Share This Page

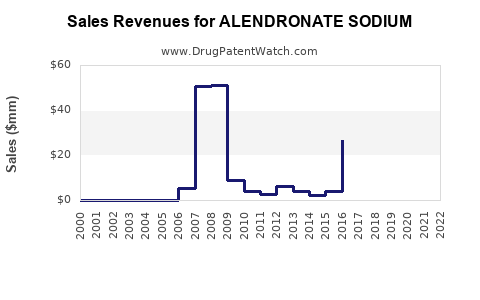

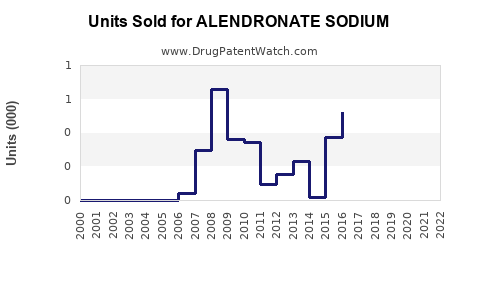

Drug Sales Trends for ALENDRONATE SODIUM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ALENDRONATE SODIUM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ALENDRONATE SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ALENDRONATE SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ALENDRONATE SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Alendronate Sodium

Introduction

Alendronate sodium, a bisphosphonate derivative, is primarily prescribed for the prevention and treatment of osteoporosis, Paget’s disease of bone, and certain other metabolic bone disorders. Market dynamics for alendronate sodium are influenced by demographic shifts, competitive landscape, regulatory pathways, and evolving clinical guidelines. This report provides an in-depth analysis of the current market landscape, future growth drivers, and sales forecasts for alendronate sodium over the next five years.

Market Overview

Global Prevalence of Osteoporosis and Related Disorders

Osteoporosis affects an estimated 200 million people worldwide, with postmenopausal women and the elderly being the most at risk [1]. An aging global population, coupled with increased life expectancy, is fueling the demand for bone health therapeutics. The rise in osteoporosis-related fractures presents significant healthcare burdens, reinforcing the need for effective treatments like alendronate sodium.

Market Segmentation

The alendronate sodium market primarily comprises:

- Branded Products: Fosamax (Merck) remains the leading brand, with established efficacy and patient familiarity.

- Generic Formulations: Several manufacturers have launched generic versions post-patent expiry, significantly impacting market competition.

- Formulations: Oral tablets (most prevalent) and injectable forms, with oral formulations dominating due to ease of administration.

Regulatory Landscape

Post-patent expiration, the entry of generics has intensified competition, reducing costs and expanding access. Regulatory bodies such as the FDA and EMA continue to oversee manufacturing standards, ensuring drug safety and efficacy, which supports market stability.

Competitive Landscape

The market features key players including Merck, Teva, Mylan, Sun Pharma, and Hikma Pharmaceuticals. The widespread availability of generics has led to pricing competition, which benefits patients and payers, but exerts pressure on branded product sales.

In recent years, some manufacturers have shifted focus towards biosimilars and combination therapies, potentially impacting initial sales figures of traditional alendronate sodium products.

Market Drivers

- Aging Population: As life expectancy increases, osteoporosis prevalence rises, directly driving demand.

- Clinical Guidelines: Most osteoporosis treatment guidelines endorse bisphosphonates like alendronate, bolstering prescription rates.

- Patent Expiry: Generics have considerably reduced prices, expanding affordability and accessibility.

- Patient Compliance: The availability in simple oral formulations supports sustained adherence.

Market Challenges

- Adherence and Safety Concerns: Rare side effects such as osteonecrosis of the jaw and atypical femur fractures have tempered enthusiasm in some regions.

- Alternative Therapies: Growing competition from newer agents like denosumab, teriparatide, and romosozumab.

- Regulatory Restrictions: Monitoring and updated guidelines on long-term use may impact prescribing patterns.

Market Forecast and Sales Projections (2023-2028)

Methodology

Projections are based on historical sales data, epidemiological trends, current market penetration, competitive dynamics, and anticipated regulatory and clinical developments. Compound annual growth rate (CAGR) estimates are derived from these parameters.

Global Sales Estimates

| Year | Estimated Market Size (USD Billion) | Growth Rate (CAGR) | Notes |

|---|---|---|---|

| 2023 | $1.2 | — | Baseline, current market size |

| 2024 | $1.4 | 16.7% | Growth driven by aging demographics |

| 2025 | $1.6 | 14.3% | Expanded access via generics |

| 2026 | $1.8 | 12.5% | Increased adoption of osteoporosis guidelines |

| 2027 | $2.0 | 11.1% | Competitive pressure from alternatives |

| 2028 | $2.2 | 10% | Market stabilization |

Regional Trends

- North America: Holds the largest share, driven by high osteoporosis prevalence and early adoption of generics. Market growth projected at a CAGR of ~11% due to patent expiry and insurance coverage patterns.

- Europe: Similar dynamics, with evolving treatment guidelines influencing sales positively.

- Asia-Pacific: Fastest growth, at approximately 15% CAGR, driven by increasing awareness, healthcare infrastructure development, and aging populations.

- Latin America and Africa: Emerging markets with lower baseline figures but significant growth potential as healthcare access improves.

Pricing and Market Penetration

As generics flood the market, pricing has dropped by approximately 60-70% relative to branded equivalents, substantially improving affordability. This price erosion, coupled with rising osteoporosis prevalence, suggests a market with increasing volume-driven growth rather than high-value per-unit sales.

Impact of New Formulations and Adjuncts

Despite competition, oral alendronate remains the first-line therapy due to its efficacy and low cost. However, injectable bisphosphonates and combination therapies are gaining traction for specific patient subsets, potentially influencing future sales.

Strategic Outlook

Manufacturers should focus on patient education to improve adherence, leverage digital health tools, and explore innovative delivery methods. Emphasizing cost-effective generic options will be essential in emerging markets.

Key Takeaways

- The global market for alendronate sodium is poised for steady growth, driven primarily by aging populations and increased diagnosis of osteoporosis.

- Generics will dominate sales due to patent expiration, with a projected CAGR of approximately 11% from 2023 to 2028.

- Regional growth will be uneven, with the Asia-Pacific region leading due to demographic shifts and expanding healthcare access.

- Market challenges include safety concerns, competition from newer therapies, and regulatory shifts, which necessitate strategic positioning.

- Companies should prioritize affordability and adherence initiatives to sustain growth and capture emerging market opportunities.

FAQs

1. How does the patent expiry of branded alendronate sodium affect market sales?

Patent expiry enables multiple generic manufacturers to produce cost-effective versions, leading to significant price reductions and increased access, thereby expanding market volume but lowering per-unit revenues for original brands.

2. What are the main competitors to alendronate sodium in osteoporosis treatment?

Alternatives include other bisphosphonates like risedronate and ibandronate, as well as newer agents such as denosumab, teriparatide, and romosozumab.

3. How does patient adherence impact sales projections?

Poor adherence reduces medication effectiveness, leading to lower prescription renewals and sales. Improving adherence through patient education and simplified dosing regimens is vital for sustained sales.

4. What regional factors influence alendronate sodium sales?

Healthcare infrastructure, osteoporosis awareness, regulatory approval processes, and reimbursement policies significantly influence regional sales. Emerging markets, notably Asia-Pacific, are expected to show the highest growth rates.

5. Are there any upcoming regulatory changes that could impact alendronate sodium sales?

Regulatory agencies are increasingly scrutinizing long-term safety profiles, which could lead to updated prescribing guidelines and restrictions. Manufacturers must stay abreast of such changes to adapt strategies accordingly.

References

[1] International Osteoporosis Foundation. "Osteoporosis Facts and Statistics." 2022.

More… ↓