Last updated: August 3, 2025

Introduction

Butrans (buprenorphine transdermal system) stands as a prominent prescription medication within the opioid analgesic market, primarily indicated for managing moderate to severe chronic pain. As a once-weekly transdermal patch, Butrans offers a unique delivery method distinguished by its sustained-release formulation, appealing to both clinicians and patients seeking consistent pain management. This report provides a comprehensive market analysis and price projection for Butrans, addressing current dynamics, competitive landscape, regulatory factors, and future pricing trends.

Market Overview

Global Opioid Analgesics Market

The global opioid analgesics market is projected to grow from USD 15.8 billion in 2022 to approximately USD 21.4 billion by 2028, exhibiting a CAGR of 5.2%, driven by increasing chronic pain prevalence, aging populations, and expanding application scope [1]. The transdermal segment, including formulations like Butrans, accounts for an increasingly significant share due to benefits like improved compliance and reduced systemic peaks.

Demand Drivers for Butrans

- Chronic Pain Management: The rise in chronic non-cancer pain linked to conditions such as osteoarthritis and back pain propels demand.

- Patient Preference: Transdermal patches offer convenience, steady plasma levels, and fewer dosing errors.

- Shift from Oral Opioids: Concerns about abuse and adverse effects of oral opioids promote transdermal options.

- Evolving Prescriber Paradigms: Guidelines favor multimodal pain management, emphasizing opioids like buprenorphine for certain patient subsets.

Market Penetration and Adoption

Despite its benefits, Butrans faces adoption barriers including high pricing, regulatory scrutiny, and competition from newer modalities. Currently, Butrans holds an estimated 10-15% share of the prescription opioid patch market, dominated by brands like Xtampza ER and newer formulations addressing opioid risk mitigation [2].

Competitive Landscape

Key Players

- Mylan (now part of Viatris): Originally introduced generic buprenorphine patches, intensifying price competition.

- Indivior: Known for its buprenorphine formulations for opioid dependence but also involved in pain markets.

- GSK and Others: Developers of alternative opioid delivery systems.

Generic Competition

Patent expirations have facilitated the entry of generic buprenorphine patches, exerting downward pressure on prices. The first generic versions entered the US market around 2018, leading to a substantial decrease in branded product prices [3].

Innovations and New Entrants

Emerging products focus on abuse-deterrent features, shorter administration durations, or combination therapies, influencing Butrans’s market share trajectory.

Regulatory and Reimbursement Dynamics

Regulatory Environment

The FDA approved Butrans in 2010, with subsequent communications highlighting risks of misuse, abuse, and overdose, compelling manufacturers to include risk mitigation strategies. Regulatory overseers continue to monitor opioid prescribing practices, impacting market growth.

Reimbursement Scenario

Coverage policies from Medicare, Medicaid, and private insurers generally favor chronic pain treatments, including transdermal opioids when prescribed appropriately. However, reimbursement limits for high-cost products like Butrans impact prescribing patterns and market penetration.

Pricing Analysis

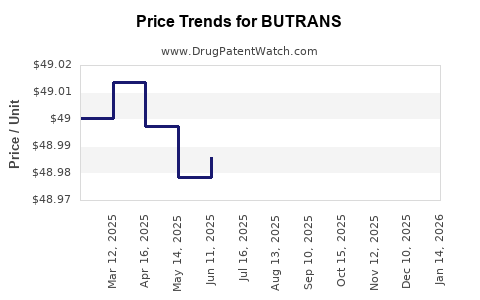

Current Pricing Landscape

- Brand Version: The branded Butrans patch retails at approximately USD 250-$300 per week, translating to roughly USD 13,000-$15,600 annually per patient (assuming consistent weekly usage).

- Generic Versions: Post-patent expiry, generic buprenorphine patches have been priced substantially lower, often between USD 50-$100 per week, drastically reducing patient and payer costs.

Factors Influencing Price

- Manufacturing Costs: High precision manufacturing for the transdermal system entails significant R&D, quality control, and regulatory compliance costs.

- Market Competition: Entry of generics has precipitated proxy price reductions, with the average wholesale price (AWP) declining by approximately 60% since generics entered the market.

- Regulatory and Risk Management Costs: Additional expenses related to abuse-deterrent formulations or risk mitigation strategies indirectly influence pricing premiums.

Price Projections

Short-term (1-3 years)

- Trend: The near-term trajectory indicates continued price erosion for branded Butrans due to generics’ expansion, with discounts of up to 50% likely.

- Forecast: The branded product's wholesale price may remain stable or decline marginally, reaching approximately USD 220-$250 per week amid increased generic competition [4].

Medium to Long-term (4-10 years)

- Factors: Patent expirations of secondary formulations, the introduction of abuse-deterrent variants, and evolving prescribing guidelines will impact prices.

- Projection: Prices could further decline by 25-40%, with branded products potentially stabilizing at USD 150-$180 per week, especially if new formulations gain market share or if payer strategies favor cost-effective generics.

Premium Price Considerations

In certain cases, niche prescribing—such as for patients with complex pain management needs or where abuse-deterrent features are prioritized—may sustain higher pricing premiums for branded formulations.

Market Opportunities and Risks

Opportunities

- Expansion into New Geographies: Emerging markets with increasing pain management needs may unlock demand.

- Combination Therapies: Developing combination patches integrating buprenorphine with non-opioid analgesics could create niche markets.

- Enhanced Formulations: Abuse-deterrent or multi-day patches with improved safety features can command higher prices.

Risks

- Regulatory Restrictions: Stricter opioid prescribing policies could limit market size.

- Competitive Displacement: Generics will continue to erode price margins.

- Market Saturation: Established presence of alternative analgesics reduces incremental growth potential.

Key Takeaways

- The global opioid patch market growth will continue driven by the rise in chronic pain prevalence and increased acceptance of transdermal delivery.

- Butrans faces significant price erosion due to patent expirations and vigorous generic competition, with prices projected to decline by up to 40% over the next decade.

- Strategic differentiation through abuse-deterrent properties, combination formulations, or niche targeting remains essential for maintaining market value.

- Reimbursement landscape and regulatory changes strongly influence pricing strategies and market share dynamics.

- Opportunities exist for geographic expansion and innovation, but clinicians’ pain management shifts toward multimodal therapies may temper long-term growth.

FAQs

1. How does the entry of generics impact Butrans’s pricing?

Generic entry drastically reduces prices, with discounts of up to 50%-60%, impacting the profitability of the branded product.

2. What are the main drivers behind Butrans’s market growth?

Growing prevalence of chronic pain, preference for transdermal delivery, and shifting prescriber practices favoring opioids like buprenorphine.

3. How might regulatory changes affect Butrans’s market?

Enhanced monitoring and stricter prescribing guidelines could limit utilization, while increased safety measures may enable premium pricing for safer formulations.

4. Are there new formulations that could challenge Butrans?

Yes, abuse-deterrent formulations and multi-day patches with improved safety profiles could shift market share away from traditional patches like Butrans.

5. What are the opportunities for market expansion?

Emerging markets, specialized pain management niches, and combination therapies present growth avenues, especially with tailored pricing strategies.

References

[1] MarketsandMarkets. “Opioid Analgesics Market by Product, Application, and Region,” 2022.

[2] IQVIA. “Top Opioid Patch Prescriptions – 2022,” 2022.

[3] U.S. FDA. “Buprenorphine Transdermal System – Market Entry and Patent Data,” 2018.

[4] EvaluatePharma. “Pharmaceutical Pricing Trends – 2023,” 2023.