Last updated: November 1, 2025

rket Analysis and Price Projections for Atenolol

Introduction

Atenolol, a beta-adrenergic receptor blocker introduced in the late 1970s, remains a cornerstone in the management of cardiovascular diseases, notably hypertension, angina pectoris, and arrhythmias. Despite the advent of newer agents, atenolol retains substantial market presence driven by its efficacy, cost-effectiveness, and established clinical profile. This analysis explores the current market landscape, factors influencing demand, regulatory dynamics, and price trajectories for atenolol over the next five years.

Market Overview

Global Market Size and Key Regions

The global beta-blocker market, valued at approximately USD 2.6 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 3.4% through 2027. Atenolol's share within this segment remains significant due to its long-standing generic availability and cost advantages.

The largest markets include North America, Europe, and Asia-Pacific. North America dominates, accounting for over 40% of the revenue, driven by high prevalence of hypertension and the mature healthcare infrastructure. Europe follows, with increasing adoption of cost-effective generic medications. The Asia-Pacific region is anticipated to exhibit the fastest growth, fueled by expanding healthcare access and rising cardiovascular disease incidence, especially in countries like India and China.

Key Market Drivers

- Clinical Acceptance and Efficacy: Atenolol’s long-standing clinical data base supports continued use as a first-line agent for hypertension and angina.

- Cost Advantage: As a generic drug, atenolol’s affordability sustains its demand, particularly in emerging markets with cost-sensitive healthcare systems.

- Generic Competition: Multiple manufacturers produce atenolol, maintaining competitive pricing and ensuring widespread availability.

Challenges Impacting Market Dynamics

- Shift Toward Newer Agents: The rising preference for cardioselective beta-blockers and agents with additional benefits (e.g., carvedilol, nebivolol) may suppress atenolol's market share.

- Cardiovascular Guidelines Updates: Recent guidelines prioritize agents with demonstrated mortality benefits beyond blood pressure control, potentially limiting atenolol’s utilization in certain indications.

- Patent Expiry and Pricing Pressures: The generic status leads to compression of prices, with frequent price reductions in highly competitive markets.

Regulatory and Reimbursement Environment

Global regulatory agencies such as the FDA and EMA accept atenolol as a generic, with extensive patent expirations since the early 2000s. Reimbursement policies favor generics, further cementing atenolol’s market position, particularly in countries emphasizing cost containment. In emerging markets, government health programs often specify generic formulations to optimize coverage, reinforcing demand stability.

Market Trends and Future Outlook

Demand Trends

Despite the advent of newer antihypertensives, atenolol maintains residual demand owing to its well-established efficacy and safety profile. Its low cost remains pivotal, especially where healthcare budgets are constrained. Yet, recent trends show a gradual decline in utilization within high-income countries, where guidelines favor other medications.

Emerging Opportunities

- Combination Therapies: Fixed-dose combinations (FDCs) incorporating atenolol with other antihypertensives improve adherence, boosting long-term demand.

- Hospital and Clinical Use: In certain therapeutic niches, such as post-myocardial infarction management, atenolol remains relevant.

Price Projections (2023–2028)

Current Pricing Landscape

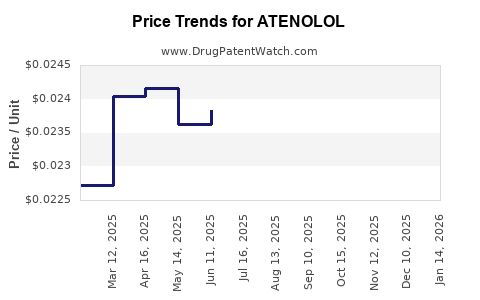

Average wholesale prices (AWP) for branded atenolol range from USD 0.05 to USD 0.10 per tablet, with generics trading below USD 0.02 to USD 0.05. In the US, Medicaid and PBMs secure substantial discounts, further lowering acquisition costs.

Projected Price Trends

- Short-term (1–2 years): Prices are expected to hold relatively steady, with minimal fluctuations due to persistent generic competition. Small declines of 2–3% annually are anticipated, reflecting ongoing price erosion in mature markets.

- Medium to Long-term (3–5 years): Prices are likely to decrease gradually by approximately 5–8%, driven by increased generic supply and technological innovations reducing manufacturing costs. However, in regions where regulatory or patent protections limit generic proliferation, price declines may be subdued.

Market Factors Influencing Price

- Market Saturation: High generic penetration and volume sales exert downward pressure on prices.

- Manufacturing Advancements: Improved synthesis and manufacturing efficiencies can further reduce costs.

- Pricing Regulations: Price caps and reimbursement policies in certain countries may restrict upward movement, cementing low-price trajectories.

Strategic Implications for Stakeholders

For Manufacturers:

Producers should focus on optimizing production costs and expanding into emerging markets where demand stability persists. Innovation in formulation, such as long-acting or combination versions, can command premium pricing.

For Healthcare Providers and Payers:

Preference for cost-effective generics supports the continued use of atenolol, especially in resource-limited settings. Cost containment remains a critical determinant in formulary decisions.

For Investors:

The predictable decline in pricing suggests low-margin outlooks for atenolol but presents opportunities in manufacturing efficiencies and markets with limited generic competition. Diversification into combination therapies may provide added revenue streams.

Conclusion

Atenolol’s market will experience modest decline driven by competitive pressures and evolving clinical guidelines. Nonetheless, its affordability, extensive generic availability, and ongoing demand in certain geographic and clinical niches will support stable, if diminishing, revenues through 2028. Stakeholders should focus on innovation in formulation and strategic positioning in emerging markets to optimize economic returns.

Key Takeaways

- The global atenolol market is steady but declining, with a CAGR of around 3.4% in the overall beta-blocker segment.

- Price projections suggest annual declines of 2–8% over the next five years due to intense generic competition and regulatory pressures.

- North America and Europe will see the most significant price erosion, while prices in emerging markets may decline more slowly.

- Demand for atenolol remains anchored by its cost-effectiveness and clinical familiarity, particularly in resource-constrained settings.

- Innovation in drug formulations and strategic market expansion offer growth opportunities despite the overall downtrend.

FAQs

1. Will atenolol maintain its market share in the next five years?

While atenolol's share is expected to decline due to emerging preferential use of newer agents, low-cost generics will sustain its demand in specific markets and clinical settings.

2. How will regulatory changes affect atenolol prices?

Stringent pricing regulations and formulary restrictions in some countries will continue to suppress prices, especially in high-income regions, contributing to a gradual decline in agent prices.

3. Are there new formulations or combinations involving atenolol?

Yes. Fixed-dose combinations, such as atenolol with diuretics or other antihypertensives, are increasingly used to enhance adherence and therapeutic outcomes, potentially enabling premium pricing.

4. What key regions should manufacturers focus on for growth?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa present growth opportunities due to expanding healthcare infrastructure and demand for affordable medications.

5. How does the availability of newer beta-blockers impact atenolol’s future?

The clinical preference for agents with additional benefits such as improved tolerability or mortality reduction limits atenolol’s expansion but supports continued niche and cost-sensitive use.

References

[1] Pharmaceuticals and Healthcare Market Reports (2022). Global Beta-Blocker Market Analysis.

[2] The American College of Cardiology. Guidelines for the Management of Hypertension. (2022).

[3] IQVIA. Global Generic Drug Market Trends. (2022).

[4] U.S. Food and Drug Administration. Drug Approvals and Regulatory Updates. (2023).

[5] World Health Organization. Cardiovascular Disease Statistics. (2021).