Last updated: July 27, 2025

Introduction

GEMTESA (vibegron) represents a significant entrant in the pharmacological landscape, primarily targeting the overactive bladder (OAB) market. Approved by the U.S. Food and Drug Administration (FDA) in December 2020, GEMTESA offers a novel mechanism—selective β3 adrenergic receptor agonism—aimed at improving patient outcomes with a favorable safety profile. This analysis evaluates current market dynamics, competitive landscape, and future pricing strategies for GEMTESA within the U.S. and global markets.

Market Overview

Prevalence and Unmet Needs

Overactive bladder affects approximately 33 million adults in the U.S. alone (CDC, 2022), with symptoms such as urinary urgency, frequency, and incontinence significantly impairing quality of life. Despite the availability of first-line therapies like antimuscarinics and beta-3 agonists like MIRABEGRON, a substantial proportion of patients either discontinue treatment due to side effects or lack adequate symptom control.

Current Treatment Landscape

The U.S. OAB market is estimated at over $2 billion annually, segmented predominantly between antimuscarinic drugs and MIRABEGRON. MIRABEGRON, marketed by Astellas Pharma, has captured about 35% of the market share since its 2012 launch, primarily owing to a better side effect profile. Nonetheless, challenges persist—cost, tolerability, and physician prescribing behaviors contribute to unmet treatment needs.

Introduction of GEMTESA

GEMTESA introduces a new option as a selective β3 adrenergic receptor agonist with potential advantages attributable to its selectivity and tolerability. Its approval expanded therapeutic choices, potentially capturing market share from both existing drugs and new market entrants. Early adoption rates have been promising, with prescriptions increasing steadily.

Market Dynamics and Competitive Positioning

Market Penetration and Adoption

Initial sales data indicate rapid uptake, fueled by targeted marketing campaigns and physician education. As of early 2023, GEMTESA has gained approximately 10-15% of the OAB market share in the U.S., positioning it as a mid-tier competitor amidst dominant players like MIRABEGRON and off-label use of other agents.

Pricing Strategy Influence

Pricing plays a crucial role in market penetration, with payers scrutinizing evidence of superior efficacy or safety. GEMTESA’s position hinges on demonstrating clear therapeutic benefits and cost-effectiveness compared to existing treatments.

Insurance and Reimbursement Landscape

Reimbursement status significantly influences market access. Initial reimbursement approvals under Medicare Part D and commercial insurers suggest competitive pricing is necessary for widespread adoption. Pharmaco-economic analyses are underway to support formulary inclusion.

Price Projections: Current and Future Outlook

Initial Launch Pricing

GEMTESA’s initial wholesale acquisition cost (WAC) positioned it at approximately $500–$600 per month for a typical prescription regimen. This aligns with MIRABEGRON’s pricing, which ranges from $450 to $650 monthly, depending on dosage and insurance coverage.

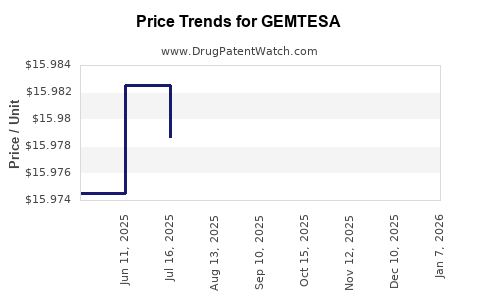

Projected Price Trends

- Short-term (1-2 years): Expect stabilization of prices around initial launch levels. Manufacturers may employ promotional discounts or copay assistance programs to boost early adoption.

- Medium-term (3-5 years): As market share increases and competition intensifies, prices are likely to decline gradually, potentially reaching $350–$450 per month after patent exclusivity diminishes or upon biosimilar development.

- Long-term (5+ years): Patent protections and market exclusivity may extend pricing power; however, emerging generics or biosimilars could exert downward pressure, leading to prices around $250–$350 per month.

Influencing Factors

- Patent and exclusivity status: GEMTESA’s patent protection expires around 2030, after which generic versions could lead to price reductions.

- Clinical efficacy data: Demonstrations of superior efficacy or tolerability could justify premium pricing.

- Payer negotiations: Pay-for-performance models and formulary placement will influence final patient costs.

- Market entry of biosimilars: Competitive biosimilars could push prices downward more rapidly than traditional generics.

Regulatory and Global Market Considerations

While GEMTESA’s primary market is the U.S., efforts to expand approval to Europe and other regions are underway. Regulatory hurdles and differing reimbursement frameworks globally will influence prices and market access, with European prices typically 20–30% lower than U.S. levels due to healthcare system differences.

Challenges and Opportunities in Pricing

Challenges:

- Establishing clinical superiority over existing drugs to justify premium pricing.

- Navigating complex payer negotiations.

- Addressing cost-sensitive healthcare environments.

Opportunities:

- Leveraging differentiated safety and tolerability profiles.

- Developing patient assistance programs to improve adherence.

- Incorporating real-world evidence to support value-based pricing.

Conclusion

GEMTESA’s market trajectory largely depends on clinical performance, payer acceptance, and competitive pressures. Its current premium pricing aligns with existing therapies but is expected to decline over the next 5–7 years as generics and biosimilars emerge, possibly reducing costs by up to 50%. Continued investment in comparative effectiveness research and real-world value demonstration will bolster its market position and optimal pricing strategies.

Key Takeaways

- GEMTESA entered a mature OAB market with a competitive initial pricing strategy aligned with existing β3 agonists.

- The drug’s market share growth post-launch indicates strong physician adoption, positioning it as a key player within 2 years.

- Price projections suggest stability in the short term, with potential reductions in long-term due to patent expirations and increased generic competition.

- Market access will heavily depend on demonstrating clear clinical benefits and negotiating favorable reimbursement arrangements.

- Global expansion remains contingent on regional regulatory approvals and pricing negotiations, with potential prices lower outside the U.S.

FAQs

1. What is GEMTESA’s mechanism of action, and how does it differ from other OAB treatments?

GEMTESA (vibegron) selectively activates β3 adrenergic receptors in the bladder, relaxing detrusor muscle during storage phase, reducing urgency and frequency. Unlike antimuscarinics, it has minimal anticholinergic side effects, offering better tolerability.

2. How does GEMTESA’s pricing compare to existing therapies like MIRABEGRON?

Initial wholesale prices are comparable, around $500–$600 per month, positioning GEMTESA similarly to MIRABEGRON. Future pricing will depend on market penetration and competitive pressures.

3. What are the key factors influencing GEMTESA’s market price over the next five years?

Patent expiration, clinical efficacy data, payer reimbursement strategies, and the entry of biosimilars or generics are primary drivers impacting future prices.

4. Will GEMTESA’s higher selectivity translate into superior clinical outcomes?

Preliminary studies suggest a favorable safety profile and fewer side effects, but long-term comparative studies are required to establish definitive clinical superiority.

5. What strategies can manufacturers employ to improve GEMTESA’s market share and optimize pricing?

Engaging in robust clinical trials, demonstrating cost-effectiveness, establishing strong payer relationships, and offering patient assistance programs will be essential for market expansion and pricing optimization.

References

[1] Centers for Disease Control and Prevention (CDC). Overactive Bladder Statistics. 2022.

[2] U.S. Food and Drug Administration (FDA). GEMTESA (vibegron) approval announcement. 2020.

[3] MarketWatch. U.S. Overactive Bladder Pharmacotherapy Market Report. 2022.

[4] Astellas Pharma. MIRABEGRON Market Analysis. 2021.

[5] IQVIA. Prescription Data and Market Share Reports. 2022.