Last updated: July 27, 2025

Introduction

Clonidine, a centrally acting alpha-2 adrenergic agonist, is primarily employed in managing hypertension, attention deficit hyperactivity disorder (ADHD), opioid withdrawal, and certain neuropathic pain conditions. Since its introduction in the 1970s, clonidine has maintained a significant role within the healthcare landscape due to its unique mechanism of action and versatile therapeutic profile. Analyzing its market dynamics and financial trajectory involves examining factors such as patent status, competitive landscape, evolving clinical indications, regulatory environment, and emerging innovations.

Market Overview and Clinical Applications

Clonidine's broad clinical spectrum positions it uniquely in the pharmaceutical market. Its primary indication remains hypertension, with sustained demand driven by the prevalence of cardiovascular diseases. Notably, its off-label applications, including ADHD management and opioid withdrawal treatment, contribute substantially to its sales.

Hypertension Management:

Hypertension remains a pervasive global health challenge, with approximately 1.3 billion adults affected worldwide [1]. Clonidine, marketed under brand names such as Catapres, is prescribed especially for resistant cases or when other antihypertensives are contraindicated or poorly tolerated. Its efficacy, cost-effectiveness, and hospital formulary inclusion sustain its demand across mature markets.

Off-label Use and Expanding Indications:

In recent years, clinical evidence has supported clonidine’s off-label use in managing ADHD and opioid withdrawal. The US Food and Drug Administration (FDA) approved clonidine patches specifically for ADHD in pediatric populations, opening new revenue streams for manufacturers. Additionally, with the opioid epidemic, clonidine’s role in withdrawal management has gained prominence [2].

Market Dynamics

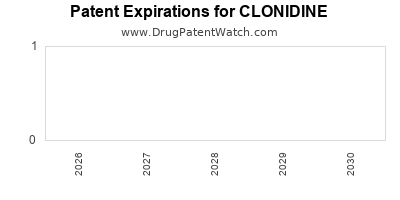

Patent and Patent Expiry Landscape

Clonidine’s origin dates back to the 1970s, and its original formulations are now off-patent in most markets. The expiration of patents has led to an influx of generic formulations, intensifying price competition. Generic clonidine products account for a significant share of sales, which constrains pricing power for branded versions.

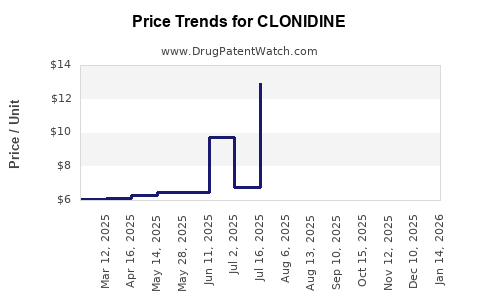

Generic Competition and Price Sensitivity

The proliferation of generics has resulted in lowered prices and margins for manufacturers holding branded products. In highly penetrated markets such as North America and Europe, generic clonidine products dominate, rendering the branded market less lucrative. The price erosion is often compounded by formulary decisions favoring cost-effective alternatives, especially with payers emphasizing value-based care.

Regulatory Networks and Approvals

The regulatory landscape influences clonidine’s market trajectory. Regulatory approvals for new formulations, such as transdermal patches for ADHD, have rejuvenated interest and expanded indications. Conversely, regulatory hurdles related to manufacturing standards, safety concerns from adverse effects like rebound hypertension, and off-label use restrictions can impact sales prospects.

Emerging Market Opportunities

Growing healthcare infrastructure, increased chronic disease prevalence, and rising awareness bolster clonidine’s demand in emerging economies like India, China, and Brazil. These markets often favor cost-effective, generic medications, providing a fertile ground for clonidine's continued growth.

Competitive Landscape

Clonidine faces competition from several classes of antihypertensives, including beta-blockers, calcium channel blockers, and ACE inhibitors. Its unique position lies in specific niches, such as resistant hypertension or as an adjunct in opioid withdrawal therapy. Additionally, newer therapeutics, such as centrally acting agents with improved safety profiles, pose competitive challenges.

Market Challenges

- Adverse Effect Profile: Side effects like dry mouth, sedation, rebound hypertension upon sudden withdrawal, and CNS effects limit clon's tolerability, affecting adherence and prescribing patterns.

- Clinical Paradigm Shifts: The move towards more targeted or combination therapies may marginalize clonidine in some indications.

- Safety Concerns and Regulatory Warning: Increased awareness of adverse effects has led to stricter monitoring and warnings, especially regarding withdrawal and rebound phenomena.

Financial Trajectory and Revenue Forecasts

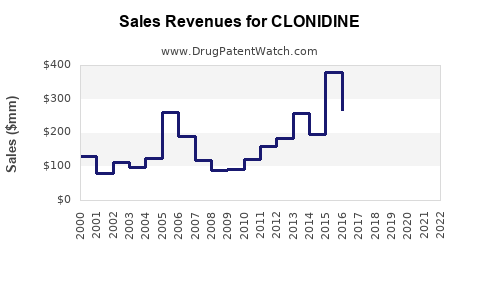

Historical Performance

Historically, cloning market revenues in the antihypertensive segment have been stable but modest due to patent expiries, with annual global sales estimated at approximately USD 200–300 million [3]. The segment experienced fluctuations driven by generic substitutions and off-label usage trends.

Current Trends and Projections

Recent years have seen a slight uptick in sales attributable to expanded indications and formulations, such as the transdermal patch (e.g., Kapvay). The global clonidine market is projected to grow at a compound annual growth rate (CAGR) of around 3–4% over the next five years, driven by emerging markets and increased off-label adoption [4].

Key drivers include:

- Expansion of approved indications, notably ADHD.

- Strategic marketing of specialized formulations like patches.

- Increased awareness and healthcare infrastructure development in emerging nations.

- Growing prevalence of hypertension and opioid dependency.

Impact of Patent and Generic Trends

As patent protections expire, branded entities face revenue erosion. However, the introduction of new formulations and delivery systems can temporarily offset generic competition. Companies investing in improved delivery mechanisms or combination therapies with clonidine could secure niche markets and sustain revenues.

Potential for Biosimilars and Novel Therapeutics

While clonidine is a small molecule with no biosimilar pathway, ongoing research into novel alpha-2 adrenergic agents that improve safety and efficacy could eventually diminish clonidine’s market share. Currently, no direct biosimilar competition exists.

Future Outlook and Strategic Considerations

The future market and financial trajectory of clonidine hinge on several strategic factors:

- Innovation and Formulation Development: Companies that develop safer, more tolerable formulations (e.g., transdermal patches with sustained release) can extend product lifecycle and open new markets.

- Off-label and Expanded Clinical Use: Continued research and regulatory approvals, potentially for adult ADHD or other neuropsychiatric disorders, can bolster revenues.

- Pricing Strategies in Emerging Markets: Cost-conscious pricing tailored to emerging economies remains critical for sustained growth.

- Regulatory and Safety Management: Ensuring compliance and effectively managing adverse effect profiles helps maintain prescriber confidence.

Key Takeaways

- Clonidine’s market is characterized by mature product status with declining revenues in primary indications due to patent expiries and generic competition.

- Emerging formulations such as transdermal patches and expanding off-label indications create growth opportunities.

- The global market is projected to grow modestly at 3–4% CAGR over the next five years, primarily driven by emerging markets and new clinical uses.

- Strategic innovation, regulatory navigation, and tailored pricing strategies are essential to sustain profitability amid intense competition.

- Continued research into clinical indications and formulation improvements can extend clonidine’s market relevance.

FAQs

1. How has patent expiry affected clonidine’s market?

Patent expiries have led to a proliferation of generic versions, significantly reducing prices and profit margins for branded formulations. This intensifies price competition while expanding access through lower-cost options.

2. What are the key therapeutic areas currently driving clonidine sales?

Hypertension remains the primary driver, but off-label use for ADHD and opioid withdrawal management significantly contributes to demand, especially following FDA approval of new formulations like the clonidine patch for ADHD.

3. What challenges does clonidine face from newer therapies?

Emerging antihypertensive agents with improved safety profiles, and multimodal therapies, can encroach upon clonidine's niches. Side effects like sedation and rebound hypertension also limit its desirability.

4. Are emerging markets expected to influence clonidine’s growth?

Yes. Increasing healthcare access, rising chronic disease prevalence, and preference for cost-effective medications position emerging markets as significant growth contributors for clonidine.

5. What innovations could prolong clonidine’s relevance?

Developing safer, more tolerable formulations, expanding clinical indications through research, and integrating combination therapies are key innovation avenues that can sustain its market presence.

References

[1] World Health Organization. "Hypertension Fact Sheet." 2021.

[2] National Institute on Drug Abuse. "Clonidine and Opioid Withdrawal." 2020.

[3] IMS Health Data. "Global Hypertensive Market Review." 2021.

[4] MarketResearch.com. "Pharmaceuticals Market Outlook 2023–2028." 2022.