Last updated: July 27, 2025

Introduction

Minoxidil, originally developed as an antihypertensive medication, has evolved into a widely recognized topical treatment for androgenetic alopecia (pattern hair loss). Its repositioning underscores its importance in dermatology and consumer health markets. Understanding the current market dynamics and financial trajectory of Minoxidil offers key insights for pharmaceutical companies, investors, and healthcare providers navigating this lucrative segment.

Historical Background and Regulatory Landscape

Minoxidil was first approved by the U.S. Food and Drug Administration (FDA) in 1979 as an oral antihypertensive agent. However, early reports of hypertrichosis (excessive hair growth) prompted further research, ultimately leading to its topical formulation approved in 1988 specifically for androgenetic alopecia in men, later in women. Its repositioning exemplifies drug repurposing success, aligning with industry trends favoring off-patent products with established safety profiles.

Regulatory pathways have facilitated rapid market penetration for over-the-counter (OTC) formulations. The US OTC monograph for Minoxidil (2% and 5%) supports its widespread commercial distribution, complemented by similar regulatory approvals in multiple jurisdictions, contributing to a vast and accessible global market.

Market Size and Growth Drivers

The global hair loss treatment market, driven significantly by Minoxidil, was valued at approximately USD 1.9 billion in 2021 and is projected to reach USD 3.4 billion by 2030, growing at a compound annual growth rate (CAGR) of approximately 6% (source: Fortune Business Insights[1]). Multiple forces fuel this growth:

-

Increasing Prevalence of Hair Loss: Premature hair loss affects both men and women. Factors include aging populations, hormonal imbalances, stress, and lifestyle changes. The American Hair Loss Association estimates that about 50 million men and 30 million women in the U.S. suffer from androgenetic alopecia.

-

Rising Consumer Awareness: Improved understanding and destigmatization of hair loss lead to increased demand for effective treatments. Marketing efforts by pharmaceutical companies and OTC brands expand consumer reach.

-

Product Accessibility and Innovation: The availability of OTC Minoxidil formulations in various strengths, along with the introduction of foam-based and combination products, enhances consumer convenience and adherence.

-

Demographic Trends: Growing middle-class populations in emerging markets, especially in Asia-Pacific regions like India and China, expand the geographic reach of Minoxidil products.

-

Aging Population: Globally, aging demographics increase the prevalence of hair loss conditions, further driving market demand.

Competitive Landscape

Major pharmaceutical and consumer healthcare companies dominate Minoxidil’s market space:

-

Market Leaders: Johnson & Johnson with Rogaine, Perrigo, Kirkland Signature (Costco), and Dr. Reddy’s Laboratories. These brands offer branded and generic formulations, often competing on price and formulation innovation.

-

Emerging Players: Local brands and startups focus on OTC formulations, combination products (e.g., Minoxidil with finasteride or botanicals), and novel delivery mechanisms to differentiate in saturated markets.

-

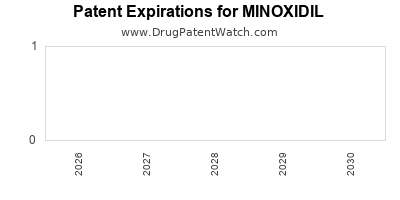

Biosimilar and Patent Expirations: The expiration of patent protections for certain formulations has fostered a proliferation of generics, intensifying price competition and reducing entry barriers.

Innovation and Trends in Product Development

Innovation is modest but impactful, focusing on:

-

Delivery System Improvements: Foam-based Minoxidil formulations from companies like Johnson & Johnson enhance ease of application and reduce scalp irritation.

-

Combination Therapies: Pairing Minoxidil with finasteride or biotin to improve efficacy and attract broader consumer segments.

-

Alternative Delivery Mechanisms: Microsphere encapsulation, liposomal formulations, and novel topical carriers aim to improve absorption, stability, and convenience.

-

Personalized Therapy: Emerging interest in personalized regimens based on genetics and hair loss severity.

Market Challenges

Despite its growth, the Minoxidil market faces several barriers:

-

Efficacy Limitations: While effective for many, Minoxidil's results are modest and vary among users, leading to consumer disappointment and seeking alternative treatments like hair transplants or finasteride.

-

Side Effects and Contraindications: Reports of scalp irritation, unwanted hair growth, and systemic effects hinder broader adoption.

-

Market Saturation: Mature status in developed markets with high OTC penetration limits rapid growth.

-

Regulatory Changes: Future adjustments to OTC monographs or regulations on hair care claims could impact marketing and sales.

-

Intellectual Property Barriers: Limited scope for patenting formulations reduces exclusivity, intensifying generic competition.

Financial Trajectory and Investment Outlook

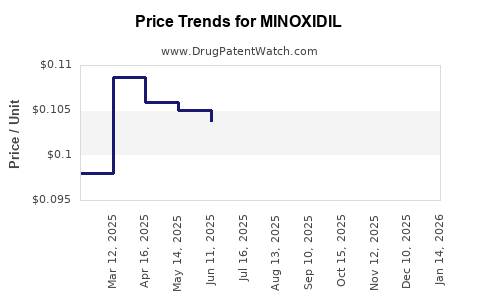

The financial outlook for Minoxidil remains bullish, driven by consistent demand and product innovation. The revenue streams derive from:

-

OTC Sales: The primary driver, stabilized by widespread accessibility in retail outlets, pharmacies, and online e-commerce platforms.

-

Prescription Formulations: Although less prevalent, certain concentrations and novel formulations continue to generate premium prices.

-

Regional Expansion: Markets in Asia-Pacific and Latin America exhibit high growth potential due to increasing awareness and urbanization.

-

Emerging Markets: Rapid economic growth and expanding middle classes provide opportunities for expansion, especially with affordable generics.

Revenue Projections and Market Share

Leading companies project steady revenue growth aligned with market expansion. For instance:

-

Johnson & Johnson reported annual Minoxidil sales of around USD 500 million globally before off-label and OTC competition intensified. Post-Patents expiry, revenue growth has stabilized but remains significant due to increased penetration and new formulations (source: company financial reports).

-

Generic manufacturers capture significant market share in price-sensitive segments, contributing to overall market volume increases despite margins compression.

Investment Trends

Private equity and venture capital increasingly target hair loss market innovations, including advanced formulations, complementary therapies, and digital health tools for hair monitoring and patient engagement. Nonetheless, the core Minoxidil product remains a low-margin commodity, emphasizing the importance of product differentiation and expanding vertical integration strategies.

Future Outlook and Strategic Considerations

Looking ahead, the Minoxidil market is poised for continued growth, driven by demographic trends and product innovation:

-

Novel Formulations: Expect more nanotechnology-enhanced formulations that improve delivery and efficacy.

-

Personalized Medicine: Integration of genetic testing to identify optimal candidates could add new revenue streams.

-

Synergistic Therapies: Combining Minoxidil with emerging hair growth agents may produce superior outcomes and command premium pricing.

-

Digital Integration: Apps and telemedicine platforms could facilitate product adherence, monitoring, and direct-to-consumer marketing.

-

Regulatory Dynamics: Changes in regulations pertaining to cosmetic vs. therapeutic claims and OTC classifications could impact commercialization strategies.

However, competition from alternative treatments, such as low-level laser therapy, platelet-rich plasma (PRP), and hair transplant procedures, may temper long-term growth unless Minoxidil’s formulations evolve accordingly.

Key Takeaways

-

The global Minoxidil market is projected to grow significantly, fueled by demographic shifts, increasing prevalence of hair loss, and consumer demand for accessible treatments.

-

Market saturation and modest efficacy result in intense generic competition, demanding innovation in formulations and delivery systems.

-

Emerging markets present substantial growth opportunities, especially through affordable generics and increased consumer awareness.

-

The trend toward combination therapies and personalized treatments could unlock new revenue streams and enhance efficacy perceptions.

-

Strategic investments in formulation innovation, digital health integrations, and regional expansion are critical for competitive advantage.

FAQs

-

What is the primary therapeutic use of Minoxidil?

Minoxidil is primarily used for treating androgenetic alopecia (pattern hair loss) in men and women.

-

Are there any significant side effects associated with Minoxidil?

Common side effects include scalp irritation, itching, and unwanted facial hair in women. Rare systemic effects are typically associated with overuse or improper application.

-

How has patent expiration impacted the Minoxidil market?

Patent expirations led to a proliferation of generic products, intensifying price competition but also expanding access globally.

-

What are the emerging trends influencing Minoxidil's market?

Innovations include foam formulations, combination therapies, nanotechnology delivery systems, and digital health integration.

-

What is the outlook for the Minoxidil market over the next decade?

The market is expected to sustain steady growth, driven by demographic shifts, product innovation, and expanding markets, despite competitive and regulatory challenges.

Sources

[1] Fortune Business Insights. "Hair Loss Treatment Market Size, Share & Industry Analysis, by Product (Minoxidil, Finasteride, Others), Distribution Channel (OTC, Prescription), Region, and Segment Forecast, 2022-2030."