ZYKADIA Drug Patent Profile

✉ Email this page to a colleague

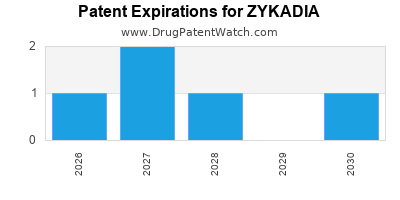

When do Zykadia patents expire, and when can generic versions of Zykadia launch?

Zykadia is a drug marketed by Novartis and is included in two NDAs. There are eight patents protecting this drug.

This drug has three hundred and twenty-two patent family members in fifty-six countries.

The generic ingredient in ZYKADIA is ceritinib. There is one drug master file entry for this compound. One supplier is listed for this compound. Additional details are available on the ceritinib profile page.

DrugPatentWatch® Generic Entry Outlook for Zykadia

Zykadia was eligible for patent challenges on April 29, 2018.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be January 18, 2032. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ZYKADIA?

- What are the global sales for ZYKADIA?

- What is Average Wholesale Price for ZYKADIA?

Summary for ZYKADIA

| International Patents: | 322 |

| US Patents: | 8 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 78 |

| Clinical Trials: | 11 |

| Patent Applications: | 4,090 |

| Drug Prices: | Drug price information for ZYKADIA |

| What excipients (inactive ingredients) are in ZYKADIA? | ZYKADIA excipients list |

| DailyMed Link: | ZYKADIA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ZYKADIA

Generic Entry Dates for ZYKADIA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

Generic Entry Dates for ZYKADIA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ZYKADIA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Plateforme labellisée Inca - Institut Bergonié, Bordeaux | Phase 3 |

| EUCLID Clinical Trial Platform | Phase 3 |

| Plateforme labellisée Inca – Institut Bergonié, Bordeaux | Phase 3 |

Pharmacology for ZYKADIA

| Drug Class | Kinase Inhibitor |

| Mechanism of Action | Cytochrome P450 2C9 Inhibitors Cytochrome P450 3A Inhibitors Tyrosine Kinase Inhibitors |

US Patents and Regulatory Information for ZYKADIA

ZYKADIA is protected by eight US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ZYKADIA is ⤷ Get Started Free.

This potential generic entry date is based on patent 9,309,229.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Novartis | ZYKADIA | ceritinib | CAPSULE;ORAL | 205755-001 | Apr 29, 2014 | DISCN | Yes | No | 8,377,921 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Novartis | ZYKADIA | ceritinib | CAPSULE;ORAL | 205755-001 | Apr 29, 2014 | DISCN | Yes | No | 7,964,592 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Novartis | ZYKADIA | ceritinib | CAPSULE;ORAL | 205755-001 | Apr 29, 2014 | DISCN | Yes | No | 8,399,450 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Novartis | ZYKADIA | ceritinib | TABLET;ORAL | 211225-001 | Mar 18, 2019 | RX | Yes | Yes | 8,039,479 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Novartis | ZYKADIA | ceritinib | TABLET;ORAL | 211225-001 | Mar 18, 2019 | RX | Yes | Yes | 8,703,787 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Novartis | ZYKADIA | ceritinib | TABLET;ORAL | 211225-001 | Mar 18, 2019 | RX | Yes | Yes | 7,964,592 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ZYKADIA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Novartis | ZYKADIA | ceritinib | TABLET;ORAL | 211225-001 | Mar 18, 2019 | 8,188,276 | ⤷ Get Started Free |

| Novartis | ZYKADIA | ceritinib | CAPSULE;ORAL | 205755-001 | Apr 29, 2014 | 7,153,964 | ⤷ Get Started Free |

| Novartis | ZYKADIA | ceritinib | TABLET;ORAL | 211225-001 | Mar 18, 2019 | 9,416,112 | ⤷ Get Started Free |

| Novartis | ZYKADIA | ceritinib | CAPSULE;ORAL | 205755-001 | Apr 29, 2014 | 9,416,112 | ⤷ Get Started Free |

| Novartis | ZYKADIA | ceritinib | TABLET;ORAL | 211225-001 | Mar 18, 2019 | 8,835,430 | ⤷ Get Started Free |

| Novartis | ZYKADIA | ceritinib | CAPSULE;ORAL | 205755-001 | Apr 29, 2014 | 9,018,204 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for ZYKADIA

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Novartis Europharm Limited | Zykadia | ceritinib | EMEA/H/C/003819Zykadia is indicated for the treatment of adult patients with anaplastic lymphoma kinase (ALK) positive advanced non small cell lung cancer (NSCLC) previously treated with crizotinib. | Authorised | no | no | no | 2015-05-06 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ZYKADIA

When does loss-of-exclusivity occur for ZYKADIA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 4309

Estimated Expiration: ⤷ Get Started Free

Patent: 2395

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 11343775

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2013015000

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 21102

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 13001723

Estimated Expiration: ⤷ Get Started Free

China

Patent: 3282359

Estimated Expiration: ⤷ Get Started Free

Patent: 4262324

Estimated Expiration: ⤷ Get Started Free

Patent: 6008462

Estimated Expiration: ⤷ Get Started Free

Patent: 6831716

Estimated Expiration: ⤷ Get Started Free

Patent: 7056751

Estimated Expiration: ⤷ Get Started Free

Patent: 2125884

Estimated Expiration: ⤷ Get Started Free

Patent: 4989139

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 01792

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0171477

Estimated Expiration: ⤷ Get Started Free

Patent: 0181737

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 19474

Estimated Expiration: ⤷ Get Started Free

Patent: 21017

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 51918

Estimated Expiration: ⤷ Get Started Free

Patent: 21171

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 13012770

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 51918

Estimated Expiration: ⤷ Get Started Free

Patent: 21171

Estimated Expiration: ⤷ Get Started Free

Patent: 53708

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 1300153

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 41845

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6474

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 16752

Estimated Expiration: ⤷ Get Started Free

Patent: 13545812

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 51918

Estimated Expiration: ⤷ Get Started Free

Patent: 21171

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 4810

Estimated Expiration: ⤷ Get Started Free

Patent: 7742

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 8210

Estimated Expiration: ⤷ Get Started Free

Patent: 13006952

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 771

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 0713

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 140698

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 013501254

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 51918

Estimated Expiration: ⤷ Get Started Free

Patent: 21171

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 51918

Estimated Expiration: ⤷ Get Started Free

Patent: 21171

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 99785

Patent: КРИСТАЛЛИЧЕСКИЕ ФОРМЫ 5-ХЛОР-N2-(2-ИЗОПРОПОКСИ-5-МЕТИЛ-4-ПИПЕРИДИН-4-ИЛ-ФЕНИЛ)-N4-[2-(ПРОПАН-2-СУЛЬФОНИЛ)-ФЕНИЛ]-ПИРИМИДИН-2,4-ДИАМИНА (CRYSTALLINE FORMS OF 5-CHLORO-N2-(2-ISOPROPOXY-5-METHYL-4-PIPERIDIN-4-YL-PHENYL)-N4-[2-(PROPANE-2-SULPHONYL)-PHENYL]-PYRIMIDINE-2,4-DIAMINE)

Estimated Expiration: ⤷ Get Started Free

Patent: 46159

Patent: КРИСТАЛЛИЧЕСКИЕ ФОРМЫ 5-ХЛОР-N2-(2-ИЗОПРОПОКСИ-5-МЕТИЛ-4-ПИПЕРИДИН-4-ИЛ-ФЕНИЛ)-N4-[2-(ПРОПАН-2-СУЛЬФОНИЛ)-ФЕНИЛ]-ПИРИМИДИН-2,4-ДИАМИНА (CRYSTAL FORMS 5-CHLORO-N2 - (2-ISOPROPOXY-5-METHYL-4-PIPERIDINE-4-YL-PHENYL) - N 4 - [2-(PROPANE-2-SULFONYL)- PHENYL] - PYRIMIDINE-2,4-DIAMINE)

Estimated Expiration: ⤷ Get Started Free

Patent: 13132947

Patent: КРИСТАЛЛИЧЕСКИЕ ФОРМЫ 5-ХЛОР-N2-(2-ИЗОПРОПОКСИ-5-МЕТИЛ-4-ПИПЕРИДИН-4-ИЛ-ФЕНИЛ)-N4-[2-(ПРОПАН-2-СУЛЬФОНИЛ)-ФЕНИЛ]-ПИРИМИДИН-2,4-ДИАМИНА

Estimated Expiration: ⤷ Get Started Free

Patent: 16136823

Patent: КРИСТАЛЛИЧЕСКИЕ ФОРМЫ 5-ХЛОР-N2-(2-ИЗОПРОПОКСИ-5-МЕТИЛ-4-ПИПЕРИДИН-4-ИЛ-ФЕНИЛ)-N4-[2-(ПРОПАН-2-СУЛЬФОНИЛ)-ФЕНИЛ]-ПИРИМИДИН-2,4-ДИАМИНА

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 771

Patent: KRISTALNI OBLICI 5-HLORO-N2-(2-IZOPROPOKSI-5-METIL-4-PIPERIDIN-4-IL-FENIL)-N4-[2-(PROPAN-2-SULFONIL)-FENIL]-PIRIMIDIN-2,4-DIAMINA (CRYSTALLINE FORMS OF 5-CHLORO-N2-(2-ISOPROPOXY-5-METHYL-4-PIPERIDIN-4-YL-PHENYL)-N4[2-(PROPANE-2-SULFONYL)-PHENYL]-PYRIMIDINE-2,4-DIAMINE)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 0856

Patent: CRYSTALLINE FORMS OF 5-CHLORO-N2-(2-ISOPROPOXY-5-METHYL-4-PIPERIDIN-4-YL-PHENYL)-N4[2-(PROPANE-2-SULFONYL)-PHENYL]-PYRIMIDINE-2,4-DIAMINE

Estimated Expiration: ⤷ Get Started Free

Patent: 201510082X

Patent: CRYSTALLINE FORMS OF 5-CHLORO-N2-(2-ISOPROPOXY-5-METHYL-4-PIPERIDIN-4-YL-PHENYL)-N4[2-(PROPANE-2-SULFONYL)-PHENYL]-PYRIMIDINE-2,4-DIAMINE

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 51918

Estimated Expiration: ⤷ Get Started Free

Patent: 21171

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1303599

Patent: CRYSTALLINE FORMS OF 5-CHLORO-N2-(2-METHYL-4-PIPERIDIN-4-YL-PHENYL)-N4[2-(PROPANE-2-SULFONYL)-PHENYL]-PYRIMIDINE2-,4-DIAMINE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2325775

Estimated Expiration: ⤷ Get Started Free

Patent: 130130022

Estimated Expiration: ⤷ Get Started Free

Patent: 180032680

Estimated Expiration: ⤷ Get Started Free

Patent: 190022903

Estimated Expiration: ⤷ Get Started Free

Patent: 200039021

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 43016

Estimated Expiration: ⤷ Get Started Free

Patent: 96526

Estimated Expiration: ⤷ Get Started Free

Patent: 05973

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 76343

Estimated Expiration: ⤷ Get Started Free

Patent: 76344

Estimated Expiration: ⤷ Get Started Free

Patent: 1307299

Patent: Crystalline forms of 5-chloro-N2-(2-isopropoxy-5-methyl-4-piperidin-4-yl-phenyl)-N4-[2-(propane-2-sulfonyl)-phenyl]-pyrimidine-2,4-diamine

Estimated Expiration: ⤷ Get Started Free

Patent: 1629021

Patent: Crystalline forms of 5-chloro-N2-(2-isopropoxy-5-methyl-4-piperidin-4-yl-phenyl)-N4-[2-(propane-2-sulfonyl)-phenyl]-pyrimidine-2,4-diamine

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 13000216

Patent: CRYSTALLINE FORMS OF 5-CHLORO-N2-(2-ISOPROPOXY-5-METHYL-4-PIPERIDIN-4-YL-PHENYL)-N4[2-(PROPANE-2-SULFONYL)-PHENYL]-PYRIMIDINE-2,4-DIAMINE

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ZYKADIA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| San Marino | T201500300 | ⤷ Get Started Free | |

| Denmark | 1534286 | ⤷ Get Started Free | |

| Cyprus | 1121017 | ⤷ Get Started Free | |

| Canada | 2399196 | COMPOSES DE PYRIMIDINE (PYRIMIDINE COMPOUNDS) | ⤷ Get Started Free |

| Iceland | 8349 | 2,4-pýrimídíndíamín gagnleg í meðhöndlun æxlissjúkdóma, bólgu- og ónæmiskerfissjúkdóma | ⤷ Get Started Free |

| Austria | E518834 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ZYKADIA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1272477 | CA 2015 00050 | Denmark | ⤷ Get Started Free | PRODUCT NAME: CERITINIB ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF; REG. NO/DATE: EU/1/15/999 20150508 |

| 2091918 | PA2015034,C2091918 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: CERITINIBAS ARBA JO FARMACINIU POZIURIU PRIIMTINA DRUSKA; REGISTRATION NO/DATE: EU/1/15/999 20150506 |

| 2091918 | C20150037 00157 | Estonia | ⤷ Get Started Free | PRODUCT NAME: TSERITINIIB;REG NO/DATE: EU/1/15/999 08.05.2015 |

| 1272477 | 122015000073 | Germany | ⤷ Get Started Free | PRODUCT NAME: CERITINIB ODER EINES SEINER PHARMAZEUTISCH AKZEPTABLEN SALZE; REGISTRATION NO/DATE: EU/1/15/999 20150506 |

| 2091918 | 300763 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: CERITINIB, OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/15/999 20150508 |

| 2091918 | 92785 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: CERITINIB OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE DE CELUI-CI. FIRST REGISTRATION: 20150508 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: ZYKADIA

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.