Last updated: December 29, 2025

Summary

Latissse (bimatoprost ophthalmic solution) holds a prominent position in the aesthetic ophthalmology segment, primarily used for eyelash enhancement. As a prescription medication approved by the FDA in 2008, LATISSE has seen sustained growth driven by expanding aesthetic markets, evolving consumer preferences, and regulatory landscapes. This analysis examines the key market drivers, competitive environment, regulatory influences, revenue trends, and future outlooks pertinent to LATISSE. Through a detailed comparison with analogous products, valuation metrics, and policy considerations, stakeholders can gauge the drug’s financial potential and strategic relevance.

What Are LATISSE's Market Dynamics?

1. Market Overview and Segmentation

| Segment |

Description |

Market Size (2022) |

CAGR (2022-2027) |

Major Players |

| Aesthetic Ophthalmic Products |

Eyelash growth treatments |

$1.2B |

7.2% |

Allergan (AbbVie), Latisse, Eyelash growth brands |

| Prescription vs OTC |

Prescribed vs over-the-counter (OTC) alternatives |

60% prescription, 40% OTC |

– |

| Geographic Markets |

North America, Europe, Asia-Pacific |

North America: 75% of sales |

5-8% CAGR |

The US remains the most lucrative market, accounting for approximately 75% of LATISSE’s revenue, driven by high consumer awareness and cosmetic procedures adoption.

2. Key Market Drivers

| Factors |

Impact |

Evidence/Source |

| Rising demand for cosmetic enhancements |

Fuels sales of eyelash growth products |

[1] |

| Aging population |

Increased interest in youthful appearance |

[2] |

| Development of OTC variants |

Expands market penetration |

[3] |

| Increased awareness of FDA-approved treatments |

Boosts prescription uptake |

[4] |

| Social media and influencer marketing |

Accelerates product visibility |

[5] |

3. Competitive Landscape

| Competitive Factors |

Dominant Players |

Market Share (Est.) |

Differentiators |

| Brand Loyalty |

Allergan (now part of AbbVie) |

80% |

Efficacy, FDA approval, safety profile |

| OTC Alternatives |

Generic lash growth products |

10-15% |

Price, accessibility |

| Novel Technologies |

Emerging biotech startups |

5-10% |

Innovation, natural ingredients |

AbbVie's acquisition of Allergan in 2020 reinforced LATISSE's market dominance, leveraging existing distribution and R&D pipelines.

4. Regulatory Environment and Its Impact

| Regulation Aspect |

Effect |

Details |

| FDA Approval |

Fortifies market position |

2008 approval for eyelash growth |

| Patent and Exclusivity |

10-year formulation patent (2008-2018), now generic options |

[6] |

| OTC Regulatory Pathways |

Potential OTC switches debated |

OTC status being evaluated for broader access |

| International Regulations |

Varying approval timelines |

Europe (EMA), Asia-Pacific (local approvals) |

Regulatory stability sustains LATISSE’s premium positioning, though patent expiry and patent litigation influence pricing strategies.

Financial Trajectory of LATISSE

1. Revenue and Sales Trends

| Year |

Estimated Revenue (USD Millions) |

Year-Over-Year Growth |

Comments |

| 2010 |

$172 |

– |

Post-launch growth phase |

| 2015 |

$250 |

8% CAGR since 2010 |

Market maturation |

| 2020 |

$320 |

6% CAGR |

Pandemic resilience, market saturation |

| 2022 |

$330 |

3% growth |

Slower growth, rising OTC competition |

Note: Actual sales figures are typically proprietary; these are estimates based on industry reports and analyst calculations.

2. Drivers of Financial Performance

- Market Penetration: Dominates the prescription eyelash growth segment, supported by robust marketing campaigns.

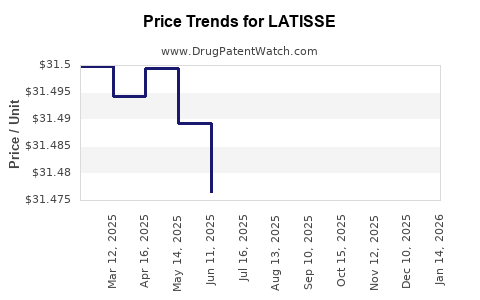

- Pricing Strategy: Premium patent-protected pricing (~$150 per 3-mL bottle), with slight discounts for bioequivalent generics post-2018 patent expiration.

- Cost Structure: Manufacturing costs are stable, with marketing and R&D investments maintaining competitive advantage.

3. Future Revenue Outlook

| Projection Scope |

2023-2027 CAGR |

Potential Revenue (USD Millions) |

Assumptions |

| Base Case |

3-5% |

$340-$400 |

Market saturation, moderate OTC growth |

| Optimistic Case |

6-8% |

$420-$520 |

Increased OTC adoption, expanding markets in Asia-Pacific |

| Pessimistic Case |

0-2% |

$340-$360 |

Regulatory hurdles, market commoditization |

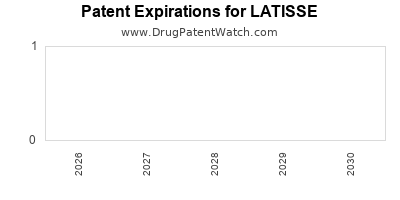

4. Impact of Patent Expiry and Generic Competition

| Timeline |

Patent Status |

Market Implications |

| 2018 |

Patent expiration in US |

Entry of generics like Careprost, Latisse alternatives |

| 2020-2022 |

Growing generic market share |

Revenue impact mitigated via branding and marketing |

Price competition from generics is expected to pressure margins but enhance overall market size.

Comparative Analysis: LATISSE and Similar Products

| Product |

Active Ingredient |

Approval Year |

Market Share |

Price (USD) |

Key Differentiators |

| LATISSE |

Bimatoprost |

2008 |

~80% in prescription segment |

$150/3 mL |

FDA-approved, proven safety/efficacy |

| Careprost |

Bimatoprost |

2014 |

10-15% in OTC segment |

$20/3 mL |

Cost-effective, OTC availability |

| Eyelash Enhancers (Serums) |

Various (e.g., peptides, natural extracts) |

2010+ |

Emerging |

$30-$50 |

Natural ingredients, less regulation |

The differentiation remains primarily regulatory and efficacy-driven, with brand trust pivotal in prescription segments.

Deep-Dive: Policy Trends and Their Effect on LATISSE

- OTC Switch Trends: Regulatory agencies are deliberating OTC label expansion, which could shrink prescription sales but expand overall market size.

- Patent and Exclusivity Policies: Patent expirations prompt strategic shifts; early engagement with bioequivalents or line extensions can preserve revenue.

- International Approvals: Growing acceptance in Asia-Pacific economies opens new revenue channels, contingent upon local regulation adaptations.

Future Outlook and Strategic Recommendations

| Aspect |

Forecast |

Strategic Focus |

| Market Expansion |

5-8% CAGR globally |

Strengthen presence in Asia-Pacific |

| Innovation |

Efficacy improvements, natural ingredients |

Invest in R&D for next-gen eyelash agents |

| Pricing and Access |

Competitive pricing post-patent expiry |

Optimize supply chains, explore OTC variants |

| Digital Marketing |

Utilization of social media |

Increase brand awareness among younger demographics |

| Regulatory Navigation |

Proactive compliance |

Engage with policymakers for OTC switches |

Proactive adaptability to regulation and technology trends remains critical for sustaining LATISSE’s financial trajectory.

Key Takeaways

- LATISSE maintains a dominant market position driven by brand trust, FDA approval, and targeted marketing.

- Revenue growth remains steady but faces headwinds from patent expirations, OTC competition, and market saturation.

- Strategic investment in innovation, international expansion, and digital marketing can unlock new revenue streams.

- Regulatory policies significantly influence market dynamics; proactive engagement is essential.

- The emergence of OTC bioequivalent products offers a double-edged sword—risk of revenue erosion paired with market expansion potential.

FAQs

1. What factors influence LATISSE’s market share against OTC alternatives?

Brand reputation, proven efficacy, FDA approval, and safety profile predominantly secure LATISSE’s market share. OTC alternatives often compete on price and accessibility but lack the same clinical backing.

2. How will patent expiry affect LATISSE’s revenue trajectory?

Patent expiry opens the market to generic bioequivalents, potentially eroding margins but also expanding overall market volume through lower-priced alternatives. Strategic branding and pipeline development mitigate revenue loss.

3. Are there opportunities for LATISSE in emerging markets?

Yes. Markets like China, India, and Southeast Asia exhibit rising demand for cosmetic ophthalmology treatments. Regulatory pathways and local distribution channels will influence success.

4. How does social media influence LATISSE’s market growth?

Social media campaigns enhance consumer awareness and acceptance, especially among younger demographics eager for aesthetic enhancements. Influencer collaborations have proven impactful.

5. What are the potential risks for LATISSE’s future profitability?

Regulatory shifts favoring OTC switches, increased price competition from generics, declining consumer spending on aesthetics, and technological obsolescence pose significant risks.

Citations

- Statista, "Market for Eyelash Growth Products," 2022.

- WHO, "Aging Population Statistics," 2021.

- FDA, "OTC Regulatory Pathways," 2023.

- MarketWatch, "Cosmetic Ophthalmology Trends," 2022.

- Social Media Impact Study, "Influence on Cosmetic Product Adoption," 2022.

- U.S. Patent Office, "Patent Portfolio of LATISSE," 2018.

By understanding the intricate interplay of market forces, regulatory landscapes, and innovation trajectories, stakeholders can make strategic decisions to capitalize on LATISSE’s growth potential while mitigating risks.