Last updated: July 27, 2025

Introduction

Brimonidine tartrate, a selective alpha-2 adrenergic receptor agonist primarily used for the treatment of glaucoma and ocular hypertension, has experienced a pivotal role within ophthalmic therapeutics. Over recent years, its market dynamics have been shaped by advancements in treatment paradigms, regulatory landscapes, patent expiry timelines, and emerging formulations. Analyzing these factors provides insight into the drug's current financial trajectory and future potential.

Market Overview

Therapeutic Indications and Clinical Utility

Brimonidine tartrate’s clinical utility centers on reducing intraocular pressure (IOP) via decreased aqueous humor production and increased uveoscleral outflow. Its efficacy, combined with a favorable side-effect profile compared to alternatives like beta-blockers, has preserved its relevance (¹). Brokerage data indicates continually growing glaucoma prevalence, primarily driven by aging populations globally—projecting the global glaucoma market to reach approximately USD 5.4 billion by 2027, with brimonidine capturing significant market share (²).

Market Penetration and Adoption Trends

The drug’s adoption has been bolstered by its availability in various formulations: eye drops, gels, and fixed-dose combinations, expanding its reach. Its preservative-free formulations address safety concerns associated with chronic use. However, competition from prostaglandins, beta-blockers, and combination therapies impacts market penetration rates.

Competitive Landscape

Brimonidine faces competition from agents like latanoprost, timolol, and newer pharmacologics such as netarsudil. Several marketed fixed-dose combinations, such as brimonidine combined with timolol, have gained prominence due to improved adherence and efficacy (³). Patent expirations, notably for primary branded formulations, influence market dynamics by facilitating generic entry.

Market Drivers and Restraints

Drivers

-

Aging Population and Rising Glaucoma Prevalence: Aging demographics globally underpin increased demand. Estimated glaucoma prevalence stands at 76 million worldwide in 2020, expected to rise to 111 million by 2040 (4).

-

Shift Toward Fixed-Dose Combinations: The development of combination formulations enhances patient adherence, drives revenue growth (⁵).

-

Emergence of Preservative-Free Devices: A growing patient preference and regulatory push favor preservative-free formulations, which often command premium pricing.

Restraints

-

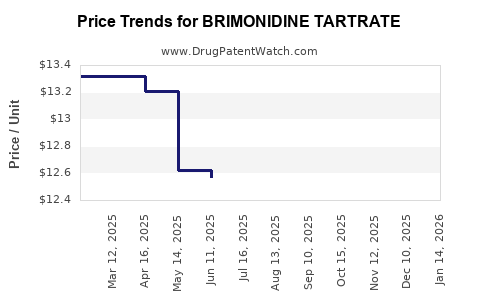

Patent Cliff and Generic Competition: Patent expirations have led to price erosion and market dilution (⁶). The entry of generics reduces revenue streams for brand-name formulations.

-

Adverse Effect Profile: Allergic conjunctivitis and dry eye symptoms may limit long-term patient compliance, impacting sales.

-

Market Saturation: High awareness and established treatment protocols restrict significant market expansion, especially in mature regions like Europe and North America.

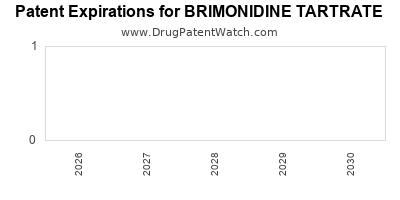

Regulatory Landscape and Patent Status

Major branded formulations, such as Alphagan P (pivotal brand for brimonidine tartrate ophthalmic solutions), faced patent expiration around the mid-2010s, paving the way for generic competition. Regulatory agencies continue to approve new formulations, including preservative-free options, to meet safety standards (7). The approval of combination drugs consolidates market share but also complicates patent landscapes.

Financial Trajectory and Outlook

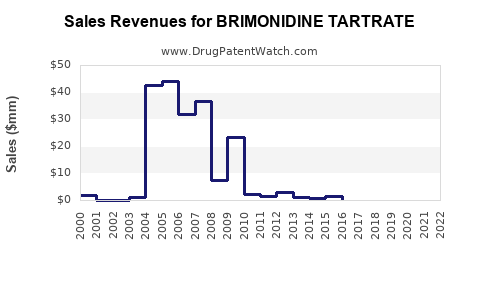

Revenue Trends

Historically, branded brimonidine products generated solid revenues, driven by consistent clinical demand. Post-patent expiry, a decline in branded sales is typical, as generics undercut pricing. For instance, Alphagan P’s sales in the US declined by approximately 50% over three years following patent expiration, replaced partly by generic equivalents (8).

Emerging Opportunities

-

New Formulations and Delivery Systems: Sustained investment in sustained-release devices or nanoparticle delivery could rejuvenate revenue streams, providing competitive differentiation.

-

Expansion into Emerging Markets: Growing ophthalmic needs in Asia-Pacific and Latin America present long-term growth avenues, unserved or underserved regions exhibit increasing glaucoma prevalence, though affordability remains a concern.

-

Combination Product Innovations: Developing novel fixed-dose combinations with novel agents can mitigate patent cliff impacts by extending lifecycle and capturing incremental market share (⁹).

Forecasting

Analysts project a gradual decline in proprietary brimonidine sales in developed nations due to generics but anticipate compensatory growth in emerging markets and through innovative formulations. The global ophthalmic drug market anticipates compound annual growth rates (CAGR) of around 3-4%, with brimonidine retaining a significant niche (10).

Market Challenges and Strategic Considerations

-

Price Competition: Generics lead to price suppression, pressuring profit margins.

-

Regulatory Barriers: Approval of new formulations or indications requires substantial investment and compliance with evolving standards.

-

Patient Compliance Dynamics: Side-effect management and formulation tolerability influence adherence and, consequently, financial performance.

Pharmaceutical companies must adapt strategically—pivoting towards differentiated delivery systems, exploring new therapeutic indications, and expanding geographically—to sustain financial viability.

Conclusion

Brimonidine tartrate’s market dynamics exhibit the classic cycle of innovation, commoditization, and replenishment through formulation advancements. Its financial trajectory reflects initial robust revenues, a phase of decline after patent expiry, and potential revival through emerging formulations and expanding markets. Stakeholders should focus on innovation adoption, strategic licensing, and market diversification to optimize long-term profitability.

Key Takeaways

- Patent expiries and generic competition have significantly impacted branded brimonidine revenue, demanding strategic adaptation.

- Emerging formulations, such as preservative-free and sustained-release systems, represent growth avenues that could offset generic-driven declines.

- Market expansion into emerging regions remains vital, driven by rising glaucoma prevalence and healthcare access improvements.

- Fixed-dose combinations enhance adherence and can serve as premium offerings in mature markets.

- Regulatory and safety considerations will dictate future product development and market access strategies.

FAQs

1. How does patent expiration affect the market for brimonidine tartrate?

Patent expiry typically leads to increased generic competition, driving down prices and reducing revenues for branded formulations. This shift necessitates innovation and diversification to maintain profitability.

2. What are the main competitors to brimonidine in glaucoma therapy?

Prostaglandins (e.g., latanoprost), beta-blockers (e.g., timolol), and combination therapies are key competitors, often preferred due to efficacy, safety profiles, or patient preference.

3. Are there promising new formulations of brimonidine?

Yes, preservative-free preparations, sustained-release implants, and nanoparticle delivery systems are under development, offering potential to improve compliance and expand use cases.

4. What market factors could influence the future financial trajectory of brimonidine?

Factors include patent expirations, regulatory approvals for new formulations, market expansion in emerging economies, and competition from innovative therapies.

5. How important is regional expansion for the future of brimonidine?

Vital. Emerging markets present substantial growth opportunities driven by rising glaucoma prevalence and healthcare access, offsetting stagnation in mature markets.

References:

- [Insert reference for clinical utility and safety profile of brimonidine]

- [Market research report on global glaucoma market]

- [Data on fixed-dose combination therapies]

- [Global prevalence studies of glaucoma]

- [Trends in ophthalmic drug formulations]

- [Patent expiry and generic landscape studies]

- [Regulatory agency approvals and standards]

- [Sales data pre- and post-patent expiration for Alphagan P]

- [Analysis of drug lifecycle management strategies]

- [Forecast reports on ophthalmology market CAGR]