Share This Page

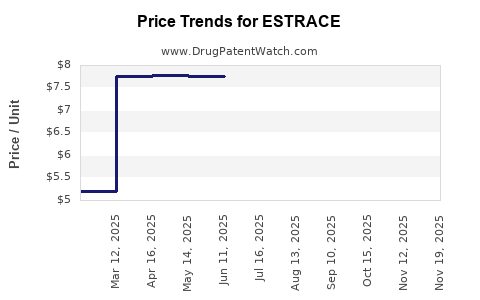

Drug Price Trends for ESTRACE

✉ Email this page to a colleague

Average Pharmacy Cost for ESTRACE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ESTRACE 0.01% CREAM | 00430-3754-14 | 7.71608 | GM | 2025-11-19 |

| ESTRACE 0.01% CREAM | 00430-3754-14 | 7.71608 | GM | 2025-10-22 |

| ESTRACE 0.01% CREAM | 00430-3754-14 | 7.75374 | GM | 2025-09-17 |

| ESTRACE 0.01% CREAM | 00430-3754-14 | 7.75206 | GM | 2025-08-20 |

| ESTRACE 0.01% CREAM | 00430-3754-14 | 7.75274 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ESTRACE

Introduction

ESTRACE, a branded hormone therapy containing estradiol, is primarily prescribed for menopausal symptoms, hypogonadism, and estrogen deficiency-related conditions. As a well-established estrogen formulation, its market landscape is shaped by demographic trends, regulatory policies, competitive landscape, and evolving treatment guidelines. This analysis provides a comprehensive overview of the current market dynamics and future price projections for ESTRACE.

Market Overview

Product Profile and Therapeutic Indications

ESTRACE offers Estradiol, a bioidentical estrogen used in hormone replacement therapy (HRT). Its primary indications include relief from menopausal vasomotor symptoms, prevention of osteoporosis, and management of estrogen deficiency. The drug’s formulation as vaginal cream or tablets targets both systemic and local estrogen delivery, broadening its clinical utility.

Market Size and Growth Drivers

The global hormone replacement therapy market is projected to reach USD 15.4 billion by 2027, expanding at a CAGR of roughly 6.8% (Grand View Research, 2022). Factors contributing to growth include:

- Aging population: Women aged 50+ are increasing globally, boosting demand for menopause-related therapies.

- Growing awareness: Increased understanding of osteoporosis and hormonal health enhances market penetration.

- Advances in formulations: Development of localized estrogen therapy reduces systemic side effects, expanding patient acceptance.

- Regulatory environment: Regulations favoring bioidentical hormone therapy bolster market stability, though some regions remain cautious due to safety concerns.

Competitive Landscape

ESTRACE faces competition from generic estradiol products, other branded hormone therapies, and compounded bioidentical hormones. Major competitors include:

- Generic estradiol formulations from multiple pharmaceutical companies.

- Biological similar hormones like Vivelle-Dot and Femring.

- Compounded hormone therapies, which are often prescribed off-label, especially in the U.S.

Despite this, ESTRACE maintains significant market share through established brand recognition, physician familiarity, and regulatory approvals.

Regulatory and Reimbursement Factors

Regulatory Status

ESTRACE’s approval status varies by region, with strong market presence in the U.S. (by Pfizer, now part of Pfizer's legacy portfolio), Europe, and other territories. Regulatory concerns primarily center around safety profiles, especially cardiovascular and breast cancer risks associated with estrogen therapy, as depicted in the WHI trials (Women’s Health Initiative, 2002).

Insurance and Reimbursement

Insurance coverage for hormone therapy remains robust in many developed markets, though increasing scrutiny over long-term use impacts prescribing patterns. The cost-effectiveness of ESTRACE compared to generics influences its pricing and market penetration.

Market Dynamics and Future Trends

Demographic Shifts

The global population aged 50+ is expanding rapidly, with the World Bank reporting over 1 billion women in this age group in 2020. This demographic driver underpins sustained demand for estrogen therapy, especially in North America and Europe.

Safety Perception and Clinical Guidelines

Recent guidelines emphasize personalized HRT, minimizing dose and duration to reduce adverse effects. Such shifts may influence ESTRACE’s prescribing patterns, favoring lower doses or localized formulations.

Emerging Alternatives

The development of selective estrogen receptor modulators (SERMs) and tissue-selective estrogen complexes (TSECs) offers alternative therapeutic options, potentially impacting ESTRACE's market share. However, traditional estrogen therapy remains the first-line treatment in many cases.

Market Penetration of Generics

The patent expiration timeline for ESTRACE's branded formulations suggests increasing adoption of generic estradiol products, pressuring ESTRACE’s pricing structure.

Price Projections

Current Pricing Landscape

In the U.S., the wholesale acquisition cost (WAC) for ESTRACE cream varies by dosage and formulation but typically ranges between USD 200-400 per month, depending on provider discounts and insurance coverage (GoodRx, 2022). The cost of generic counterparts is approximately 50-70% lower, prompting competitive pressure.

Projected Price Trends (2023-2028)

-

Stability in Premium Pricing (2023-2024):

Given brand loyalty and clinical familiarity, ESTRACE is expected to maintain stable pricing initially, especially in managed care settings. -

Gradual Price Erosion (2025-2026):

As patents expire and generics saturate the market, ESTRACE prices are forecasted to decline by approximately 10-15%, consistent with historical trends observed for other branded hormones. -

Further Price Reduction (2027-2028):

By this period, a 20-30% price decrease is plausible, driven by increased generic penetration and shifting treatment preferences toward cost-effective options.

Influence of Regulatory and Market Factors

- Biosimilar and generic entry will be the primary catalyst for price reductions.

- Regulatory changes aiming to enhance access may lead to drug price negotiations, further affecting ESTRACE’s pricing.

- Market consolidation and volume-based discounts may offset per-unit price declines for branded ESTRACE.

Distribution and Pricing Strategies

Pharmaceutical companies are expected to adopt multi-tiered strategies:

- Premium branding in specialty and high-income markets to sustain profitability.

- Tiered pricing models in emerging markets to expand access while maintaining margins.

- Engagement with payers to establish favorable formulary placements, safeguarding sales volume.

Key Market Opportunities and Risks

Opportunities

- Expansion into emerging markets with burgeoning menopausal populations.

- Development of localized formulations offering reduced systemic risks.

- Strategic collaborations to enhance distribution channels.

Risks

- Increased competition from generics and biosimilars.

- Regulatory scrutiny over long-term safety, affecting prescribing trends.

- Socio-cultural factors impacting estrogen therapy acceptance in certain regions.

Key Takeaways

- The ESTRACE market remains robust but faces imminent pricing pressures due to patent expiration and generic competition.

- Revenue streams are likely to decline modestly (~10-15%) over the next 2-3 years before stabilizing.

- Demographic trends and evolving clinical guidelines continue to support long-term demand, especially in aging populations.

- Strategic positioning through cost-effective alternatives and expanded geographic access can sustain ESTRACE’s market relevance.

- Monitoring regulatory developments and competitive differentiation will be critical for pricing and market share strategies.

FAQs

1. How does patent expiration impact ESTRACE's market price?

Patent expiration typically leads to increased generic competition, resulting in significant price reductions—usually 50-70%—as generics enter the market, challenging the branded product’s pricing power.

2. What are the main drivers influencing estrogen therapy pricing?

Key drivers include demographic demand, regulatory safety concerns, availability of generics, reimbursement policies, and clinical guideline shifts emphasizing personalized treatment.

3. Are there regional differences in ESTRACE pricing?

Yes, pricing varies significantly by region due to differing healthcare systems, regulatory standards, and market competition, with developed markets generally maintaining higher prices.

4. What role do biosimilars and generics play in ESTRACE's future?

They are expected to put downward pressure on prices, increasing accessibility but challenging the profitability of branded formulations.

5. What strategic measures can Pfizer adopt to maintain ESTRACE’s market position?

Investing in differentiated formulations, expanding into emerging markets, optimizing supply chain efficiencies, and aligning with evolving clinical guidelines will be key strategies.

References

- Grand View Research. (2022). Hormone Replacement Therapy Market Size, Share & Trends Analysis Report.

- Women’s Health Initiative (WHI). (2002). Estrogen Plus Progestin Study: Cardiovascular Disease Outcomes.

- GoodRx. (2022). Estrace (Estradiol) Prices and Savings Tips.

More… ↓