Last updated: July 27, 2025

Introduction

Brimonidine Tartrate, marketed under various brand names including Alphagan P and Mirvaso, is a selective alpha-2 adrenergic receptor agonist primarily used in ophthalmology and dermatology. It treats conditions like open-angle glaucoma, ocular hypertension, and facial erythema associated with rosacea. As the global demand for ophthalmic and dermatological therapies rises, understanding the market landscape and future pricing dynamics of Brimonidine Tartrate is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Indications and Therapeutic Use

Brimonidine Tartrate’s primary indications encompass:

- Glaucoma and Ocular Hypertension: To lower intraocular pressure (IOP) and prevent optic nerve damage.

- Rosacea-associated Erythema: To reduce facial redness through topical formulations.

The global prevalence of glaucoma is estimated at over 70 million cases, with open-angle glaucoma accounting for approximately 90% of cases [1]. Rosacea affects around 5% of the adult population worldwide, with facial erythema being its hallmark symptom [2].

Market Segmentation

The ophthalmic segment outpaces dermatological applications in revenue, driven by the chronic nature of glaucoma and the importance of IOP management. Conversely, dermatological formulations, such as Mirvaso, target niche markets but offer higher per-unit prices due to topical application and branding.

Current Market Size

The global ophthalmic glaucoma medication market was valued at approximately USD 3.8 billion in 2022 and is projected to grow at a CAGR of 4-6% through 2030 [3]. The dermatology segment, though smaller, exhibits promising growth, with the rosacea treatment market expected to grow at a CAGR of 6.2% over the next decade [4].

Key Market Players

Major companies involved include Allergan (AbbVie), Novartis, Santen Pharmaceutical, and Kaken Pharmaceutical, holding significant market share due to their established product portfolios and global distribution networks.

Competitive Landscape and Regulatory Environment

Brand and Generic Presence

Brimonidine Tartrate’s patent protection, particularly for branded formulations like Alphagan P, has expired or is nearing expiry in key markets, facilitating generic entry. Competition from generic manufacturers is intensifying, exerting downward pressure on prices.

Regulatory Considerations

Regulatory approvals vary by region but generally follow rigorous clinical trial standards for safety and efficacy. Recent approvals of newer formulations with improved bioavailability or reduced side effects could influence market dynamics.

Price Trends and Projections

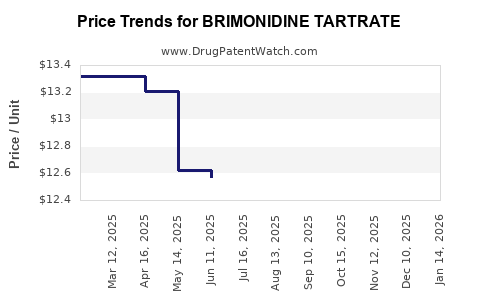

Historical Pricing Trends

Historically, branded ophthalmic formulations of Brimonidine Tartrate have traded at higher price points—USD 50–USD 70 per bottle (10 mL)—reflecting branding, formulation exclusivity, and marketing costs. The entrance of generics has reduced prices by approximately 30-50% in mature markets over the past five years [5].

Topical dermatological formulations like Mirvaso command higher per-gram prices, often exceeding USD 1,000 per gram, attributed to topical application convenience and branding premiums.

Future Price Drivers

- Patent Expiry and Generic Competition: As patents lapse, aggressive pricing by generics can reduce prices significantly.

- Regulatory Approvals of New Formulations: Innovations such as sustained-release or ring-shaped delivery systems could impact pricing by offering improved efficacy or convenience.

- Market Penetration in Emerging Economies: Lower-cost generics and localized formulations may reduce prices further as access expands.

- Manufacturing and Supply Chain Dynamics: Cost efficiencies and scale economies tend to lower prices over time.

Price Projections (2023-2030)

Forecasting indicates that:

- Ophthalmic formulations: Prices are expected to decline at an average rate of 2-4% annually in mature markets post-patent expiry, influenced heavily by generic penetration.

- Dermatological products: Topical formulations may see marginal price stabilization or slight decreases (1-3% annually) due to market saturation but could be offset by innovations.

- Emerging markets: Prices will likely see steeper declines (up to 10% annually) owing to increased competition and local manufacturing.

Overall, the median unit price for branded ophthalmic Brimonidine Tartrate is projected to decrease from USD 60 to USD 45 by 2030, whereas generic versions could be priced as low as USD 20–USD 25 in mature markets. Dermatological topical prices may hover around USD 1,200 per gram for branded products, with generics priced approximately USD 900 per gram.

Market Outlook and Growth Opportunities

Emerging evidence suggests expanding use cases, such as potential neuroprotective effects in glaucoma and combination therapies, could bolster demand. Additionally, innovative delivery systems—implantable devices, sustained-release formulations—may command higher prices initially before generics flood the market, influencing long-term pricing.

The global focus on affordable healthcare access in low- and-middle-income countries (LMICs) propels the growth of low-cost generics. Consequently, market share shifts toward generic manufacturers are likely to continue, with significant price erosion expected in the coming decade.

Regulatory and Reimbursement Impact

Reimbursement policies vary considerably. In the U.S., insurance reimbursement influences consumer access and pricing strategies, often favoring generics. In developing regions, government procurement programs prioritize affordable medications, pressuring prices downward. Regulatory pathways for biosimilars and generics are becoming more streamlined, further accelerating market entry and price competition.

Key Factors Influencing Market Dynamics

- Patent expirations slated for the next 3-5 years.

- Development and approval of new formulations with enhanced efficacy.

- Increasing prevalence of glaucoma and rosacea, particularly in aging populations.

- Health policy initiatives favoring cost-effective therapies.

- Potential impact of biosimilars or biobetters.

Conclusion

Brimonidine Tartrate’s market is poised for sustained growth, driven by aging demographics and expanding indications. Patent expiry and market saturation will drive prices downward, especially in developed markets. Innovative formulations and emerging market expansion suggest a complex pricing landscape, with potential for premium pricing in specialized or novel delivery systems.

Key Takeaways

- Market expansion: The global Glaucoma and rosacea markets present lucrative opportunities with steady growth projections.

- Pricing trend: Prices are expected to decline in mature markets due to generic competition, with branded formulations maintaining premiums temporarily.

- Regulatory influence: New formulations and biosimilars will shape future pricing and market share distribution.

- Emerging markets: Expect rapid price declines as local manufacturing increases and affordability becomes a priority.

- Innovation potential: Delivery system enhancements could command higher prices initially, offsetting general downward pressure.

FAQs

-

When will patent expiry affect Brimonidine Tartrate pricing?

Patents for key Brimonidine Tartrate formulations are expected to expire between 2023 and 2028, initiating significant generic market entry and reducing prices.

-

How do generic entries influence the market?

Generics compete primarily on price, often reducing branded drug prices by 30-50%, thereby making therapies more accessible but squeezing margins for original manufacturers.

-

Are there new formulations expected to impact pricing?

Yes, sustained-release implants, gel formulations, and combination products could command premium prices initially, altering traditional pricing dynamics.

-

What role do regulatory policies play in pricing?

Regulatory approvals and reimbursement policies heavily impact market entry, price setting, and accessibility, especially in diverse international markets.

-

Will biosimilars or biobetters emerge for Brimonidine Tartrate?

Currently, biosimilars are less relevant due to the molecule’s small size; however, biobetters—improved formulations—could impact the market landscape in the upcoming years.

Sources

- World Health Organization. Glaucoma Fact Sheet.

- National Rosacea Society. Epidemiology of Rosacea.

- Research and Markets. Global Ophthalmic Glaucoma Medication Market. 2022.

- MarketsandMarkets. Dermatology Market by Type and Region. 2022.

- IQVIA. Global Trends in Ophthalmic Drug Pricing. 2022.