Last updated: July 27, 2025

Introduction

LUMIGAN (bimatoprost ophthalmic solution) is a prostaglandin analog used primarily to treat elevated intraocular pressure (IOP) and open-angle glaucoma. Since its approval by the FDA in 2001, LUMIGAN has established itself as a leading medication in the ocular hypertensive and glaucoma treatment sectors. Analyzing its market dynamics and financial trajectory provides insights into the broader ophthalmic pharmaceuticals landscape, competitive positioning, and future growth prospects.

Market Overview

The global glaucoma treatment market, driven principally by an aging population and increased awareness, is projected to reach USD 7.7 billion by 2027, growing at a CAGR of around 5.7% from 2020 to 2027 ([1]). LUMIGAN, as a prominent prostaglandin analog, accounts for a significant share within this segment, reflecting high prescription rates and manufacturer dominance.

In key markets such as the U.S., Europe, and Japan, LUMIGAN maintains a strong commercial presence owing to its efficacy and once-daily dosing. Market penetration is further supported by a broad patient base, including those with primary open-angle glaucoma and ocular hypertension.

Market Drivers

1. Aging Population and Increasing Glaucoma Prevalence

Global demographic shifts toward older populations create a steady rise in glaucoma incidence. The World Health Organization estimates that glaucoma affects over 76 million people worldwide, with primary open-angle glaucoma (POAG) being the most common subtype ([2]). As age remains a significant risk factor, this trend sustains demand for effective IOP-lowering therapies like LUMIGAN.

2. Advancements in Drug Delivery and Formulation

The development of once-daily prostaglandin analogs, including LUMIGAN, improves patient adherence, directly impacting market growth. Moreover, formulations with preservative-free options cater to increasing patient sensitivity concerns, enhancing market acceptance.

3. Competitive and Regulatory Environment

Patent expiration and the advent of generics or biosimilars influence market pricing and accessibility. Innovative formulations or combination products serve as strategic responses from manufacturers, impacting LUMIGAN’s market share.

Market Challenges

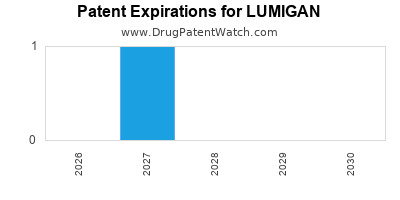

1. Patent Expiry and Generic Competition

LUMIGAN’s patent protection has expired in many jurisdictions, leading to the entry of generic equivalents. This shift sharply reduces drug pricing and margin, necessitating strategic diversification or innovation ([3]).

2. Side Effect Profile and Patient Tolerance

Common adverse effects such as iris pigmentation, eyelash growth, and conjunctival hyperemia may limit patient adherence and influence prescribing behaviors.

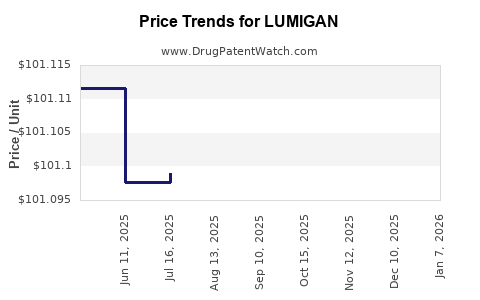

3. Pricing Pressures and Payer Landscape

Pricing pressures from insurers and health authorities, especially in developed markets, may constrain revenue growth. Cost containment efforts tend to favor generics and lower-cost alternatives.

Financial Trajectory and Revenue Outlook

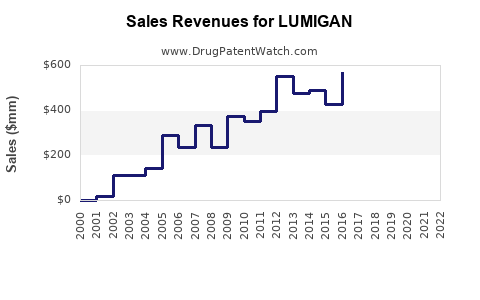

Historical Performance

Earnings reports from company disclosures (e.g., Allergan, now part of AbbVie) highlight that LUMIGAN traditionally generated annual revenues exceeding USD 1 billion globally at its peak, with the U.S. contributing a majority share. The product’s sales trajectory was robust until patent expiry and market entry of competitors.

Post-Patent Strategies

To counteract patent loss, manufacturers have introduced new formulations or combination therapies, such as LUMIGAN + Timolol, which command premium pricing and retain market share. For example, the launch of LUMIGAN Eye Drops in combination with other IOP-lowering agents (~2010s) helped sustain revenues.

Impact of Generic Entry

Following patent expiration, the influx of generics has led to a sharp decline in LUMIGAN’s per-unit price in many markets. However, ongoing efforts, including expanding indications (e.g., hypotrichosis via lash enhancement) and innovative formulations, aim to regain revenue streams.

Forecast and Growth Opportunities

The future revenue trajectory hinges on several factors:

- Market Penetration of Biosimilars: Expected expansion into biosimilar prostaglandins could reduce prices but also broadens accessibility.

- Emergence of Novel Delivery Technologies: Sustained investment in sustained-release implants (e.g., iDose or micro-injectables) could revolutionize therapy adherence and open new markets.

- Orphan Drug Designations and New Indications: Potential expansion into other ophthalmic conditions may unlock new revenue channels.

Industry forecasts suggest that while initial growth post-patent expiry is challenging, strategic innovations could stabilize or even increase LUMIGAN’s market value in the mid-to-long term.

Competitive Landscape

LUMIGAN’s primary competitors include other prostaglandin analogs like latanoprost (Xalatan), travoprost, and tafluprost, alongside beta-blockers, combination therapies, and laser procedures. Generics of Xalatan and generic equivalents of LUMIGAN have gained prominence, intensifying price competition ([4]).

Emerging therapies, such as Rho kinase inhibitors (e.g., netarsudil), may challenge prostaglandin analogs in future market shares, although these tend to target different patient subsets or disease stages.

Regulatory and Patent Considerations

Patent protections for LUMIGAN expired in major jurisdictions in the late 2010s, prompting increased generic competition. The strategic patent filings for new formulations or combination products serve as key defensive measures. Regulatory pathways for biosimilars and drug-device combination products also influence future market dynamics.

Conclusion

LUMIGAN remains a cornerstone treatment within glaucoma pharmacotherapy, having demonstrated sustained efficacy and patient adherence advantages. However, patent expiration and market saturation by generics have compressed its revenue margins. Future growth depends on innovation in drug delivery, formulation, and expanding therapeutic indications.

Industry stakeholders should monitor regulatory developments, patent statuses, and emerging technologies to optimize investment and market strategy. The continued evolution of the ophthalmic market, driven by demographic trends and technological innovation, suggests that LUMIGAN’s financial trajectory will be characterized by adaptation rather than decline.

Key Takeaways

- Market Growth: The global glaucoma treatment market is projected to grow steadily (~5.7% CAGR), supporting demand for established therapies like LUMIGAN.

- Patent Expiry Impact: Patent expiration has introduced significant generic competition, reducing prices and margins.

- Innovation as Survival Strategy: Formulation innovations, combination therapies, and new indications are critical to sustaining revenue streams.

- Technological Advancements: Long-term growth may hinge on advanced delivery systems, such as sustained-release implants and gene therapies.

- Competitive Positioning: Navigating a crowded market with numerous generics and emerging therapies requires strategic agility.

FAQs

1. How has patent expiration affected LUMIGAN’s market share?

Patent expiration led to the entry of generic versions, significantly reducing sales revenue and market share dominance for the original branded product.

2. What are the primary competitors to LUMIGAN?

Major competitors include other prostaglandin analogs like latanoprost (Xalatan), travoprost, and tafluprost, as well as combination therapies and emerging novel agents.

3. Are there any new formulations or indications for LUMIGAN?

Yes, efforts focus on preservative-free formulations, combination drugs, and off-label uses such as lash enhancement for cosmetic purposes, which may expand its applications.

4. What role do technological innovations play in LUMIGAN’s future?

Innovations like sustained-release implants and bioengineered delivery systems aim to enhance adherence, reduce dosing frequency, and open new markets.

5. How is the ophthalmic pharmaceutical market expected to evolve?

It will likely see increased competition from biosimilars, technological advancements in delivery systems, and potential shifts toward personalized and gene-based therapies.

References

[1] Grand View Research. (2020). Glaucoma Therapy Market Size & Trends.

[2] WHO. (2020). Global Data on Visual Impairment and Blindness.

[3] FDA. (2021). Drug Patent and Exclusivity Data.

[4] IMS Health. (2019). Ophthalmic Market Competitive Landscape.