GEMTESA Drug Patent Profile

✉ Email this page to a colleague

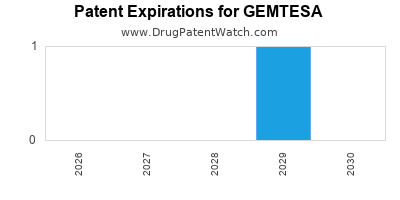

When do Gemtesa patents expire, and when can generic versions of Gemtesa launch?

Gemtesa is a drug marketed by Sumitomo Pharma Am and is included in one NDA. There are five patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and nineteen patent family members in forty-eight countries.

The generic ingredient in GEMTESA is vibegron. One supplier is listed for this compound. Additional details are available on the vibegron profile page.

DrugPatentWatch® Generic Entry Outlook for Gemtesa

Gemtesa was eligible for patent challenges on December 23, 2024.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be April 2, 2029. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for GEMTESA?

- What are the global sales for GEMTESA?

- What is Average Wholesale Price for GEMTESA?

Summary for GEMTESA

| International Patents: | 119 |

| US Patents: | 5 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 27 |

| Clinical Trials: | 3 |

| Patent Applications: | 139 |

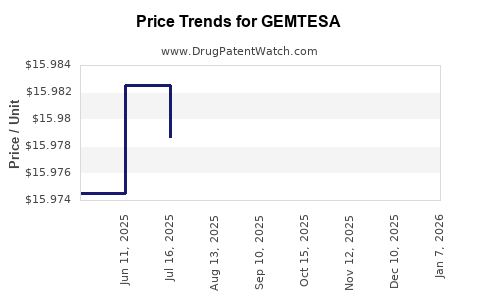

| Drug Prices: | Drug price information for GEMTESA |

| What excipients (inactive ingredients) are in GEMTESA? | GEMTESA excipients list |

| DailyMed Link: | GEMTESA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for GEMTESA

Generic Entry Date for GEMTESA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for GEMTESA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Wake Forest University Health Sciences | PHASE3 |

| University of Missouri-Columbia | EARLY_PHASE1 |

| Urovant Sciences GmbH | Phase 4 |

Pharmacology for GEMTESA

| Drug Class | beta3-Adrenergic Agonist |

| Mechanism of Action | Adrenergic beta3-Agonists |

US Patents and Regulatory Information for GEMTESA

GEMTESA is protected by five US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of GEMTESA is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,653,260.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sumitomo Pharma Am | GEMTESA | vibegron | TABLET;ORAL | 213006-001 | Dec 23, 2020 | RX | Yes | Yes | 12,102,638 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Sumitomo Pharma Am | GEMTESA | vibegron | TABLET;ORAL | 213006-001 | Dec 23, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Sumitomo Pharma Am | GEMTESA | vibegron | TABLET;ORAL | 213006-001 | Dec 23, 2020 | RX | Yes | Yes | 8,653,260 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Sumitomo Pharma Am | GEMTESA | vibegron | TABLET;ORAL | 213006-001 | Dec 23, 2020 | RX | Yes | Yes | 12,357,636 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Sumitomo Pharma Am | GEMTESA | vibegron | TABLET;ORAL | 213006-001 | Dec 23, 2020 | RX | Yes | Yes | 8,247,415 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for GEMTESA

When does loss-of-exclusivity occur for GEMTESA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 2043

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 09231714

Estimated Expiration: ⤷ Get Started Free

Austria

Patent: 35521

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0909768

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 19876

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 09000815

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2056917

Estimated Expiration: ⤷ Get Started Free

Patent: 2391255

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 31440

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 751

Estimated Expiration: ⤷ Get Started Free

Patent: 120282

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0120129

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 12552

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 76756

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 010000294

Estimated Expiration: ⤷ Get Started Free

Patent: 013000267

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 10010518

Estimated Expiration: ⤷ Get Started Free

El Salvador

Patent: 10003687

Patent: HIDROXIMETIL PIRROLIDINAS COMO AGONISTAS DEL RECEPTOR ADRENERGICO BETA 3

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 0135

Estimated Expiration: ⤷ Get Started Free

Patent: 1071169

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 76756

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 0240046

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1051

Estimated Expiration: ⤷ Get Started Free

Georgia, Republic of

Patent: 0125666

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 10002030

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 47099

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 8215

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 83867

Estimated Expiration: ⤷ Get Started Free

Patent: 83870

Estimated Expiration: ⤷ Get Started Free

Patent: 32846

Estimated Expiration: ⤷ Get Started Free

Patent: 11201897

Estimated Expiration: ⤷ Get Started Free

Patent: 11510023

Estimated Expiration: ⤷ Get Started Free

Patent: 12020961

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 10010929

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 988

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 257

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1305

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 8266

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 1000164

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 24055

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 091825

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 76756

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 76756

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 175

Patent: HIDROKSIMETIL PIROLIDINI KAO AGONISTI BETA 3 ADRENERGIČKOG RECEPTORA (HYDROXYMETHYL PYRROLIDINES AS BETA 3 ADRENERGIC RECEPTOR AGONISTS)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 8883

Patent: HYDROXYMETHYL PYRROLIDINES AS BETA 3 ADRENERGIC RECEPTOR AGONISTS

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 76756

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1006720

Patent: HYDROXYMETHYL PYRROLIDINES AS BETA 3 ADRENERGIC RECEPTOR AGONISTS

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1288798

Estimated Expiration: ⤷ Get Started Free

Patent: 1331771

Estimated Expiration: ⤷ Get Started Free

Patent: 100126860

Estimated Expiration: ⤷ Get Started Free

Patent: 120104257

Estimated Expiration: ⤷ Get Started Free

Patent: 120118086

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 76278

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 78098

Estimated Expiration: ⤷ Get Started Free

Patent: 0944521

Patent: Hydroxymethyl pyrrolidines as beta 3 adrenergic receptor agonists

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 10000447

Patent: HYDROXYMETHYL PYRROLIDINES AS BETA 3 ADRENERGIC RECEPTOR AGONISTS

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 1367

Patent: ГІДРОКСИМЕТИЛПІРОЛІДИНИ ЯК АГОНІСТИ АДРЕНЕРГІЧНИХ РЕЦЕПТОРІВ β3[Normal;heading 1;heading 2;heading 3;ГИДРОКСИМЕТИЛПИРРОЛИДИНЫ КАК АГОНИСТЫ АДРЕНЕРГИЧЕСКИХ РЕЦЕПТОРОВ β3 (Normal;heading 1;heading 2;heading 3;HYDROXYMETHYL PYRROLIDINES AS BETA 3 ADRENERGIC RECEPTOR AGONISTS)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering GEMTESA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| European Patent Office | 2968269 | ⤷ Get Started Free | |

| Spain | 2376278 | ⤷ Get Started Free | |

| Eurasian Patent Organization | 020135 | ⤷ Get Started Free | |

| Japan | 5432846 | ⤷ Get Started Free | |

| Canada | 3115190 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for GEMTESA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2276756 | LUC00366 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: VIBEGRON OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF; AUTHORISATION NUMBER AND DATE: EU/1/24/1822 20240628 |

| 2276756 | 122024000082 | Germany | ⤷ Get Started Free | PRODUCT NAME: VIBEGRON ODER EIN PHARMAZEUTISCH ANNEHMBARES SALZ DAVON; REGISTRATION NO/DATE: EU/1/24/1822 20240627 |

| 2276756 | 2024C/551 | Belgium | ⤷ Get Started Free | PRODUCT NAME: VIBEGRON OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT HIERVAN; AUTHORISATION NUMBER AND DATE: EU/1/24/1822 20240628 |

| 2276756 | CR 2024 00054 | Denmark | ⤷ Get Started Free | PRODUCT NAME: VIBEGRON OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF; REG. NO/DATE: EU/1/24/1822 20240628 |

| 2276756 | C20240046 | Finland | ⤷ Get Started Free | |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for GEMTESA (Vibegron)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.