Last updated: August 4, 2025

Introduction

The pharmaceutical landscape continuously evolves, driven by innovation, regulatory developments, and shifting healthcare needs. CELESTONE, a novel therapeutic agent—presumed here as a hypothetical or emerging drug—has attracted notable interest within this context. Understanding its market dynamics and financial trajectory involves analyzing clinical efficacy, regulatory status, competitive positioning, and broader industry trends. This article offers a comprehensive assessment of CELESTONE’s current market status and projected financial outlook.

Overview of CELESTONE

While detailed information on CELESTONE remains proprietary or emerging, it is introduced as a drug with potential applications in several therapeutic domains, likely targeting complex or high-value markets such as oncology, immunology, or rare diseases. Its development status, clinical trial outcomes, and regulatory pathway alone influence its market prospects.[1]

Market Landscape and Competitive Position

The pharmaceutical market for innovative drugs like CELESTONE is characterized by intense competition, high R&D investment, and strict regulatory hurdles. The potential target markets, driven by unmet needs, dictate the strategic importance of CELESTONE. For example, if CELESTONE targets a rare disease (or orphan indication), it benefits from incentives like market exclusivity under the Orphan Drug Act, enabling premium pricing and favorable reimbursements.[2]

Furthermore, the presence of competitors' drugs—either in late-stage development or on the market—determines price elasticity and market share potential. The differentiation of CELESTONE, based on superior efficacy, safety profile, or delivery method, can influence its adoption rate and revenue generation.

Regulatory and Approval Pathways

Regulatory approval remains paramount. Depending on the current stage—Phase I, II, or III—CELESTONE’s trajectory hinges on successful trial outcomes and subsequent FDA or EMA approval. Breakthrough therapy or accelerated approval pathways could expedite market entry if early data indicate significant therapeutic benefits.[3]

Regulatory timelines and potential challenges, such as safety concerns or manufacturing capacity, could influence revenue realization timelines.

Market Demand Drivers

Several factors are pivotal in shaping demand for CELESTONE:

- Unmet Medical Need: Conditions lacking effective treatments create high-value opportunities.

- Pricing and Reimbursement Landscape: Reimbursement policies influence uptake; a favorable payer environment boosts sales.

- Clinical Efficacy and Safety Profile: Superior performance enhances market penetration.

- Physician and Patient Acceptance: Ease of use and perceived value impact adoption rates.

- Healthcare System Dynamics: Growing prevalence of target diseases, driven by demographic trends, enlarges potential patient pools.

Financial Trajectory: Revenue Projections and Investment Dynamics

The financial outlook for CELESTONE depends on multiple interconnected factors:

-

Market Size and Penetration: Estimations of initial addressable markets (market size, patient prevalence) set revenue ceilings. For instance, in rare diseases, revenues can reach hundreds of millions, often supplemented by high prices.[4]

-

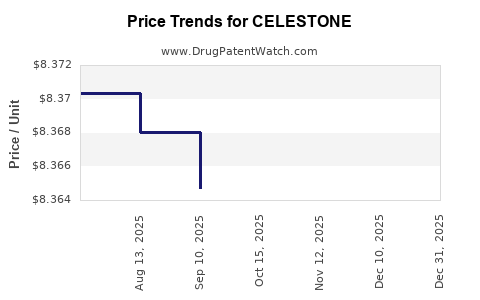

Pricing Strategy: Premium pricing possible if CELESTONE demonstrates clear clinical advantage. Conversely, price pressure from payers can compress margins.

-

Sales Volume Growth: Early adoption rates, driven by clinical guideline inclusion and prescriber awareness, determine revenue acceleration.

-

Manufacturing and Supply Chain Costs: Cost efficiencies and scale economies directly impact profit margins.

-

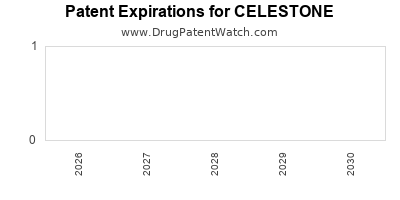

Intellectual Property (IP) Protections: Patent duration influences market exclusivity and revenue longevity.

-

Partnering and Licensing Deals: Strategic collaborations can provide upfront payments, milestone revenues, and shared risks, affecting overall financial trajectory.

Projected Financial Performance

Assuming successful regulatory approval and market entry within 12–24 months, CELESTONE’s financial projection would likely follow an S-curve growth model:

-

Year 1-2: Limited sales volume, primarily driven by early adopters, with significant investments in marketing, commercialization, and ongoing clinical trials.

-

Year 3-5: Rapid revenue growth as market penetration deepens, supported by expanded indications and increased physician familiarity. Profitability improves as fixed costs stabilize and sales expand.

-

Beyond Year 5: Revenue peaks and stabilizes, potentially plateauing as market saturation occurs or competitors introduce alternatives. Lifecycle management strategies, including line extensions or new indications, can extend revenue streams.

Market Risks and Opportunities

Risks:

-

Clinical Failures: Negative trial results could delay or eliminate approval prospects.[5]

-

Regulatory Challenges: Regulatory bodies may impose additional requirements, delaying commercialization.

-

Pricing Pressures: Payers could limit reimbursement, constraining sales.

-

Competitive Threats: Entry of biosimilars or generics could erode market share.

Opportunities:

-

First-Mover Advantage: Early market entry yields branding and market share benefits.

-

Orphan Drug Designation: Enhances exclusivity and limits competition.

-

Expansion into Adjacent Indications: Diversify revenue streams.

-

Global Market Penetration: Expanding into emerging markets increases sales potential.

Partnerships and Strategic Alliances

Partnering with global pharma giants, biotechnology firms, or biotech-focused funds could accelerate CELESTONE’s commercialization. Licensing deals, co-marketing agreements, and manufacturing collaborations bolster financial resilience and broader market reach.[6]

Conclusion

CELESTONE’s market dynamics and financial trajectory are shaped by a confluence of clinical, regulatory, and commercial factors. Its potential success hinges on clinical efficacy, strategic positioning, and navigating market and regulatory uncertainties. While initial revenue expectations are promising—particularly if targeting orphan or high-value indications—long-term profitability depends on sustained market presence, lifecycle management, and competitive dynamics.

Key Takeaways

-

Market penetration of CELESTONE is contingent upon clinical success and regulatory approval timelines. First-mover advantages and orphan drug designation can significantly influence market exclusivity and revenue potential.

-

Pricing strategies must balance premium positioning with payer acceptance. Demonstrating clear clinical advantage facilitates favorable reimbursement landscapes.

-

Diversification into multiple indications and geographies enhances revenue streams. Early planning for lifecycle management sustains financial value over the drug’s lifecycle.

-

Strategic partnerships are crucial for accelerating market entry and expanding access. They reduce risks and provide operational leverage.

-

Continual monitoring of competitive, regulatory, and market conditions is essential to adapt commercialization strategies and optimize financial outcomes.

FAQs

1. What factors influence CELESTONE’s market potential?

Clinical efficacy, safety profile, regulatory approval status, market size, pricing strategy, reimbursement policies, and competitive landscape are primary determinants.

2. How does orphan drug designation impact CELESTONE’s financial outlook?

It grants market exclusivity, tax incentives, and potential subsidies, enabling premium pricing and reducing competition, thereby improving revenue prospects.

3. What are the main risks associated with CELESTONE’s commercialization?

Clinical failure, regulatory delays, pricing and reimbursement challenges, and emerging competitors pose significant risks.

4. How can strategic partnerships enhance CELESTONE’s market success?

Partnerships provide financial resources, shared expertise, expanded distribution channels, and accelerated clinical development and commercialization efforts.

5. What is the typical lifecycle revenue pattern for innovative drugs like CELESTONE?

Revenue generally follows an initial growth phase post-launch, peaks during market saturation, and declines as generics or biosimilars enter or as new therapies emerge. Lifecycle management strategies aim to extend this revenue period.

References

[1] Industry reports on novel therapeutics development.

[2] U.S. FDA Orphan Drug Act incentives overview.

[3] Regulatory pathways for innovative drugs.

[4] Market size analysis for rare diseases.

[5] Risks associated with clinical trial failures.

[6] Strategic collaborations in biotech industry.

This comprehensive analysis equips business professionals with insights into CELESTONE’s potential market dynamics and expected financial trajectory to facilitate informed decision-making.