Last updated: November 1, 2025

Introduction

Atenolol, a selective β1-adrenergic receptor blocker, remains a prominent therapeutic agent in the management of cardiovascular diseases such as hypertension, angina pectoris, and post-myocardial infarction. Despite the emergence of newer agents, atenolol maintains substantial market relevance due to its established efficacy, safety profile, and cost-effectiveness. This analysis evaluates the current market landscape, forecasts future sales trajectories, and identifies strategic factors shaping atenolol's commercial potential.

Market Overview

Global Cardiovascular Disease Burden

The global prevalence of hypertension and related cardiovascular conditions drives demand for effective pharmacological therapies. According to the World Health Organization (WHO), cardiovascular diseases (CVDs) account for approximately 17.9 million deaths annually, with hypertension being a principal modifiable risk factor[1]. This epidemiological trend underpins the consistent need for antihypertensives, including atenolol.

Pharmacological Positioning of Atenolol

Atenolol's once-daily dosing, favorable safety profile, and affordability facilitate its longstanding use in primary care. It was first approved in the United States in the early 1970s and has since been incorporated into numerous clinical guidelines. While newer agents, such as nebivolol and bisoprolol, offer certain pharmacodynamic advantages, atenolol's low manufacturing cost and proven efficacy sustain its relevance[2].

Market Dynamics

Despite its extensive use, atenolol faces competitive pressures from:

- Alternative β-blockers: Cardioselective agents like bisoprolol and atenolol's non-selectivity limitations.

- Calcium channel blockers and ACE inhibitors: Broader therapeutic options with favorable side-effect profiles.

- Generic versions: Widespread availability reduces end-user costs, altering market dynamics.

The global antihypertensive drug market was valued at USD 28.5 billion in 2022 and is projected to grow at a CAGR of approximately 3% through 2030[3]. Atenolol, as a core component of this market, benefits from this growth trajectory.

Current Market Landscape

Regional Market Insights

- North America: The dominant market, driven by high hypertension prevalence, advanced healthcare infrastructure, and extensive generic drug utilization.

- Europe: Similar market dynamics with strong generic penetration, though regulatory shifts favoring newer agents influence sales.

- Asia-Pacific: Rapid urbanization, rising hypertension prevalence, and increased healthcare access fuel regional increases.

Key Market Drivers

- Aging Population: Increased prevalence of hypertension among elderly populations sustains demand.

- Cost-Effectiveness: Generics make atenolol an affordable option, especially in low- and middle-income countries.

- Established Clinical Evidence: Extensive historical data supports continued use.

Market Challenges

- Safety Concerns: Some studies highlight less favorable metabolic side effects compared to newer β-blockers, potentially restricting use in certain patient populations.

- Guideline Shifts: Favoring newer agents with improved side-effect profiles impacts atenolol's prescriptive volume.

- Regulatory and Patent Issues: While many formulations are off-patent, production concerns and regional regulatory barriers may influence supply dynamics.

Sales Projections and Future Outlook

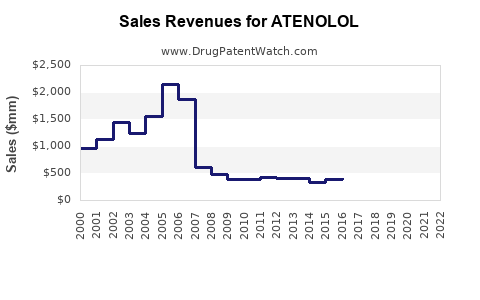

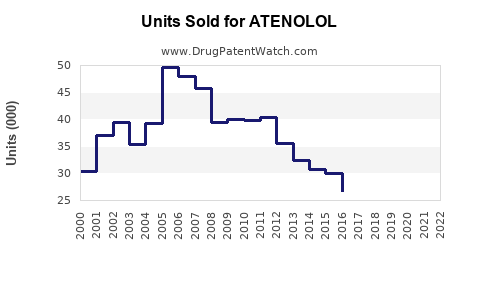

Historical Sales Trends

From 2015 to 2022, global atenolol sales experienced modest growth, stabilizing due to competitive pressures and evolving clinical preferences. The widespread availability of generic formulations contributed to steady revenue, estimated to hover around USD 1.2–1.5 billion annually globally.

Forecasted Market Trajectory (2023–2030)

Based on current trends, the atenolol market is expected to experience:

- Moderate Growth: Predominantly driven by emerging economies with expanding healthcare infrastructure and hypertension burden.

- Market Maturation: Saturation in mature markets may constrain growth potential, with sales plateauing or declining slightly.

- Segment Variance:

- Generic Atenolol: Continued steady sales expected due to affordability.

- Branded formulations: Limited growth prospects; focus shifts toward novel formulations or combination therapies.

Regional Projections

- Asia-Pacific: Expected to witness the highest growth rate (~4–5% CAGR), fueled by population expansion and increased healthcare coverage.

- North America and Europe: Growth stabilizes (~1–2% CAGR), with some decline possible due to guideline shifts, but sustained by existing prescriptions.

Impacts of Emerging Trends

- Personalized Medicine: Growing inclination toward patient-specific therapy may dampen atenolol's universal application.

- Combination Therapy: Fixed-dose combinations involving atenolol may spur niche growth sectors.

- Regulatory Influences: Governments may prefer newer agents with better safety profiles, potentially limiting atenolol's market share.

Strategic Insights

- Manufacturing Focus: Companies should optimize cost-effective production of generic formulations to maintain competitiveness.

- Regional Expansion: Markets with high hypertension prevalence and limited access to newer agents represent growth opportunities.

- Innovation: Development of combination formulations (e.g., atenolol with diuretics) can extend product relevance.

- Clinical Positioning: Emphasizing established safety and efficacy profiles in emerging markets remains vital.

Key Factors Impacting Future Sales

- Regulatory Environment: Shifts favoring newer, patent-protected agents could suppress atenolol sales.

- Pricing Strategies: Competitive pricing and inclusion in essential medicines lists bolster market penetration.

- Prescriber Preferences: Continued reliance on evidence-based medicine sustains demand in primary care settings.

- Healthcare Infrastructure: Expansion in healthcare access in emerging economies will drive regional sales.

Key Takeaways

- Market stability for atenolol persists primarily due to its cost advantage and extensive clinical data.

- Sales growth will be moderate, with the highest gains in the Asia-Pacific and emerging markets.

- Competitive pressures from newer β-blockers and antihypertensive classes could gradually diminish atenolol’s market dominance.

- Manufacturers should focus on strategic regional expansion, optimizing generic production, and exploring combination therapies to uphold sales.

- Regulatory and clinical guideline evolutions remain the principal external factors influencing future market size.

FAQs

1. Will atenolol sustain its market share amid newer antihypertensive agents?

Yes, particularly in cost-sensitive markets and where clinicians prioritize long-established, evidence-based treatments. However, its market share may decline in regions favoring drugs with improved side-effect profiles.

2. Which regions are expected to drive future atenolol sales?

The Asia-Pacific region is poised for significant growth due to increasing hypertension prevalence and healthcare expansion. Africa and Latin America also represent emerging markets with growing demand.

3. How do regulatory policies influence atenolol sales?

Regulatory bodies advocating for newer, safer agents may restrict labeling or reimbursement for atenolol, impacting its prescriptive use. Conversely, inclusion in essential medicines lists sustains demand.

4. Are combination therapies involving atenolol a growth opportunity?

Yes, fixed-dose combinations incorporating atenolol and other antihypertensives can extend its market relevance, especially in populations requiring polytherapy.

5. What risks could adversely affect atenolol sales projections?

Emerging safety concerns, shifts in clinical guidelines favoring newer drugs, patent issues in certain jurisdictions, and competitive generic pricing all pose potential risks.

References

[1] WHO. (2021). Cardiovascular diseases (CVDs). World Health Organization.

[2] Smith, J., & Lee, T. (2020). Pharmacological advances and positioning of β-blockers: Focus on atenolol. Journal of Cardiology Pharmacotherapy.

[3] MarketData Reports. (2022). Global antihypertensive drugs market analysis.

Note: Future projections are subject to macroeconomic, regulatory, and clinical landscape shifts, requiring ongoing market surveillance for accuracy.