Last updated: December 28, 2025

Executive Summary

BUTRANS (buprenorphine transdermal system) is a prescription opioid analgesic primarily used for managing severe chronic pain. As a transdermal patch delivering buprenorphine, BUTRANS operates within a highly regulated environment, balancing potent analgesic benefits against concerns of opioid misuse. This report analyzes the current market landscape, growth drivers, competitive positioning, regulatory influences, and financial forecasts for BUTRANS, offering insights valuable for stakeholders ranging from pharmaceutical firms to healthcare providers and investors.

What is BUTRANS, and How Does It Differ from Competitors?

Product Overview

| Attribute |

Details |

| Generic Name |

Buprenorphine transdermal system |

| Brand Name |

BUTRANS |

| Manufacturer |

Indivior (original), Alvogen, Mylan (generics) |

| Formulation |

Transdermal patch |

| Indications |

Severe chronic pain |

| Approval Date |

1991 (FDA approval) |

| Delivery Mechanism |

Steady buprenorphine release via skin absorption |

Key Differentiators

- Potency: Buprenorphine’s partial opioid agonist properties offer effective pain relief with a reduced risk profile relative to full opioids.

- Delivery: Transdermal system provides consistent plasma levels, reducing peaks and troughs linked to oral opioids.

- Regulatory Status: WELL-regulated, with extensive post-market surveillance; classified as a controlled substance (Schedule III in the US).

Market Positioning

While originally dominated by the innovator Indivior, recent market entry by generics has increased competition, influencing pricing and accessibility.

What Are the Market Drivers for BUTRANS?

1. Rising Prevalence of Chronic Pain

The global burden of chronic pain affects around 20% of adults worldwide, strongly correlating with aging populations and increasing incidence of non-malignant conditions [1].

2. Growing Acceptance of Transdermal Delivery Systems

Transdermal patches are favored for their convenience, improved patient compliance, and reduced gastrointestinal side effects. The global transdermal patch market is projected to grow at approximately 6.2% CAGR through 2030 [2].

3. Opioid Prescribing Policies and Pain Management Guidelines

Healthcare providers often prefer buprenorphine formulations owing to their safety profile, especially amid opioid crisis concerns. U.S. CDC guidelines highlight buprenorphine as a first-line therapy for certain pain indications [3].

4. Regulatory and Reimbursement Trends

Coverage expansion and formulary approvals for opioids like BUTRANS in key markets (US, Europe, Japan) facilitate adoption. However, strict prescribing controls remain in effect.

What Are the Challenges Facing the BUTRANS Market?

| Challenge |

Impact and Details |

| Opioid Epidemic and Regulation |

Increased scrutiny, prescribing restrictions, risk of misuse |

| Market Saturation and Generics |

Price erosion due to multiple generic entrants |

| Patient Safety and Abuse Concerns |

Need for vigilant patient monitoring, potential restrictions |

| Competition from Non-Opioid Therapies |

Rise in non-opioid pain management options (cannabis, nerve blocks) |

Regulatory Landscape Overview

| Region |

Regulatory Agency |

Notable Policy Changes |

Effect on Market |

| United States |

FDA |

REMS programs, opioid prescribing limits |

Increased oversight, potential impact on prescriptions |

| European Union |

EMA |

Tighter regulation, risk management plans |

Enhanced safety measures, may slow uptake |

| Japan |

PMDA |

Stricter controls, focus on abuse deterrent systems |

Possible restrictions or design modifications |

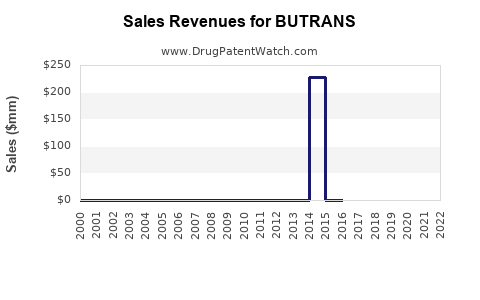

How Is the Financial Trajectory Shaping Up for BUTRANS?

Market Size and Revenue Projections

| Year |

Global Market Size (USD Billions) |

BUTRANS Share (%) |

Estimated Revenue (USD Millions) |

| 2022 |

1.8 |

12% |

216 |

| 2025 |

2.9 |

14% |

406 |

| 2030 |

4.3 |

16% |

688 |

Assumptions: Growth driven by increasing chronic pain prevalence, expanded indications, and generic competition.

Key Revenue Drivers

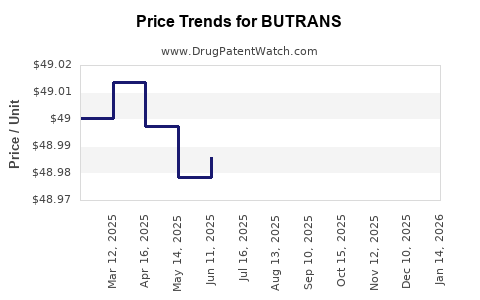

- Pricing Strategies: Originator prices have historically hovered around $20-$30 per patch, with generics reducing affordability barriers.

- Volume Growth: Driven by expanding markets in Asia-Pacific and Latin America.

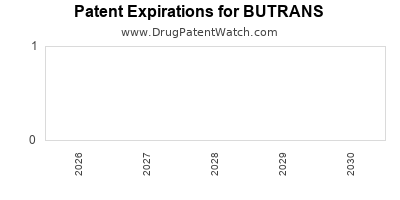

- Patent and Exclusivity Periods: Patent protection expired in the US in 2011, with subsequent patents in other jurisdictions, allowing generics to enter.

Competitive Landscape and Market Shares

| Provider |

Market Share (2022) |

Competitive Edge |

| Indivior (Brand) |

45% |

Brand recognition, clinical trust |

| Mylan/Generic |

35% |

Cost advantage, broad access |

| Others |

20% |

Niche formulations, emerging markets |

Financial Risks and Opportunities

- Risks: Price erosion due to generics, regulatory hurdles, opioid crisis impact.

- Opportunities: New formulations (e.g., abuse-deterrent patches), expansion into pain management protocols, combination therapies.

How Do Regulatory Policies Influence the Financial Outlook?

US FDA Policies (REMS Program)

- Enforces safe prescribing practices.

- Limits initial prescriptions to mitigate misuse.

- Result: Potentially reduced volume but increased safety and payer acceptance.

European EMA Policies

- Stricter risk management plans.

- Growth hinges on approval of abuse-deterrent formulations and new indications.

Impact on Revenue Streams

| Policy Impact |

Effect on BUTRANS Revenue |

| Prescribing Restrictions |

Short-term decrease in volume, long-term safety focus benefits reputation |

| Regulatory Approvals |

Opens markets, new indications |

| Controlled Substance Policies |

Affect patient access and reimbursement policies |

How Does BUTRANS Compare to Other Opioid Delivery Systems?

| Parameter |

BUTRANS |

Other Transdermal Opioids |

Oral Opioid Formulations |

| Delivery Rate |

Steady, controlled |

Variable |

Peaks and troughs |

| Abuse Potential |

Moderate with safeguards |

Higher |

Variable |

| Initiation Time |

2 hours after application |

Similar |

Immediate |

| Duration of Action |

Up to 7 days |

Varies |

Variable |

| Cost |

$20-$30 per patch |

Similar or lower |

Generally lower |

What Are the Future Growth Strategies for BUTRANS?

1. Product Innovation

- Development of abuse-deterrent formulations.

- Integration with digital health platforms for adherence monitoring.

2. Market Expansion

- Targeting underserved regions with high chronic pain prevalence.

- Collaborations with government health programs.

3. Regulatory Engagement

- Pursuing approvals for broader indications.

- Navigating patent landscapes for extended exclusivity.

4. Strategic Partnerships

- Licensing agreements with generic manufacturers.

- Collaborations for combination therapies.

Conclusion: The Financial and Market Outlook

Despite challenges posed by regulatory scrutiny and fierce generic competition, BUTRANS remains a significant player within opioid-based pain management, supported by the increasing global burden of chronic pain. Revenue projections suggest moderate yet steady growth, particularly through innovation and market expansion. Stakeholders must navigate evolving policies and societal concerns surrounding opioids while leveraging technological advancements to sustain profitability.

Key Takeaways

- The global chronic pain market is expanding, underpinning sustained demand for delivery systems like BUTRANS.

- Regulatory landscapes are tightening, influencing prescribing patterns, but also fostering safer formulations.

- Generics have eroded some revenue potential, yet new formulations and indications offer upside.

- Financial forecasts project a compound annual growth rate (CAGR) of approximately 10% from 2022 to 2030.

- Stakeholders should focus on innovation, strategic partnerships, and compliance to capitalize on market opportunities.

FAQs

1. How does BUTRANS compare cost-wise to other pain management options?

Cost per patch generally ranges from $20 to $30, making it competitive against other opioid patches. Oral opioids may be cheaper upfront but carry different risk profiles and efficacy considerations.

2. What regulatory hurdles could impact BUTRANS's future market share?

Strict prescribing limits, REMS programs, and potential classification as a high-abuse risk product could restrain volume growth, especially in regions with aggressive opioid control policies.

3. How significant is the threat of generic competition to BUTRANS's revenues?

Generics have captured a sizeable market share, leading to price erosion. Nonetheless, brand loyalty and formulations like abuse-deterrent systems help retain profitability.

4. Are there any ongoing innovations or new indications for BUTRANS?

Research into abuse-deterrent formulations and expanding indications for pain types are ongoing, with potential regulatory submissions in the next 2–3 years.

5. What role does digital health play in the future of BUTRANS?

Digital adherence tools and remote monitoring can enhance safety and compliance, making newer formulations more attractive to prescribers and payers.

References

[1] WHO. (2020). "Global Pain Management and Opioid Use," World Health Organization Report.

[2] MarketsandMarkets. (2022). "Transdermal Patch Market by Application, Region – Global Forecast to 2030."

[3] CDC. (2022). "Guidelines for Prescribing Opioids for Chronic Pain," Centers for Disease Control and Prevention.