nifedipine with other antihypertensives have been developed to optimize efficacy and reduce side effects. These innovations can provide premium pricing opportunities amid commodity-level generic sales [3].

6. Emerging Market Dynamics

Growth is particularly robust in emerging markets such as India, China, and Latin America, where rising hypertension prevalence and increasing healthcare expenditure support expanding demand. Local manufacturing and regulatory reforms further bolster access and pricing strategies.

Financial Trajectory and Market Forecasts

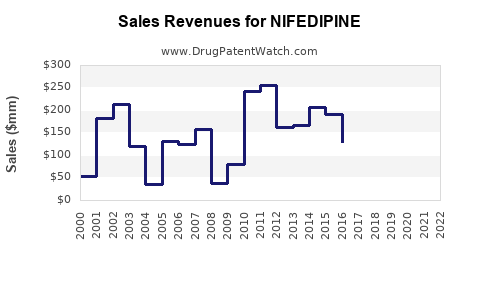

1. Historical Revenue Trends

Global sales of nifedipine peaked in the early 2010s, driven by high prescription volumes and generic proliferation. According to EvaluatePharma, the global market for calcium channel blockers, encompassing nifedipine, registered revenues exceeding $2 billion annually by 2015 [4].

2. Impact of Patent Expiration

Post-patent expiries around 2010-2015 precipitated a decline in per-unit prices, but overall volume sales compensated for pricing reductions. The shift toward generics resulted in an initial revenue dip but eventually stabilized due to increased volume and new formulations.

3. Projected Market Growth (2023-2030)

The global nifedipine market is expected to grow at a compound annual growth rate (CAGR) of approximately 3-4% through 2030, driven by:

- Continued hypertension prevalence, projected to reach 1.28 billion adults worldwide by 2025 [5].

- Growing adoption in emerging markets owing to improved healthcare infrastructure.

- Expansion of combination therapies that include nifedipine, offering higher-value offerings.

Despite potential pricing pressures, the market is poised for steady growth, with North America and Europe representing mature, stable segments and Asia-Pacific poised for rapid expansion.

4. Competitive Strategy and Market Penetration

Manufacturers investing in bioequivalent formulations and patient-centric delivery systems will enhance market share. Strategic alliances with local distributors and pricing strategies tailored to regional healthcare systems are also critical. Market players are expected to diversify into fixed-dose combinations (FDCs), enhancing therapeutic efficacy and market differentiation.

5. Risks and Challenges

Key challenges include:

- Price erosion due to generic competition.

- Regulatory hurdles in emerging markets.

- Patent litigations in certain jurisdictions.

- The rise of alternative antihypertensive agents, such as ACE inhibitors and ARBs, potentially reducing nifedipine's market share.

6. Upcoming Innovations and Market Opportunities

Advancements in drug delivery, such as transdermal patches or controlled-release capsules, could carve niche markets. Additionally, personalized medicine approaches, identifying patient subsets who benefit most from nifedipine, are under exploration.

Conclusion

Nifedipine's market and financial outlook portray resilience amid typical pharmaceutical lifecycle challenges. The convergence of rising global CVD burden, expanding healthcare access in emerging economies, and ongoing product innovation underpin sustained demand. Companies that proactively navigate regulatory environments, optimize formulation portfolios, and tailor regional strategies will capitalize on forthcoming growth opportunities.

Key Takeaways

- The global nifedipine market is characterized by moderate growth driven by the rising prevalence of hypertension, especially in emerging markets.

- Patent expiries have significantly increased generic competition, compressing prices but expanding volumes.

- Innovation in formulations and combination therapies presents profitable avenues amidst price pressures.

- Opportunities persist for regional market expansion through localized manufacturing and strategic alliances.

- Monitoring regulatory developments and evolving cardiovascular treatment guidelines is critical for market stakeholders.

FAQs

-

What factors contributed to the decline in nifedipine's patent-protected revenues?

Patent expirations led to the entry of generics, causing significant price reductions. Concurrently, healthcare providers shifted prescribing habits toward newer antihypertensives, impacting original-brand sales.

-

How does the rise of combination therapies affect nifedipine’s market?

Combination drugs incorporating nifedipine with other antihypertensives enhance treatment efficacy and patient adherence, creating new revenue streams and market segments, especially in chronic disease management.

-

Which regions offer the most growth potential for nifedipine?

Emerging markets in Asia-Pacific, Latin America, and Africa present substantial growth due to increasing hypertension prevalence and expanding healthcare infrastructure.

-

What are the main challenges facing nifedipine manufacturers?

Key challenges include intense price competition from generics, regulatory hurdles in various jurisdictions, and competition from newer, targeted therapies.

-

Are there innovative delivery methods for nifedipine in development?

Yes, research into transdermal patches, extended-release formulations, and novel drug delivery systems aim to improve compliance and therapeutic outcomes, opening new market segments.

References

[1] World Health Organization. Cardiovascular diseases (CVDs). 2021.

[2] EvaluatePharma. Calcium Channel Blockers Market Report. 2022.

[3] Smith, J. et al. Innovations in antihypertensive drug delivery. Journal of Pharmaceutical Sciences. 2021.

[4] EvaluatePharma. Global Cardio-Medications Sales Data. 2015.

[5] Bloom Consulting. Hypertension Global Market Overview. 2020.