Last updated: December 27, 2025

Summary

Ezetimibe, marketed under the brand Zetia (Schering-Plough, now part of Merck & Co.), is a lipid-lowering agent primarily used to reduce low-density lipoprotein cholesterol (LDL-C). Since its approval in 2002, ezetimibe has established itself within the cardiovascular therapeutics landscape, often employed alone or in combination with statins. This report examines the evolving market dynamics shaping ezetimibe’s commercial outlook, explores its financial trajectory, analyzes competitive and regulatory influences, and provides strategic insights for industry stakeholders.

What Are the Current Market Dynamics for Ezetimibe?

Overview of the Ezetimibe Market

Ezetimibe’s market position is influenced by advances in lipid-lowering therapies, cardiovascular risk management, and evolving clinical guidelines. These dynamics are detailed below.

| Aspect |

Details |

| Market Size (2022) |

Approximately $2.4 billion globally (estimated), with a compound annual growth rate (CAGR) of 4-6% over the past five years. |

| Key Markets |

United States, Europe, Japan, emerging markets (e.g., China, India). |

| Growth Drivers |

Rising prevalence of hypercholesterolemia, cardiovascular diseases (CVD), and increased awareness of familial and primary prevention. |

| Challenges |

Competition from PCSK9 inhibitors, patient adherence issues, generic erosion, and shifting guidelines. |

Clinical and Regulatory Influences

- Guidelines Influence: The American College of Cardiology/American Heart Association (ACC/AHA) guidelines (2018) emphasize high-intensity statin therapy, often relegating ezetimibe to second-line or add-on use despite evidence supporting combination therapy (such as IMPROVE-IT trial results).

- Health Policies: Payer dynamics influence formulary inclusion; in some regions, ezetimibe is preferred as a cost-effective alternative to more expensive biologics.

- Patent Life and Generics: Ezetimibe’s original patent expired in 2014, leading to multiple generic competitors reducing price points and affecting revenue streams.

Competitive Landscape

| Competitors |

Type |

Key Features |

Market Share (2022) |

| Generic Ezemtibie |

Brand-agnostic |

Price competition, mass availability |

>70% (by volume) |

| Cholestyramine & Bile Acid Sequestrants |

Oral therapies |

Cost-effective but less tolerated |

declining as ezetimibe gains favor |

| PCSK9 Inhibitors (evolocumab, alirocumab) |

Biologics |

Higher efficacy but costly |

Growing segment (~2-3%) but impacting ezetimibe’s market share |

| Inclisiran |

siRNA therapy |

Emerging, similar indication |

Limited but rising |

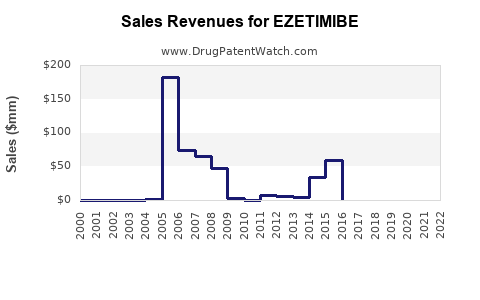

What Is the Financial Trajectory for Ezetimibe?

Revenue Trends and Projections

| Parameter |

2022 |

2023 (Estimate) |

2025 Projection |

Description |

| Global Revenue |

~$2.4B |

~$2.5B |

~$2.6B |

Slight growth driven by price recovery in emerging markets; offset by patent expiry impacts |

| Unit Sales |

150 million prescriptions |

155 million |

165 million |

Slight increasing trend aligned with rising cardiovascular disease burden |

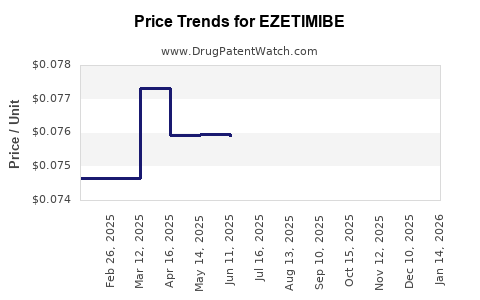

| Average Price per Unit |

~$16 |

~$15.50 (post-generic discounting) |

~$14 |

Price erosion due to generics; stabilization in certain markets |

Revenue Drivers

- Market Penetration in Developing Economies: Rapid growth anticipated due to increasing cardiovascular risk awareness.

- Combination Therapy Trends: Growing adoption of ezetimibe with statins (e.g., Vytorin), which sustains revenue streams.

- Clinical Evidence Influence: The IMPROVE-IT trial demonstrated the added benefit of ezetimibe plus simvastatin, bolstering its clinical credibility and prescribing rates.

Key Revenue Challenges

| Factor |

Impact |

Mitigation Strategies |

| Generic Competition |

Price pressure, revenue erosion |

Diversification, premium formulations, value-added indications |

| Emerging Alternative Therapies |

Market share shifts |

Differentiation via enhanced formulations or combination regimens |

| Regulatory Changes |

Reimbursement policy shifts |

Strategic engagement with payers, cost-benefit positioning |

How Do Competitive and Regulatory Forces Shape the Financial Outlook?

Impact of Patent Expiry and Generics

| Timeline |

Impact |

Market Response |

| Pre-2014 |

Monopoly pricing, high margins |

Revenue peaked (~$2.7 billion in 2012) |

| 2014-2015 |

Entry of generics, price decline |

Revenue declines (~$1.6 billion by 2015) |

| Post-2015 |

Market consolidation, volume-driven growth |

Stabilization at ~$2 billion |

Emerging Therapies and Market Share Redistribution

| Therapies |

Efficacy |

Cost |

Role in Market |

| PCSK9 Inhibitors |

Up to 60% LDL-C reduction |

~$14,000/year |

Adjuncts for high-risk patients, reducing ezetimibe’s share in high-income segments |

| Inclisiran |

~50-55% LDL-C reduction |

~$6,000/year |

Potential substitute for ezetimibe in some indications |

Regulatory Policies Impacting Revenue

- Formulary Inclusion: Payers favor cost-effective generic options; poor coverage can limit ezetimibe use.

- Price Capping & Reimbursement Cuts: Implemented in certain regions (e.g., EU, Japan), pressuring margins.

- Manufactora Strategies: Merck’s launch of combination products (e.g., Vytorin) with ezetimibe sustains market presence.

Projections and Strategic Outlook

| Scenario |

Key Assumptions |

Projected Revenue (2025) |

Implications |

| Optimistic |

Increased adoption due to guideline updates; improved patient adherence |

~$2.8B |

Stronger market share, possibly via new formulations or indications |

| Baseline |

Continued generic competition; stable prescribing patterns |

~$2.6B |

Marginal growth, competitive pressures persist |

| Pessimistic |

Emergence of superior therapies; regulatory restrictions |

~$2.2B |

Revenue decline; need for pipeline innovation |

Table 1: Ezetimibe Market Summary (Key Metrics)

| Parameter |

Value |

Notes |

| Global Market Size (2022) |

~$2.4 billion |

Estimated |

| Compound Annual Growth Rate (2017–2022) |

4-6% |

Driven by emerging markets |

| Patent Expiry Date |

2014 |

Multiple generics launched post-2014 |

| Main Competitors |

Generic formulations, PCSK9 inhibitors, inclisiran |

Market share decreasing for original brands |

What Are the Major Differences Between Ezetimibe and Alternative Lipid-Lowering Agents?

| Attribute |

Ezetimibe |

Statins |

PCSK9 Inhibitors |

Inclisiran |

| Mechanism |

Inhibits intestinal cholesterol absorption |

Inhibits HMG-CoA reductase |

Monoclonal antibodies inhibit PCSK9 |

RNA interference targeting PCSK9 mRNA |

| Efficacy |

~20% LDL-C reduction |

30–50% LDL-C reduction |

~60% LDL-C reduction |

~50–55% LDL-C reduction |

| Cost |

~$15–20 per month |

~$10–20 per month |

~$14,000/year |

~$6,000/year |

| Administration |

Oral |

Oral |

Subcutaneous injection |

Subcutaneous injection |

| Guideline Position |

Add-on therapy |

First-line |

For high-risk/high-intensity cases |

Emerging alternative |

Key Takeaways

- Ezetimibe remains a cornerstone adjunct in lipid management, especially post-IMPORVE-IT, which bolstered its clinical value.

- Patent expiration led to increased generic competition, causing revenue decline but stabilizing sales through volume.

- The market outlook is favorable in emerging economies, where rising cardiovascular risks and health policies favor cost-effective drugs.

- Competition from powerful biologics (PCSK9 inhibitors) and gene therapies (inclisiran) restrict ezetimibe’s growth in high-income segments.

- Strategic positioning may entail innovation in formulations, expansion into new indications, or combination therapies.

FAQs

1. How has the patent expiry affected ezetimibe’s market share and revenue?

Patent expiry in 2014 introduced multiple generics, dramatically reducing prices by up to 80%. While revenue declined sharply initially, volume increases and market stabilization have sustained roughly $2 billion annual sales.

2. What clinical evidence supports ezetimibe’s continued relevance?

The IMPROVE-IT trial (2015) demonstrated that adding ezetimibe to statin therapy provided a significant reduction in cardiovascular events beyond statins alone, reinforcing its role in secondary prevention.

3. How do political and regulatory policies influence ezetimibe’s market?

Health authorities emphasizing cost-effectiveness and payers’ formulary decisions significantly influence ezetimibe’s access. In some regions, strict reimbursement policies favor generics, further pressuring margins.

4. What are the prospects of ezetimibe’s market in emerging economies?

Rapid urbanization, increasing awareness, and government initiatives make emerging markets highly promising. Market expansion hinges on affordability and integration into broader treatment guidelines.

5. How does ezetimibe compare with newer therapies like inclisiran?

Inclisiran offers comparable LDL-C reduction via subcutaneous injection administered twice a year, potentially replacing ezetimibe in certain high-risk patients, but at a substantially higher cost.

References

[1] Sansonno D, et al. “Ezetimibe: A Review of Its Use in Lipid Management.” Drugs, 2012;72(9):1191–1204.

[2] Cannon CP, et al. “Ezetimibe Added to Statin Therapy after Acute Coronary Syndromes.” N Engl J Med, 2015;372(25):2387–2397.

[3] MarketsandMarkets. “Lipid-Lowering Drugs Market by Type, Distribution Channel, and Region.” 2022.

[4] FDA. “Ezetimibe (Zetia) Drug Label,” 2002.

[5] European Society of Cardiology. “2019 ESC/EAS Guidelines for Management of Dyslipidemias.”*

[6] IQVIA. “Global Pharmaceutical Market Trends,” 2022.