DARUNAVIR Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Darunavir, and when can generic versions of Darunavir launch?

Darunavir is a drug marketed by Amneal, Annora Pharma, Aurobindo Pharma Ltd, Cipla, Dr Reddys, Hetero Labs Ltd Iii, Lupin Ltd, MSN, Mylan, Teva Pharms Usa, and Zydus Lifesciences. and is included in eleven NDAs.

The generic ingredient in DARUNAVIR is darunavir. There are twenty-five drug master file entries for this compound. Fourteen suppliers are listed for this compound. Additional details are available on the darunavir profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Darunavir

A generic version of DARUNAVIR was approved as darunavir by LUPIN LTD on September 29th, 2022.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for DARUNAVIR?

- What are the global sales for DARUNAVIR?

- What is Average Wholesale Price for DARUNAVIR?

Summary for DARUNAVIR

| US Patents: | 0 |

| Applicants: | 11 |

| NDAs: | 11 |

| Finished Product Suppliers / Packagers: | 13 |

| Raw Ingredient (Bulk) Api Vendors: | 96 |

| Clinical Trials: | 226 |

| Patent Applications: | 6,343 |

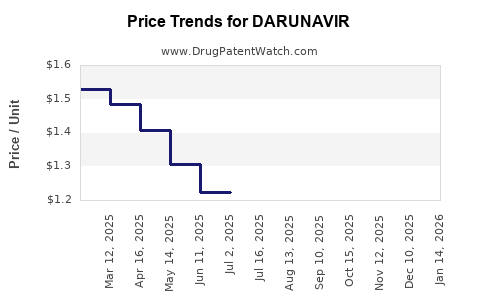

| Drug Prices: | Drug price information for DARUNAVIR |

| DailyMed Link: | DARUNAVIR at DailyMed |

Recent Clinical Trials for DARUNAVIR

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| SolidarMed | PHASE3 |

| Instituto Nacional de Sade, Mozambique | PHASE3 |

| Muhimbili University of Health and Allied Sciences | PHASE3 |

Pharmacology for DARUNAVIR

| Drug Class | Protease Inhibitor |

| Mechanism of Action | Cytochrome P450 2D6 Inhibitors Cytochrome P450 3A Inhibitors HIV Protease Inhibitors |

Anatomical Therapeutic Chemical (ATC) Classes for DARUNAVIR

US Patents and Regulatory Information for DARUNAVIR

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amneal | DARUNAVIR | darunavir | TABLET;ORAL | 212493-001 | Dec 8, 2023 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Mylan | DARUNAVIR | darunavir | TABLET;ORAL | 202136-002 | Jul 22, 2025 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Zydus Lifesciences | DARUNAVIR | darunavir | TABLET;ORAL | 214085-002 | Dec 13, 2023 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Cipla | DARUNAVIR | darunavir | TABLET;ORAL | 206288-001 | Nov 28, 2023 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for DARUNAVIR

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Mylan Pharmaceuticals Limited | Darunavir Mylan | darunavir | EMEA/H/C/004068Darunavir, co-administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV-1) infection (see section 4.2).Darunavir Mylan 75 mg, 150 mg, 300 mg and 600 mg tablets may be used to provide suitable dose regimens (see section 4.2):For the treatment of HIV-1 infection in antiretroviral treatment (ART)-experienced adult patients, including those that have been highly pre-treated.For the treatment of HIV-1 infection in paediatric patients from the age of 3 years and at least 15 kg body weight.In deciding to initiate treatment with darunavir co-administered with low dose ritonavir, careful consideration should be given to the treatment history of the individual patient and the patterns of mutations associated with different agents. Genotypic or phenotypic testing (when available) and treatment history should guide the use of darunavir (see sections 4.2, 4.4 and 5.1).Darunavir co-administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV-1) infection. Darunavir co-administered with cobicistat is indicated in combination with other antiretroviral medicinal products for the treatment of human immunodeficiency virus (HIV-1) infection in adults and adolescents (aged 12 years and older, weighing at least 40 kg) (see section 4.2). Darunavir Mylan 400 mg and 800 mg tablets may be used to provide suitable dose regimens for the treatment of HIV-1 infection in adult and paediatric patients from the age of 3 years and at least 40 kg body weight who are: antiretroviral therapy (ART)-naïve (see section 4.2). ART-experienced with no darunavir resistance associated mutations (DRV-RAMs) and who have plasma HIV-1 RNA < 100,000 copies/ml and CD4+ cell count ≥ 100 cells x 10⁶/L. In deciding to initiate treatment with darunavir in such ART-experienced patients, genotypic testing should guide the use of darunavir (see sections 4.2, 4.3, 4.4 and 5.1). | Authorised | yes | no | no | 2017-01-03 | |

| Janssen-Cilag International NV | Prezista | darunavir | EMEA/H/C/000707PREZISTA, co administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of human immunodeficiency virus (HIV 1) infection in adult and paediatric patients from the age of 3 years and at least 15 kg body weight.PREZISTA, co administered with cobicistat is indicated in combination with other antiretroviral medicinal products for the treatment of human immunodeficiency virus (HIV 1) infection in adults and adolescents (aged 12 years and older, weighing at least 40 kg).In deciding to initiate treatment with PREZISTA co administered with cobicistat or low dose ritonavir, careful consideration should be given to the treatment history of the individual patient and the patterns of mutations associated with different agents. Genotypic or phenotypic testing (when available) and treatment history should guide the use of PREZISTA.PREZISTA, co administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV 1) infection.PREZISTA 75 mg, 150 mg, and 600 mg tablets may be used to provide suitable dose regimens:For the treatment of HIV 1 infection in antiretroviral treatment (ART) experienced adult patients, including those that have been highly pre treated.For the treatment of HIV 1 infection in paediatric patients from the age of 3 years and at least 15 kg body weight.In deciding to initiate treatment with PREZISTA co administered with low dose ritonavir, careful consideration should be given to the treatment history of the individual patient and the patterns of mutations associated with different agents. Genotypic or phenotypic testing (when available) and treatment history should guide the use of PREZISTA.PREZISTA, co administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV 1) infection.PREZISTA, co administered with cobicistat is indicated in combination with other antiretroviral medicinal products for the treatment of human immunodeficiency virus (HIV 1) infection in adults and adolescents (aged 12 years and older, weighing at least 40 kg).PREZISTA 400 mg and 800 mg tablets may be used to provide suitable dose regimens for the treatment of HIV 1 infection in adult and paediatric patients from the age of 3 years and at least 40 kg body weight who are:antiretroviral therapy (ART) naïve.ART experienced with no darunavir resistance associated mutations (DRV RAMs) and who have plasma HIV 1 RNA < 100,000 copies/ml and CD4+ cell count ≥ 100 cells x 106/L. In deciding to initiate treatment with PREZISTA in such ART experienced patients, genotypic testing should guide the use of PREZISTA. | Authorised | no | no | no | 2007-02-11 | |

| KRKA, d.d., Novo mesto | Darunavir Krka d.d. | darunavir | EMEA/H/C/004891400mg and 800 mg Film-coated TabletsDarunavir Krka d.d., co-administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV-1) infection.Darunavir Krka d.d., co-administered with cobicistat is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV-1) infection in adult patients (see section 4.2).Darunavir Krka d.d. 400 mg and 800 mg tablets may be used to provide suitable dose regimens for the treatment of HIV-1 infection in adult and paediatric patients from the age of 3 years and at least 40 kg body weight who are:antiretroviral therapy (ART)-naïve (see section 4.2).ART-experienced with no darunavir resistance associated mutations (DRV-RAMs) and who have plasma HIV-1 RNA < 100,000 copies/ml and CD4+ cell count ≥ 100 cells x 106/l. In deciding to initiate treatment with darunavir in such ART-experienced patients, genotypic testing should guide the use of darunavir (see sections 4.2, 4.3, 4.4 and 5.1).600mg Film-coated TabletsDarunavir Krka d.d., co-administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV-1) infection.Darunavir Krka d.d. 600 mg tablets may be used to provide suitable dose regimens (see section 4.2):For the treatment of HIV-1 infection in antiretroviral treatment (ART)-experienced adult patients, including those that have been highly pre-treated.For the treatment of HIV-1 infection in paediatric patients from the age of 3 years and at least 15 kg body weight.In deciding to initiate treatment with darunavir co-administered with low dose ritonavir, careful consideration should be given to the treatment history of the individual patient and the patterns of mutations associated with different agents. Genotypic or phenotypic testing (when available) and treatment history should guide the use of darunavir. | Withdrawn | yes | no | no | 2018-01-18 | |

| KRKA, d.d., Novo mesto | Darunavir Krka | darunavir | EMEA/H/C/004273400 and 800 mgDarunavir Krka, co-administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV-1) infection.Darunavir Krka 400 mg and 800 mg tablets may be used to provide suitable dose regimens for the treatment of HIV-1 infection in adult and paediatric patients from the age of 3 years and at least 40 kg body weight who are:antiretroviral therapy (ART)-naïve (see section 4.2).ART-experienced with no darunavir resistance associated mutations (DRV-RAMs) and who have plasma HIV-1 RNA < 100,000 copies/ml and CD4+ cell count ≥ 100 cells x 106/l. In deciding to initiate treatment with darunavir in such ART-experienced patients, genotypic testing should guide the use of darunavir (see sections 4.2, 4.3, 4.4 and 5.1).600 mg Darunavir Krka, co-administered with low dose ritonavir is indicated in combination with other antiretroviral medicinal products for the treatment of patients with human immunodeficiency virus (HIV-1) infection.Darunavir Krka 600 mg tablets may be used to provide suitable dose regimens (see section 4.2):For the treatment of HIV-1 infection in antiretroviral treatment (ART)-experienced adult patients, including those that have been highly pre-treated.For the treatment of HIV-1 infection in paediatric patients from the age of 3 years and at least 15 kg body weight.In deciding to initiate treatment with darunavir co-administered with low dose ritonavir, careful consideration should be given to the treatment history of the individual patient and the patterns of mutations associated with different agents. Genotypic or phenotypic testing (when available) and treatment history should guide the use of darunavir. | Authorised | yes | no | no | 2018-01-26 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

Market Dynamics and Financial Trajectory for Darunavir: A Comprehensive Analysis

More… ↓