Last updated: September 4, 2025

Introduction

Ketorolac Tromethamine, a potent non-steroidal anti-inflammatory drug (NSAID), is widely recognized for its analgesic effectiveness, particularly in postoperative pain management. Since its introduction, the drug has experienced significant shifts driven by clinical demand, regulatory changes, and evolving healthcare landscapes. This article provides an in-depth analysis of the market dynamics affecting Ketorolac Tromethamine and projects its future financial trajectory, equipping stakeholders with crucial insights for strategic decision-making.

Pharmacological Profile and Clinical Use

Ketorolac Tromethamine is distinguished by its strong analgesic properties, often considered an alternative to opioid analgesics within acute care settings. Its primary indications encompass short-term management of moderate to severe acute pain, notably post-surgical and trauma-related pain [2]. The drug’s efficacy, coupled with a favorable safety profile when used appropriately, has sustained its prominence in hospital formularies globally. However, its usage is tempered by notable adverse effects, especially gastrointestinal and renal toxicity, which influence prescribing patterns.

Market Drivers

1. Growing Demand for Non-Opioid Analgesics

The opioid epidemic has prompted healthcare providers to favor NSAIDs like Ketorolac as safer pain management alternatives. Regulatory agencies, including the FDA, have intensified restrictions on opioid prescriptions, indirectly bolstering the demand for non-opioid options [3]. Ketorolac's role in multimodal analgesia regimens enhances its appeal, especially in hospital settings.

2. Rising Surgical Procedures and Trauma Cases

An expanding global volume of elective and emergency surgeries significantly contribute to Ketorolac’s market penetration. According to the World Health Organization, the global surgical volume is increasing annually, which correlates with higher analgesic consumption [4]. Hospitals and surgical centers seek effective, fast-acting pain relief agents, augmenting Ketorolac's usage.

3. Favorable Patent and Regulatory Environment

While many formulations are off-patent, several branded versions continue to generate revenue due to strong clinical trust and physician preference. Regulatory approvals in emerging markets further expand the geographical footprint of Ketorolac, offering growth avenues amid saturated markets in developed economies.

4. Advancements in Drug Delivery

Innovations in injectable formulations and combination therapies enhance the therapeutic profile and compliance, stimulating market growth. Sustained-release formulations or combination products are under investigation, potentially broadening applicative scope.

Market Challenges

1. Safety Concerns Limiting Usage

Ketorolac’s adverse reactions, particularly gastrointestinal bleeding and renal impairment, lead to cautious prescribing. Regulatory advisories recommend limited duration (typically five days), which constrains volume growth potential [2]. These safety issues necessitate closely monitored usage, especially among high-risk populations.

2. Competition from Alternative Analgesics

The analgesic landscape is crowded with alternative non-opioid drugs such as acetaminophen, other NSAIDs, and emerging modalities like nerve blocks and non-pharmacologic interventions. The increasing preference for drugs with superior safety profiles constrains Ketorolac’s market share.

3. Regulatory Restrictions and Reimbursement Policies

Some countries impose strict usage guidelines, and reimbursement policies may limit access or favor newer, more expensive alternatives. These policies influence prescribing patterns and sales volumes.

Market Segmentation and Regional Dynamics

By Formulation: Injectable formulations dominate hospital environments due to rapid onset and high efficacy, whereas oral (tablet and liquid) forms target outpatient settings.

By Application: Postoperative pain management remains the dominant segment, with trauma and orthopedic pain constituting a significant portion. Usage in labor analgesia and cancer-related pain remains limited but shows incremental growth.

Regional Trends:

-

North America: The largest market, driven by high surgical volumes, opioid restrictions, and advanced healthcare infrastructure. USFDA approvals and clinical guidelines favoring NSAIDs bolster sales [5].

-

Europe: Similar trends with notable adoption in surgical protocols; however, stringent safety regulations temper rapid growth.

-

Asia-Pacific: Rapidly expanding healthcare infrastructure, increasing surgical procedures, and rising awareness contribute to burgeoning demand. Regulatory approvals are accelerating, with China and India serving as significant markets.

-

Latin America and Middle East & Africa: Emerging opportunities driven by expanding healthcare access; however, safety concerns and reimbursement issues may impede growth.

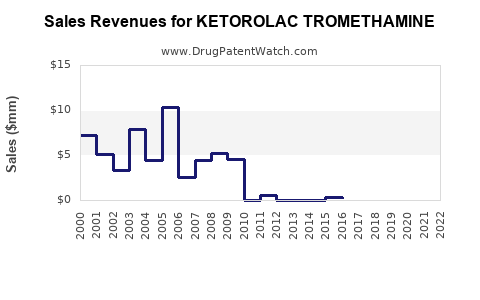

Financial Trajectory and Market Forecast

Data from industry research firms projects the global Ketorolac market to expand at an estimated compound annual growth rate (CAGR) of 4-6% over the next five years, reaching approximately USD 500-600 million by 2028 [1].

This growth is underpinned by:

- Increased adoption in surgical settings.

- Strategic penetration into emerging markets.

- Novel combination formulations extending indications.

However, the growth rate may be moderated by safety restrictions and competition from newer analgesic agents.

Revenue contributors are expected to shift gradually, with injectable formulations maintaining dominance but oral formulations gaining incremental market share due to outpatient demand.

Strategic Opportunities

1. Innovation in Safety Profile: Developing formulations with reduced gastrointestinal and renal risks can expand usage, especially across vulnerable populations.

2. New Indication Development: Clinical trials exploring Ketorolac’s efficacy in chronic pain or conjunction with other agents could diversify revenue streams.

3. Market Expansion: Focused regulatory strategies and partnerships in emerging markets could capitalize on untapped growth potential.

4. Formulation Diversification: Sustained-release and combination therapies serve as differentiators in competitive landscapes.

Risks and Outlook

While the outlook remains positive, risks encompass regulatory restrictions, changing clinical guidelines, and competitive innovations. The increasing focus on personalized medicine and safety monitoring will influence product development and market strategies.

Regulatory landscape will shape the trajectory, with agencies balancing analgesic efficacy against safety. Industry stakeholders must prioritize pharmacovigilance and demonstrate benefit-risk profiles to sustain and grow their market share.

Key Takeaways

- Ketorolac Tromethamine’s market growth is predominantly driven by the global rise in surgical procedures and the shift away from opioids.

- Safety concerns limit broad application; innovations aimed at reducing adverse effects could unlock new growth avenues.

- The Asia-Pacific region presents significant opportunities due to healthcare infrastructure development.

- Competition from other NSAIDs and alternative analgesic modalities constrains market expansion, emphasizing the need for strategic differentiation.

- The financial outlook remains favorable with a projected CAGR of 4-6% over five years, reaching USD 500-600 million by 2028, contingent on regulatory and clinical developments.

FAQs

1. What are the primary clinical indications for Ketorolac Tromethamine?

Short-term management of moderate to severe acute pain, especially post-surgical pain.

2. How do safety concerns impact Ketorolac’s market?

Adverse effects like gastrointestinal bleeding and renal impairment restrict duration and dosage, curbing widespread use.

3. Which regions are the fastest-growing markets for Ketorolac?

The Asia-Pacific region, driven by expanding healthcare infrastructure and surgical volumes, shows robust growth potential.

4. Are there any innovative formulations of Ketorolac in development?

Yes; sustained-release formulations and combination products are under investigation to improve safety and efficacy.

5. How does the market compare to other NSAIDs?

While still prominent, Ketorolac faces stiff competition from other NSAIDs with improved safety profiles and from non-pharmacologic analgesics.

References

[1] Market Research Future, “Ketorolac Market Analysis,” 2022.

[2] U.S. Food and Drug Administration, “Ketorolac Prescribing Information,” 2020.

[3] National Institute on Drug Abuse, “Opioid Epidemic Impacts on Pain Management,” 2021.

[4] World Health Organization, “Global Surgical Volume Data,” 2020.

[5] IQVIA, “Pharmaceutical Market Reports,” 2022.