Last updated: September 7, 2025

Introduction

Bimatoprost, a synthetic prostaglandin analog, is a prominent ophthalmic agent primarily used to treat open-angle glaucoma and ocular hypertension by reducing intraocular pressure (IOP). Since its FDA approval in 2001, bimatoprost has become an integral component of glaucoma management. Its market trajectory is shaped by technological advances, competitive landscape, regulatory influences, and emerging therapeutic uses. This report delves into the current market dynamics, future growth prospects, and the financial outlook for bimatoprost within the broader ophthalmic pharmaceutical sector.

Market Overview

Product Profile and Therapeutic Applications

Bimatoprost is marketed under brand names such as Lumigan (by Allergan/AbbVie) and extensively as a generic. Its primary indication is lowering IOP in patients with glaucoma or ocular hypertension. Its mechanism involves increasing uveoscleral outflow, effectively reducing the risk of optic nerve damage and preserving vision.

Beyond glaucoma, bimatoprost’s notable off-label use as a cosmetic solution—designed to enhance eyelash growth—has expanded its market scope, although regulation limits this application mainly to dermatological or cosmetic segments.

Current Market Size

The global ophthalmic drugs market was valued at approximately USD 16 billion in 2022, with glaucoma treatments constituting a significant component, estimated at over USD 7 billion (Grand View Research). Bimatoprost's share remains substantial due to its efficacy and market penetration, with annual sales exceeding USD 600 million, predominantly in North America, Europe, and Asia.

Market Drivers

Clinical Efficacy and Safety Profile

Bimatoprost’s longstanding presence in the market underscores its proven efficacy and safety, which enhances physician confidence and patient adherence. Its once-daily dosing regimen further promotes compliance, positively impacting market dynamics.

Growing Glaucoma Prevalence

The global burden of glaucoma is expected to increase from approximately 80 million cases in 2020 to over 111 million by 2040, driven by aging populations and urbanization. This demographic trend acts as a catalyst for sustained demand for intraocular pressure-lowering agents like bimatoprost.

Innovation and Formulation Improvements

Recent advances include preservative-free formulations and sustained-release delivery systems, aimed at improving tolerability and adherence. These innovations potentially extend the product lifecycle and open new revenue streams.

Market Expansion in Emerging Economies

Increasing healthcare expenditure in Asia-Pacific and Latin America broadens access to ophthalmic therapies, fueling growth. Local regulatory approvals and price competitiveness facilitate market entry for generics, intensifying competition but also expanding overall market size.

Market Challenges

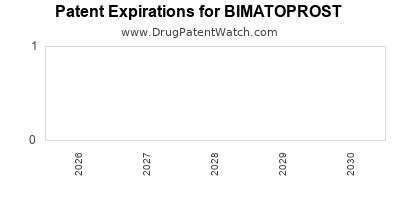

Patent Expirations and Generic Competition

Bimatoprost faced patent cliffs in recent years, notably as companies like Sandoz and Sun Pharmaceutical launched generic equivalents. Price erosion and market share redistribution are ongoing challenges, compelling brand manufacturers to innovate and differentiate.

Regulatory and Reimbursement Barriers

Variations in healthcare policies and reimbursement criteria across regions influence market access and pricing strategies. Delays in approvals for new formulations or indications can hinder rapid market penetration.

Adverse Events and Tolerance

Though generally well tolerated, ocular side effects such as hyperemia can impede patient adherence. Managing tolerability remains a focal point for clinicians and formulators.

Emerging Opportunities and Strategic Trends

Combination Therapies

The development of fixed-dose combinations integrating bimatoprost with other agents (e.g., timolol) has demonstrated superior efficacy and improved compliance, representing a significant growth avenue.

Cosmetic and Off-Label Applications

While off-label eyelash growth promotion has driven consumer demand, regulatory scrutiny limits this avenue. Nonetheless, marketing efforts in the cosmetic domain continue to indirectly support brand visibility.

Technological Innovations

Nanoparticle-based delivery systems, sustained-release implants, and minimally invasive surgical adjuncts are on the horizon, promising to enhance effectiveness and reduce dosing frequency.

Regulatory Trends

Regulatory agencies are emphasizing biosimilar and generic drug approvals, aiming to boost affordability while maintaining safety standards—factors influencing market entry strategies.

Financial Trajectory and Revenue Forecasts

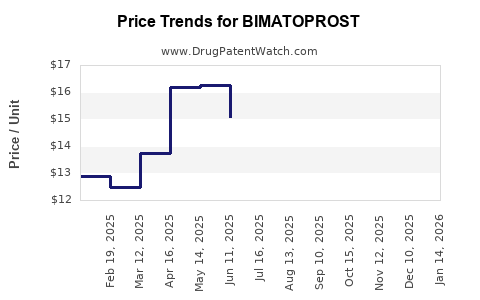

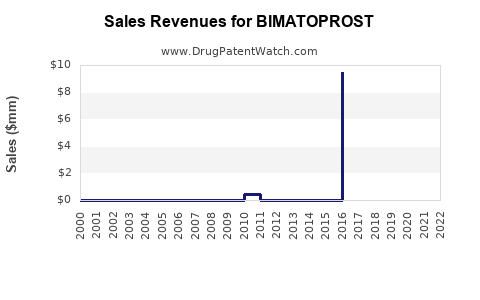

Historical Financial Performance

The last decade has seen stable growth for bimatoprost, with innovations and market expansion sustaining revenues despite generic challenges. The introduction of fixed-dose combinations and formulations contributed to incremental gains.

Future Revenue Projections

Analysts project a compound annual growth rate (CAGR) of approximately 3-5% for the glaucoma segment, influenced by rising prevalence and technological advancements. The favorable outlook is tempered by patent expirations, which may cause short-term revenue dips. Nonetheless, continued interest in fixed-dose combinations and innovative delivery methods counters potential declines.

Impact of Patent Dynamics

The expiration of key patents, such as Allergan’s Lumigan in specific markets, has led to a surge in generic competition, depressing prices and margins. However, brand manufacturers are compensating through value-added formulations, expanded indications, and marketing efforts.

Market Share & Competition

Major players like AbbVie (post-Astellas acquisition), Sandoz, and Sun Pharma hold significant shares. Their strategic focus on cost-effective generics and pipeline innovation will be critical to maintaining or growing their market position.

Emerging Markets and Revenue Diversification

Increased adoption in Asia-Pacific and Latin America offers considerable growth potential. Investment in localized manufacturing and tailored marketing strategies enables global companies to capitalize on these markets.

Regulatory and Patent Landscape

Patent Life and Litigation

Patent protections extending up to 2024 in key jurisdictions underscore impending generic entry. Patent litigation and licensing negotiations shape the competitive landscape.

Regulatory Approvals and Reimbursement Policies

Inclusion in national formularies and reimbursement schemes significantly influence market penetration and revenue streams. Regulatory harmonization efforts expedite approvals for innovative formulations and biosimilars.

Conclusion

Bimatoprost’s market remains resilient despite approximately two decades of commercial presence. Its growth prospects hinge on technological innovation, expanding global glaucoma prevalence, and strategic market diversification. While patent expirations and fierce generic competition present revenue challenges, ongoing product differentiation and emerging delivery systems are poised to sustain its financial trajectory.

In summary, stakeholders should focus on R&D investments for combination therapies and sustained-release formulations, leverage emerging markets, and navigate evolving patent and regulatory environments to optimize financial outcomes.

Key Takeaways

-

Growing Demand: Population aging and increased glaucoma prevalence underpin sustained demand for bimatoprost.

-

Competitive Landscape: Patent expirations have introduced price competition via generics, prompting innovation and formulatory diversification.

-

Innovation as a Differentiator: Fixed-dose combinations and advanced delivery methods enhance adherence and extend product lifecycles.

-

Emerging Markets Potential: Asia-Pacific and Latin America offer significant growth opportunities with improving healthcare infrastructure.

-

Strategic Focus: Success depends on balancing patent management, regulatory navigation, and continuous innovation to maintain market share and profitability.

FAQs

-

What are the main therapeutic uses of bimatoprost?

Bimatoprost is primarily used to lower intraocular pressure in patients with open-angle glaucoma and ocular hypertension. Off-label, it’s also used cosmetically to promote eyelash growth.

-

How have patent expirations affected bimatoprost's market?

Patent expirations have led to increased entry of generic competitors, causing price reductions and revenue declines for brand-name manufacturers. This has prompted innovation in formulations and combination therapies.

-

What upcoming innovations could influence bimatoprost’s market?

Developments include sustained-release implants, preservative-free formulations, and combination drugs aimed at improving adherence and clinical outcomes.

-

Which regions present the most growth opportunities for bimatoprost?

Asia-Pacific, Latin America, and parts of Europe are expanding markets due to rising glaucoma incidence and increasing healthcare spending.

-

What are the main challenges for bimatoprost’s future growth?

Key challenges include intense generic competition, regulatory hurdles, patent expiries, and managing side effects that may impact patient adherence.

References

- Grand View Research. (2022). Ophthalmic Drugs Market Analysis.

- FDA. (2001). Approval of Bimatoprost.

- Ophthalmic: Market Trends & Forecasts. (2022). Global Glaucoma Therapeutics.

- Statista. (2023). Global Glaucoma Patient Population.

- IQVIA. (2022). Ophthalmic Drugs Market Reports.