Last updated: July 29, 2025

Introduction

ESTRACE (Estradiol), a hormone therapy primarily used for managing menopausal symptoms, osteoporosis prevention, and certain hormonal deficiencies, operates within a complex and evolving pharmaceutical landscape. Its market dynamics are influenced by demographic shifts, regulatory factors, competitive landscape, and evolving healthcare policies. This analysis provides a comprehensive perspective on the market trends and financial trajectory of ESTRACE, emphasizing its strategic positioning within the broader hormone replacement therapy (HRT) market.

Market Overview

Global Market Landscape

The global estrogen therapy market, encompassing ESTRACE, is projected to experience moderate growth driven by aging populations, increasing awareness of menopause management, and the rising prevalence of osteoporosis among women over 50. According to market research, the global hormone replacement therapy market is expected to grow at a CAGR of approximately 5-6% over the next five years [1]. ESTRACE, as a leading oral estradiol formulation, holds a significant share within this sector, especially in North America and Europe, where HRT practices are well-established.

Demographic Drivers

The primary driver for ESTRACE’s market expansion is the rising number of menopausal and postmenopausal women. The World Health Organization estimates that by 2030, women aged 50 and above will constitute over 20% of the global female population, increasing demand for menopausal symptom relief [2]. Additionally, the aging population correlates with an increased incidence of osteoporosis, where estrogen therapy remains a pivotal treatment option.

Regulatory and Reimbursement Factors

Regulatory environments significantly influence ESTRACE's market viability. In regions like the US and Europe, FDA and EMA approvals facilitate market access. Moreover, healthcare reimbursement policies for hormone therapy impact patient affordability and prescribing patterns. In some countries, reimbursement for ESTRACE remains favorable; however, safety concerns associated with hormone therapy have led to cautious prescribing practices, potentially constraining growth.

Competitive Landscape

While ESTRACE remains a dominant estrogen therapy, competition from other formulations—transdermal patches, gels, buccal tablets, and bioidentical hormones—has intensified. Companies such as Pfizer, Bayer, and compounding pharmacies offer alternatives, sometimes with differing safety profiles, dosing convenience, or cost advantages [3]. The market's fragmentation necessitates continuous innovation and strategic positioning by ESTRACE manufacturers.

Market Challenges

Safety Concerns and Prescribing Trends

The history of hormone therapy is marred by concerns over cardiovascular risks, breast cancer, and stroke, stemming from pivotal studies like the Women's Health Initiative (WHI). Although contemporary guidelines favor individualized risk assessment, safety concerns still influence physician prescribing habits, partially suppressing ESTRACE's market potential [4].

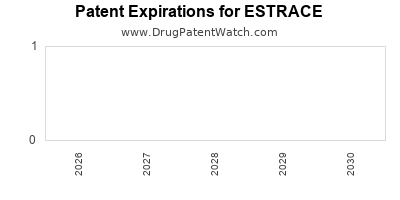

Patent Expiry and Generic Competition

Patent expiration of branded hormone therapies introduces increased competition from generics, exerting downward pressure on prices and margins. Ensuring differentiating factors—such as formulation convenience, bioavailability, or delivery methods—is critical to maintaining profitability.

Manufacturing and Supply Chain Considerations

Ensuring consistent quality, supply chain efficiency, and regulatory compliance are vital. Disruptions—from raw material shortages or manufacturing complexities—could impact market availability and financial performance.

Financial Trajectory Analysis

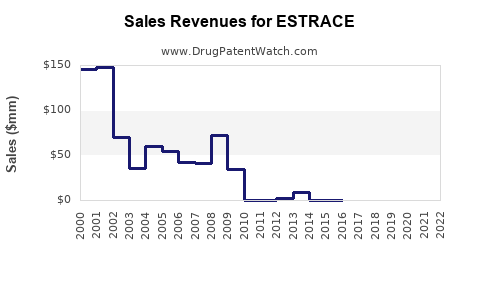

Revenue Trends

Historically, ESTRACE’s revenues have reflected the broader trends within HRT markets—periods of growth aligned with increasing menopausal populations and favorable prescribing trends, followed by stagnation or decline when safety concerns prevail. Based on historical data and current market forecasts, ESTRACE’s sales are projected to grow modestly at a CAGR of approximately 3-4% over the next five years [1].

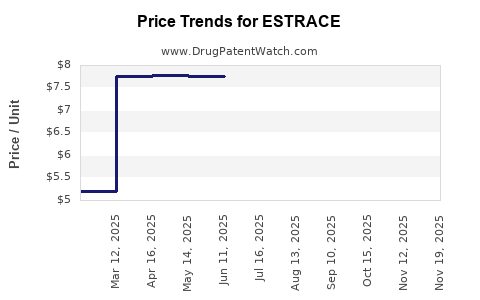

Pricing and Market Share Evolution

Pricing strategies significantly influence revenue. With patent expiry and intensified competition, average selling prices are under pressure. Manufacturers increasingly adopt value-added strategies—such as improved formulations and combination therapies—to sustain market share and revenue streams.

Regulatory Impact on Financials

Approval of new formulations or indications can open additional revenue streams. Conversely, regulatory restrictions or safety warnings may weaken sales forecasts and market penetration, necessitating proactive engagement with health authorities.

Investment and R&D Outlook

Continued investment in research and development, particularly in developing transdermal or bioidentical formulations of estradiol with favorable safety profiles, could yield future growth avenues. Strategic alliances and licensing agreements may also bolster financial trajectories.

Profitability Projections

Margins are sensitive to pricing pressures, manufacturing costs, and marketing expenses. Companies that successfully differentiate ESTRACE through innovative delivery systems or expanded indications are better positioned to sustain profitability.

Future Outlook

The future trajectory of ESTRACE hinges on several interconnected factors:

- Demographic Trends: Aging populations will sustain baseline demand.

- Innovation: Novel formulations and personalized medicine approaches could redefine market positioning.

- Regulatory Environment: Stricter safety standards could impose constraints but also promote innovation in safer formulations.

- Competitive Strategies: Effective branding, clinical evidence, and reimbursement strategies will influence market share.

Given global trends, a steady, albeit cautious, growth trajectory is anticipated, with profits potentially expanding through diversification and innovation.

Key Takeaways

- ESTRACE's market growth aligns with demographic shifts, notably aging populations and menopause prevalence.

- Safety concerns remain a critical factor, influencing prescribing patterns and regulatory decisions.

- Competition from alternative formulations and generics exerts pricing pressures, emphasizing the importance of innovation and differentiation.

- Revenues are expected to increase modestly over the next five years, contingent upon successful clinical development and strategic marketing.

- Emphasizing patient safety, regulatory compliance, and formulation innovation are essential for sustaining and enhancing financial performance.

Frequently Asked Questions (FAQs)

1. How does safety concern impact ESTRACE’s market penetration?

Safety concerns, especially regarding cardiovascular risks and breast cancer, influence physician prescribing habits, leading to cautious utilization of estrogen therapies like ESTRACE. Regulatory warnings and evolving clinical guidelines contribute to conservative market growth.

2. What are the primary competitive threats facing ESTRACE?

Competing formulations, including transdermal patches, gels, and bioidentical hormones, threaten ESTRACE’s market share. The expiration of patents and the rise of compounded therapies further intensify competition.

3. How significant is demographic aging to ESTRACE’s future sales?

Aging demographics markedly contribute to sustained demand, as menopausal and postmenopausal women seek hormone replacement therapies, supporting long-term revenue stability.

4. Are there ongoing innovations in ESTRACE formulations that could influence its market?

Yes, efforts are underway to develop transdermal, buccal, and bioidentical variants of estradiol, which could enhance safety profiles and user convenience, impacting future market dynamics.

5. What strategic actions can manufacturers take to improve ESTRACE’s financial outlook?

Investing in formulation innovation, expanding indications, strengthening regulatory pathways, and optimizing pricing strategies will be vital to sustain profitability amid competitive pressures.

Sources

[1] MarketWatch, "Hormone Replacement Therapy Market Size, Trends & Forecast," 2022.

[2] WHO, "Global Population Ageing," 2021.

[3] EvaluatePharma, "Pharmaceutical Competition and Innovation," 2022.

[4] U.S. Food and Drug Administration, "Hormone Therapy Labeling and Safety Communications," 2020.