Last updated: July 29, 2025

Introduction

FOSAMAX (generic name: alendronate sodium) is a bisphosphonate widely prescribed for osteoporosis management and the prevention of fracture risk in postmenopausal women and other at-risk populations. Since its development by Merck & Co., Inc., and subsequent generic availability, FOSAMAX has become a pivotal product within the global osteoporosis treatment landscape. This report examines the evolving market dynamics, regulatory influences, competitive environment, and the financial trajectory shaping FOSAMAX’s future role.

Market Landscape and Demand Drivers

The global osteoporosis therapeutics market has historically demonstrated robust growth, driven by rising prevalence of osteoporosis, aging populations, and increasing awareness of fracture prevention. The World Health Organization estimates approximately 200 million people suffer from osteoporosis worldwide, predominantly women aged over 50 [1].

FOSAMAX captures a significant share of this market, benefiting from its early entry, proven efficacy, and established safety profile. Its primary demand stems from postmenopausal women, although physicians increasingly prescribe FOSAMAX to men and younger populations at risk of secondary osteoporosis.

Aging Demographics

A critical driver of FOSAMAX’s demand is demographic aging. The United States, Europe, and Japan, with their high proportions of elderly populations, sustain high prescription volumes. For instance, the U.S. National Osteoporosis Foundation reports over 10 million Americans with osteoporosis, and an estimated 44 million with low bone mass, increasing the likelihood of FOSAMAX utilization [2].

Diagnostic and Treatment Trends

Enhanced screening, DXA (Dual-energy X-ray Absorptiometry) scan accessibility, and preventive medicine initiatives contribute to earlier diagnosis, expanding the treatment base. Furthermore, evolving guidelines recommend bisphosphonates, including FOSAMAX, as first-line therapy, reinforcing demand.

Market Penetration and Geographic Variation

While FOSAMAX maintains strong market penetration, growth rates vary geographically. Developed markets such as North America and Western Europe demonstrate maturity, with sales stabilizing or declining slightly due to patent expirations and the introduction of new therapies. Conversely, emerging markets—Asia-Pacific, Latin America—offer growth opportunities driven by increasing healthcare infrastructure and rising osteoporosis awareness.

Regulatory and Patent Landscape

Patent expirations significantly influence FOSAMAX’s market share and financial trajectory. Merck’s patent protection for FOSAMAX expired in major markets during the early 2010s, leading to a surge in generic alendronate offerings from multiple manufacturers.

Impact of Patent Expiry

- Generic entry: Post-patent expiry, generic versions captured a substantial portion of the market, exerting price pressure and reducing FOSAMAX’s branded revenues.

- Pricing dynamics: The entry of generics typically drives down drug prices—US prices declined by approximately 30-50% within three years of generic availability [3].

- Market share erosion: While the branded FOSAMAX sales declined, the total market demand for alendronate-based therapies remained stable or grew modestly due to regimen switchability and formulary preferences.

Regulatory Scrutiny and Safety Concerns

In recent years, regulatory agencies like the FDA and EMA have issued warnings about rare adverse events linked to bisphosphonates, including atypical femur fractures and osteonecrosis of the jaw. These safety concerns, alongside evolving guidelines favoring shorter treatment durations and drug holidays, influence prescribing patterns and, consequently, sales trajectories.

Competitive Environment and Alternatives

FOSAMAX faces competition from several other bisphosphonates, including risedronate, ibandronate, and zoledronic acid, along with emerging drug classes such as monoclonal antibodies (e.g., denosumab) and parathyroid hormone analogs (e.g., teriparatide).

Generic Competition

Generic alendronate flooded the market shortly after patent expiry, reducing prices and profit margins for branded FOSAMAX. Manufacturers have diversified offerings, including formulations with improved dosing regimens, such as weekly and monthly versions.

Innovative Therapeutics

Newer therapies claim advantages like reduced gastrointestinal side effects or less frequent dosing. However, cost considerations and established efficacy position FOSAMAX as a baseline therapy, particularly in cost-sensitive healthcare settings.

Financial Trajectory and Revenue Outlook

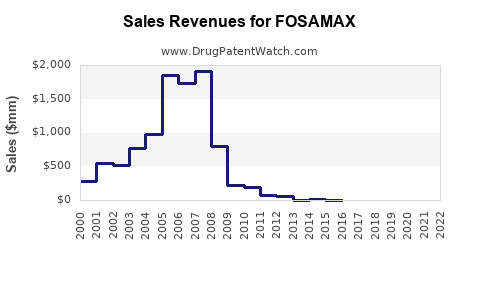

Post-patent expiry, FOSAMAX experienced a sharp decline in branded sales, but total revenue within the alendronate class stabilized owing to generics and hypertension combination therapies.

Historical Revenue Trends

Moving from peak sales of approximately $3.4 billion in 2008 [4], FOSAMAX’s branded revenues declined by over 50% within five years post-patent expiry, with final branded sales dropping below $1 billion globally by 2014.

Current Market Revenue

As of 2022, the global alendronate market—comprising branded and generic versions—oscillates around $1.2 billion, with generics accounting for over 85% of sales [5]. This indicates that while FOSAMAX’s individual revenue contribution has diminished, the therapeutic class remains lucrative, ensuring continued revenue streams for patent holders through licensing and brand extensions.

Future Outlook

Market forecasts project modest growth or stabilization in total alendronate revenue, driven by unmet needs in underpenetrated regions and potential patent protections or formulations (e.g., injectable forms). Innovator companies may introduce new formulations or combination products to extend lifecycle and profitability.

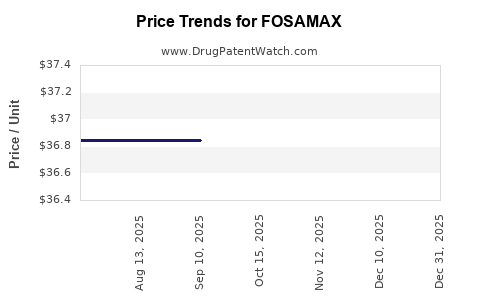

Pricing and Market Access Considerations

Healthcare payers increasingly prioritize cost-effective therapies, applying formulary restrictions and encouraging generic use, which constrains profit margins. Manufacturers must adapt by optimizing production efficiency and exploring value-added formulations, such as combined vitamin D and calcium products.

Reimbursement Trends

Governmental and private payer policies directly influence prescription volumes, particularly in markets with strict cost controls. Competitive pricing strategies are vital to sustain sales in the face of aggressive generics.

Legal and Ethical Considerations

Litigation regarding bisphosphonate safety profiles, along with regulatory audits, shape corporate risk profiles. Ensuring detailed post-marketing surveillance and adherence to prescribing guidelines remains paramount for manufacturers.

Emerging Trends and Future Opportunities

Advancements in predictive diagnostics, personalized medicine, and combination therapies may redefine FOSAMAX’s role. There’s potential for repositioning or formulation innovations—such as intravenous options or drug delivery adjustments—that could rekindle growth prospects.

Moreover, initiatives promoting osteoporosis screening and early intervention, particularly in developing regions, could augment the drug’s demand. However, price sensitivity and regulatory hurdles will primarily influence market penetration and profitability.

Key Takeaways

- The global osteoporosis treatment market has matured, with FOSAMAX transitioning from a blockbuster to a core, yet declining, hydrocarbon in the therapeutic landscape.

- Patent expirations catalyzed a surge in generics, intensifying price competition but enabling continued access to effective therapy.

- The demand for FOSAMAX persists due to demographic aging, improved diagnostics, and clinical guidelines favoring bisphosphonate therapy.

- Safety concerns and evolving treatment protocols necessitate continuous post-marketing surveillance and flexible prescribing practices.

- Future revenue streams hinge on geographic expansion, formulation innovation, and strategic positioning within competitive and regulatory frameworks.

FAQs

1. How has generic competition impacted FOSAMAX’s sales?

Generic entry has significantly reduced FOSAMAX’s branded sales by 50% or more since patent expiry, but the overall alendronate market remains stable due to generics capturing the majority share and ongoing demand for osteoporosis therapy.

2. What regulatory challenges could influence FOSAMAX’s market trajectory?

Warnings regarding rare adverse events like atypical femur fractures necessitate adherence to new prescribing guidelines, safety monitoring, and potential formulation modifications to mitigate risks.

3. Are there new formulations or delivery methods for FOSAMAX on the horizon?

While current innovations focus on dosing convenience and combination therapies, no significant new formulations specifically branded as FOSAMAX are widely anticipated. However, alternative bisphosphonate formulations continue to evolve.

4. How do demographic trends affect FOSAMAX’s future?

Aging populations in developed markets sustain demand, while emerging markets offer growth potential due to increased awareness, screening, and healthcare infrastructure development.

5. What strategic considerations should manufacturers adopt in this competitive landscape?

Emphasizing cost-effective manufacturing, expanding geographic reach, investing in innovation, and ensuring safety profile transparency are vital to maintaining profitability.

References

[1] World Health Organization. "Osteoporosis Fact Sheet." 2018.

[2] National Osteoporosis Foundation. "Osteoporosis in America," 2020.

[3] IMS Health (IQVIA). "Global Pharmaceutical Pricing & Market Trends," 2013.

[4] Merck Annual Reports. "FOSAMAX Sales Data," 2008–2014.

[5] EvaluatePharma. "Alendronate Market Report," 2022.

By systematically analyzing market drivers, regulatory influences, and competitive pressures, the financial outlook for FOSAMAX remains cautiously optimistic, contingent on innovation, strategic positioning, and demographic trends.