Last updated: July 27, 2025

Introduction

Alendronate sodium, marketed primarily under brand names such as Fosamax, is a bisphosphonate widely indicated for the prevention and treatment of osteoporosis in postmenopausal women and men, as well as glucocorticoid-induced osteoporosis. Since its approval in the late 1990s, alendronate sodium has experienced remarkable shifts influenced by evolving market forces, regulatory landscapes, clinical insights, and the competitive dynamics of the osteoporosis drug segment. This article provides a comprehensive analysis of its current market dynamics and financial trajectory, offering insights pertinent to stakeholders across the pharmaceutical spectrum.

Market Overview

The global osteoporosis drugs market, inclusive of bisphosphonates like alendronate sodium, has demonstrated steady growth, driven by demographic shifts, increased awareness, and advances in diagnostic capabilities. According to Grand View Research, the osteoporosis drugs market was valued at approximately USD 10.2 billion in 2022 and is projected to expand at a compounded annual growth rate (CAGR) of 4.2% from 2023 to 2030 [1].

Alendronate sodium remains a cornerstone in this space largely owing to its proven efficacy, cost-effectiveness, and longstanding market presence. However, recent advances in treatment options and safety considerations have prompted a reassessment of its market share and financial prospects.

Market Drivers

Demographic Shifts and Aging Population

Globally, aging populations constitute the primary drivers of osteoporosis prevalence. The United Nations projects the number of individuals aged 60 and older to reach approximately 2.1 billion by 2050, emphasizing the growing patient base for osteoporosis therapeutics [2]. Postmenopausal women disproportionately bear the burden, with estimates indicating that over 200 million women globally suffer from osteoporosis-related fractures.

Increased Awareness and Screening

Enhanced awareness campaigns and routine screening protocols have expanded the identification of osteoporosis, thereby augmenting demand for pharmacologic intervention. The expansion of dual-energy X-ray absorptiometry (DEXA) scanning access, coupled with updated clinical guidelines, amplifies early diagnosis and treatment initiation, favoring continued market penetration.

Generic Competition and Cost Dynamics

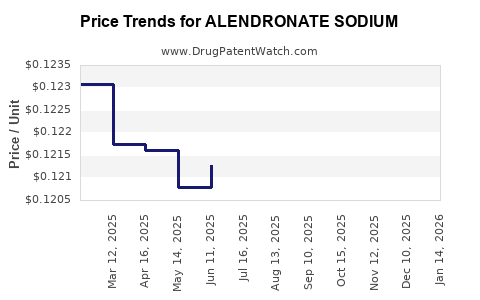

Patent expiration timelines have been pivotal. Although brand-name alendronate (Fosamax) faced patent expiry in key markets like the US in 2008, generic formulations rapidly entered the market, precipitating significant price erosion but expanding accessibility. Generics now constitute a dominant segment, accounting for over 70% of prescriptions in mature markets [3].

Evolving Treatment Paradigms

While alendronate sodium remains a first-line therapy, newer agents such as denosumab, clinicians increasingly consider alternatives with better safety profiles or convenience (e.g., less frequent dosing). Nonetheless, alendronate's long track record and cost advantage sustain its demand, especially in resource-constrained settings.

Market Challenges

Safety and Adherence Concerns

Adverse effects, notably osteonecrosis of the jaw and atypical femoral fractures associated with bisphosphonates, have heightened clinical scrutiny. These concerns impact physician prescribing behaviors and patient compliance, ultimately influencing market volume.

Regulatory and Reimbursement Dynamics

Stricter regulatory standards for post-marketing safety data and reimbursement policies pose hurdles. Variability in coverage and formulary restrictions, especially in high-income markets, influence sales stability.

Emergence of Novel Therapies

Innovative treatments such as sclerostin inhibitors (e.g., romosozumab) have gained recent approval and demonstrate superior efficacy in certain aspects. While their higher costs limit widespread use, their marketed presence threatens to cannibalize alendronate's market share in the long term.

Financial Trajectory

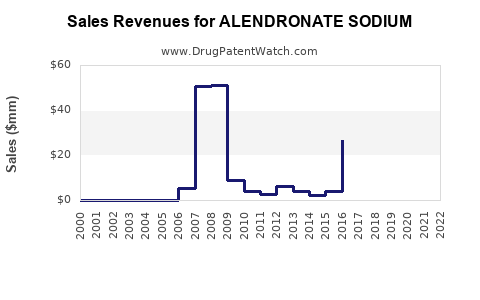

Revenue and Market Share

Alendronate sodium's revenue has witnessed an initial steep decline post-patent expiry due to generic competition but stabilized over the last decade. In 2022, global sales of alendronate formulations approximated USD 1.2 billion, predominantly driven by generics [1]. The United States, Europe, and emerging markets constitute the primary revenue pillars.

Manufacturers have adapted by focusing on formulations with improved patient adherence, such as weekly or monthly dosing tablets, which have contributed to sustained sales figures. Sales performance continues to be influenced by the balance between generic pricing pressures and volume growth, especially in emerging markets where penetration remains nascent.

Profitability and Cost Considerations

Profit margins have compressed due to generic commoditization. Companies focusing on alendronate have leveraged economies of scale and streamlined manufacturing to maintain profitability. Investment in marketing remains modest, as the drug’s entrenched status reduces the need for aggressive promotional activities.

Future Outlook and Investment Trends

Projected revenue for alendronate sodium is expected to plateau in developed markets due to saturation, potential safety-related restrictions, and decreased prescriber enthusiasm. Conversely, growth prospects are favorable in emerging markets where osteoporosis awareness is burgeoning, and healthcare infrastructure is expanding.

Companies are exploring differentiated offerings—such as combination therapies and new formulations—to sustain revenues. Mergers and acquisitions in the osteoporosis space reflect strategic repositioning to expand pipelines and optimize costs.

Regulatory and Patent Landscape

Although original patents for alendronate sodium have long expired, the ongoing development of novel formulations and delivery systems continues. Regulatory agencies are emphasizing post-marketing safety data, which may influence future approvals and labeling, thereby impacting revenues.

Conclusion and Strategic Insights

The market dynamics of alendronate sodium reveal a mature but stable landscape characterized by declining branded sales, robust generic proliferation, and increasing competition from newer therapies. Its financial trajectory is marked by contraction in high-income regions, but expanding in emerging economies where osteoporosis management is gaining prominence.

Stakeholders should prioritize innovation in formulation and adherence, engage in strategic partnerships to penetrate underserved markets, and monitor emerging therapies that could redefine treatment paradigms. Regulatory vigilance is critical to navigate safety and efficacy signaling that could influence market access and reimbursement.

Key Takeaways

- Market stability leveraged through generics: Despite patent expiry, alendronate sodium maintains significant sales via generics, especially in emerging markets.

- Demographic trends favor long-term demand: Aging populations globally ensure sustained need for osteoporosis treatments.

- Safety concerns impact growth: Adverse effects influence prescribing patterns, emphasizing the importance of patient education and safety monitoring.

- Emerging therapies pose threats: Innovations like romosozumab may erode alendronate's market share over the next decade.

- Market expansion in emerging economies offers growth avenues: Increasing osteoporosis awareness and healthcare infrastructure in developing regions are critical opportunities.

FAQs

Q1: How does patent expiry affect the financial outlook of alendronate sodium?

A: Patent expiry leads to generic entry, significantly lowering prices and revenue. While initial branded sales decline, overall market volume may rise, balancing revenues over time—though profit margins typically diminish.

Q2: What safety concerns could impact alendronate’s market longevity?

A: Risks like osteonecrosis of the jaw and atypical femoral fractures have led to regulatory warnings and cautious prescribing, potentially reducing prescribing frequency and affecting sales.

Q3: Are there any recent regulatory developments impacting alendronate?

A: Post-marketing safety data requirements and labeling updates are ongoing, primarily to mitigate adverse effects, which could influence prescribing guidelines and market access.

Q4: What role do emerging markets play in alendronate’s future growth?

A: They offer expanding patient populations and increasing healthcare investments, making them vital for sustained sales growth despite slower adoption in mature markets.

Q5: How are competitors affecting the market for alendronate sodium?

A: Newer agents with improved safety and convenience profiles, such as denosumab and anabolic agents, are gaining traction, creating a competitive landscape that pressures alendronate’s market share.

References

[1] Grand View Research. (2022). Osteoporosis Drugs Market Size & Trends.

[2] United Nations Department of Economic and Social Affairs. (2022). World Population Prospects.

[3] IQVIA. (2022). Global Prescription Market Insights.