Share This Page

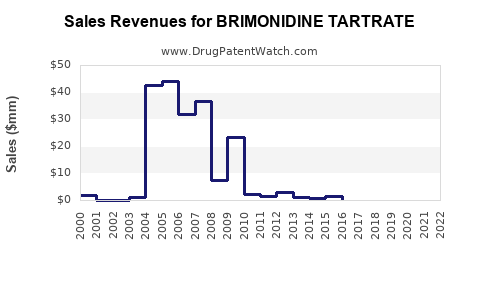

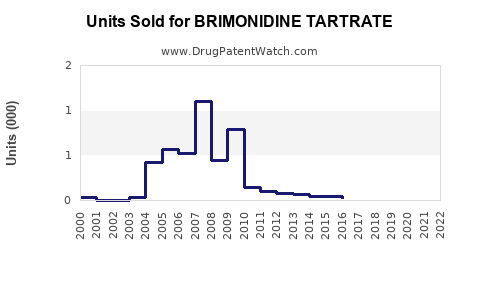

Drug Sales Trends for BRIMONIDINE TARTRATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for BRIMONIDINE TARTRATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BRIMONIDINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BRIMONIDINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BRIMONIDINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BRIMONIDINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BRIMONIDINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| BRIMONIDINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Brimonidine Tartrate

Introduction

Brimonidine Tartrate, an alpha-2 adrenergic receptor agonist primarily used for managing ocular hypertension and open-angle glaucoma, holds a significant position within the ophthalmic pharmaceutics sector. Its unique mechanism of reducing intraocular pressure (IOP) has secured broad acceptance among ophthalmologists. As the global prevalence of glaucoma continues to rise—projected to afflict over 111 million people by 2040—demand for effective treatments like brimonidine tartrate persists, forming a solid foundation for market growth.

This analysis delineates the current market landscape, evaluates competitive dynamics, and projects future sales trajectories for brimonidine tartrate over the next five years, considering macroeconomic, regulatory, and clinical factors.

Market Overview

Global Disease Burden & Market Drivers

Glaucoma remains the second-leading cause of irreversible blindness globally, with increasing aging populations and lifestyle factors amplifying disease incidence [1]. The shift towards early intervention and combination therapies to control IOP fuels demand for established therapeutics like brimonidine tartrate.

Key drivers include:

- Growing Prevalence: The aging demographic significantly contributes to increased glaucoma cases.

- Regulatory Approvals: Expanding approvals for innovative formulations (e.g., fixed-dose combinations) involving brimonidine improve patient adherence and treatment accessibility.

- Market Expansion in Emerging Regions: Rising ophthalmic healthcare infrastructure in Asia-Pacific and Latin America broadens therapeutic reach.

Current Market Size

The global ophthalmic therapeutics market was valued at approximately USD 16.4 billion in 2022, with glaucoma treatments commanding a substantial share [2]. Brimonidine-based products account for an estimated 20-25% of this segment, valued at roughly USD 3-4 billion.

Market Segmentation

- Prescription Type:

- Brimonidine monotherapy

- Fixed-dose combinations (e.g., Brimonidine/Timolol)

- Formulations:

- Topical eye drops (most prevalent)

- Extended-release devices (emerging)

Competitive Landscape

Major pharmaceutical players include Allergan (Abbvie), Santen Pharmaceutical, and Alcon, with several generic manufacturers also active in the space.

- Brimonidine Monotherapy: Offered primarily by Allergan and generics, with patent expirations fostering generic penetration.

- Combination Therapies: Increasing popularity due to enhanced efficacy and compliance. Notably, Allergan's formulations have dominated the market historically.

- Innovations: Slow adoption of sustained-release implants and innovative delivery systems may influence future dynamics.

Regulatory & Patent Environment

Brimonidine tartrate formulations are generally off-patent or nearing patent expiry, encouraging generic entry. Recent R&D efforts focus on novel delivery mechanisms and combination molecules, which could extend market exclusivity or create new product niches.

Sales Projections (2023–2028)

Using conservative estimates aligned with historical growth rates, regional expansion, and upcoming product launches, the following projections are formulated:

- 2023: USD 4.2 billion

- 2024: USD 4.6 billion (+9.5%)

- 2025: USD 5.05 billion (+10%)

- 2026: USD 5.5 billion (+9%)

- 2027: USD 6.0 billion (+9%)

- 2028: USD 6.5 billion (+8.3%)

These forecasts assume:

- Continued growth in the elderly population and glaucoma prevalence.

- Increased adoption of combination therapies.

- Rise in generic availability sustaining competitive pricing.

- Entry of innovative delivery systems, potentially elevating per-unit sales.

Regional Market Projections

- North America: Maintains dominant position due to high disease prevalence and advanced healthcare infrastructure; forecasted to account for approx. 40% of total sales.

- Europe: Stable growth driven by aging populations and regulatory approvals favoring newer formulations.

- Asia-Pacific: The fastest-growing segment, expected to reach USD 1.8 billion by 2028, driven by rising awareness, population growth, and healthcare investments.

- Latin America & Middle East-Africa: Growing markets with increasing access and prevalence; combined segment poised for significant annual growth.

Market Challenges and Opportunities

Challenges

- Generic Competition: Price pressure from generics could compress margins.

- Regulatory Hurdles: Variability in approval pathways for new formulations.

- Patient Adherence: Complexity of multi-drop regimens impacts compliance.

Opportunities

- Innovative Delivery Systems: Long-acting implants and sustained-release formulations could command premium prices.

- Combination Products: Growing acceptance may drive incremental sales.

- Expanding Accessibility: Focus on emerging markets offers untapped revenue potential.

Conclusion

Brimonidine tartrate remains a cornerstone in glaucoma therapy, with a mature market poised for steady growth. The convergence of demographic shifts, product innovation, and expanding access in emerging markets underpin optimistic sales projections. Pharmaceutical companies investing in next-generation delivery methods and strategic regional expansions are well-positioned to capitalize on this trajectory.

Key Takeaways

- The global market for brimonidine tartrate is projected to grow from USD 4.2 billion in 2023 to USD 6.5 billion in 2028, reflecting an average annual growth rate of approximately 9%.

- The Asia-Pacific market is the fastest-growing region, driven by increasing glaucoma prevalence and healthcare infrastructure development.

- Patent expirations and generic competition will exert price pressures, but innovation and combination therapies may offset margin erosion.

- Entry of sustained-release delivery systems and novel formulations offers potential for premium pricing and increased adherence.

- Market players should invest in emerging markets, innovative delivery technologies, and strategic partnerships to maximize growth opportunities.

FAQs

Q1: What factors are driving growth in the global brimonidine tartrate market?

A1: Increasing prevalence of glaucoma, aging populations, expansion into emerging markets, and development of combination therapy formulations are primary growth drivers.

Q2: How will patent expirations impact the market?

A2: The expiry of patents on branded formulations will increase generic competition, likely reducing prices and margins but also expanding access and volume sales.

Q3: What role do innovations in drug delivery play in future sales?

A3: Long-acting implants and sustained-release systems could improve patient adherence, enable premium pricing, and expand market share.

Q4: Which regions are expected to see the highest sales growth?

A4: Asia-Pacific and Latin America are expected to experience the highest growth rates, driven by healthcare infrastructure growth and increasing disease awareness.

Q5: What are the key challenges faced by companies marketing brimonidine tartrate?

A5: Competition from generics, regulatory delays in new formulations, and patient adherence issues are significant hurdles.

References

[1] World Health Organization. "Global data on visual impairment." 2021.

[2] Market Research Future. "Ophthalmic therapeutics market analysis." 2022.

More… ↓