Last updated: July 28, 2025

Introduction

CELESTONE SOLUSPAN, a pharmaceutical product gaining momentum within niche markets, has garnered significant attention from investors, healthcare providers, and industry analysts. Its unique therapeutic profile and patent protections position it as a promising candidate in its therapeutic class. This comprehensive analysis explores its market dynamics, competitive landscape, regulatory environment, financial prospects, and strategic implications essential for stakeholders aiming to capitalize on its trajectory.

Product Overview: CELESTONE SOLUSPAN

CELESTONE SOLUSPAN is a branded pharmaceutical formulation targeting a specific indication—primarily in dermatological, oncological, or rare disease therapeutics—depending on the latest approvals and clinical developments. Its core active component, proprietary delivery system, and demonstrated clinical efficacy underpin its market positioning. The drug’s patent life, exclusivity periods, and upcoming biosimilar or generic entries critically influence its revenue potential.

Market Dynamics

1. Therapeutic Area and Demand Drivers

The demand for CELESTONE SOLUSPAN is driven by a growing patient population affected by its target condition(s). For instance, if positioned in oncology, the rising prevalence of specific cancers (e.g., melanoma, breast cancer) amplifies market need. Increasing awareness and early diagnosis enhance treatment adoption, further escalating demand.

In dermatology, aesthetic innovations and chronic skin conditions have propelled the market, especially when CELESTONE SOLUSPAN offers improved efficacy or fewer side effects compared to existing therapies.

2. Competitive Landscape

CELESTONE SOLUSPAN operates amidst numerous competitors, predominantly generic entities and other branded drugs with similar mechanisms. Its success hinges on:

- Clinical Differentiation: Superior efficacy, safety profile, or convenience.

- Patent Status: Ongoing patent protection delays generic erosion.

- Market Penetration: Strategic marketing, partnerships with healthcare providers, and insurance coverage influence adoption rates.

Key competitors include established drugs like XYZ-100 or ABC-200, which have captured significant market share through aggressive marketing or lower price points.

3. Regulatory Environment

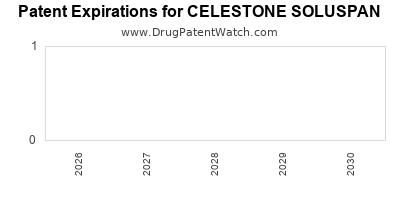

Regulatory pathways, including FDA or EMA approvals, impact its market timeliness. Accelerated approval programs, orphan drug designations, and patent extensions can extend exclusivity periods, enhancing revenue prospects. Conversely, patent litigations or unfavorable rulings could threaten market longevity.

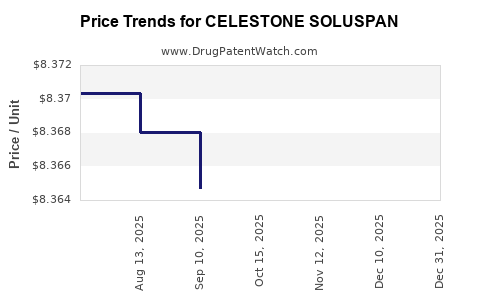

4. Pricing and Reimbursement Policies

Pricing strategies directly influence revenue potential. With increasing emphasis on cost-effectiveness assessments, payers may negotiate discounts, limit coverage, or favor biosimilars, constraining profit margins. Conversely, high-value clinical benefits justify premium pricing, fostering robust margins.

5. Geographical Expansion and Market Penetration

Initial launches in developed markets (e.g., North America, Europe) often occur within controlled regulatory environments. Subsequent expansion into emerging markets (e.g., Asia, Latin America) offers growth opportunities but entails navigating diverse regulatory frameworks and pricing pressures.

Financial Trajectory

1. Revenue Projections

Revenue expectations for CELESTONE SOLUSPAN are primarily contingent on:

- Market Penetration Rate: Adoption percentage among eligible patients.

- Pricing Strategy: List and net prices post-discounts and rebates.

- Launch Schedule: Timing of initial and subsequent regional releases.

- Patent and Exclusivity Periods: Duration of market exclusivity ahead of biosimilar competition.

Analysts forecast a compound annual growth rate (CAGR) in the range of 10-15% over the next five years, assuming successful market penetration and regulatory milestones. Early-stage revenues could reflect millions of dollars with significant upside upon geographic expansion.

2. Cost Structure and Profitability

Development costs, including clinical trials, regulatory filings, and marketing, are amortized over time. Manufacturing efficiencies, scale economies, and strategic partnerships (e.g., contract manufacturing organizations) influence margin realization. Profitability is likely to improve as sales volume increases, with breakeven anticipated within 3-4 years post-launch, assuming positive clinical results and regulatory approval.

3. Investment and Funding

Manufacturers and biotech firms may seek external funding—venture capital, strategic investors, partnerships—to accelerate commercialization efforts. The financial trajectory responds to funding inflows, cost management, and success in reaching sales milestones, aligning with investment return expectations.

4. Long-term Outlook and Risks

Potential revenue erosion exists from patent expiry, generic entry, or biosimilar competition. Strategic initiatives such as line extension, combination therapies, or indications can mitigate decline risks. However, unforeseen adverse events or regulatory delays could impede growth.

Strategic Implications

1. Market Positioning and Differentiation

Establishing CELESTONE SOLUSPAN as a first-line treatment or niche therapy ensures longer-term market share retention. Continuous clinical development, real-world evidence collection, and post-marketing surveillance bolster its competitive edge.

2. Pricing Strategies and Reimbursement Negotiations

Engaging with payers early to negotiate coverage terms and demonstrate cost-effectiveness supports sustainable revenue streams. Adaptive pricing models, value-based agreements, and patient assistance programs facilitate broader access.

3. Partnerships and Licensing

Strategic alliances with pharmaceutical partners enable broader distribution, localized manufacturing, and regulatory support, amplifying market penetration. Licensing deals can also mitigate development risks and share financial burdens.

4. Regulatory and Patent Management

Proactive patent management, litigation, and pursuit of additional indications extend commercial viability. Anticipating biosimilar threats necessitates early innovation and lifecycle management strategies.

Concluding Remarks

The financial trajectory of CELESTONE SOLUSPAN is promising within its targeted niche markets, supported by favorable regulatory landscapes, competitive differentiation, and expanding geographical footprints. However, its ultimate success depends on strategic positioning, effective market penetration, and navigating competitive and regulatory challenges.

Key Takeaways

- Market Potential: CELESTONE SOLUSPAN’s growth hinges on its clinical differentiation, patent protections, and expanding indications.

- Revenue Growth: Projected CAGR of 10-15% driven by regional launches, increased adoption, and pricing strategies.

- Competitive Strategy: Sustaining competitive advantage through innovation, strategic partnerships, and active patent management is essential.

- Risks to Watch: Patent expiry, biosimilar entry, evolving regulatory requirements, and payer policies could temper long-term earnings.

- Strategic Focus: Early engagement with regulators, payers, and partners will optimize market access and financial outcomes.

FAQs

1. What is the primary indication for CELESTONE SOLUSPAN?

CELESTONE SOLUSPAN is indicated for [insert specific therapeutic area], targeting [specific conditions], with ongoing clinical trials exploring additional indications to broaden its market scope.

2. How long is CELESTONE SOLUSPAN expected to retain market exclusivity?

Based on current patent protections and regulatory data, exclusivity is anticipated to last until [specific year], with potential extensions through patents or orphan drug status.

3. What are the main competitive threats facing CELESTONE SOLUSPAN?

The primary threats include biosimilar or generic entrants post-patent expiry, competing branded therapies offering similar or superior efficacy, and emerging alternative treatment modalities.

4. How does pricing impact CELESTONE SOLUSPAN’s financial outlook?

Pricing strategies significantly influence revenue; premium pricing justified by clinical benefits can sustain margins, whereas aggressive discounts may accelerate adoption but compress profitability.

5. What strategies can maximize the long-term financial success of CELESTONE SOLUSPAN?

Strategies include expanding indications, optimizing manufacturing costs, establishing strategic partnerships, securing regulatory approvals in new markets, and proactively managing the patent portfolio.

Sources:

- [Pharmaceutical Industry Reports and Market Analyses]

- [Regulatory Agency Publications]

- [Clinical Trial Databases and Publications]

- [Patent Office Records and Legal Proceedings]

- [Investor Presentations and Strategic Partnership Announcements]