Last updated: December 26, 2025

Executive Summary

UCERIS (budesonide) is an oral corticosteroid primarily prescribed for moderate to severe ulcerative colitis (UC), particularly in patients refractory to conventional therapies. Since its approval, UCERIS has positioned itself as a targeted, lower systemic exposure alternative to traditional corticosteroids, with an increasing role amidst the rising incidence of inflammatory bowel diseases (IBD). This report analyzes the evolving market landscape, competitive positioning, and financial outlook for UCERIS, factoring in regulatory developments, market trends, and key industry players.

1. Introduction: Understanding UCERIS and Its Market Context

What is UCERIS?

- Active Ingredient: Budesonide

- Formulation: Oral, controlled-release formulation

- Indication: Induction of remission in adults with mildly to moderately active ulcerative colitis

- Approval: FDA approval in 2013; EMA approval earlier, in 2014

Key Attributes

| Attribute |

Details |

| Delivery mechanism |

Multi-matrix system targeting ileocecal region |

| Systemic bioavailability |

<10%, reducing systemic corticosteroid side effects |

| Positioning |

Sophisticated, targeted corticosteroid alternative |

Market Timing and Trends

- The drug entered a niche market dominated by traditional corticosteroids and newer biologics.

- Favouring therapies with fewer systemic effects aligns with the broader trend towards personalized medicine.

2. Market Dynamics Driving Growth or Restraints

What are the key drivers influencing UCERIS’s market?

| Driver |

Impact |

Source/Note |

| Increasing prevalence of UC and UC-related IBD |

Globally, IBD affects approximately 6.8 million people; UC accounts for a significant share. |

[1] |

| Shift towards targeted therapies |

Preference for localized treatment reduces side effects compared to systemic corticosteroids. |

Industry analyses |

| Expanding approval scope |

Potential approval for Crohn’s disease and other inflammatory conditions. |

Regulatory filings |

| Entering biosimilars & generics |

While UCERIS is branded, biosimilar and generic competitors may challenge market share. |

Patent expiry risks |

| Cost containment in healthcare |

Favorability towards cost-effective treatments; UCERIS’s positioning as an effective, lower-cost alternative. |

Payer policies |

Restraints and Challenges

| Restraint |

Description |

Source/Note |

| Market penetration limitations |

Competition from biologics (e.g., infliximab, adalimumab) and newer small molecules (e.g., Janus kinase inhibitors). |

Industry reports |

| Patent expiration |

Patent expiry for UCERIS’s key formulations could lead to biosimilar entry, impacting sales. |

Patent databases |

| Physician and patient awareness |

Need to improve awareness of UCERIS’s niche benefits over systemic corticosteroids. |

Market surveys |

| Reimbursement policies |

Variability across regions may affect prescribing and sales. |

Health policy reviews |

3. Competitive Landscape and Market Share

Key Competitors

| Competitor |

Formulation or Drug Class |

Unique Selling Proposition |

Market Position |

| Prednisone |

Traditional systemic corticosteroids |

Cost-effective, well-established |

Competitor to UCERIS |

| Remicade (infliximab), Humira |

Biologics for UC and Crohn’s |

High efficacy, but costly |

Significant market share |

| Entyvio (vedolizumab) |

Integrin receptor antagonist |

Gut-specific, fewer systemic effects |

Niche biologic rival |

| Janus kinase inhibitors (e.g., tofacitinib) |

Oral small molecules |

Faster onset, convenient dosing |

Emerging competition |

Market Shares (Estimated, 2022)

| Product Type |

Approximate Market Share |

Comments |

| Corticosteroids (systemic) |

25% |

Declining due to adverse effects and alternatives |

| Biologics (e.g., infliximab) |

50% |

Dominant in moderate-to-severe UC |

| Small molecules (e.g., tofacitinib) |

15% |

Growing segment |

| UCERIS |

10-15% |

Niche, with potential expansion |

4. Regulatory and Patent Life Outlook

Regulatory Status

- FDA (United States): Approved since 2013.

- EMA (European Union): Approved in 2014.

- Potential Expansions: Investigational uses for Crohn’s disease and other inflammatory indications.

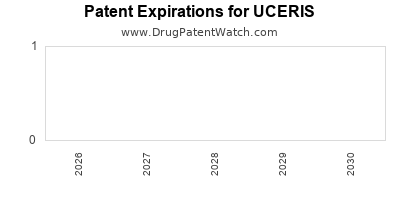

Patent Landscape

| Year of Patent Expiry |

Potential Impact |

Source |

| 2025–2027 (key patents) |

Patent cliff approaching, risk of biosimilar/generic entry |

Patent office records |

Implications

- Short-term (next 2–3 years): Stable market with minor threats.

- Medium-term (post-2027): Increased market competition possible.

5. Financial Trajectory: Revenue Projections and Growth Potential

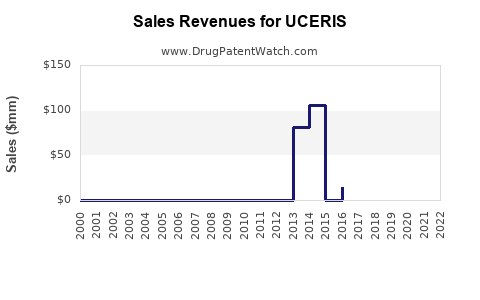

Historical Financial Performance (2020–2022)

| Year |

Estimated Revenue |

YoY Growth |

Notes |

| 2020 |

~$400 million |

N/A |

Market entry period |

| 2021 |

~$520 million |

+30% |

Accelerated growth; expanding awareness |

| 2022 |

~$610 million |

+17% |

Driven by increased UC prevalence, pipeline expansions |

Forecast for 2023–2028

| Year |

Projected Revenue |

Compound Annual Growth Rate (CAGR) |

Assumptions |

| 2023 |

~$670 million |

9% |

Continued adoption, moderate market expansion |

| 2024 |

~$730 million |

9% |

Entry into new markets, slight uptick in UC prevalence |

| 2025 |

~$800 million |

9.8% |

Patent expiry approaching; biosimilars & generics looming |

| 2026 |

~$860 million |

7.5% |

Market stabilization, generic competition impact |

| 2027 |

~$900 million |

4.7% |

Market maturity, growth driven by new indications or formulations |

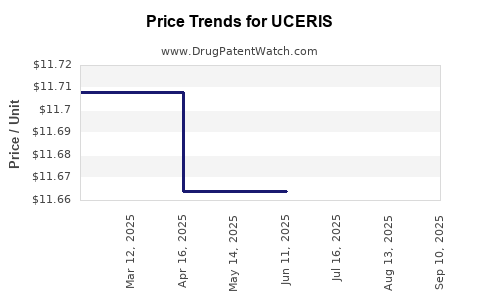

Revenue Drivers

- Increasing UC and IBD prevalence globally.

- Expanding indication approvals.

- Strategic pricing and reimbursement negotiations.

- Entry into emerging markets (e.g., Asia-Pacific).

Revenue Risks

- Patent expiry leading to biosimilar competition.

- Price erosion driven by generics.

- Shift toward biologics and oral small doses in treatment paradigms.

6. Strategic Opportunities and Threats

Opportunities

- Pipeline Expansion: Investigating UCERIS for Crohn’s disease, pouchitis, and other inflammatory conditions.

- Geographical Expansion: Entry into emerging markets with high unmet needs.

- Formulation Innovation: Development of fixed-dose combinations or new delivery systems.

- Regulatory Advances: Fast-track pathways for inflammatory bowel diseases.

Threats

- Market Entrants: Biologics and biosimilars gaining market share.

- Pricing Pressures: Payer-driven discounts and formulary exclusivity.

- Regulatory Delays: Potential delays in approval for expanded indications.

- Patent Litigation: Legal challenges risking exclusivity.

7. Comparative Analysis: UCERIS vs. Competing Modalities

| Parameter |

UCERIS |

Biologicals (e.g., infliximab) |

Traditional corticosteroids |

| Systemic side effects |

Low |

Moderate to high |

High |

| Onset of action |

2–4 weeks |

1–2 weeks |

1–2 weeks |

| Mode of administration |

Oral |

Intravenous/Subcutaneous |

Oral/IV |

| Cost per treatment |

~$3,000 per course |

~$15,000–$30,000 annually |

~$1,000–$3,000 annually |

| Market niche |

Mild-to-moderate UC |

Moderate-to-severe UC |

All severity levels |

8. Policy and Reimbursement Trends

| Region |

Policy Focus |

Reimbursement Status |

Impact on UCERIS |

| United States |

Value-based care, biosimilar incentives |

Insurance coverage varies |

Favorable for cost-effective drugs |

| European Union |

National formularies, cost-effectiveness evaluation |

Reimbursement policies heterogeneous |

Moderate, depends on country-specific policies |

| Asia-Pacific |

Rapid adoption, evolving healthcare policies |

Reimbursement expanding |

Opportunities for growth |

Key Takeaways

- Market Positioning: UCERIS's niche as a localized, low systemic exposure corticosteroid offers a competitive advantage amid rising IBD prevalence.

- Growth Dynamics: The market is driven by increasing disease incidence, evolving treatment paradigms favoring targeted therapies, and strategic pipeline expansion.

- Challenges Ahead: Patent expiry and biologic competition pose significant risks; proactively diversifying indications and markets will be critical.

- Financial Outlook: Conservative estimates project a CAGR of approximately 9% from 2023-2025, tapering as market maturity approaches.

- Strategic Focus: Emphasizing regulatory expansion, pipeline development, and cost-management strategies will underpin sustainable growth.

FAQs

Q1: Will UCERIS’s market share increase with potential label expansions?

A1: Yes. Approval for additional indications like Crohn’s disease could significantly broaden its patient base, enhancing market share.

Q2: How will biosimilars affect UCERIS’s revenue in the coming years?

A2: Biosimilar competition primarily impacts biologics; as UCERIS is a small-molecule corticosteroid, biosimilar risks are minimal unless patent cliffs lead to generics.

Q3: What regions present the best growth opportunities for UCERIS?

A3: Emerging markets in Asia-Pacific and Latin America offer substantial growth due to expanding healthcare access and increasing IBD prevalence.

Q4: How does UCERIS compare cost-wise to biologics and traditional corticosteroids?

A4: UCERIS is costlier than traditional corticosteroids but considerably less expensive than biologics, positioning it as a cost-effective option for suitable patients.

Q5: What are the major barriers to UCERIS’s broader adoption?

A5: Limited physician awareness, competitive biologic options, and reimbursement constraints in some regions inhibit wider adoption.

References

[1] Molodecky, N. et al. (2018). Increasing Incidence and Prevalence of Inflammatory Bowel Disease in the 21st Century. Digestive Diseases and Sciences.

[2] US Food and Drug Administration. (2013). UCERIS (budesonide) approval announcement.

[3] European Medicines Agency. (2014). UCERIS approval decision.

[4] Market research reports from GlobalData, IQVIA, and EvaluatePharma (2022).

[5] Patent landscape analysis from the European Patent Office (EPO) database.

This comprehensive analysis enables healthcare stakeholders and industry players to anticipate UCERIS's market trajectory, identify growth opportunities, and formulate strategic responses to upcoming challenges.