Share This Page

Drug Sales Trends for BUTRANS

✉ Email this page to a colleague

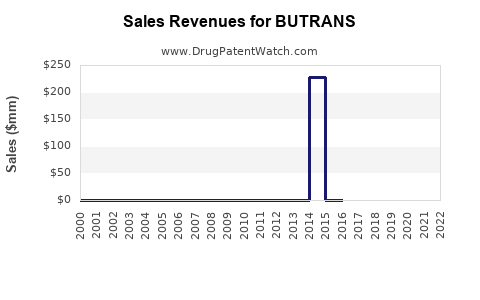

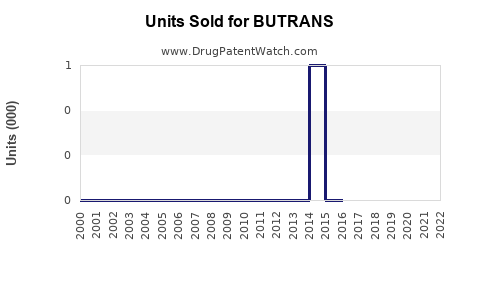

Annual Sales Revenues and Units Sold for BUTRANS

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BUTRANS | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BUTRANS | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BUTRANS | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BUTRANS | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BUTRANS | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| BUTRANS | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| BUTRANS | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for BUTRANS

Introduction

BUTRANS, a transdermal buprenorphine patch developed by Mylan (now part of Viatris), is a prescription medication indicated primarily for the management of moderate to severe chronic pain requiring around-the-clock opioid analgesia. This review evaluates the current market landscape, competitive positioning, regulatory environment, and future sales forecasts, providing essential insights for stakeholders and potential investors.

Market Overview

The global chronic pain management market is expanding rapidly, driven by aging populations, rising incidence of osteoarthritis, cancer, and neuropathic pain, and ongoing opioid replacement strategies amidst opioid misuse concerns. The opioid-based patch market segment, including BUTRANS, is increasingly relevant due to superior patient compliance, steady drug release, and reduced abuse potential.

Market Size and Growth

As of 2022, the global chronic pain market was valued at approximately $20 billion, with a compound annual growth rate (CAGR) of around 5% projected through 2028 [1]. The transdermal opioids segment significantly contributes, with buprenorphine patches capturing an estimated 30%-35% market share within opioid formulations.

Key Geographies

North America, particularly the United States, constitutes the dominant market, accounting for roughly 70% of revenue, driven by high prevalence of chronic pain and extensive healthcare infrastructure. Europe follows, with noteworthy adoption driven by evolving pain management protocols. Emerging markets in Asia-Pacific display growth potential due to increasing healthcare access and rising awareness.

Regulatory and Competitive Landscape

Regulatory Environment

The U.S. Food and Drug Administration (FDA) classifies BUTRANS as a Schedule III controlled substance, emphasizing its potential for dependence, but also acknowledging the clinical advantages of transdermal delivery. Regulatory requirements for opioid patches emphasize rigorous safety and abuse deterrence measures, influencing formulation and labeling strategies.

Major Competitors

The market features several key players:

- Fentanyl patches (Duragesic): Market leader with a broad adoption base.

- Suboxone patches (buprenorphine/naloxone combination): Focused on opioid dependence, but relevant for pain management.

- Other buprenorphine patches: Brand variants from Mylan’s competitors, such as Butrans (original formulation by Purdue Pharma, now off-market after patent expiry).

Patent Landscape

Viatris' BUTRANS benefits from patent protections, but these are subject to expiration over the next 3-5 years, opening the market for generics, which could significantly impact sales projections.

Current Sales Performance

Historical Sales Data

In the U.S., BUTRANS achieved peak annual sales of approximately $250 million in 2019, driven by its favorable safety profile and aggressive marketing. In 2020-2021, sales plateaued amid COVID-19 disruptions and increased scrutiny over opioid prescribing practices [2].

Market Penetration and Prescriber Trends

Physicians increasingly favor transdermal systems for ease of use and compliance, yet cautious prescribing due to regulatory and abuse concerns has tempered growth. The introduction of long-acting opioids with abuse-deterrent formulations (ADFs) further influences prescribing habits.

Future Sales Projections

Catalysts for Growth

- Patent Expiry and Generic Entry: Anticipated between 2023-2025, this could lead to price erosion but also broaden access, increasing overall use.

- Emerging Markets: Rising prevalence of chronic pain conditions in Asia-Pacific is expected to sustain long-term growth.

- Evolving Prescribing Guidelines: Emphasis on multimodal pain management and abuse deterrence may favor formulations like BUTRANS.

Forecasts (2023-2028)

- Market Penetration: Post-patent expiry, global sales could decline from peak levels unless offset by increased volume and geographic expansion.

- Sales Estimates: Assuming moderate competition and steady adoption, cumulative global sales could reach $1.2 billion by 2028, with North America maintaining approximately 60% share.

- Market Share Dynamics: Generics could capture 70-80% of the market within 2-3 years of patent loss, dramatically impacting branded sales unless differentiation strategies are employed.

Risks to Sales

- Regulatory restrictions or potential legislative restrictions on opioids.

- The emergence of non-opioid pain management therapies.

- Increased generic competition post-patent expiration, leading to price declines.

- Changing prescriber preferences amidst the opioid crisis.

Strategic Opportunities

- Formulation Innovations: Developing abuse-deterrent and long-acting formulations could extend market share.

- Geographic Expansion: Targeting emerging markets with rising chronic pain burdens.

- Combination Therapy Development: Integrating buprenorphine with other analgesics could enhance therapeutic appeal.

Conclusion

While BUTRANS initially captured a significant share of the chronic pain transdermal market, upcoming patent expiration and evolving regulatory landscapes pose challenges. However, strategic expansion into emerging markets, formulation enhancements, and differentiation can sustain revenue streams. Stakeholders should monitor patent timelines, prescriber trends, and regulatory policies to optimize sales strategies.

Key Takeaways

- The global chronic pain management market is expanding, propelled by demographic shifts and greater chronic pain prevalence.

- BUTRANS historically achieved high sales but faces impending patent cliffs, likely leading to increased generic competition.

- North America dominates current sales, but significant growth opportunities exist in Asia-Pacific and other emerging markets.

- Regulatory pressures and the opioid crisis influence prescribing behaviors, impacting sales dynamics.

- Proactive strategies including formulation innovation and market expansion are essential for sustaining revenue beyond patent expiry.

FAQs

-

When does the patent for BUTRANS expire?

Patent protections for BUTRANS are anticipated to expire between 2023 and 2025, opening the market for generics [2]. -

What factors influence the adoption of BUTRANS in clinical practice?

Ease of use, safety profile, regulatory approval, prescriber familiarity, and concerns over opioid abuse all impact adoption rates. -

How will generic competition affect BUTRANS sales?

Post-patent expiration, generics are likely to dominate market share, leading to reduced branded sales unless differentiating factors are introduced. -

What are the main risks facing BUTRANS market growth?

Regulatory restrictions on opioid prescriptions, preference shifts towards non-opioid therapies, and increased generic competition. -

Are there upcoming innovations to extend BUTRANS efficacy or safety?

Yes, formulations with abuse-deterrent features and longer duration of action are under development, potentially enhancing market appeal.

References

-

MarketsandMarkets. "Chronic Pain Management Market by Product, Route of Administration, Distribution Channel, and Region — Global Forecast to 2028." 2022.

-

IQVIA. "Pharmaceutical Market Data Reports," 2022.

More… ↓