Last updated: July 27, 2025

Introduction

Methylphenidate, a central nervous system stimulant primarily used to treat Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy, has maintained a pivotal position within the pharmaceutical landscape for decades. With a legacy rooted in stability and expanding indications, its market dynamics are shaped by regulatory, clinical, and societal factors. Navigating its financial trajectory entails understanding these multifaceted elements, including competitive forces, patent status, evolving healthcare policies, and emerging alternative therapies.

Market Overview

Methylphenidate, marketed predominantly under brand names such as Ritalin and Concerta, commands a significant share in the global ADHD treatment market. The compound’s therapeutic efficacy, established safety profile, and longstanding presence have contributed to robust demand. According to market research, the ADHD pharmacotherapy market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4-6% over the next five years, driven by increasing diagnosis rates, evolving prescribing practices, and expanding approval for pediatric and adult populations [1].

The global methylphenidate market size was valued at USD 1.4 billion in 2022 and is expected to reach USD 2.0 billion by 2030. Factors such as rising awareness, destigmatization of mental health conditions, and the proliferation of pharmaceutical formulations conducive to adherence bolster this positive outlook.

Market Drivers

1. Rising Prevalence of ADHD and Other Indications

ADHD prevalence is growing globally, with the World Health Organization estimates indicating up to 5% of children and 2.5% of adults affected worldwide [2]. The increased diagnosis rates have corresponded with higher methylphenidate prescriptions. Moreover, off-label uses, such as treatment for treatment-resistant depression and cognitive enhancement, are further expanding the market.

2. Market Expansion into Adult ADHD

Historically considered a childhood disorder, adult ADHD diagnosis has surged, doubling the demand for methylphenidate formulations adapted for adult use. Extended-release formulations cater specifically to this demographic, solidifying market presence.

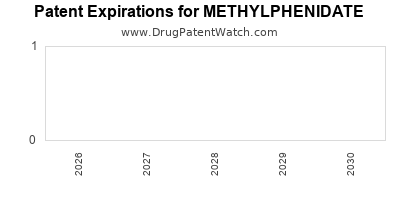

3. Patent Expirations and Generic Penetration

The expiration of key patents for methylphenidate formulations has prompted a surge of generic entrants, significantly reducing drug prices and expanding accessibility. For example, the expiration of Concerta’s patent in 2017 and Ritalin’s in 2010 increased generic competition, leading to price erosion but broader market penetration.

4. Healthcare Policy and Reimbursement Trends

Government initiatives aimed at mental health awareness and coverage expansion bolster market stability. In several jurisdictions, insurance coverage of ADHD medications encourages utilization, though regulatory controls on amphetamines and controlled substances influence prescribing behaviors.

Market Challenges

1. Regulatory Environment and Controlled Substance Regulations

Methylphenidate's classification as a Schedule II controlled substance entails stringent regulations, impacting manufacturing, dispensing, and prescribing. Changes in policies or enforcement can influence supply chains and accessibility.

2. The Rise of Alternative Pharmacotherapies

Non-stimulant medications such as atomoxetine and viloxazine, cognitive-behavioral therapies, and emerging digital therapeutics are alternative treatment options eroding market share of methylphenidate. Notably, non-stimulant drugs appeal to patients concerned about abuse potential.

3. Abuse and Regulation Risks

The potential for misuse and diversion remains a concern. Enhanced regulatory oversight and risk mitigation strategies, such as prescription drug monitoring programs, influence prescribing patterns.

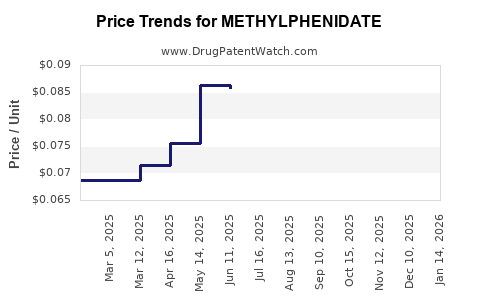

4. Market Saturation and Price Erosion

Due to the proliferation of generics, methylphenidate prices have declined substantially over recent years, impacting revenue streams for original patent holders and model profitability of manufacturers relying on brand premium.

Financial Trajectory

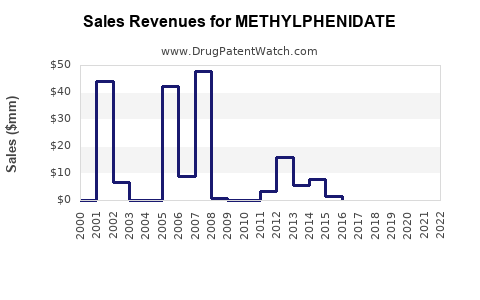

1. Revenue Trends

The revenue growth trajectory for methylphenidate depends highly on market share retention amid commoditization. While global revenues declined slightly from peak 2015-2017 levels due to generic entry, stabilization has occurred with increased volume sales, especially in emerging markets.

2. Impact of Patent Strategies

Manufacturer strategies to extend intellectual property, such as formulation patents or digital health integrations, influence future revenue streams. Companies investing in novel delivery systems or combination therapies aim to protect market share.

3. Investment in R&D and Digital Health

Companies are increasingly channeling funds into reformulations, once-daily dosing options, or digital therapeutics to complement pharmacotherapy. These initiatives hold potential for premium pricing and patient adherence benefits, positively impacting the financial outlook.

4. Market Consolidation and Mergers & Acquisitions

The competitive landscape witnesses ongoing consolidation, with large pharmaceutical firms acquiring smaller biotech companies developing innovative methylphenidate delivery systems or formulations. Such moves could influence market pricing and investment trends.

Emerging Trends and Future Outlook

1. Biosimilars and Next-Generation Formulations

While biosimilars are less relevant for small-molecule methylphenidate, proprietary formulations and digital health adjuncts are a focus. Notably, extended-release formulations and transdermal patches will continue to command importance, potentially driving premium pricing.

2. Digital and Personalized Medicine

Wearable devices and digital therapeutics for ADHD management are poised to integrate with pharmacotherapy, opening new revenue streams. Personalized dosing guided by pharmacogenomics may optimize treatment efficacy, influencing future market sizes.

3. Market Expansion in Developing Economies

Growing healthcare access in Asia-Pacific, Latin America, and Africa presents untapped markets. Price-sensitive formulations and government-funded programs will be crucial for growth.

4. Regulatory and Legal Considerations

Regulatory hurdles, including tight controls on prescribing, ongoing monitoring of abuse potential, and evolving policies, will continue to influence revenue stability and growth potential.

Conclusion

The pharmaceutical market landscape for methylphenidate remains robust but increasingly complex. While patent expirations and generic proliferation initially dampened revenue growth, expanding indications, demographic shifts, and innovations in delivery systems are sustaining its financial viability. The trajectory forward hinges on balancing regulatory compliance, addressing societal concerns about misuse, and integrating digital health solutions to enhance adherence and efficacy.

Market players positioning for growth will need to prioritize innovation, strategic IP management, and expanded global reach, especially in emerging markets. As societal awareness of ADHD and mental health imperatives rise, methylphenidate’s market fundamentals appear resilient, though unlikely to resume peak revenue levels seen prior to generics’ entry.

Key Takeaways

- Demand for methylphenidate is driven by rising ADHD diagnoses and expanding adult use, with global revenues poised for moderate growth amid increasing competition.

- Patent expirations have cultivated a wave of generics, reducing prices but broadening access, which moderates revenue growth for original formulations.

- Regulatory risks, including scheduling and abuse concerns, impact both supply and prescribing practices.

- Innovative delivery systems and integration with digital therapeutics offer avenues for premium pricing and market differentiation.

- Emerging markets and digital health integration are critical growth opportunities, requiring strategic planning and investment.

FAQs

1. How will patent expirations affect methylphenidate’s market revenue?

Patent expirations led to widespread generic competition, significantly reducing prices and profit margins for brand-name drugs. However, increased volume sales and new formulations help offset some declines, maintaining overall market dynamism.

2. Are there any promising new formulations or delivery methods for methylphenidate?

Yes. Extended-release formulations, transdermal patches, and digital therapeutics aimed at improving compliance and reducing abuse are under development, potentially supporting premium pricing and market differentiation.

3. How does regulation influence methylphenidate’s market?

As a Schedule II controlled substance, methylphenidate faces strict manufacturing, prescribing, and monitoring regulations. Changes in legal frameworks directly impact supply chain stability and prescribing behaviors.

4. What are the competitive threats from alternatives to methylphenidate?

Non-stimulant medications like atomoxetine and behavioral therapies pose competition, especially for patients concerned about abuse potential or experiencing side effects.

5. What strategies should pharmaceutical companies adopt to ensure growth?

Investing in innovative formulations, digital health integration, expanding into emerging markets, and maintaining regulatory agility will be essential for sustained growth in methylphenidate’s market.

References

[1] MarketsandMarkets. “ADHD Treatment Market by Drug Class, Distribution Channel, and Region – Global Forecast to 2030.” 2022.

[2] World Health Organization. “Adolescent Mental Health.” 2021.