BUDESONIDE Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Budesonide, and what generic alternatives are available?

Budesonide is a drug marketed by Padagis Israel, Amneal Pharms, Aurobindo Pharma Usa, Barr Labs Div Teva, Dr Reddys Labs Sa, Natco, Rising, Sciecure Pharma Inc, Zydus Pharms, Apotex, Cipla, Eugia Pharma, Impax Labs Inc, Lupin, Nephron, Sandoz, Sun Pharm, Teva Pharms, Teva Pharms Usa, Actavis Labs Fl Inc, and Mylan. and is included in twenty-one NDAs.

The generic ingredient in BUDESONIDE is budesonide. There are twenty-two drug master file entries for this compound. Forty-two suppliers are listed for this compound. Additional details are available on the budesonide profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Budesonide

A generic version of BUDESONIDE was approved as budesonide by TEVA PHARMS on November 18th, 2008.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for BUDESONIDE?

- What are the global sales for BUDESONIDE?

- What is Average Wholesale Price for BUDESONIDE?

Summary for BUDESONIDE

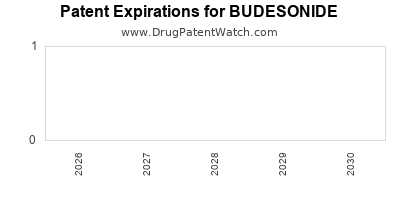

| US Patents: | 0 |

| Applicants: | 21 |

| NDAs: | 21 |

| Finished Product Suppliers / Packagers: | 33 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 470 |

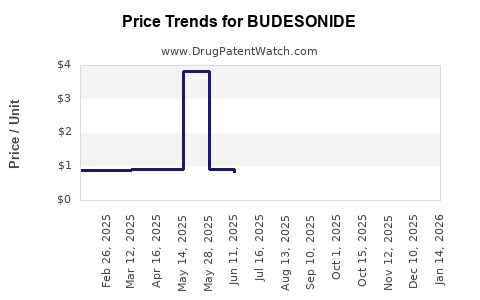

| Drug Prices: | Drug price information for BUDESONIDE |

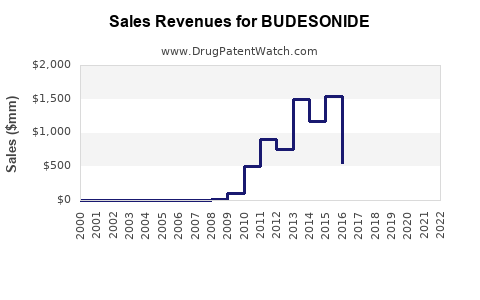

| Drug Sales Revenues: | Drug sales revenues for BUDESONIDE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for BUDESONIDE |

| What excipients (inactive ingredients) are in BUDESONIDE? | BUDESONIDE excipients list |

| DailyMed Link: | BUDESONIDE at DailyMed |

See drug prices for BUDESONIDE

Recent Clinical Trials for BUDESONIDE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Wisconsin, Madison | PHASE2 |

| Meriter Foundation | PHASE2 |

| AHS Cancer Control Alberta | PHASE2 |

Pharmacology for BUDESONIDE

| Drug Class | Corticosteroid |

| Mechanism of Action | Corticosteroid Hormone Receptor Agonists |

Medical Subject Heading (MeSH) Categories for BUDESONIDE

Anatomical Therapeutic Chemical (ATC) Classes for BUDESONIDE

Paragraph IV (Patent) Challenges for BUDESONIDE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| EOHILIA | Oral Suspension | budesonide | 2 mg/10 mL | 213976 | 1 | 2025-03-31 |

| TARPEYO | Delayed-release Capsules | budesonide | 4 mg | 215935 | 1 | 2024-12-26 |

| UCERIS | Extended-release Tablets | budesonide | 9 mg | 203634 | 1 | 2013-03-11 |

| PULMICORT RESPULES | Inhalation Suspension | budesonide | 1 mg/2 mL | 020929 | 1 | 2010-05-28 |

| ENTOCORT EC | Enteric Coated Capsules | budesonide | 3 mg | 021324 | 1 | 2008-02-01 |

| RHINOCORT ALLERGY | Nasal Spray | budesonide | 0.032 mg (32 mcg)/spray | 020746 | 1 | 2007-05-14 |

| PULMICORT RESPULES | Inhalation Suspension | budesonide | 0.25 mg/2 mL and 0.5 mg/2 mL | 020929 | 1 | 2005-09-15 |

US Patents and Regulatory Information for BUDESONIDE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Teva Pharms Usa | BUDESONIDE | budesonide | SUSPENSION;INHALATION | 204548-001 | Mar 8, 2016 | AN | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Actavis Labs Fl Inc | BUDESONIDE | budesonide | TABLET, EXTENDED RELEASE;ORAL | 205457-001 | Jul 3, 2018 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Padagis Israel | BUDESONIDE | budesonide | AEROSOL, FOAM;RECTAL | 215328-001 | Apr 12, 2023 | AB | RX | No | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Nephron | BUDESONIDE | budesonide | SUSPENSION;INHALATION | 078202-001 | Mar 30, 2009 | AN | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Sun Pharm | BUDESONIDE | budesonide | SUSPENSION;INHALATION | 211922-002 | Apr 14, 2021 | AN | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Rising | BUDESONIDE | budesonide | CAPSULE, DELAYED RELEASE;ORAL | 207367-001 | Apr 7, 2017 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Barr Labs Div Teva | BUDESONIDE | budesonide | CAPSULE, DELAYED RELEASE;ORAL | 090379-001 | Apr 2, 2014 | DISCN | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for BUDESONIDE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Dr. Falk Pharma GmbH | Jorveza | budesonide | EMEA/H/C/004655Jorveza is indicated for the treatment of eosinophilic esophagitis (EoE) in adults (older than 18 years of age). | Authorised | no | no | yes | 2018-01-08 | |

| Stada Arzneimittel AG | Kinpeygo | budesonide | EMEA/H/C/005653Kinpeygo is indicated for the treatment of primary immunoglobulin A (IgA) nephropathy (IgAN) in adults at risk of rapid disease progression with a urine protein-to-creatinine ratio (UPCR) ≥1.5 g/gram. | Authorised | no | no | yes | 2022-07-15 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

Market Dynamics and Financial Trajectory for BUDESONIDE

More… ↓